Stocks: The ‘Generals” Lead The Market Lowe; Small-Caps Lag As Rate Cuts Are Pushed Farther Out; Emerging Markets Outperform, Buoyed By Chinese Stocks; Poor IPO Performance A Cautionary Tale.

Download Weekly Market Commentary | September 25 2023

Key Observations

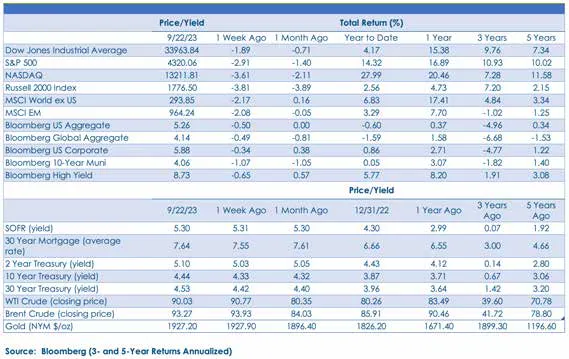

- Selling pressure took hold stateside after the FOMC’s meeting as interest rate projections and some apparent disagreement within the Fed’s ranks regarding the path forward for the U.S. economy rattled markets. The S&P 500 and small-cap Russell 2000 ultimately fell 2.9% and 3.8% respectively, as weakness out of economically sensitive sectors such as consumer discretionary, industrials, and materials weighed on domestic indices.

- The 10-year Treasury yield hit the highest level since October of 2007 on the heels of the FOMC meeting, briefly touching 4.5% before buyers stepped in on Friday and forced yields lower. The Bloomberg Aggregate and Bloomberg Corporate indices responded negatively to the move higher in long-term yields, falling 0.5% and 0.3%, respectively, on the week.

- As expected, the FOMC left the fed funds rate unchanged last week but did keep another quarter-point hike in its year- end projections, giving the Committee the option to hike further should it need to do so. Markets were taken aback by the removal of 50-basis points of projected rate cuts in both ’24 and ’25 from the FOMC’s updated Summary of Economic Projections, or dot-plot, which called into question whether inflation was moving toward the Fed’s target on a sustainable path.

- The Bank of England (BoE) somewhat surprised markets by standing pat on rates as it chose to focus on faltering economic growth projections rather than inflationary pressures that remain well above the central bank’s target. The BoE’s inaction led to weakness in the British pound and a modest lift in U.K. sovereign bond yields as investors appeared to fear inflation becoming entrenched.

What We’re Watching:

- The Conference Board’s Consumer Confidence survey for September is released Tuesday and is expected to fall to 105.0 from 106.1 in August.

- Durable goods orders for August are released Wednesday and are expected to have fallen 0.2% month over month, which would be a vast improvement over the -5.2% reading from July.

- Personal Consumption Expenditure (PCE), the FOMC’s preferred inflation g auge, f or A ugust i s r eleased F riday. PCE Deflator is expected to rise 0.45% month over month, more than twice the 0.21% reading from July, while core PCE Deflator is expected to rise 0.20% month over month, a modest deceleration from 0.22% in July. Year over year, PCE Deflator is expected to rise 3.5%, while core PCE is projected to show a 3.9% increase, still well above the FOMC’s 2% target.

- Chicago Purchasing Managers Index (PMI), otherwise known as the Chicago Business Barometer, for September is released Friday and is expected to fall to 48.5 from 48.7 in August. A reading above 50 indicates that economic activity is generally expanding, below 50 that it is generally declining.

What Happened Last Week:

Stocks: The ‘Generals” Lead The Market Lowe; Small-Caps Lag As Rate Cuts Are Pushed Farther Out; Emerging Markets Outperform, Buoyed By Chinese Stocks; Poor IPO Performance A Cautionary Tale.

September Swoon Continues With 2023’s Winners Bearing The Brunt Of Last Week’s Selloff. The S&P 500 ended the week lower by 2.9% with all sectors in the red. On a relative basis, consumer staples, communication services, energy, and health care outperformed the S&P 500, while consumer discretionary, industrials, and materials underperformed. What stood out most in last week’s selloff was the pronounced weakness in some of this year’s biggest winners as Alphabet, Amazon, Microsoft, Nvidia, and Tesla, among others, each experienced profit taking and lagged the S&P 500. On its surface, not an encouraging sign for market bulls. While there were few positive takeaways from last week’s price action, the adage “they take out the generals last” comes to mind as last week’s selloff in this year’s winners or, the “generals,” could be a sign that we are nearing the end of this pullback. As September winds down, we are preparing to enter what has historically been a more favorable stretch in the calendar for stocks, but a likely government shutdown in early October, along with the prospect of continued upward pressure on Treasury yields, clouds the near-term outlook for stocks and may tamp down investor sentiment for a bit longer still.

Small Caps Lag As Expected Relief From Rate Cuts Is Pushed Farther Out In Time. Equites were weaker across the board last week, but companies farther down the cap-spectrum with greater refinancing needs and shorter debt maturities fared the worst, evidenced by the Russell 2000’s 3.8% drop. Interest rate sensitive sectors such as real estate, information technology, and consumer discretionary were the leading detractors on the week, while defensive areas like consumer staples and utilities were relative bright spots, independent of market capitalization. Despite the recent underperformance out of the Russell 2000, we maintain a neutral allocation to small- and mid-cap (SMid) U.S. stocks as active managers could have the wind at their sails relative to benchmarks as they seek to pick up profitable, higher quality names that have been sold due to investor de-risking across the equity landscape.

A Cautionary Tale From Recent High-Profile IPOs. After strong starts out of the gate, three recent high-profile initial public offerings (IPOs) have since faltered as profit taking quickly took hold as broader market sentiment soured. Arm came public two weeks ago, while Instacart and Klaviyo began trading last week, each to fanfare surrounding their offering. However, after share price pops on their first few days of trading, the newness and excitement quickly wore off and share prices for all three offerings have dropped dramatically. Arm and Instacart closed last week below their IPO price, while Klaviyo ended the week 15% below its post-IPO high, all of which should throw up a caution flag for other companies considering going public in the current market environment. When it comes to IPOs, timing matters, and the current market environment isn’t likely to reward new entrants, even profitable, higher quality ones such as the three listed above, and as a result a projected late-’23 IPO boom may prove to be a bust.

Bonds: A Surprise Out Of The FOMC Meeting As More Rate Cuts Are Removed From The Committee’s Projections Than Expected; Bank Of England Inaction Likely To Push U.K. Sovereign Yields Higher, Weaken The Pound.

FOMC Meeting Recap: Updated Dot-Plot Takes Out Rate Cuts In ’24 And ’25; Chair Powell, The Committee Have Differing View On The Likelihood Of A ‘Soft Landing’. Federal Open Market Committee (FOMC) met last Tuesday/Wednesday and as expected, left the fed funds rate unchanged with 5.5% remaining the top-end of the range. The Committee left its options open for November and December as the closely watched Summary of Economic Projections (SEP), or dot-plot still had one more 25-basis point hike included for 2023, but we don’t view this as explicit guidance regarding the path forward for rates so much as the Committee maintaining the option to hike if it feels it needs to do so. While most of the Committee’s projections were in-line with the market’s expectations, what seemed to catch investors off guard in the dot-plot was the removal of 50-basis points of rate cuts from both the 2024 and 2025 projections as the Committee now expects fed funds to average 5.1% next year and 3.9% in 2025, up from 4.6% and 3.4% when the FOMC last issued its dot-plot in June. The removal of cuts from the Committee’s projections for 2024 and 2025 rattled markets and pushed interest rates across the U.S. Treasury yield curve higher on the week. Notably, FOMC Chair Jerome Powell’s stated in his post-meeting press conference that the Committee will be watching movements in inflation, the labor market, and economic growth data over coming meetings and that the economy is now at a point where the Committee should “proceed carefully” regarding future rate hikes while stating that “the full effects of tightening have yet to be felt.” Chair Powell stated that while a soft landing for the U.S. economy is the Committee’s goal, that outcome is not his base case, which is appears to be at odds with the FOMC’s projections. Investors hate uncertainty above all else, and the selloff in stocks and bonds last week is a byproduct of investors stepping to the sidelines until some semblance of clarity or certainty can be found, which may take some time.

Corporate Borrowers Tap Markets Early To Mitigate Expected Rate Volatility Post-FOMC. Monday marked the peak in deal volume last week as ten corporate issuers came to market with one hold-out, with paper totaling $15B that was 3 times oversubscribed. Corporate treasurers may be patting themselves on the back after the decision to get ahead of last week’s Fed meeting as pricing early in the week likely saved them a substantial sum in interest payments due to the subsequent rise in longer-term rates. As might be expected, new issuance was muted over the remainder of the week and after the recent rise in Treasury yields, those corporations able to do so may choose to sit on their hands for a bit and wait for the dust to settle before tapping the credit markets. The Bloomberg Corporate index, which is a purely investment-grade index, ended the week lower by 0.3% as tighter credit spreads week over week wasn’t enough to offset losses in longer duration bonds stemming from the rise in Treasury yields. The Bloomberg Corporate index carries a yield shy of 6%, and while investment- grade corporates are increasingly attractive, we would like to see long-term Treasury yields stabilize before getting more involved due to the longer duration profile of these bonds, broadly speaking.

Bank of England Holds Rates Steady As Recession Fears Take Precedent Over Fighting Inflation. In a narrow decision, the BoE voted 5-4 to leave its policy rate unchanged at 5.25% last week. The BoE’s decision to ere on the side of not forcing the U.K. into a recession rather than focusing solely on waging war on elevated inflation is a notable shift with sweeping ramifications. This decision comes on the heels of a better than feared August inflation reading as year-over-year Consumer Price Index (CPI) fell to 6.7% vs. the 7.0% forecasted by economists, and year- over-year core CPI came in at 6.2%, well below the 6.8% estimate. Even though inflation in the U.K. continues to run well above what we’re currently experiencing in the U.S., its highly likely this is the peak in rates for the BoE as the central bank has limited flexibility to tighten further given substantial economic weakness in the U.K. The British pound weakened materially over the balance of last week vs. the U.S. dollar, evidence that the currency market believes the BoE is done and that higher inflation is likely to become entrenched. This dynamic is likely to keep upward pressure on U.K. gilt yields into the winter months and is likely to weigh on economic growth due to the U.K.’s heavy reliance on imported goods. The U.K.’s central bank is now more closely aligned with the FOMC, but with far less flexibility and fewer options at its disposal should inflationary pressures reaccelerate into year-end.

The content and any portion of this newsletter is for personal use only and may not be reprinted, sold or redistributed without the written consent of Regions Bank. Regions, the Regions logo and other Regions marks are trademarks of Regions Bank. The names and marks of other companies or their services or products may be the trademarks of their owners and are used only to identify such companies or their services or products and not to indicate endorsement or sponsorship of Regions or its services or products. The information and material contained herein is provided solely for general information purposes.

Regions does not make any warranty or representation relating to the accuracy, completeness or timeliness of any information contained in the newsletter and shall not be liable for any damages of any kind relating to such information nor as to the legal, regulatory, financial or tax implications of the matters referred herein. This material is not intended to be investment advice nor is this information intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only current as of the stated date of their issue. Regions Asset Management is a business group within Regions Bank that provides investment management services to customers of Regions Bank. Employees of Regions Asset Management may have positions in securities or their derivatives that may be mentioned in this report or in their personal accounts. Additionally, affiliated companies may hold positions in the mentioned companies in their portfolios or strategies. The companies mentioned specifically are sample companies, noted for illustrative purposes only.

The mention of the companies should not be construed as a recommendation to buy, hold or sell positions in your investment portfolio. Neither Regions Bank nor Regions Asset Management (collectively, “Regions”) are registered municipal advisors nor provide advice to municipal entities or obligated persons with respect to municipal financial products or the issuance of municipal securities (including regarding the structure, timing, terms and similar matters concerning municipal financial products or municipal securities issuances) or engage in the solicitation of municipal entities or obligated persons for such services.

With respect to this presentation and any other information, materials or communications provided by Regions, (a) Regions is not recommending an action to any municipal entity or obligated person, (b) Regions is not acting as an advisor to any municipal entity or obligated person and does not owe a fiduciary duty pursuant to Section 15 B of the Securities Exchange Act of 1934 to any municipal entity or obligated person with respect to such presentation, information, materials or communications, (c) Regions is acting for its own interests, and (d) you should discuss this presentation and any such other information, materials or communications with any and all internal and external advisors and experts that you deem appropriate before acting on this presentation or any such other information, materials or communications. Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The information provided herein is for informational purposes only and is intended to report on various investment views held by Multi-Asset Solutions (MAS) and Highland Associates. Opinions, estimates, forecasts, and statements of financial market trends are based on current market conditions that constitute the judgement of MAS and Highland Associates and are subject to change. The information is received from third parties, which is believed to be accurate, but no representation is made that the information provided is accurate and complete. The information is given as of the date indicated and believed to be reliable. While MAS and Highland have tried to provide accurate and timely information, there may be inadvertent technical or factual inaccuracies or typographical errors for which we apologize. The information provided herein does not constitute a solicitation or offer by Highland or its affiliates, to buy or sell any securities or other financial instrument, or to provide investment advice or service. Nothing contained herein should be construed as investment advice or a recommendation to purchase or sell a particular security. Investing involves a high degree of risk, and all investors should carefully consider their investment objective and the suitability of any investments.

Research services are provided through Multi-Asset Solutions, a department of the Regions Asset Management business group within Regions Bank. Highland is a wholly owned subsidiary of Regions Bank, which in turn is a wholly owned subsidiary of Regions Financial Corporation.

Past performance is not indicative of future results. Investments are subject to loss.