Stocks: The ‘Magnificent 7,’ Mega-Cap Technology Leads The Charge In A Bounce Back Week For U.S. Stocks; The Corporate Buyback Window Closing Could Act As A Near-Term Headwind; Economically Sensitive Sectors Are Sources Of Funds As Capital Rotates Back Into ‘Growth.’

Download Weekly Market Commentary | September 16 2024

What We’re Watching:

- August U.S. Retail Sales are released Tuesday and are projected to be flat month over month, a potentially sharp drop from a 1.0% month over month rise in July. Retail sales will be closely monitored as a reading on the willingness and/or ability of the U.S. consumer to spend after concerns surrounding discretionary spending have mounted over the past month.

- The Federal Open Market Committee (FOMC) concludes its two-day meeting on Wednesday. A cut to the Fed funds rate is all but assured, but the magnitude of any move remains uncertain in the eyes of market participants and the futures market views the decision between a 25-basis point and a 50-basis point cut as a coin-flip.

- The Conference Board will publish its index of Leading Economic Indicators (LEIs) for August Thursday with the consensus estimate expecting a drop of 0.25%, which would be an improvement over the -0.6% reading in July.

Key Observations

- Risk appetite returned with U.S. stocks of all market caps and corporate bonds rallying over the balance of the week. Institutional investors and those in charge of corporate buyback programs returned from vacations and appeared eager to put cash to work after the selloff in riskier assets that took place during the Labor Day- shortened week.

- Information technology stocks, specifically semiconductors, staged an impressive comeback after falling sharply the prior week, providing a much-needed boost for investor sentiment as a notoriously challenging seasonal stretch for stocks remains in place into mid- October. Economically sensitive sectors such as energy and financial services were sources of funds as capital rotated back into the ‘Magnificent 7’ with six of the seven members of this anointed group rallying 4% or more on the week.

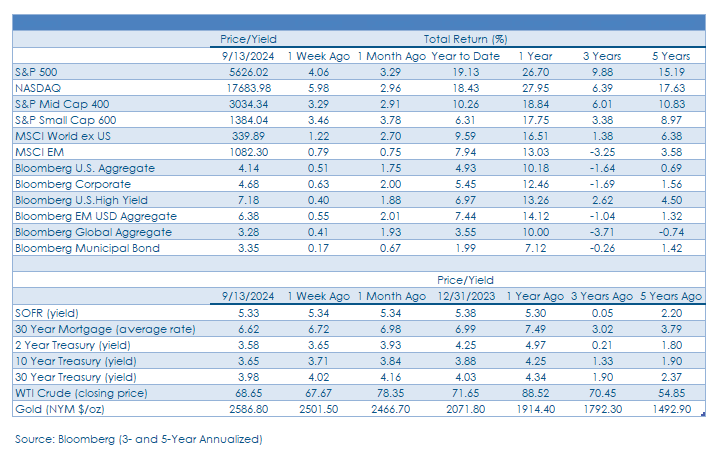

- Yields on U.S. Treasury bonds across the maturity spectrum ended the week lower by 5- to 10-basis points as investors shrugged off a ‘warm’ August inflation reading, and strong 10- and 30-year Treasury auction results put downward pressure on yields. The 3.65% level for the 10-year Treasury yield remains as a key support level, in our view, and given our view that the U.S. economy is normalizing, not cracking, a bounce in yields on long-term Treasuries could materialize in the near-term with 3.85%-3.90% a reasonable upside target for the 10-year yield.

What Happened Last Week:

Stocks: The ‘Magnificent 7,’ Mega-Cap Technology Leads The Charge In A Bounce Back Week For U.S. Stocks; The Corporate Buyback Window Closing Could Act As A Near-Term Headwind; Economically Sensitive Sectors Are Sources Of Funds As Capital Rotates Back Into ‘Growth.’

A Bounce Back Week For The Technology Sector With Semiconductors Leading The Way. Many of the top names in the information technology sector found their footing last week after faltering the prior week, propelling the sector to a 7.3% gain. The closely watched Philadelphia Semiconductor Index staged an impressive 10% rally after falling over 12% the week before, easily outpacing the S&P 500’s more than respectable 4% weekly gain. The bulk of those returns came in the back half of the week as Nvidia’s CEO Jensen Huang commented that customers appeared “tense’’ when it came to being able to acquire the company’s chips and software given the outsized demand the semiconductor behemoth is seeing. These remarks threw cold water on the narrative that spending on semiconductors and other companies tied to the artificial intelligence (AI) and data-center ecosystem was set to slow materially in the coming quarters. Huang’s comments coincided with a ‘warmer’ August core CPI print on Wednesday, but the CPI reading was quickly dismissed as noise and little more than a rounding error, causing only a short-lived market hiccup. Institutional investors largely absent during the Labor Day shortened week appeared eager to jump back into mega-cap technology names trading at discounted prices after the prior week’s low volume selloff. Investors may be well served to tread lightly in higher beta areas such as semiconductors in the coming weeks to blunt the potential negative impacts of seasonal headwinds, but the AI and data center buildout themes remain alive and quite well, in our view, and investors maintaining allocations in these secular growth areas in the coming years should be rewarded for doing so. In the near-term, one dynamic worth watching that could impact stock prices is the closing of the buyback window for corporations in the lead-up to quarterly earnings season kicking off in three weeks. After the prior week’s sharp selloff in growthier pockets of the market, we suspect corporations repurchasing their own shares at discounted prices provided a market tailwind last week, but that support will be removed in the coming weeks and this source of demand for stocks may not return until the back-half of October as earnings season is wrapping up.

Energy, Financial Services Underperform As Capital Rotates Back Into ‘Growth.’ Seesaw price action continued last week as capital rotated out of cyclical sectors such as energy and financial services and back into secular growth names in the communication services, consumer discretionary, and information technology sectors. Energy and financial services, both cyclical sectors, both lagged the S&P 500 meaningfully on the week with financials rising 0.4% and energy falling 0.7%. Money center banks experienced price declines mid-week as heavyweights J.P. Morgan and Goldman Sachs came under selling pressure amid less encouraging remarks made by executives from both companies at conferences last week on the outlook for net interest margins (NIM) and the prospect for an acceleration in capital markets and trading activity in the coming quarters. Also of note, Ally Financial reported an uptick in auto loan delinquencies and net charge-offs, prompting concerns that other lenders in the consumer finance area could be at significant risk should economic growth slow even modestly. For now, credit quality concerns appear company-specific but merit watching into earnings season to ensure any pockets of weakness remain contained. For the energy sector, China’s weak economy continues to put downward pressure on oil prices, with West Texas Intermediate (WTI) crude oil trading as low as $65.75 per barrel in the middle of last week before rallying to end the week at $69.24. The S&P 500 energy sector has only managed to eke out a 1.8% year-to-date price return, well below the S&P 500’s 17.9% gain and is now one of the cheapest segments in the S&P 500 with a price-to-earnings ratio of just 12.3 times. However, buying economically sensitive stocks based on ‘cheap’ valuations and in the absence of positive fundamental catalysts increases the likelihood you’re buying a value trap as opposed to true value. With energy inventories elevated and China’s economy showing few signs of reaccelerating in the near-term, potential drivers of a rally in crude oil and the S&P 500 energy sector are less easily identifiable, leaving us with the opinion that energy stocks may be more trap than value over the near-term.

Bonds: Treasury Yields End The Week Lower Investors Shrug Off ‘Warm’ Inflation Data With Strong Demand For 10- and 30-Year Auctions Evident; FOMC Set To Cut Rates This Week, But The Messaging May Be More Meaningful For Markets Than The Magnitude Of The Move.

Few Signs Of A Drop Off In Demand Despite Lower Treasury Yields. Bond market participants benefited from volatility early last week as demand for Treasuries rose in the lead- up to CPI mid-week. This was a welcome coincidence for the U.S. Treasury which was scheduled to auction off both shorter-term and longer maturity bonds during the week. Our attention was fixed on the 10- and 30-year Treasury auctions given the prospect of significantly weaker demand on the back of falling yields on the long end of the yield curve in recent months. Instead, both auctions were well-bid with the 30-year auction posting a bid-to- cover ratio (a higher number indicates greater demand) of 2.38, modestly above the ten-auction average of 2.31 with indirect bidders, primarily foreign central banks, more active than expected. The midweek 10-year auction posted an even higher 2.64 bid-to-cover, underscoring just how strong demand for intermediate and longer-term paper continues to be despite the sharp decline in interest rates. Market participants have appeared willing, if not eager to venture into longer maturity bonds in advance of the start of a Fed easing cycle beginning this week, but as fears of an economic slowdown prove unfounded, Treasury yields could bounce from current levels. The Bloomberg Aggregate Bond index ended the week with a 0.5% gain and is now higher by 4.9% year-to-date, but given our view that economic growth is normalizing, not collapsing, we see Treasuries, broadly speaking, as a clip- your-coupon asset class, at best, over the coming months.

FOMC Meeting Preview: All About The Messaging. With the Federal Open Market Committee (FOMC) all but certain to cut the Fed funds rate when it meets this week, market participants have been placing their bets in recent weeks as to whether the Committee will initially cut by a measured and largely symbolic 25-basis points, or if it could potentially make a more impactful, albeit potentially problematic from an optics and messaging perspective, 50-basis point move. A 25-basis point cut is undoubtedly easier to defend and wouldn’t likely rattle markets as investors tend to prefer gradual to sudden when it comes to monetary policy adjustments. However, a quarter-point cut wouldn’t do much to halt the cooling labor market, which could deteriorate further between now and the FOMC’s next meeting in mid-November with the Committee unable to do much about it, potentially requiring a more aggressive policy adjustment seven weeks hence. By its own admission, the FOMC doesn’t seek further deterioration in the labor market to ease inflationary pressures, and a 50-basis point rate cut would send a strong message to corporations and market participants that the Fed has shifted its focus from the price stability (inflation) component of its dual mandate to the full employment component, which could boost corporate confidence and potentially spur an uptick in hiring in the coming months. However, one counter argument to a larger rate cut could be that the market’s interpretation of such a move would be that the FOMC is increasingly behind the curve and should have cut when it met in late July, and/or that the economy and labor market are slowing/deteriorating more rapidly than had been previously appreciated by Committee members and market participants. How the market interprets this week’s policy shift will likely rest on the shoulders of Chair Jerome Powell and his ability to communicate the rationale for the move and allay fears or concerns that the FOMC has lost credibility by not acting sooner to make monetary policy less restrictive.

August Inflation Mostly In-Line, But ‘Warm’ Core CPI Makes The Case For A 50-Basis Point Cut This Week Tougher To Make. Consumer Price Index (CPI) for August was released last Wednesday with the headline reading rising 0.2% month over month and 2.5% year over year, while core CPI rose 0.3% month over month, after rounding up from 0.28%, and 3.2% year over year. Headline readings were in-line with consensus estimates, but the headline grabber was month over month core coming in ‘warm’ versus the consensus estimate. The modestly higher than expected core CPI reading initially led Fed funds futures to lower the likelihood of a 50-basis point cut to the Fed funds rate when the FOMC meets this week to around 15% from 33% the day prior. The probability of a half-point cut was viewed as a coin-flip on Friday as at least one vocal former FOMC member voiced his support for a more sizable cut. While less likely now than it was in the lead-up to the CPI release, in our view, a more sizable and impactful half-point cut still can’t be ruled out entirely. Committee members focused on the cooling labor market could make the case to move more aggressively now given the seven-week gap between FOMC meetings and any additional deterioration in the labor market between now and then could lead to even more drastic measures. Our base case continues to call for a 25-basis point cut this week, followed by additional quarter-point rate cuts in November and December.

IMPORTANT DISCLOSURES: THIS PUBLICATION HAS BEEN PREPARED BY THE STAFF OF HIGHLAND ASSOCIATES, INC. FOR DISTRIBUTION TO, AMONG OTHERS, HIGHLAND ASSOCIATES, INC. CLIENTS. HIGHLAND ASSOCIATES IS REGISTERED WITH THE UNITED STATES SECURITY AND EXCHANGE COMMISSION UNDER THE INVESTMENT ADVISORS ACT OF 1940. HIGHLAND ASSOCIATES IS A WHOLLY OWNED SUBSIDIARY OF REGIONS BANK, WHICH IN TURN IS A WHOLLY OWNED SUBSIDIARY OF REGIONS FINANCIAL CORPORATION. RESEARCH SERVICES ARE PROVIDED THROUGH MULTI-ASSET SOLUTIONS, A DEPARTMENT OF THE REGIONS ASSET MANAGEMENT BUSINESS GROUP WITHIN REGIONS BANK. THE INFORMATION AND MATERIAL CONTAINED HEREIN IS PROVIDED SOLELY FOR GENERAL INFORMATION PURPOSES ONLY. TO THE EXTENT THESE MATERIALS REFERENCE REGIONS BANK DATA, SUCH MATERIALS ARE NOT INTENDED TO BE REFLECTIVE OR INDICATIVE OF, AND SHOULD NOT BE RELIED UPON AS, THE RESULTS OF OPERATIONS, FINANCIAL CONDITIONS OR PERFORMANCE OF REGIONS BANK. UNLESS OTHERWISE SPECIFICALLY STATED, ANY VIEWS, OPINIONS, ANALYSES, ESTIMATES AND STRATEGIES, AS THE CASE MAY BE (“VIEWS”), EXPRESSED IN THIS CONTENT ARE THOSE OF THE RESPECTIVE AUTHORS AND SPEAKERS NAMED IN THOSE PIECES AND MAY DIFFER FROM THOSE OF REGIONS BANK AND/OR OTHER REGIONS BANK EMPLOYEES AND AFFILIATES. VIEWS AND ESTIMATES CONSTITUTE OUR JUDGMENT AS OF THE DATE OF THESE MATERIALS, ARE OFTEN BASED ON CURRENT MARKET CONDITIONS, AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. ANY EXAMPLES USED ARE GENERIC, HYPOTHETICAL AND FOR ILLUSTRATION PURPOSES ONLY. ANY PRICES/QUOTES/STATISTICS INCLUDED HAVE BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT HIGHLAND ASSOCIATES, INC. DOES NOT WARRANT THEIR COMPLETENESS OR ACCURACY. THIS INFORMATION IN NO WAY CONSTITUTES RESEARCH AND SHOULD NOT BE TREATED AS SUCH. THE VIEWS EXPRESSED HEREIN SHOULD NOT BE CONSTRUED AS INDIVIDUAL INVESTMENT ADVICE FOR ANY PARTICULAR PERSON OR ENTITY AND ARE NOT INTENDED AS RECOMMENDATIONS OF PARTICULAR SECURITIES, FINANCIAL INSTRUMENTS, STRATEGIES OR BANKING SERVICES FOR A PARTICULAR PERSON OR ENTITY. THE NAMES AND MARKS OF OTHER COMPANIES OR THEIR SERVICES OR PRODUCTS MAY BE THE TRADEMARKS OF THEIR OWNERS AND ARE USED ONLY TO IDENTIFY SUCH COMPANIES OR THEIR SERVICES OR PRODUCTS AND NOT TO INDICATE ENDORSEMENT, SPONSORSHIP, OR OWNERSHIP BY REGIONS OR HIGHLAND ASSOCIATES. EMPLOYEES OF HIGHLAND ASSOCIATES, INC., MAY HAVE POSITIONS IN SECURITIES OR THEIR DERIVATIVES THAT MAY BE MENTIONED IN THIS REPORT. ADDITIONALLY, HIGHLAND’S CLIENTS AND COMPANIES AFFILIATED WITH HIGHLAND ASSOCIATES MAY HOLD POSITIONS IN THE MENTIONED COMPANIES IN THEIR PORTFOLIOS OR STRATEGIES. THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR AN INVITATION BY OR ON BEHALF OF HIGHLAND ASSOCIATES TO ANY PERSON OR ENTITY TO BUY OR SELL ANY SECURITY OR FINANCIAL INSTRUMENT OR ENGAGE IN ANY BANKING SERVICE. NOTHING IN THESE MATERIALS CONSTITUTES INVESTMENT, LEGAL, ACCOUNTING OR TAX ADVICE. NON-DEPOSIT PRODUCTS INCLUDING INVESTMENTS, SECURITIES, MUTUAL FUNDS, INSURANCE PRODUCTS, CRYPTO ASSETS AND ANNUITIES: ARE NOT FDIC-INSURED I ARE NOT A DEPOSIT I MAY GO DOWN IN VALUE I ARE NOT BANK GUARANTEED I ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY I ARE NOT A CONDITION OF ANY BANKING ACTIVITY.

NEITHER REGIONS BANK NOR REGIONS ASSET MANAGEMENT (COLLECTIVELY, “REGIONS”) ARE REGISTERED MUNICIPAL ADVISORS NOR PROVIDE ADVICE TO MUNICIPAL ENTITIES OR OBLIGATED PERSONS WITH RESPECT TO MUNICIPAL FINANCIAL PRODUCTS OR THE ISSUANCE OF MUNICIPAL SECURITIES (INCLUDING REGARDING THE STRUCTURE, TIMING, TERMS AND SIMILAR MATTERS CONCERNING MUNICIPAL FINANCIAL PRODUCTS OR MUNICIPAL SECURITIES ISSUANCES) OR ENGAGE IN THE SOLICITATION OF MUNICIPAL ENTITIES OR OBLIGATED PERSONS FOR SUCH SERVICES. WITH RESPECT TO THIS PRESENTATION AND ANY OTHER INFORMATION, MATERIALS OR COMMUNICATIONS PROVIDED BY REGIONS, (A) REGIONS IS NOT RECOMMENDING AN ACTION TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON, (B) REGIONS IS NOT ACTING AS AN ADVISOR TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON AND DOES NOT OWE A FIDUCIARY DUTY PURSUANT TO SECTION 15B OF THE SECURITIES EXCHANGE ACT OF 1934 TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON WITH RESPECT TO SUCH PRESENTATION, INFORMATION, MATERIALS OR COMMUNICATIONS, (C) REGIONS IS ACTING FOR ITS OWN INTERESTS, AND (D) YOU SHOULD DISCUSS THIS PRESENTATION AND ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS WITH ANY AND ALL INTERNAL AND EXTERNAL ADVISORS AND EXPERTS THAT YOU DEEM APPROPRIATE BEFORE ACTING ON THIS PRESENTATION OR ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS.

SOURCE: BLOOMBERG INDEX SERVICES LIMITED. BLOOMBERG® IS A TRADEMARK AND SERVICE MARK OF BLOOMBERG FINANCE L.P. AND ITS AFFILIATES (COLLECTIVELY “BLOOMBERG”). BARCLAYS® IS A TRADEMARK AND SERVICE MARK OF BARCLAYS BANK PLC (COLLECTIVELY WITH ITS AFFILIATES, “BARCLAYS”), USED UNDER LICENSE. BLOOMBERG OR BLOOMBERG’S LICENSORS, INCLUDING BARCLAYS, OWN ALL PROPRIETARY RIGHTS IN THE BLOOMBERG BARCLAYS INDICES. NEITHER BLOOMBERG NOR BARCLAYS APPROVES OR ENDORSES THIS MATERIAL OR GUARANTEES THE ACCURACY OR COMPLETENESS OF ANY INFORMATION HEREIN, OR MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED THEREFROM AND, TO THE MAXIMUM EXTENT ALLOWED BY LAW, NEITHER SHALL HAVE ANY LIABILITY OR RESPONSIBILITY FOR INJURY OR DAMAGES ARISING IN CONNECTION THEREWITH.