Stocks: Cyclical Sectors, Small Cap Stocks Lead The Rally As Rate Cut Boosts The U.S. Economic Outlook; Emerging Markets Remain A Country Selection Story Even As U.S. Dollar Weakness Provides A Fundamental Tailwind.

Download Weekly Market Commentary | September 23 2024

What We’re Watching:

- The Conference Board’s September Consumer Confidence Survey is released Tuesday with a modest drop to 103.0 from 103.3 in August expected.

- Initial jobless claims for the week ended September 21 and continuing jobless claims for the week ended September 14 are released Thursday. Continuing claims are expected to rise to 1.855 million from 1.829 million the prior week, while initial jobless claims are expected to rise to 230k from 219k the prior week.

- August Personal Consumption Expenditure (PCE) Deflator, the FOMC’s preferred inflation measure, is released Friday. Headline PCE Deflator is expected to rise 0.1% month over month and 2.3% year over year, compared to 0.16% and 2.5% in July. Core PCE Deflator, which is more closely watched by monetary policymakers, is expected to rise 0.2% month over month and 2.7% year over year, which would be above the prior month’s 0.16% and 2.6% readings and evidence that inflationary pressures remain sticky.

Key Observations

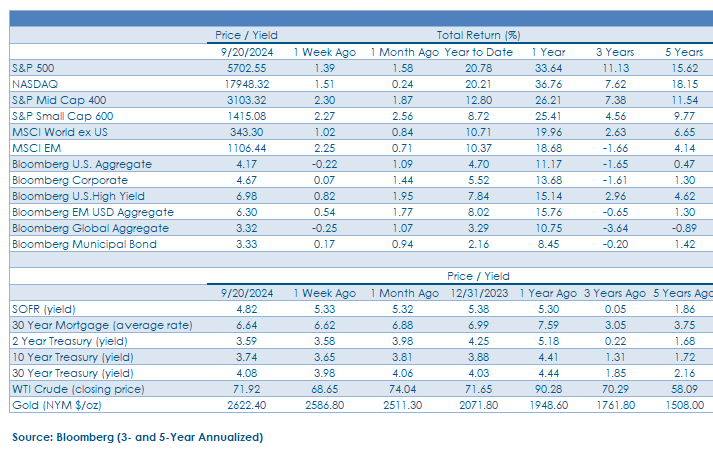

- Stocks and riskier pockets of the fixed income market got a lift from the Federal Open Market Committee (FOMC) which delivered a larger than expected 50-basis point cut to the Fed funds rate at its September meeting. The Committee expects to cut the funds rate by another 50-basis points between now and year-end, while Fed funds futures expect 75-basis points, a disconnect worth monitoring in the lead-up to the FOMC’s November meeting.

- The FOMC’s aggressive start to this rate cutting cycle is likely a tailwind for stocks and precious metals, and a potential headwind for longer duration U.S. Treasury bonds in the near-term.

- Yields on U.S. Treasuries maturing 2-years and farther out in the future rose on the heels of the FOMC’s rate cut as investors appeared to modestly ratchet up their expectations for U.S. economic growth and/or inflation in the coming quarters. Less restrictive monetary policy should provide a continued tailwind for riskier corporate bonds and U.S. dollar denominated emerging market debt, but sizing these exposures appropriately remains crucial due to the elevated volatility profile and risk of larger drawdowns inherent with these non-core fixed income areas.

What Happened Last Week:

Stocks: Cyclical Sectors, Small Cap Stocks Lead The Rally As Rate Cut Boosts The U.S. Economic Outlook; Emerging Markets Remain A Country Selection Story Even As U.S. Dollar Weakness Provides A Fundamental Tailwind.

S&P 500 Ends The Week Within Shouting Distance Of An All-Time High And Market Breadth Remains Supportive Of Additional Upside. Stocks made a mid-week push higher after the FOMC delivered a somewhat surprising 50-basis point cut to the Fed funds rate, with the S&P 500 briefly registering a new high for the Index on Thursday before closing out the week with a 1.3% gain. The market’s bullish take on the larger rate cut might seem misguided as prognosticators expected investors to interpret a more sizable cut as an indictment that the economy may be in worse shape than it appears. But FOMC Chairman Jerome Powell’s constructive commentary on the economy when paired with improved market breadth in recent weeks signaled the path of least resistance for stocks was higher. The percentage of S&P 500 companies trading above their 50- and 200-day moving averages puts the market on strong footing as around 75% of index constituents can make that claim, and the percentage of stocks trading above their 50- and 200-day has remained steady over the past two weeks. At a high level, stocks are taking the FOMC’s outsized rate cut and dovish tone as incremental positives, rising in an orderly manner, and metrics such as market breadth and sector leadership display a growing confidence on the part of investors that an economic soft landing is the most likely outcome, evidenced by strength out of economically sensitive sectors (consumer discretionary, financial services, and industrials) as well as secular growth plays in the communication services and information technology sectors into the weekend.

Small Caps Surge On More Aggressive Pace Of Policy Easing. The rollercoaster ride for investors in small cap stocks continued last week as the S&P 600 Small Cap Index returned 2.2% as the FOMC’s 50-basis point cut is expected to improve the outlook for U.S. economic growth in the coming quarters and should serve to lower borrowing costs for this cohort of stocks. The most immediate relief for smaller companies comes in the form of lower borrowing costs as between 40% and 50% of smaller capitalization companies rely on issuing some combination of either floating rate and/ or short-term debt to fund operations, debt that can now be floated at lower rates. Lower borrowing costs should boost profits and improve the economics surrounding borrowing capital for expansionary efforts like capital expenditures that can improve a company’s cash flow over time. At the same time, the FOMC’s outsized rate cut improves the odds of an economic soft landing and should translate into tighter credit spreads, another tailwind for smaller companies whose issues tend to reside in below-investment grade bond indices. A boost to economic growth from less restrictive policy could also thaw investor sentiment and push capital into economically sensitive areas such as small caps. We would rather be late than early should last week’s small cap rally prove durable as there have been head fakes in recent months with rallies being met by sellers amid the first signs of economic turmoil.

Outside The U.S, Asian Markets Rally While Latin America Struggles. The MSCI Emerging Markets (EM) index returned 2.2% on the week, driven by China and South Africa with country indices tied to each gaining 4.3% or more on the week, while Brazil and Mexico were detractors. The rally in Chinese equities appears to be a product of reduced pressure on the yuan from a lowering of the Fed funds rate which potentially provides the People’s Bank of China (PBOC) with the flexibility to ease policy further in the coming months to support consumption and spending. Emerging economies often see capital outflows as U.S. rates rise, and now appear poised to benefit as U.S. rates fall as a weaker U.S. dollar, along with macro catalysts on top of already appealing valuations likely to spur gains out of developing market stocks. Notably, political concerns in Mexico and a rate hike out of Brazil’s central bank present near-term headwinds and make allocations difficult to justify in the near-term, but these remain countries worth watching.

Bonds: FOMC Cuts The Fed Funds Rate By 50-Basis Points, Sending Yields On Long-Term Treasuries Higher As Investors Recalibrate Their Growth And Inflation Expectations; Higher Yielding Corporate Bonds A Beneficiary Of Less Restrictive Monetary Policy, Improved Growth Outlook.

Long-Term Treasury Yields Push Higher As Investors Recalibrate Their Economic Growth And Inflation Expectations After The FOMC’s Larger Than Expected Rate Cut. Treasury yields treaded water leading up to the FOMC’s rate decision last Wednesday but rose into the weekend as investors ratcheted their expectations for economic growth and/or inflation higher in the wake of the Fed’s 50-basis point cut to the Fed funds rate. The yield curve experienced a bear steepener over the balance of last week as yields on bonds maturing between 2- and 30-years all climbed, but upside moves in yields on bonds maturing farther out in the future rose more than those on shorter-dated securities. Our base case for U.S. economic growth and inflation is unchanged in the wake of the FOMC’s decision and we expect both to normalize at around 2% in 2025. However, given the FOMC’s efforts to get ahead of weakness in the labor market with a more sizable half-point rate cut last week, we see risks skewed to the upside for economic growth, inflation, and, in turn, Treasury yields. We see little upside in Treasury bonds at present, particularly those maturing in the 3- to 10-year portion of the curve with yields of 3.75% or less. Credit and higher yielding non-core fixed income segments, broadly speaking, hold greater appeal, but we acknowledge that yields have come down and credit spreads have narrowed, leaving us with the opinion that investors in fixed income, should have more modest return expectations for the asset class over the near-to-intermediate term.

FOMC Delivers A ‘Super-Sized’ 50-Basis Point Rate Cut To Get Things Started, But A Gulf Still Remains Between The Fed And The Market. Fed funds futures favored a 50-basis point cut in the lead-up to last week’s FOMC meeting. The Committee met those expectations, opting to begin this cutting cycle with a larger move, taking the target range for the Fed funds rate from 5.25% to 5.50% down by 50-basis points to 4.75% to 5%. Of note, the FOMC’s decision was not unanimous as there was 1 dissenting voter for the first time since 2005 and this one Committee member favored a quarter-point cut while the other 11 voters felt it prudent to start with a larger and more impactful move. The FOMC’s closely watched Summary of Economic Projections (SEP), or dot plot, which is released four times a year, now points toward an additional 50-basis points of rate cuts between now and year-end, with the median expectation for the Fed funds rate at 4.4% at year-end. Fed funds futures expect the FOMC to be more aggressive than the median dot would imply with 75-basis points of cuts between now and year-end projected, and the futures market views the probability of a half-point cut at either the November or December meeting as a coin-flip at present. FOMC Chair Jerome Powell noted that the Committee expected balance sheet runoff or quantitative tightening (QT) to continue at the current pace “for a time,” but gave little guidance as to when QT might end. With the FOMC still running down its balance sheet into 2025, one big potential buyer for long-dated Treasuries will remain on the sidelines, potentially putting upward pressure on long- term U.S. Treasury yields, in our view.

A Good Week For High Yield As Credit Spreads Narrow On Improved Growth Outlook. While Treasury yields rose on the week, leading to paper losses on higher quality, longer duration bonds, non-core fixed income fared relatively well, with lower quality, shorter duration corporate bonds performing best. The Bloomberg U.S. Corporate High Yield index closed out the week with a 0.8% gain, taking its year-to-date return to 7.8%, well ahead of the Bloomberg Aggregate Bond index’s respectable 4.7% gain. An improved outlook for U.S. economic growth along with expectations the FOMC will continue to make monetary policy less restrictive in the coming months should continue to force cash into riskier higher yielding bonds over time and supports further gains for high yield corporate bonds, broadly speaking. We do expect corporate defaults to increase in the coming quarters, so an active approach to the space centered around security selection remains preferable, but barring an economic downturn capital should continue to find its way into riskier corporate bonds as the near 7% yield-to-worst on the index is tough to find elsewhere.

IMPORTANT DISCLOSURES: THIS PUBLICATION HAS BEEN PREPARED BY THE STAFF OF HIGHLAND ASSOCIATES, INC. FOR DISTRIBUTION TO, AMONG OTHERS, HIGHLAND ASSOCIATES, INC. CLIENTS. HIGHLAND ASSOCIATES IS REGISTERED WITH THE UNITED STATES SECURITY AND EXCHANGE COMMISSION UNDER THE INVESTMENT ADVISORS ACT OF 1940. HIGHLAND ASSOCIATES IS A WHOLLY OWNED SUBSIDIARY OF REGIONS BANK, WHICH IN TURN IS A WHOLLY OWNED SUBSIDIARY OF REGIONS FINANCIAL CORPORATION. RESEARCH SERVICES ARE PROVIDED THROUGH MULTI-ASSET SOLUTIONS, A DEPARTMENT OF THE REGIONS ASSET MANAGEMENT BUSINESS GROUP WITHIN REGIONS BANK. THE INFORMATION AND MATERIAL CONTAINED HEREIN IS PROVIDED SOLELY FOR GENERAL INFORMATION PURPOSES ONLY. TO THE EXTENT THESE MATERIALS REFERENCE REGIONS BANK DATA, SUCH MATERIALS ARE NOT INTENDED TO BE REFLECTIVE OR INDICATIVE OF, AND SHOULD NOT BE RELIED UPON AS, THE RESULTS OF OPERATIONS, FINANCIAL CONDITIONS OR PERFORMANCE OF REGIONS BANK. UNLESS OTHERWISE SPECIFICALLY STATED, ANY VIEWS, OPINIONS, ANALYSES, ESTIMATES AND STRATEGIES, AS THE CASE MAY BE (“VIEWS”), EXPRESSED IN THIS CONTENT ARE THOSE OF THE RESPECTIVE AUTHORS AND SPEAKERS NAMED IN THOSE PIECES AND MAY DIFFER FROM THOSE OF REGIONS BANK AND/OR OTHER REGIONS BANK EMPLOYEES AND AFFILIATES. VIEWS AND ESTIMATES CONSTITUTE OUR JUDGMENT AS OF THE DATE OF THESE MATERIALS, ARE OFTEN BASED ON CURRENT MARKET CONDITIONS, AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. ANY EXAMPLES USED ARE GENERIC, HYPOTHETICAL AND FOR ILLUSTRATION PURPOSES ONLY. ANY PRICES/QUOTES/STATISTICS INCLUDED HAVE BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT HIGHLAND ASSOCIATES, INC. DOES NOT WARRANT THEIR COMPLETENESS OR ACCURACY. THIS INFORMATION IN NO WAY CONSTITUTES RESEARCH AND SHOULD NOT BE TREATED AS SUCH. THE VIEWS EXPRESSED HEREIN SHOULD NOT BE CONSTRUED AS INDIVIDUAL INVESTMENT ADVICE FOR ANY PARTICULAR PERSON OR ENTITY AND ARE NOT INTENDED AS RECOMMENDATIONS OF PARTICULAR SECURITIES, FINANCIAL INSTRUMENTS, STRATEGIES OR BANKING SERVICES FOR A PARTICULAR PERSON OR ENTITY. THE NAMES AND MARKS OF OTHER COMPANIES OR THEIR SERVICES OR PRODUCTS MAY BE THE TRADEMARKS OF THEIR OWNERS AND ARE USED ONLY TO IDENTIFY SUCH COMPANIES OR THEIR SERVICES OR PRODUCTS AND NOT TO INDICATE ENDORSEMENT, SPONSORSHIP, OR OWNERSHIP BY REGIONS OR HIGHLAND ASSOCIATES. EMPLOYEES OF HIGHLAND ASSOCIATES, INC., MAY HAVE POSITIONS IN SECURITIES OR THEIR DERIVATIVES THAT MAY BE MENTIONED IN THIS REPORT. ADDITIONALLY, HIGHLAND’S CLIENTS AND COMPANIES AFFILIATED WITH HIGHLAND ASSOCIATES MAY HOLD POSITIONS IN THE MENTIONED COMPANIES IN THEIR PORTFOLIOS OR STRATEGIES. THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR AN INVITATION BY OR ON BEHALF OF HIGHLAND ASSOCIATES TO ANY PERSON OR ENTITY TO BUY OR SELL ANY SECURITY OR FINANCIAL INSTRUMENT OR ENGAGE IN ANY BANKING SERVICE. NOTHING IN THESE MATERIALS CONSTITUTES INVESTMENT, LEGAL, ACCOUNTING OR TAX ADVICE. NON-DEPOSIT PRODUCTS INCLUDING INVESTMENTS, SECURITIES, MUTUAL FUNDS, INSURANCE PRODUCTS, CRYPTO ASSETS AND ANNUITIES: ARE NOT FDIC-INSURED I ARE NOT A DEPOSIT I MAY GO DOWN IN VALUE I ARE NOT BANK GUARANTEED I ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY I ARE NOT A CONDITION OF ANY BANKING ACTIVITY.

NEITHER REGIONS BANK NOR REGIONS ASSET MANAGEMENT (COLLECTIVELY, “REGIONS”) ARE REGISTERED MUNICIPAL ADVISORS NOR PROVIDE ADVICE TO MUNICIPAL ENTITIES OR OBLIGATED PERSONS WITH RESPECT TO MUNICIPAL FINANCIAL PRODUCTS OR THE ISSUANCE OF MUNICIPAL SECURITIES (INCLUDING REGARDING THE STRUCTURE, TIMING, TERMS AND SIMILAR MATTERS CONCERNING MUNICIPAL FINANCIAL PRODUCTS OR MUNICIPAL SECURITIES ISSUANCES) OR ENGAGE IN THE SOLICITATION OF MUNICIPAL ENTITIES OR OBLIGATED PERSONS FOR SUCH SERVICES. WITH RESPECT TO THIS PRESENTATION AND ANY OTHER INFORMATION, MATERIALS OR COMMUNICATIONS PROVIDED BY REGIONS, (A) REGIONS IS NOT RECOMMENDING AN ACTION TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON, (B) REGIONS IS NOT ACTING AS AN ADVISOR TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON AND DOES NOT OWE A FIDUCIARY DUTY PURSUANT TO SECTION 15B OF THE SECURITIES EXCHANGE ACT OF 1934 TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON WITH RESPECT TO SUCH PRESENTATION, INFORMATION, MATERIALS OR COMMUNICATIONS, (C) REGIONS IS ACTING FOR ITS OWN INTERESTS, AND (D) YOU SHOULD DISCUSS THIS PRESENTATION AND ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS WITH ANY AND ALL INTERNAL AND EXTERNAL ADVISORS AND EXPERTS THAT YOU DEEM APPROPRIATE BEFORE ACTING ON THIS PRESENTATION OR ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS.

SOURCE: BLOOMBERG INDEX SERVICES LIMITED. BLOOMBERG® IS A TRADEMARK AND SERVICE MARK OF BLOOMBERG FINANCE L.P. AND ITS AFFILIATES (COLLECTIVELY “BLOOMBERG”). BARCLAYS® IS A TRADEMARK AND SERVICE MARK OF BARCLAYS BANK PLC (COLLECTIVELY WITH ITS AFFILIATES, “BARCLAYS”), USED UNDER LICENSE. BLOOMBERG OR BLOOMBERG’S LICENSORS, INCLUDING BARCLAYS, OWN ALL PROPRIETARY RIGHTS IN THE BLOOMBERG BARCLAYS INDICES. NEITHER BLOOMBERG NOR BARCLAYS APPROVES OR ENDORSES THIS MATERIAL OR GUARANTEES THE ACCURACY OR COMPLETENESS OF ANY INFORMATION HEREIN, OR MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED THEREFROM AND, TO THE MAXIMUM EXTENT ALLOWED BY LAW, NEITHER SHALL HAVE ANY LIABILITY OR RESPONSIBILITY FOR INJURY OR DAMAGES ARISING IN CONNECTION THEREWITH.