Stocks: Rising U.S./China Tensions Contribute To Dollar Strength, Generate A Modest Equity Pullback; Higher Crude, Natural Gas Prices A Boon For Energy Companies And A Headwind For The S&P 500.

Download Weekly Market Commentary | September 11 2023

Key Observations

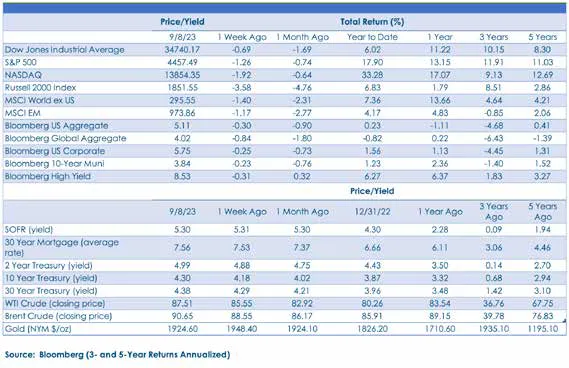

- The first week of September was far from dull for equity markets as the S&P 500 fell 1.2% as China retaliated against bans on U.S. technology exports by targeting tech behemoth Apple.

- Domestic small-cap stocks were notably weak, evidenced by the outsized 3.5% drop in the Russell 2000. Along with persistent strength in the U.S. dollar, weakness in small-cap stocks is another indicator of ‘risk off’ dominating, a condition that could remain in place into next week’s FOMC meeting, and perhaps into October.

- Initial jobless claims and strength in the services sector in August will likely spur substantial debate within the Fed when it meets next week. We don’t expect a rate hike in September, but the release of the Consumer Price Index (CPI) from August later this week, as well as the path forward for energy prices over coming months, could keep November ‘live.’

- Corporate bond issuance spiked last week with approximately $55B of investment-grade bonds coming to market, nearly half of the $120B expected in September. Demand was robust as the ‘average’ deal was 3X oversubscribed, and credit spreads widened only modestly, an encouraging indicator of investor risk appetite for higher quality bonds.

What We’re Watching:

- The National Federation of Independent Business (NFIB) Small Business Index for August is released on Tuesday and will be worth watching for a read on the state of small business trends, particularly related to hiring given recent data pointing toward a cooling labor market.

- Eurozone Industrial Production for July is released Wednesday and is expected to fall month over month by 0.7% after rising by 0.5% month over month in June versus May. This data point is worth watching as an indicator of demand, or the lack thereof, for exports out of the Eurozone, primarily Germany, by the U.S. and China, specifically.

- U.S. Consumer Price Index (CPI) for August is released Wednesday. Headline CPI is expected to have risen 0.6% month over month, a sharp reacceleration after a 0.2% month over month rise in July, driven primarily by rising energy prices. Core CPI, which excludes food and energy, is expected to rise 0.2% over July, in-line with the July reading.

- Initial jobless claims for the week ending September 9 are released Thursday. This data point will be closely watched moving forward on the heels of the August nonfarm payrolls report and Job Openings and Labor Turnover Survey (JOLTS) which both pointed toward a cooling labor market.

- The University of Michigan Index of Consumer Sentiment for September is released Friday and is expected to fall to 69.0 from 69.5 in August.

What Happened Last Week:

Stocks: Rising U.S./China Tensions Contribute To Dollar Strength, Generate A Modest Equity Pullback; Higher Crude, Natural Gas Prices A Boon For Energy Companies And A Headwind For The S&P 500.

China Targets Apple As Retaliation Against U.S. Bans On Advanced Semiconductor, AI-Related Exports. Early last week, China announced that government employees were no longer allowed to use Apple phones at work, which market participants viewed as retaliation for the U.S.’ ban on advanced semiconductor exports to China that was announced in August. This may prove to be mostly ‘noise’ and little more than saber rattling rather than something that impacts Apple’s earnings outlook, but it does coincide with phone manufacturer Huawei, one of China’s ‘national champions,’ releasing new phones, so it comes across as an effort on the part of the Chinese government to dissuade consumers from buying Apple products. Apple stock sold off by 6% on Wednesday and Thursday and even after rebounding Friday ended the week lower by 5%, but with Apple making up 7.5% of the S&P 500, it’s not surprising that the broader index struggled over the balance of last week as the S&P 500 fell 1.2%. Notably, Nike and Starbucks, two other U.S. companies often associated with doing business in China, sold off in sympathy with Apple as investor’s began to price-in a less friendly environment for U.S.-domiciled companies in the country moving forward. U.S./China tensions festering does nothing to improve upon already sour investor sentiment surrounding Chinese stocks and could weigh on broader emerging markets over the near-term. However, with the MSCI China index losing 4.3% last week on this news, and fears growing that the U.S./ China trade relationship is beyond repair, we believe the selloff in Chinese stocks is likely overdone as this concern overstates the importance and intent of China’s response. De-escalation is in the best interest of both parties, and with China dealing with a litany of economic issues at home, we suspect this is just an attempt to get the U.S. to the bargaining table so the two sides can work out a deal and China can save face.

Rumors Of The Dollar’s Demise Greatly Exaggerated. The U.S. Dollar Index, or DXY, hit a six-month high at 105.16 last Thursday, a notable move given that 105 had acted as a strong ceiling of resistance in recent weeks. Prior to last week, each time the DXY approached that level it had been turned away, so closing above it, even for one day, potentially points toward more upside ahead. A weaker U.S. dollar has been oft discussed as a potential tailwind for corporate profits and, in turn, equity prices over coming quarters. But with the DXY higher by 1.6% over the prior month and knocking on the door of 105 at the end of last week, the longer the dollar remains strong, the more conviction surrounding this potential earnings tailwind is likely to wane.

Energy Sector Strength Problematic For The S&P 500, Emerging Markets. Last week, Saudi Arabia extended a 1 million barrel per day supply cut through year-end, providing a tailwind for prices of Brent and West Texas Intermediate (WTI) crude oil which rose despite continued strength in the U.S. dollar, which often moves in the opposite direction of energy prices. The S&P 500 fell 1.2% last week, while the S&P 500 energy sector rose 1.4%, and the sector is now higher by 5.2% since the end of July, easily outpacing the S&P 500’s 2.6% decline. While energy has fared well of late, rising energy costs dampens the outlook for consumer spending, evidenced in the S&P 500 consumer discretionary and consumer staples sectors falling 2.8% and 5.3%, respectively, since the end of July. With the discretionary and staples sectors combining to account for over 17% of the S&P 500 while energy makes up just 4.5%, in this case, gains for the energy sector are at the expense of the S&P 500. In isolation, rising energy prices are problematic for emerging markets given that, on balance, developing economies are importers of crude oil, and with the U.S. dollar strengthening again last week, the negative impact felt from higher/rising energy costs is compounded. Dollar strength coinciding with rising energy prices is close to a worse-case scenario for emerging markets, and if these trends are sustained, a rebound in emerging market stocks could be pushed into 2024 as central banks will have limited capacity to cut rates to spur near-term economic growth.

Bonds: Labor Market Strength, Energy Prices Contributing To Fears Of Inflation Reaccelerating Into Year-End; Surge In Investment-Grade Corporate Bond Issuance Met With Solid Demand, Modest Widening In Credit Spreads.

FOMC Set To ‘Skip’ September, But Economic Data Keeps November ‘Live.’ Initial jobless claims for the week ended September 2 came in at 216k, below the 231.5k estimate and the 229k reading the prior week, which along with continuing jobless claims for the week ended August 26 falling 40k from the prior week, point toward labor market strength and not the ‘cooling’ of the labor market narrative that the August nonfarm payrolls report led some to latch onto. The Institute for Supply Management (ISM) Services Purchasing Managers Index (PMI) for August jumped to 54.5, above the 52.3 estimate and the 52.7 reading from July, material month-over-month growth in the services sector of the U.S. economy. While the headline Services PMI reading is an encouraging data point from an economic perspective, the continued rise in the prices paid component of the survey which jumped to 58.9 from a 56.8 reading in July will be worrisome for the FOMC as it is supportive of a reacceleration in inflationary pressures. The Fed funds futures market expects the FOMC to ‘skip’ a rate hike when it meets September 19-20, but rising energy and gasoline prices, a higher prices paid component of the Services PMI, and continued labor market strength likely don’t give the Committee comfort that its job is done. November is likely to be a ‘live’ meeting and with Fed funds futures viewing a rate hike as a 50/50 outcome at present, we wouldn’t rule out another quarter-point rate hike, although a potential government shutdown in October could impact the FOMC’s decision and the outlook for inflation into year-end.

Surge In Corporate Debt Issuance Met With Solid Demand. The first week of September exceeded estimates for projected debt issuance with $55B of new paper coming to market month-to-date through Friday, nearly half-way to the $120B forecasted for the month. Last Tuesday alone saw 20 companies price some $36B of bonds, which was the highest single-day issuance in over three years, and that’s despite a few companies deciding to hold off at the last minute, choosing not to issue bonds for fear of being crowded out by the surge in issuance. It is interesting that more issuers didn’t shelve deals with yields on long-term Treasuries rising sharply early last week, which could be an indication that corporate issuers, broadly speaking, don’t see borrowing costs moving much lower any time soon. When corporate issuance picks-up, the demand picture shows its true colors and with credit spreads widening only a handful of basis points last week, and with the average deal oversubscribed by three times, appetite for high-grade corporate bonds appears robust. Investors in bond mutual funds and ETFs followed price action (down) over yields (up) and redeemed over $2B last week, a continuation of the August trend, while high yield funds continued to garner interest with $1.3B of inflows in the last two weeks. From our seat, market participants have the right idea focusing on absolute yields, and with the yield-to-worst on the Bloomberg Corporate index ending the week at 5.76%, we remain comfortable with our current positioning in investment grade corporates as re-investment risk should be of significant concern for bond investors moving forward.

IMPORTANT DISCLOSURES: THIS PUBLICATION HAS BEEN PREPARED BY THE STAFF OF HIGHLAND ASSOCIATES, INC. FOR DISTRIBUTION TO, AMONG OTHERS, HIGHLAND ASSOCIATES, INC. CLIENTS. HIGHLAND ASSOCIATES IS REGISTERED WITH THE UNITED STATES SECURITY AND EXCHANGE COMMISSION UNDER THE INVESTMENT ADVISORS ACT OF 1940. HIGHLAND ASSOCIATES IS A WHOLLY OWNED SUBSIDIARY OF REGIONS BANK, WHICH IN TURN IS A WHOLLY OWNED SUBSIDIARY OF REGIONS FINANCIAL CORPORATION. RESEARCH SERVICES ARE PROVIDED THROUGH MULTI-ASSET SOLUTIONS, A DEPARTMENT OF THE REGIONS ASSET MANAGEMENT BUSINESS GROUP WITHIN REGIONS BANK. THE INFORMATION AND MATERIAL CONTAINED HEREIN IS PROVIDED SOLELY FOR GENERAL INFORMATION PURPOSES ONLY. TO THE EXTENT THESE MATERIALS REFERENCE REGIONS BANK DATA, SUCH MATERIALS ARE NOT INTENDED TO BE REFLECTIVE OR INDICATIVE OF, AND SHOULD NOT BE RELIED UPON AS, THE RESULTS OF OPERATIONS, FINANCIAL CONDITIONS OR PERFORMANCE OF REGIONS BANK. UNLESS OTHERWISE SPECIFICALLY STATED, ANY VIEWS, OPINIONS, ANALYSES, ESTIMATES AND STRATEGIES, AS THE CASE MAY BE (“VIEWS”), EXPRESSED IN THIS CONTENT ARE THOSE OF THE RESPECTIVE AUTHORS AND SPEAKERS NAMED IN THOSE PIECES AND MAY DIFFER FROM THOSE OF REGIONS BANK AND/OR OTHER REGIONS BANK EMPLOYEES AND AFFILIATES. VIEWS AND ESTIMATES CONSTITUTE OUR JUDGMENT AS OF THE DATE OF THESE MATERIALS, ARE OFTEN BASED ON CURRENT MARKET CONDITIONS, AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. ANY EXAMPLES USED ARE GENERIC, HYPOTHETICAL AND FOR ILLUSTRATION PURPOSES ONLY. ANY PRICES/QUOTES/STATISTICS INCLUDED HAVE BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT HIGHLAND ASSOCIATES, INC. DOES NOT WARRANT THEIR COMPLETENESS OR ACCURACY. THIS INFORMATION IN NO WAY CONSTITUTES RESEARCH AND SHOULD NOT BE TREATED AS SUCH. THE VIEWS EXPRESSED HEREIN SHOULD NOT BE CONSTRUED AS INDIVIDUAL INVESTMENT ADVICE FOR ANY PARTICULAR PERSON OR ENTITY AND ARE NOT INTENDED AS RECOMMENDATIONS OF PARTICULAR SECURITIES, FINANCIAL INSTRUMENTS, STRATEGIES OR BANKING SERVICES FOR A PARTICULAR PERSON OR ENTITY. THE NAMES AND MARKS OF OTHER COMPANIES OR THEIR SERVICES OR PRODUCTS MAY BE THE TRADEMARKS OF THEIR OWNERS AND ARE USED ONLY TO IDENTIFY SUCH COMPANIES OR THEIR SERVICES OR PRODUCTS AND NOT TO INDICATE ENDORSEMENT, SPONSORSHIP, OR OWNERSHIP BY REGIONS OR HIGHLAND ASSOCIATES. EMPLOYEES OF HIGHLAND ASSOCIATES, INC., MAY HAVE POSITIONS IN SECURITIES OR THEIR DERIVATIVES THAT MAY BE MENTIONED IN THIS REPORT. ADDITIONALLY, HIGHLAND’S CLIENTS AND COMPANIES AFFILIATED WITH HIGHLAND ASSOCIATES MAY HOLD POSITIONS IN THE MENTIONED COMPANIES IN THEIR PORTFOLIOS OR STRATEGIES. THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR AN INVITATION BY OR ON BEHALF OF HIGHLAND ASSOCIATES TO ANY PERSON OR ENTITY TO BUY OR SELL ANY SECURITY OR FINANCIAL INSTRUMENT OR ENGAGE IN ANY BANKING SERVICE. NOTHING IN THESE MATERIALS CONSTITUTES INVESTMENT, LEGAL, ACCOUNTING OR TAX ADVICE. NON-DEPOSIT PRODUCTS INCLUDING INVESTMENTS, SECURITIES, MUTUAL FUNDS, INSURANCE PRODUCTS, CRYPTO ASSETS AND ANNUITIES: ARE NOT FDIC-INSURED I ARE NOT A DEPOSIT I MAY GO DOWN IN VALUE I ARE NOT BANK GUARANTEED I ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY I ARE NOT A CONDITION OF ANY BANKING ACTIVITY.

NEITHER REGIONS BANK NOR REGIONS ASSET MANAGEMENT (COLLECTIVELY, “REGIONS”) ARE REGISTERED MUNICIPAL ADVISORS NOR PROVIDE ADVICE TO MUNICIPAL ENTITIES OR OBLIGATED PERSONS WITH RESPECT TO MUNICIPAL FINANCIAL PRODUCTS OR THE ISSUANCE OF MUNICIPAL SECURITIES (INCLUDING REGARDING THE STRUCTURE, TIMING, TERMS AND SIMILAR MATTERS CONCERNING MUNICIPAL FINANCIAL PRODUCTS OR MUNICIPAL SECURITIES ISSUANCES) OR ENGAGE IN THE SOLICITATION OF MUNICIPAL ENTITIES OR OBLIGATED PERSONS FOR SUCH SERVICES. WITH RESPECT TO THIS PRESENTATION AND ANY OTHER INFORMATION, MATERIALS OR COMMUNICATIONS PROVIDED BY REGIONS, (A) REGIONS IS NOT RECOMMENDING AN ACTION TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON, (B) REGIONS IS NOT ACTING AS AN ADVISOR TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON AND DOES NOT OWE A FIDUCIARY DUTY PURSUANT TO SECTION 15B OF THE SECURITIES EXCHANGE ACT OF 1934 TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON WITH RESPECT TO SUCH PRESENTATION, INFORMATION, MATERIALS OR COMMUNICATIONS, (C) REGIONS IS ACTING FOR ITS OWN INTERESTS, AND (D) YOU SHOULD DISCUSS THIS PRESENTATION AND ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS WITH ANY AND ALL INTERNAL AND EXTERNAL ADVISORS AND EXPERTS THAT YOU DEEM APPROPRIATE BEFORE ACTING ON THIS PRESENTATION OR ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS.

SOURCE: BLOOMBERG INDEX SERVICES LIMITED. BLOOMBERG® IS A TRADEMARK AND SERVICE MARK OF BLOOMBERG FINANCE L.P. AND ITS AFFILIATES (COLLECTIVELY “BLOOMBERG”). BARCLAYS® IS A TRADEMARK AND SERVICE MARK OF BARCLAYS BANK PLC (COLLECTIVELY WITH ITS AFFILIATES, “BARCLAYS”), USED UNDER LICENSE. BLOOMBERG OR BLOOMBERG’S LICENSORS, INCLUDING BARCLAYS, OWN ALL PROPRIETARY RIGHTS IN THE BLOOMBERG BARCLAYS INDICES. NEITHER BLOOMBERG NOR BARCLAYS APPROVES OR ENDORSES THIS MATERIAL OR GUARANTEES THE ACCURACY OR COMPLETENESS OF ANY INFORMATION HEREIN, OR MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED THEREFROM AND, TO THE MAXIMUM EXTENT ALLOWED BY LAW, NEITHER SHALL HAVE ANY LIABILITY OR RESPONSIBILITY FOR INJURY OR DAMAGES ARISING IN CONNECTION THEREWITH.