“Do C’s Still Get Degrees?”- A Fresh Look at Active Equity Investing

Download White Paper | October 29 2024

As an undergraduate in college, I made it to my senior year with several unused electives and a solid GPA. So, I sought to broaden my horizons by taking courses like Introduction to Water Polo, Ballroom Dancing, and History of Motion Picture Criticism, and it was in this last course that I, for the first time, received a “C”. Disappointed and little perplexed, I approached my professor to discuss. The explanation was succinct and disheartening: “I didn’t really like your interpretation of the symbolism” in the film we were asked to critique for our final. For a student with a curriculum steeped in quantitative analysis, the idea that a subjective opinion could lower my GPA left an indelible mark. To add to insult to injury, he nonchalantly reassured me with, “C’s still get degrees”.

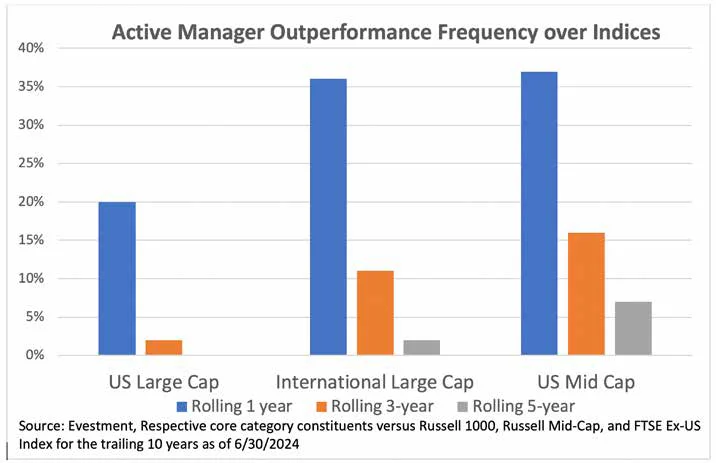

The mindset- accepting average as “good enough”- has been similarly embraced by many institutional investors. For many, mirroring returns of the index is enough. At the same time, if consistently outperforming the S&P 500 or similar large cap indices was an easy task, the monumental shift from active to passive investing over the past two decades would never have occurred. Yet statistics are telling: the past decade, approximately 73% of large cap active managers have underperformed the S&P over rolling one- year periods and a staggering 94% have underperformed over rolling three-year periods. Why then, do so many persist in this Sisyphean task of picking active equity managers?

Active Manager Outperformance Frequency over Indices

Source: Evestment, Respective core category constituents versus Russell 1000, Bloomberg Bond Indices, and the ICE AMT Free Municipal Index for the trailing 10 years as of 6/30/2024

The idea that we control our own destiny is alluring to us all. In fact, it is the basic premise for the American dream. However, market forces play a crucial role in this dream, and some approaches to active management have a lower success rate than others. The MLB batting average hovers around .250, and reaching base in one out of four attempts lets you play with some of the best in the world. Many of those that get on base one out of three (.333 BA) times land in the Baseball Hall of Fame. There are no baseball players commemorated in Cooperstown, NY that have a career batting average greater than .400, but there are many games where the success rates of the key performance metrics are well above 50%. Picking large cap stocks is difficult, and few have demonstrated repeatable success rates. However, some strategies with structural advantages have much higher success rates, and it is possible to isolate the “alpha” of a strategy today with the “beta” of another.

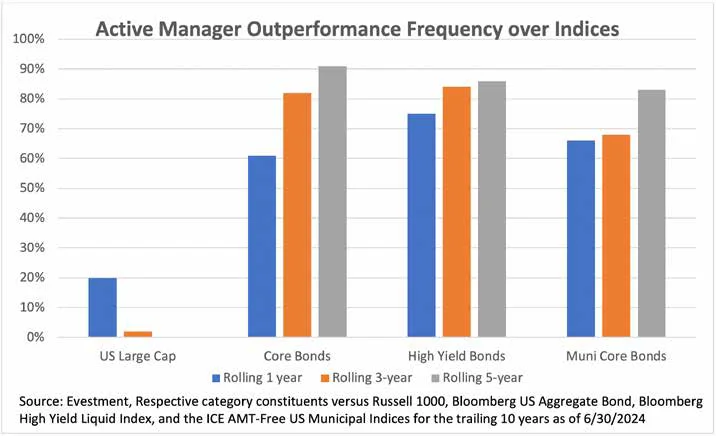

Strategies with structural advantages often live in markets or segments of markets with inefficiencies and in some cases, they involve utilizing an approach that a benchmark can’t. Certain markets and securities, such as emerging markets or many fixed income instruments, are structurally less efficient. Given that most equity investors tend to be long-term in nature, capitalizing on short-term inefficiencies- such as those related to index inclusion/ exclusion, secondary offerings, or earnings expectations- can also be a source of excess return for equity investors. Altering the nature of a strategy- such as introducing or replacing a beta to complement a separate source of alpha has traditionally been known as “Portable Alpha”. Highland Associates first began running portable alpha strategies in 2017 as a small portion of our client’s total equity allocation, and their proven effectiveness led to these strategies becoming the majority allocation in discretionary portfolios by 2020.

Active Manager Outperformance Frequency over Indices

Source: Evestment, Respective core category constituents versus Russell 1000, Bloomberg Bond Indices, and the ICE AMT Free Municipal Index for the trailing 10 years as of 6/30/2024

Portable Alpha is not a novel concept; its origins trace back to the early 1980s. Much like their hedge fund counterparts, there have been some hard learned lessons over the years, due to flawed implementations. Some of the earliest pioneers of Portable Alpha utilized longer duration fixed income securities as the alpha source. However, these strategies experienced issues as rates rose quickly in recent years. The assumption that stock and bond beta would never correlate proved fundamentally flawed. Portable alpha also became adopted by many prior to the great financial crisis. Regrettably, many of these early adopters did not count on the potential asset/liability mismatch. When stocks plummeted in 2008, and hedge funds were unable to pay redemptions, many were compelled to liquidate their beta exposures at the worst possible moment. This underscores one of the most critical lessons of portable alpha implementation: ensuring that alpha and beta sources always remain highly liquid. The final, and the most crucial lesson in portable alpha implementation, came from the experience of one of Germany’s largest asset managers. Their structured alpha fund delivered strong performance for several years, but during the unexpectedly sharp downturn of March 2020, many investors faced an unrecoverable loss. The strategy took advantage of volatility by being long options while being short exotic instruments- called variance swaps, and this ultimately proved disastrous. With flawed assumptions about performance in extreme environments, the mismatch resulted in a painful lesson in early 2020. In hindsight of course the lesson is clear: avoid excessive correlation between alpha and beta in the tails of the distribution.

To make the cost and complexity worth the price of admission in portable alpha, it requires three qualities: consistency, superior risk adjusted returns, and some scalability. If the alpha generated fails to exceed the cost of equity financing, driven by the risk-free rate, then it may not be genuine alpha. Some strategies that deliver mostly consistent excess returns simply add other risk factors, and investors should be mindful about how much these strategies can underperform. Deleveraging risks are common in strategies that have hedge fund attributes, and these strategies can go from delivering modest outperformance to modest underperformance. However, strategies that deliver excess performance through adding risk factors, such as a momentum factor or high yield credit spreads, may have better performance at a lower cost in the good years, but the level of underperformance in a difficult equity environment could be monumental. When designing a portable alpha program, it is crucial to either diversify these strategies to mitigate underperformance in an equity market downturn or establish an acceptable level of underperformance. This stands in contrast to traditional active equity which often has its best relative performance when equity markets decline. Beyond consistency, strong risk adjusted returns are an ideal hallmark. The Sharpe Ratio is common gauge of such performance, and when the equity funding cost mirrors the risk-free rate, these portfolios will exhibit high information ratios. Both metrics measure the volatility of excess return, the simple difference is that information ratios calculate this over a benchmark while Sharpe ratios calculations are over the risk-free rate. In essence, high Sharpe ratio strategies often result in high information ratio strategies within portable alpha portfolios. Many high Sharpe strategies come with capacity constraints, limiting scalability. As equity allocations for most portfolios often dwarf hedge fund or absolute return allocations, more strategies will be needed to meet the demand. For the largest asset owners, scaling becomes an even greater challenge. However, combining strategies in a thoughtful and uncorrelated way has proven to be a winning solution.

Today, we are witnessing a surge in new portable alpha launches. Many of these strategies have learned from the past and mitigated some of the obvious risks. Others may still have these lessons to learn. We view portable alpha as a compelling and attractive way to alter the return distributions in asset classes where long-only managers typically underperform. While it offers the potential to enhance the return distribution and risk adjusted returns, it comes with a caveat: it introduces unfamiliar risks in most equity portfolios, it can be more expensive, and is rarely tax efficient for the tax conscious investors. In the future, such strategies may become more widely available in tax-efficient active ETFs, but until then, they are likely more appropriate for tax exempt institutions and those that value performance over fees or tax efficiency.

IMPORTANT DISCLOSURES: This publication has been prepared by the staff of Highland Associates, Inc. for distribution to, among others, Highland Associates, Inc. clients. Highland Associates is registered with the United States Security and Exchange Commission under the Investment Advisors Act of 1940. Highland Associates is a wholly owned subsidiary of Regions Bank, which in turn is a wholly owned subsidiary of Regions Financial Corporation. Research services are provided through Multi-Asset Solutions, a department of the Regions Asset Management business group within Regions Bank. The information and material contained herein is provided solely for general information purposes only. To the extent these materials reference Regions Bank data, such materials are not intended to be reflective or indicative of, and should not be relied upon as, the results of operations, financial conditions or performance of Regions Bank. Unless otherwise specifically stated, any views, opinions, analyses, estimates and strategies, as the case may be (“views”), expressed in this content are those of the respective authors and speakers named in those pieces and may differ from those of Regions Bank and/or other Regions Bank employees and affiliates. Views and estimates constitute our judgment as of the date of these materials, are often based on current market conditions, and are subject to change without notice. Any examples used are generic, hypothetical and for illustration purposes only. Any prices/quotes/statistics included have been obtained from sources believed to be reliable, but Highland Associates, Inc. does not warrant their completeness or accuracy. This information in no way constitutes research and should not be treated as such. The views expressed herein should not be construed as individual investment advice for any particular person or entity and are not intended as recommendations of particular securities, financial instruments, strategies or banking services for a particular person or entity. The names and marks of other companies or their services or products may be the trademarks of their owners and are used only to identify such companies or their services or products and not to indicate endorsement, sponsorship, or ownership by Regions or Highland Associates. Employees of Highland Associates, Inc., may have positions in securities or their derivatives that may be mentioned in this report. Additionally, Highland’s clients and companies affiliated with Highland Associates may hold positions in the mentioned companies in their portfolios or strategies. This material does not constitute an offer or an invitation by or on behalf of Highland Associates to any person or entity to buy or sell any security or financial instrument or engage in any banking service. Nothing in these materials constitutes investment, legal, accounting or tax advice. Non-deposit products including investments, securities, mutual funds, insurance products, crypto assets and annuities: Are Not FDIC-Insured I Are Not a Deposit I May Go Down in Value I Are Not Bank Guaranteed I Are Not Insured by Any Federal Government Agency I Are Not a Condition of Any Banking Activity.

Neither Regions Bank nor Regions Asset Management (collectively, “Regions”) are registered municipal advisors nor provide advice to municipal entities or obligated persons with respect to municipal financial products or the issuance of municipal securities (including regarding the structure, timing, terms and similar matters concerning municipal financial products or municipal securities issuances) or engage in the solicitation of municipal entities or obligated persons for such services. With respect to this presentation and any other information, materials or communications provided by Regions, (a) Regions is not recommending an action to any municipal entity or obligated person, (b) Regions is not acting as an advisor to any municipal entity or obligated person and does not owe a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934 to any municipal entity or obligated person with respect to such presentation, information, materials or communications, (c) Regions is acting for its own interests, and (d) you should discuss this presentation and any such other information, materials or communications with any and all internal and external advisors and experts that you deem appropriate before acting on this presentation or any such other information, materials or communications.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.