Download Whitepaper | October 2025

Artificial intelligence (AI) continues to revolutionize industries and redefine the boundaries of digital innovation. It has become a widely adopted tool across multiple industries that has helped companies and employees operate more efficiently. It is tremendous that AI is being utilized in this manner, but there are some computational limits on the horizon. One of those limits is the massive amount of energy required to power data centers and the current grid infrastructure in the United States. Tack on the advances in quantum computing that are only going to accelerate from here and it makes data centers and grid infrastructure that much more important.

Artificial intelligence refers to programs designed to perform tasks that typically require human intelligence such as recognizing patterns, processing language, making predictions, and learning from data. Traditional AI systems operate on classical computers, relying on algorithms, machine learning, and vast datasets to improve performance over time. The core of AI is about software intelligence that teaches machines to “think” in a way that mimics human decision-making and problem-solving. Quantum computing is a change to hardware and computation itself. Instead of using traditional bits that represent information as either 0 or 1, quantum computers use qubits that can be viewed as 0 or 1 simultaneously. This allows quantum computers to perform certain types of calculations much faster and more efficiently than classical machines. Unlike AI, which focuses on simulating intelligence through software, quantum computing is about harnessing the principles of quantum mechanics to radically expand computing power. In fact, the two fields can complement each other: AI can benefit from quantum computing’s speed in solving complex optimization or simulation problems, while quantum computing can leverage AI for error correction and system optimization.

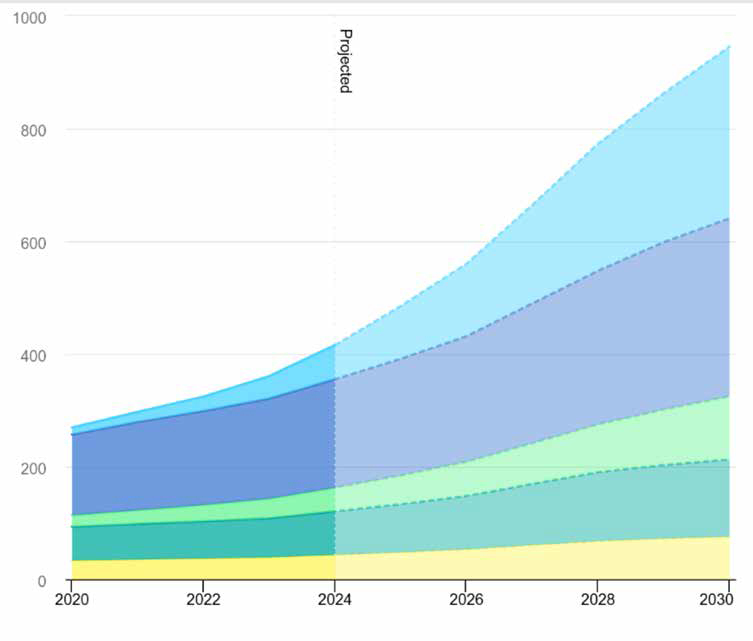

Highland Associates sees investment opportunities capitalizing on these trends. The chart below from the International Energy Agency (IEA) shows global data center electricity consumption is projected to more than double from the current approximate 400 TWh to just below 1,000 TWh by 2030.

Source: IEA.org

AI and quantum computing are poised to increase the structural demand for electricity (the long-term sustained consumption driven by a fundamental change in the need for power) instead of the cyclicaldemand (that fluctuates over the short-term). The growth of AI is creating an increasing baseline for energy use that isn’t dependent on economic cycles. Training and running AI models require high-performance GPUs and specialized chips that consume substantial electricity in both computation and cooling. Quantum systems require ultra-stable environments and often operate at cryogenic temperatures that require continuous power for refrigeration. As AI and quantum computing are integrated into traditional sectors like manufacturing, distribution, and finance, the need for consistent and stable power will be crucial regardless of the economic cycle. These advances represent a technological shift that transforms electricity from a production input that rises and falls with business cycles into a foundational resource for digital infrastructure. Over time, this will place upward pressure on long-term electricity demand, grid capacity planning, and investment in renewable and resilient energy sources to meet the needs of an increasingly computation-driven economy.

Source: Harvard

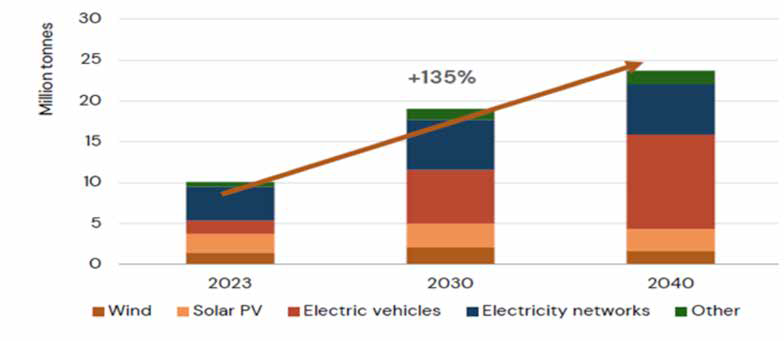

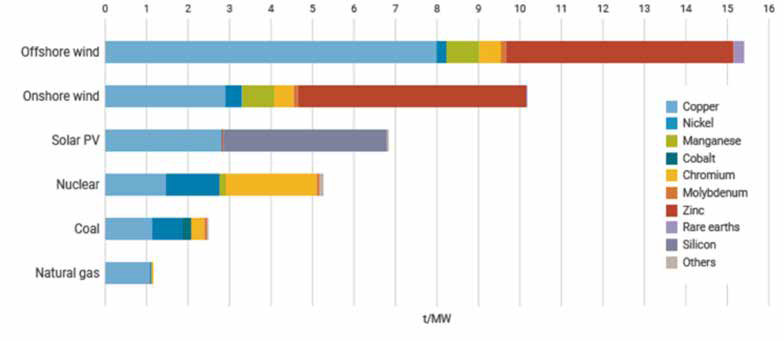

Traditional fossil fuels like natural gas will play an integral role in unlocking AI and quantum computing’s full potential, but upgrading the U.S. infrastructure grid to meet these needs will require a broad mix of natural resources and materials. Commodities like copper and aluminum are essential for transmission and distribution because of their conductivity. Commodities like lithium, cobalt, nickel, and graphite will be needed more in energy storage and grid stability. Demand for these resources underscores a structural shift in additional U.S. infrastructure investments requiring robust domestic mining, recycling, and supply chain resilience to ensure reliable access in the decades ahead.

Source: IEA.org

To make the investments needed for a modern power grid, the U.S. will have to source a wide range of critical natural resources both domestically and through strategic international partnerships. Domestic production capacity is available for copper (Arizona, New Mexico, Utah), lithium (Nevada’s Clayton Valley and potentially North Carolina), and magnetic elements (Mountain Pass mine in California), but these sites cannot meet the projected demand alone and will require partnerships with various countries. Chile and Peru are leading suppliers of copper, while countries like Australia, Chile, and Argentina are the leading lithium producers. Indonesia, the Philippines, and Canada are key sources of nickel and cobalt, although the Democratic Republic of Congo remains the dominant cobalt exporter. Expanding mining, refining, and recycling capacity within U.S. borders will be crucial for reducing supply chain risk, but permitting challenges and environmental reviews mean full self-sufficiency is unlikely in the near term. Stable partnerships with USMCS partners Canada and Mexico will be critical for aluminum, nickel, and graphite.

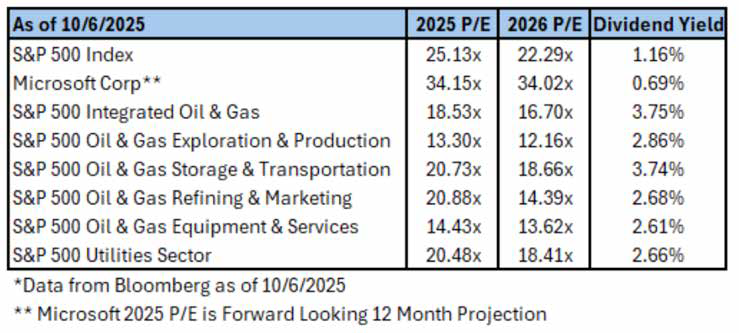

From an investment perspective, we believe that the structural shift in demand has still not been factored into Energy and Utilities valuations and it shows in the forward-looking price to earnings ratio (P/E).

Using Microsoft as a proxy for AI you can see how the forward-looking valuation of 34.02x 2026 earnings estimates is much richer than the S&P 500, the five Energy Sub Industries, and the Utilities Sector. Four of the five Energy Sub Industries are trading at less than 18x 2026 earnings estimates and you can pick up a higher yield than Microsoft. Using the S&P 500 Integrated Oil & Gas Sub Industry as an example. It has a yield of 3.75% which is 306 bps higher than the .69% yield for shares of Microsoft.

Where Do We Go From Here? There are opportunities to invest in companies/sectors trading at attractive valuations that will benefit from the increasing demand in AI and quantum computing. Most equity portfolios already contain leading names like Microsoft and Oracle which benefit directly from the tailwind in AI, but we believe additional opportunities exist outside of those beneficiaries.

Highland’s approach to constructing an public inflation hedges sleeve includes an investment in these needs through dedicated allocations to publicly traded natural resource equities and infrastructure companies who provide the necessary materials and power-generation facilities needed for these upgrades. These include not only domestic companies, but international companies across the globe which have already begun their power grid upgrades. The portfolio also contains exposure to commodities futures like precious and industrial metals, although the returns of these can be driven more by contract maturities and roll-yield in the short-term.

For clients with private investment portfolios who can take on higher illiquidity, additional opportunities are available for greenfield investment. Many private infrastructure companies will take on the construction risk of building new power-generation facilities, then sell the assets off to larger, publicly listed companies upon completion. Additionally, strategies like infrastructure debt are another attractive opportunity to earn additional yield not available in traditional bond markets.

Large cap equities tend to make up a bulk of equity portfolio allocations. At the end of September 2025, the top three sectors of the S&P 500 (Information Technology, Financials, and Consumer Discretionary) had a total weight of 58% in the index while the bottom four sectors (Materials, Real Estate, Utilities, and Energy) made up less than 10% of the index. Highland believes investors without dedicated inflation-sensitive portfolios could benefit by increasing allocations to natural resource equities and infrastructure within the equity portfolios. While AI-related companies have soared throughout the year, the necessary infrastructure investments and power grid updates continue to appear underappreciated by the market. There is a vast amount of capital expenditures needed to meet the expected power demand for this new technology and we expect these sectors will be the primary beneficiaries.

EA (2025), Global data centre electricity consumption, by equipment, Base Case, 2020-2030, IEA, Paris https://www.iea.org/data-and-statistics/charts/global-data-centre-electricity-consumption-by-equipment-base-case-2020-2030, Licence: CC BY 4.0

IMPORTANT DISCLOSURES: This publication has been prepared by the staff of Highland Associates, Inc. for distribution to, among others, Highland Associates, Inc. clients. Highland Associates is registered with the United States Security and Exchange Commission under the Investment Advisors Act of 1940. Highland Associates is a wholly owned subsidiary of Regions Bank, which in turn is a wholly owned subsidiary of Regions Financial Corporation. Research services are provided through Multi-Asset Solutions, a department of the Regions Asset Management business group within Regions Bank. The information and material contained herein is provided solely for general information purposes only. To the extent these materials reference Regions Bank data, such materials are not intended to be reflective or indicative of, and should not be relied upon as, the results of operations, financial conditions or performance of Regions Bank. Unless otherwise specifically stated, any views, opinions, analyses, estimates and strategies, as the case may be (“views”), expressed in this content are those of the respective authors and speakers named in those pieces and may differ from those of Regions Bank and/or other Regions Bank employees and affiliates. Views and estimates constitute our judgment as of the date of these materials, are often based on current market conditions, and are subject to change without notice. Any examples used are generic, hypothetical and for illustration purposes only. Any prices/quotes/statistics included have been obtained from sources believed to be reliable, but Highland Associates, Inc. does not warrant their completeness or accuracy. This information in no way constitutes research and should not be treated as such. The views expressed herein should not be construed as individual investment advice for any particular person or entity and are not intended as recommendations of particular securities, financial instruments, strategies or banking services for a particular person or entity. The names and marks of other companies or their services or products may be the trademarks of their owners and are used only to identify such companies or their services or products and not to indicate endorsement, sponsorship, or ownership by Regions or Highland Associates. Employees of Highland Associates, Inc., may have positions in securities or their derivatives that may be mentioned in this report. Additionally, Highland’s clients and companies affiliated with Highland Associates may hold positions in the mentioned companies in their portfolios or strategies. This material does not constitute an offer or an invitation by or on behalf of Highland Associates to any person or entity to buy or sell any security or financial instrument or engage in any banking service. Nothing in these materials constitutes investment, legal, accounting or tax advice. Non-deposit products including investments, securities, mutual funds, insurance products, crypto assets and annuities: Are Not FDIC-Insured I Are Not a Deposit I May Go Down in Value I Are Not Bank Guaranteed I Are Not Insured by Any Federal Government Agency I Are Not a Condition of Any Banking Activity.

Neither Regions Bank nor Regions Asset Management (collectively, “Regions”) are registered municipal advisors nor provide advice to municipal entities or obligated persons with respect to municipal financial products or the issuance of municipal securities (including regarding the structure, timing, terms and similar matters concerning municipal financial products or municipal securities issuances) or engage in the solicitation of municipal entities or obligated persons for such services. With respect to this presentation and any other information, materials or communications provided by Regions, (a) Regions is not recommending an action to any municipal entity or obligated person, (b) Regions is not acting as an advisor to any municipal entity or obligated person and does not owe a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934 to any municipal entity or obligated person with respect to such presentation, information, materials or communications, (c) Regions is acting for its own interests, and (d) you should discuss this presentation and any such other information, materials or communications with any and all internal and external advisors and experts that you deem appropriate before acting on this presentation or any such other information, materials or communications.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.