Stocks: Another Week Of Gains For U.S. Indices But Narrowing Breadth Is Worth Watching; Sectors Capable Of Playing Both Offense And Defense Performing Well; Thaw In The IPO Market Continues; Broad-Based Strength In Emerging Markets A Positive Development.

Download Weekly Market Commentary | September 15 2025

What We’re Watching:

- August retail sales are released on Tuesday with Control Group sales expected to rise 0.4% month over month, down from the 0.5% jump in July.

- The Federal Open Market Committee (FOMC) concludes its two-day meeting on Wednesday. The Committee is expected to cut the Fed funds rate by 25 basis points and take the midpoint of the target range to 4.125% from the current 4.375%. The FOMC will also provide an updated Summary of Economic Projections, commonly known as the dot plot, at this meeting. Revisions to the Committee’s outlook for inflation and the unemployment rate from the June dot plot could be market moving.

- Initial jobless claims for the week ended September 13 and continuing claims for the week ended September 6 are released Thursday and will likely be closely watched after initial claims for the week ended September 6 surprised to the upside.

Key Observations

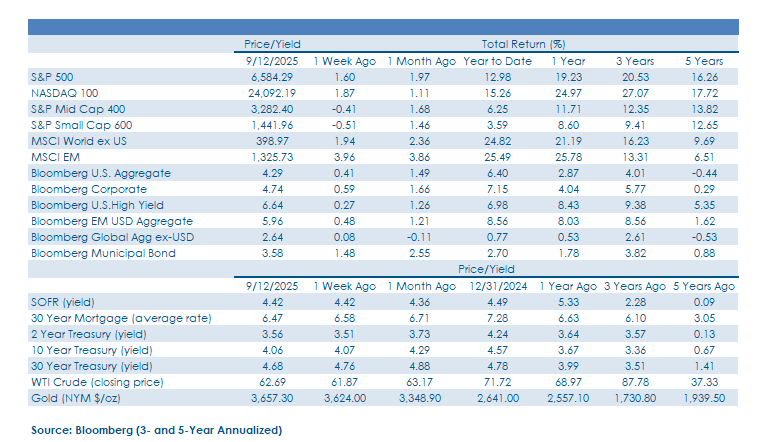

- U.S. equity indices rallied as August inflation data failed to throw cold water on the case for rate cuts. U.S. large cap stocks led the charge as Oracle’s earnings release pulled the information technology sector higher as capital moved back into some of the biggest companies in the S&P 500. Narrow breadth stands out as a blemish for the broader market, evidenced by the equal weight S&P 500 underperforming the market capitalization weighted index by a sizable margin on the week. The September FOMC meeting looms large in this regard as projections of more rate cuts than is currently expected could lead to rotation and a broadening of the rally.

- The MSCI Emerging Markets index was a standout performer on the week as country-specific catalysts in China, South Korea, and Taiwan, among others, buoyed investor sentiment and spurred inflows. We have observed signs that India has bottomed as well, and a trade deal between the U.S. and India could get those stocks moving, providing additional fuel for the rally in developing markets abroad.

- Treasury auctions were indicative of strong demand for long-term debt, both from U.S.-based investors and abroad, even after the drop in yields month-to-date. The 10-year Treasury yield bounced after touching 3.99% on Thursday, which happened to be the year-to-date low made in early April. With inflation still running around 3% year over year and showing few signs of easing, we continue to believe near-term downside for yields is limited. Yields are low and credit spreads are tight, which means diversification is crucial across segments of the U.S. bond market as well as abroad as we see opportunities in developed and developing market sovereigns.

What Happened Last Week:

Stocks: Another Week Of Gains For U.S. Indices But Narrowing Breadth Is Worth Watching; Sectors Capable Of Playing Both Offense And Defense Performing Well; Thaw In The IPO Market Continues; Broad-Based Strength In Emerging Markets A Positive Development.

Another Positive Week For The S&P 500, But Breadth Narrows As Tech Leads The Way. The market capitalization weighted S&P 500 returned 1.6% last week, but the equally weighted S&P 500 rose just 0.2%. This is evidence that last week’s strength was primarily centered around the largest companies at the top of the market and this dynamic bears watching in the coming week(s) as the messaging coming out of this week’s FOMC meeting regarding the path forward for monetary policy could dictate whether breadth improves or a rate cut turns into a ‘sell the news’ event with investors crowding into the largest, most well-capitalized companies. The information technology sector rode the coattails of networking giant Oracle (ORCL) to a 3% gain as the company released quarterly earnings that fell short of expectations but provided guidance for the coming years that far exceeded estimates and led analysts to ratchet higher growth expectations for a broad swath of companies tied to the adoption of artificial intelligence (AI) technology and the buildout of data centers.

Offense Or Defense? Health Care, Utilities Offer A Bit Of Both. Oracle’s earnings release pointed toward exponential growth in the company’s data center business in the coming years which contributed to a mid-week rally out of the S&P 500 utilities sector and propelled this historically sleepy segment of the market to a 2.3% weekly gain. The utilities sector is often viewed as defensive and dull, but with one of the biggest bottlenecks in the data center buildout a shortage of reliable power, utilities can be viewed as having both offensive and defensive characteristics. This dynamic should be supportive of further gains, particularly if Treasury yields continue to trend lower, making the yield/income from utility stocks more attractive.

The health care sector can be viewed through a similar lens as it has a healthy exposure to established pharmaceutical players with relatively steady earnings growth and impressive free cash flow generation characteristics, while also being exposed to higher beta biotechnology stocks. Biotech stocks are often viewed as lottery tickets due to the feast or famine nature of their business models as these stocks have the potential for significant upside on positive trial data, while failures often lead to equally sizable drawdowns. Biotechnology stocks also hold appeal as merger and acquisition (M&A) candidates in the ‘right’ environment, and with expectations of lower short-term interest rates in the coming months, the outlook for biotech M&A appears to be brighter than it has been in some time.

IPO Market Remains Active With Performance Of New Issues Still Supportive. Last Wednesday, fintech darling Klarna, a buy now, pay later company, went public with the offering pricing above the high-end of the expected range before closing the day higher by over 15%. Then, on Friday, cryptocurrency platform Gemini went public with the offering 20-times oversubscribed, and the stock opened over 20% above its IPO price before closing the day higher by over 14%, additional evidence of robust demand. The early success of these two high profile offerings provides more evidence that demand for newly public companies in some of the hottest industry groups remains robust and online ticket broker StubHub, among others, set to price soon, the IPO market shows few signs of cooling off.

At some point, should the supply of new issues become too great and/or the quality of issues fall off, this could weigh on small cap indices as the price performance would likely suffer and investors looking to chase the ‘hot dot’ to quick profits in the IPO market would get burned. However, up to this point, the bulk of recent IPOs have been tied to more established companies that are known commodities that have come to market with private equity backing and much fanfare, increasing the odds of better initial performance in the public markets. So long as this remains the case, the uptick in IPO activity will likely be more supportive rather than detrimental to U.S. small cap stocks.

Broad-Based Strength Leaves Us Constructive On Developing Markets. The MSCI Emerging Markets index gained 3.9% last week, with sizable exposures to China, South Korea, and Taiwan, among others, contributing in a significant way. Optimism is building that China’s efforts to spur consumption are starting to bear fruit, and some of the country’s national champions in the technology arena are garnering increased investor interest as AI plays, driving continued gains for Chinese stocks. In country indices tied to South Korea and Taiwan, SK Hynix and Taiwan Semiconductor carry sizable weights within each country’s respective index, and both rallied alongside U.S. semiconductor stocks as potential beneficiaries of the mania surrounding AI and the data center buildout stateside, and there are reasons to believe additional gains lie ahead for these markets. While the MSCI India lagged the broader MSCI EM index last week, returning 1.4% versus 3.9%, we are encouraged by signs that India bottomed in late August, and a trade deal with the U.S. could be a near-term catalyst to get Indian equities to join in the rally.

The drop in U.S. Treasury yields in the past month, while credit spreads have remained tight is another potentially powerful tailwind for emerging markets as these countries can now issue or roll existing dollar-denominated debt to support economic growth at a lower cost, broadly speaking. Another feather in the cap for emerging markets last week was the bounce out of the MSCI Emerging Markets currency index that took it back above the 50-day moving average for the first time since late July. Strength in the broader EM currency index is a byproduct of capital inflows into developing economies, specifically some of the larger country weights, and is likely a sign of increased confidence in the growth outlook.

Bonds: Auction Results Point To Strong Demand For Long-Term Treasuries, But The 10-Year Yield Bounces Off Technical Support Around 4%; August Inflation Data Doesn’t Alter The Path Forward For Monetary Policy; FOMC All But Certain To Cut The Funds Rate At This Week’s Meeting.

Buyers Appear Eager To Buy 10- And 30-Year Treasuries At Auction, But Yields Reverse Course, Move Higher Into The Weekend. Yields on U.S. Treasuries maturing 3-years and farther out fell modestly over the balance of the week. We were on the lookout for a potential back up in the 10-year yield, specifically, after a multi-month rally took that yield down to levels last seen in early April. However, the $39B 10-year auction on Wednesday was surprisingly very well received with dealers forced to take down just 4.2% of the $39B issue, the lowest percentage on record for that tenor. Notably, the bulk of the demand came from abroad as indirect bidders, primarily central banks, took down a whopping 83.1% of the issue, the 2nd highest percentage on record for the 10-year Treasury at auction.

On the heels of the 10-year auction Wednesday, the U.S. Treasury followed that up with a $22B 30-year bond auction on Thursday. The 30-year auction Thursday was also well received with the dealer community taking down just 10% of the issue, the lowest figure for a 30-year auction since June of 2023. While indirect bidders took down 62%, direct bidders such as the Federal Reserve, U.S. banks, hedge funds, pension funds, and insurance companies were more active, receiving 28% of the issue, the highest percentage dating back to 2011. While we were surprised at how strong the 10- and 30-year auctions were last week, it’s notable that the 10-year yield, specifically, encountered resistance at 3.99% Thursday, the same level from which it bounced in early April. The move higher for yields Friday was partially driven by a rise in the 5–10-year outlook for inflation in the University of Michigan’s September Consumer Sentiment survey, and the FOMC should take note as it risks inflation expectations becoming unanchored if it moves too aggressively to cut rates.

Wholesale Prices Cool In August, But Consumer Prices Remain Sticky. Last week, we received two potentially market moving inflation readings in the form of the August Producer Price Index (PPI) on Wednesday and the August Consumer Price Index (CPI) on Thursday. The PPI reading surprised to the downside with the Final Demand reading falling 0.1% month over month, well below the 0.3% rise expected, and year over year that same measure rose 2.6%, again well below the 3.3% estimate. On the heels of the PPI release, the 10-year U.S. Treasury yield fell 4-basis points to end the day at 4.03%, its lowest level close since April 4, as investors speculated that the cooler August PPI could give the FOMC the confidence to cut the funds rate by more than 25-basis points at its upcoming meeting. On balance, the details of the August CPI release on Thursday were in-line with expectations with the headline reading rising 0.4% month over month, a notch above the 0.3% estimate, and 2.9% year over year, in-line with the consensus estimate but above the 2.7% reading in July. Core CPI, which is more closely watched by policymakers, rose 0.3% month over month and 3.1% year over year, with both readings in-line with the consensus estimate. After the move lower in yields on heels of the PPI release, the 10-year yield closed Thursday unchanged, and our suspicion is that the 4% level will be difficult to break below.

Previewing This Week’s FOMC Meeting. The Federal Open Market Committee (FOMC) concludes its two-day meeting this Wednesday, and we, along with an overwhelming majority of market participants, expect the Committee to cut the Fed funds rate by 25 basis points, taking the target range for this key interest rate to 4.00% to 4.25%. On the heels of the cooler August PPI reading, in-line CPI reading, and jump in initial jobless claims, market participants began to speculate as to whether the FOMC would entertain the idea of cutting the funds rate by more than 25 basis points this week. We view this as a very low probability outcome as it would send the signal that the FOMC is behind the curve, while also likely leading to inflation expectations rising and forcing yields on the long end of the Treasury curve meaningfully higher.

Fed funds futures are close to fully pricing in three quarter-point cuts between now and year-end, and we acknowledge that the likelihood of that occurring has increased. However, with the August CPI reading suggestive that inflation remains stuck at an elevated level, this is far from a done deal and the Committee is likely to move at a more measured pace than the market currently believes, barring a sharp move higher in the unemployment rate in the coming months. The FOMC’s updated Summary of Economic Projections, or dot plot, could prove market moving and is worth watching to see how the Committee’s views on the outlook for inflation, unemployment, and economic growth has shifted since June.

IMPORTANT DISCLOSURES: THIS PUBLICATION HAS BEEN PREPARED BY THE STAFF OF HIGHLAND ASSOCIATES, INC. FOR DISTRIBUTION TO, AMONG OTHERS, HIGHLAND ASSOCIATES, INC. CLIENTS. HIGHLAND ASSOCIATES IS REGISTERED WITH THE UNITED STATES SECURITY AND EXCHANGE COMMISSION UNDER THE INVESTMENT ADVISORS ACT OF 1940. HIGHLAND ASSOCIATES IS A WHOLLY OWNED SUBSIDIARY OF REGIONS BANK, WHICH IN TURN IS A WHOLLY OWNED SUBSIDIARY OF REGIONS FINANCIAL CORPORATION. RESEARCH SERVICES ARE PROVIDED THROUGH MULTI-ASSET SOLUTIONS, A DEPARTMENT OF THE REGIONS ASSET MANAGEMENT BUSINESS GROUP WITHIN REGIONS BANK. THE INFORMATION AND MATERIAL CONTAINED HEREIN IS PROVIDED SOLELY FOR GENERAL INFORMATION PURPOSES ONLY. TO THE EXTENT THESE MATERIALS REFERENCE REGIONS BANK DATA, SUCH MATERIALS ARE NOT INTENDED TO BE REFLECTIVE OR INDICATIVE OF, AND SHOULD NOT BE RELIED UPON AS, THE RESULTS OF OPERATIONS, FINANCIAL CONDITIONS OR PERFORMANCE OF REGIONS BANK. UNLESS OTHERWISE SPECIFICALLY STATED, ANY VIEWS, OPINIONS, ANALYSES, ESTIMATES AND STRATEGIES, AS THE CASE MAY BE (“VIEWS”), EXPRESSED IN THIS CONTENT ARE THOSE OF THE RESPECTIVE AUTHORS AND SPEAKERS NAMED IN THOSE PIECES AND MAY DIFFER FROM THOSE OF REGIONS BANK AND/OR OTHER REGIONS BANK EMPLOYEES AND AFFILIATES. VIEWS AND ESTIMATES CONSTITUTE OUR JUDGMENT AS OF THE DATE OF THESE MATERIALS, ARE OFTEN BASED ON CURRENT MARKET CONDITIONS, AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. ANY EXAMPLES USED ARE GENERIC, HYPOTHETICAL AND FOR ILLUSTRATION PURPOSES ONLY. ANY PRICES/QUOTES/STATISTICS INCLUDED HAVE BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT HIGHLAND ASSOCIATES, INC. DOES NOT WARRANT THEIR COMPLETENESS OR ACCURACY. THIS INFORMATION IN NO WAY CONSTITUTES RESEARCH AND SHOULD NOT BE TREATED AS SUCH. THE VIEWS EXPRESSED HEREIN SHOULD NOT BE CONSTRUED AS INDIVIDUAL INVESTMENT ADVICE FOR ANY PARTICULAR PERSON OR ENTITY AND ARE NOT INTENDED AS RECOMMENDATIONS OF PARTICULAR SECURITIES, FINANCIAL INSTRUMENTS, STRATEGIES OR BANKING SERVICES FOR A PARTICULAR PERSON OR ENTITY. THE NAMES AND MARKS OF OTHER COMPANIES OR THEIR SERVICES OR PRODUCTS MAY BE THE TRADEMARKS OF THEIR OWNERS AND ARE USED ONLY TO IDENTIFY SUCH COMPANIES OR THEIR SERVICES OR PRODUCTS AND NOT TO INDICATE ENDORSEMENT, SPONSORSHIP, OR OWNERSHIP BY REGIONS OR HIGHLAND ASSOCIATES. EMPLOYEES OF HIGHLAND ASSOCIATES, INC., MAY HAVE POSITIONS IN SECURITIES OR THEIR DERIVATIVES THAT MAY BE MENTIONED IN THIS REPORT. ADDITIONALLY, HIGHLAND’S CLIENTS AND COMPANIES AFFILIATED WITH HIGHLAND ASSOCIATES MAY HOLD POSITIONS IN THE MENTIONED COMPANIES IN THEIR PORTFOLIOS OR STRATEGIES. THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR AN INVITATION BY OR ON BEHALF OF HIGHLAND ASSOCIATES TO ANY PERSON OR ENTITY TO BUY OR SELL ANY SECURITY OR FINANCIAL INSTRUMENT OR ENGAGE IN ANY BANKING SERVICE. NOTHING IN THESE MATERIALS CONSTITUTES INVESTMENT, LEGAL, ACCOUNTING OR TAX ADVICE. NON-DEPOSIT PRODUCTS INCLUDING INVESTMENTS, SECURITIES, MUTUAL FUNDS, INSURANCE PRODUCTS, CRYPTO ASSETS AND ANNUITIES: ARE NOT FDIC-INSURED I ARE NOT A DEPOSIT I MAY GO DOWN IN VALUE I ARE NOT BANK GUARANTEED I ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY I ARE NOT A CONDITION OF ANY BANKING ACTIVITY.

NEITHER REGIONS BANK NOR REGIONS ASSET MANAGEMENT (COLLECTIVELY, “REGIONS”) ARE REGISTERED MUNICIPAL ADVISORS NOR PROVIDE ADVICE TO MUNICIPAL ENTITIES OR OBLIGATED PERSONS WITH RESPECT TO MUNICIPAL FINANCIAL PRODUCTS OR THE ISSUANCE OF MUNICIPAL SECURITIES (INCLUDING REGARDING THE STRUCTURE, TIMING, TERMS AND SIMILAR MATTERS CONCERNING MUNICIPAL FINANCIAL PRODUCTS OR MUNICIPAL SECURITIES ISSUANCES) OR ENGAGE IN THE SOLICITATION OF MUNICIPAL ENTITIES OR OBLIGATED PERSONS FOR SUCH SERVICES. WITH RESPECT TO THIS PRESENTATION AND ANY OTHER INFORMATION, MATERIALS OR COMMUNICATIONS PROVIDED BY REGIONS, (A) REGIONS IS NOT RECOMMENDING AN ACTION TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON, (B) REGIONS IS NOT ACTING AS AN ADVISOR TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON AND DOES NOT OWE A FIDUCIARY DUTY PURSUANT TO SECTION 15B OF THE SECURITIES EXCHANGE ACT OF 1934 TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON WITH RESPECT TO SUCH PRESENTATION, INFORMATION, MATERIALS OR COMMUNICATIONS, (C) REGIONS IS ACTING FOR ITS OWN INTERESTS, AND (D) YOU SHOULD DISCUSS THIS PRESENTATION AND ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS WITH ANY AND ALL INTERNAL AND EXTERNAL ADVISORS AND EXPERTS THAT YOU DEEM APPROPRIATE BEFORE ACTING ON THIS PRESENTATION OR ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS.

SOURCE: BLOOMBERG INDEX SERVICES LIMITED. BLOOMBERG® IS A TRADEMARK AND SERVICE MARK OF BLOOMBERG FINANCE L.P. AND ITS AFFILIATES (COLLECTIVELY “BLOOMBERG”). BARCLAYS® IS A TRADEMARK AND SERVICE MARK OF BARCLAYS BANK PLC (COLLECTIVELY WITH ITS AFFILIATES, “BARCLAYS”), USED UNDER LICENSE. BLOOMBERG OR BLOOMBERG’S LICENSORS, INCLUDING BARCLAYS, OWN ALL PROPRIETARY RIGHTS IN THE BLOOMBERG BARCLAYS INDICES. NEITHER BLOOMBERG NOR BARCLAYS APPROVES OR ENDORSES THIS MATERIAL OR GUARANTEES THE ACCURACY OR COMPLETENESS OF ANY INFORMATION HEREIN, OR MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED THEREFROM AND, TO THE MAXIMUM EXTENT ALLOWED BY LAW, NEITHER SHALL HAVE ANY LIABILITY OR RESPONSIBILITY FOR INJURY OR DAMAGES ARISING IN CONNECTION THEREWITH.