Stocks: Positive Momentum For U.S. Large- Caps Persists But Small-Caps Fare Better As Cyclicals Outperform; Chinese Stocks Extend Losses With The MSCI China Index Now Negative In October.

Download Weekly Market Commentary | October 21 2024

What We’re Watching:

- Quarterly reporting season ramps up in the coming week with just shy of 25% of the S&P 500 set to post results. The consumer staples, financial services, information technology, and industrials sectors will be well represented in the coming week, and we will be paying the most attention to results out of semiconductor and data center-related stocks, as well as engineering and construction plays and railroads for a read on the state of the U.S. economy entering 4Q24.

- Initial jobless claims for the week ended October 19 and continuing jobless claims for the week ended October 12 are released Wednesday. Initial claims are expected to come in at 240k, a notch below the prior week’s reading of 241k. Continuing claims are expected to rise to 1,876k from 1,867k the prior week. Labor market data has been based off low survey response rates for some time now and has been rife with seasonal adjustment and weather-related noise so we hesitate to put much stock in the data rolling in but will be monitoring the trend in initial and continuing claims for continued signs of stabilization.

- Tokyo (Japan) October Consumer Price Index (CPI) is released Thursday and is expected to rise 1.8% year over year, which would be a notable deceleration from 2.1% year over year in September. Of late, the Japanese yen has weakened relative to the U.S. dollar as the Bank of Japan has been able to talk down the prospect of additional policy tightening in the coming months, but even a modestly hotter CPI reading could bring the BoJ back into play and put upward pressure on the yen and downward pressure on Japanese equities.

Key Observations

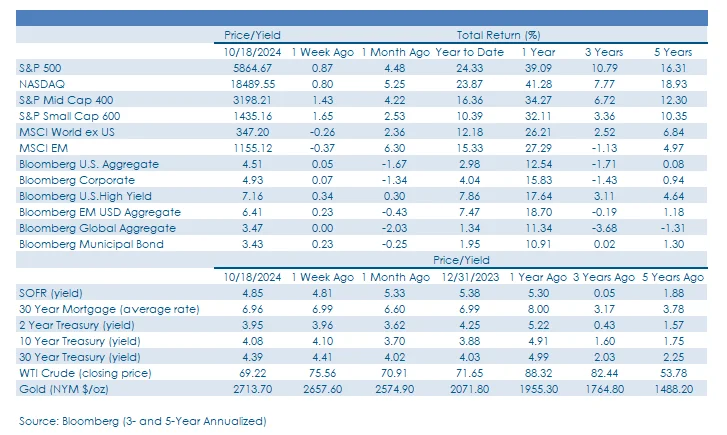

- A solid start to quarterly earnings season kept the uptrend in place for U.S. large cap indices last week as a handful of bellwether banks and brokers in the financial services sector set a positive tone for the remainder of the reporting period.

- Economically sensitive sectors such as consumer discretionary, financial services, materials, and real estate, along with utilities outpaced growthy and defensive sectors as earnings releases and stronger economic data provided upside catalysts. This leadership profile allowed small- and mid-cap (SMid) indices to outperform on the week due to higher exposures to these sectors.

- Treasury yields content to move sideways in the holiday- shortened trading week as fixed income investors digest economic data and attempt to distinguish signal from noise. The 10-year Treasury yield traded between 4% and 4.10% over the balance of the week, bringing some relative calm to the bond market. But calm could give way to a sizable move for yields – in either direction – in the coming weeks given the key economic and labor market datapoints to be released at month-end and early November.

What Happened Last Week:

Stocks: Positive Momentum For U.S. Large- Caps Persists But Small-Caps Fare Better As Cyclicals Outperform; Chinese Stocks Extend Losses With The MSCI China Index Now Negative In October.

Signs Of Life In Transportation Stocks A Welcome Development. Through September, the S&P Transportation Index ETF (IYT), which includes a broader set of stocks than the bellwether Dow Jones Transportation Average, has exposure to airlines, railroads, ridesharing providers, and shipping companies, among others, had sat out the rally, gaining an underwhelming 5% and significantly lagging both the S&P 500 industrials sector (+18.9%) and the S&P 500 (+20.8%) in the process. But the tables have turned somewhat in October as the IYT ETF has risen 2.8% month- to-date and has outpaced the S&P 500’s 1.7% return and the 2.6% gain out of the broader industrials sector. Most encouragingly, strength out of the transportation industry sub-group in recent weeks has been fairly broad based, but security selection remains important even in an industry group or segment of the market with such strong momentum. Seasoned investors and followers of Dow Theory, which states that rallies/new highs in the Dow Jones Industrial Average should be ‘confirmed’ by rallies/new highs in the Dow Jones Transportation Average, should view the recent catch-up in the transports positively as it highlights how capital is continuing to rotate between sectors in search of relative value. It’s also another sign of a healthy market, and potentially points toward some positive economic surprises on the horizon.

Big Bank, Broker Earnings Set A Positive Tone For Earnings Season. Quarterly reporting season is still in the early innings, but the ‘Big 4’ banks – J.P. Morgan Chase, Bank of America, Citigroup, and Wells Fargo – along with Goldman Sachs and Morgan Stanley, were some of the first companies out of the gate to post results. On balance, these releases have provided investors with ample reasons to remain constructive on both the health of the U.S. economy and the staying power of the equity bull market.

Strength In Economically Sensitive Sectors Translates Into Gains For Small And Mid Cap Indices. Last week’s 1.6% return out of the S&P Small Cap 600 index was a byproduct of promising earnings and guidance out of the financial services and materials sectors which, on balance, suggested an improving economic backdrop could still be in the cards. Factor tilts to growth and value are historically the strongest in smaller capitalization stocks, a trend that materialized last week as the value-led rally put the S&P Small Cap Value Indices at the top of the list of relative performers on the week. It’s too early in this reporting season to be taking a victory lap but small caps at least started out on the right foot and served to lift animal spirits for cyclicals. From a top- down perspective, the retail sales beat last Thursday again called into question the narrative that the U.S. economy was set to slow in 3Q and perhaps 4Q, thereby weighing on earnings for U.S.-focused companies in the small and mid- cap areas. Upcoming economic data is likely to be fraught with seasonal adjustment and weather-related noise in the coming month(s) which could make the data appear weaker than it truly is, the inverse of what we’ve seen over the prior month where the data has, broadly speaking, appeared to be stronger than it is. This backdrop could create opportunities for those with cash to deploy able to take a longer-term view.

Easy Come, Easy Go As Rally In Chinese Stocks Fades, Dragging Down The MSCI EM Index. The MSCI China index extended recent losses last week posting its second straight weekly decline of 4% or more, despite late-week moves out of the People’s Bank of China (PBoC) to support markets as economic growth metrics disappointed. For the better part of the week disappointment around stimulus and renewed tension on chip restrictions from the U.S. government were top of mind, being cited as a reason for declining demand on the earnings call of Netherland-based ASML that fell 13.9% on the week. The broader MSCI Emerging Markets Index couldn’t escape chip restriction concerns and China stimulus skepticism but experienced a far less painful 0.3% decline last week as weakness in China was offset by upbeat earnings from Taiwan Semiconductor, the largest stock in the MSCI EM benchmark. Taiwan’s most influential stock posted profit margin growth that topped street expectations at 54% and raised guidance for capex that sent the stock higher by 9.8% on Thursday alone. On balance, regulation is a wildcard for international chip makers more broadly and while we think ultimately the Chinese stimulus will succumb to pressure of hitting economic growth targets, its likely to be a volatile path of upside and downside surprises.

Bonds: Treasury Yields Move Sideways With The 10-Year Holding Above 4% Amid Stronger Economic Data; Corporate Bonds, Emerging Market Debt Perform Relatively Well In A Range-Bound Week For Treasuries.

Economic Data Releases Further Call Into Question The Pace Of Monetary Policy Easing. In a relatively light week of economic data, two releases caught our eye, and the market’s attention. On Thursday, September Retail Sales Control Group, which flows into GDP, rose 0.7% month over month, much stronger than the 0.3% estimate, pointing toward a continued willingness on the part of consumers to spend. The same day, initial jobless claims for the week ended October 12 came in at 241k, below the 259k estimate and the prior 260k from October 5, which pointed toward stabilization in the labor market. All told, these two readings depict continued resilience in the U.S. economy and the labor market and further muddy the waters regarding the path forward for the Federal Open Market Committee (FOMC) in the coming months. In our view, recent data increases the likelihood the Committee will pause in November, but we still lean toward another 25-basis point move next month. Fed funds futures are pricing in a 92% chance of a 25-basis point cut in November but lowered the likelihood of a quarter-point cut in December to 80% from 90% the day before retail sales and initial claims were released. Most notably, Fed funds futures now expect a terminal Fed funds rate of 3.25% in January of 2026, 50-basis points above where the terminal rate was expected to be as of the end of September.

Corporate Bonds Steady As Issuance Slows. Early last week the Bloomberg U.S. Corporate Bond Index appeared to be well on its way to breaking a three-week losing streak, but Treasury yields rose Thursday on better retail sales and the investment-grade Corporate Bond Index ultimately eked out just shy of a 0.1% gain. Corporate bond supply over the course of the week was limited, which along with financial services issuers with mid-tier credit ratings reporting positive earnings reports, led spreads to tighten by a handful of basis points. It remains difficult to identify near-term headwinds for the investment grade bond market beyond a buyers strike driven by spreads continuing to tighten which has partially offset the rise in Treasury yields experienced in recent weeks. Valuations made fresh 20-year lows this week with the Investment Grade index spread falling to just 79-basis points over the Treasury curve, but as we’ve highlighted before, we appear to be in a secular downtrend for credit spreads as this cohort of companies is viewed as far more fiscally disciplined than the U.S. government at present.

Emerging Market Debt Undaunted By Recent Strength In The U.S. Dollar. The greenback’s recent rebound has taken the U.S. Dollar Index, or DXY, back above $103.50, putting pressure on emerging market currencies for the third consecutive week. However, an improving fundamental outlook has led to ‘richer’ valuations for EM debt which overcame the currency headwind and the Bloomberg USD Emerging Debt Index returned 0.2% last week. Valuations for this sub-asset class have been tightening consistenly since the start of September as investor sentiment has improved on the heels of China’s stimulus efforts, which stands in stark contrast to the elevated volatility seen in emerging market stocks since China’s announcements. This contrast is a valuable reminder that emerging market stocks and bonds may seem like two sides of the same coin, but exposures and country allocations differ drastically and the two often don’t trade in lockstep.

IMPORTANT DISCLOSURES: THIS PUBLICATION HAS BEEN PREPARED BY THE STAFF OF HIGHLAND ASSOCIATES, INC. FOR DISTRIBUTION TO, AMONG OTHERS, HIGHLAND ASSOCIATES, INC. CLIENTS. HIGHLAND ASSOCIATES IS REGISTERED WITH THE UNITED STATES SECURITY AND EXCHANGE COMMISSION UNDER THE INVESTMENT ADVISORS ACT OF 1940. HIGHLAND ASSOCIATES IS A WHOLLY OWNED SUBSIDIARY OF REGIONS BANK, WHICH IN TURN IS A WHOLLY OWNED SUBSIDIARY OF REGIONS FINANCIAL CORPORATION. RESEARCH SERVICES ARE PROVIDED THROUGH MULTI-ASSET SOLUTIONS, A DEPARTMENT OF THE REGIONS ASSET MANAGEMENT BUSINESS GROUP WITHIN REGIONS BANK. THE INFORMATION AND MATERIAL CONTAINED HEREIN IS PROVIDED SOLELY FOR GENERAL INFORMATION PURPOSES ONLY. TO THE EXTENT THESE MATERIALS REFERENCE REGIONS BANK DATA, SUCH MATERIALS ARE NOT INTENDED TO BE REFLECTIVE OR INDICATIVE OF, AND SHOULD NOT BE RELIED UPON AS, THE RESULTS OF OPERATIONS, FINANCIAL CONDITIONS OR PERFORMANCE OF REGIONS BANK. UNLESS OTHERWISE SPECIFICALLY STATED, ANY VIEWS, OPINIONS, ANALYSES, ESTIMATES AND STRATEGIES, AS THE CASE MAY BE (“VIEWS”), EXPRESSED IN THIS CONTENT ARE THOSE OF THE RESPECTIVE AUTHORS AND SPEAKERS NAMED IN THOSE PIECES AND MAY DIFFER FROM THOSE OF REGIONS BANK AND/OR OTHER REGIONS BANK EMPLOYEES AND AFFILIATES. VIEWS AND ESTIMATES CONSTITUTE OUR JUDGMENT AS OF THE DATE OF THESE MATERIALS, ARE OFTEN BASED ON CURRENT MARKET CONDITIONS, AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. ANY EXAMPLES USED ARE GENERIC, HYPOTHETICAL AND FOR ILLUSTRATION PURPOSES ONLY. ANY PRICES/QUOTES/STATISTICS INCLUDED HAVE BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT HIGHLAND ASSOCIATES, INC. DOES NOT WARRANT THEIR COMPLETENESS OR ACCURACY. THIS INFORMATION IN NO WAY CONSTITUTES RESEARCH AND SHOULD NOT BE TREATED AS SUCH. THE VIEWS EXPRESSED HEREIN SHOULD NOT BE CONSTRUED AS INDIVIDUAL INVESTMENT ADVICE FOR ANY PARTICULAR PERSON OR ENTITY AND ARE NOT INTENDED AS RECOMMENDATIONS OF PARTICULAR SECURITIES, FINANCIAL INSTRUMENTS, STRATEGIES OR BANKING SERVICES FOR A PARTICULAR PERSON OR ENTITY. THE NAMES AND MARKS OF OTHER COMPANIES OR THEIR SERVICES OR PRODUCTS MAY BE THE TRADEMARKS OF THEIR OWNERS AND ARE USED ONLY TO IDENTIFY SUCH COMPANIES OR THEIR SERVICES OR PRODUCTS AND NOT TO INDICATE ENDORSEMENT, SPONSORSHIP, OR OWNERSHIP BY REGIONS OR HIGHLAND ASSOCIATES. EMPLOYEES OF HIGHLAND ASSOCIATES, INC., MAY HAVE POSITIONS IN SECURITIES OR THEIR DERIVATIVES THAT MAY BE MENTIONED IN THIS REPORT. ADDITIONALLY, HIGHLAND’S CLIENTS AND COMPANIES AFFILIATED WITH HIGHLAND ASSOCIATES MAY HOLD POSITIONS IN THE MENTIONED COMPANIES IN THEIR PORTFOLIOS OR STRATEGIES. THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR AN INVITATION BY OR ON BEHALF OF HIGHLAND ASSOCIATES TO ANY PERSON OR ENTITY TO BUY OR SELL ANY SECURITY OR FINANCIAL INSTRUMENT OR ENGAGE IN ANY BANKING SERVICE. NOTHING IN THESE MATERIALS CONSTITUTES INVESTMENT, LEGAL, ACCOUNTING OR TAX ADVICE. NON-DEPOSIT PRODUCTS INCLUDING INVESTMENTS, SECURITIES, MUTUAL FUNDS, INSURANCE PRODUCTS, CRYPTO ASSETS AND ANNUITIES: ARE NOT FDIC-INSURED I ARE NOT A DEPOSIT I MAY GO DOWN IN VALUE I ARE NOT BANK GUARANTEED I ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY I ARE NOT A CONDITION OF ANY BANKING ACTIVITY.

NEITHER REGIONS BANK NOR REGIONS ASSET MANAGEMENT (COLLECTIVELY, “REGIONS”) ARE REGISTERED MUNICIPAL ADVISORS NOR PROVIDE ADVICE TO MUNICIPAL ENTITIES OR OBLIGATED PERSONS WITH RESPECT TO MUNICIPAL FINANCIAL PRODUCTS OR THE ISSUANCE OF MUNICIPAL SECURITIES (INCLUDING REGARDING THE STRUCTURE, TIMING, TERMS AND SIMILAR MATTERS CONCERNING MUNICIPAL FINANCIAL PRODUCTS OR MUNICIPAL SECURITIES ISSUANCES) OR ENGAGE IN THE SOLICITATION OF MUNICIPAL ENTITIES OR OBLIGATED PERSONS FOR SUCH SERVICES. WITH RESPECT TO THIS PRESENTATION AND ANY OTHER INFORMATION, MATERIALS OR COMMUNICATIONS PROVIDED BY REGIONS, (A) REGIONS IS NOT RECOMMENDING AN ACTION TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON, (B) REGIONS IS NOT ACTING AS AN ADVISOR TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON AND DOES NOT OWE A FIDUCIARY DUTY PURSUANT TO SECTION 15B OF THE SECURITIES EXCHANGE ACT OF 1934 TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON WITH RESPECT TO SUCH PRESENTATION, INFORMATION, MATERIALS OR COMMUNICATIONS, (C) REGIONS IS ACTING FOR ITS OWN INTERESTS, AND (D) YOU SHOULD DISCUSS THIS PRESENTATION AND ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS WITH ANY AND ALL INTERNAL AND EXTERNAL ADVISORS AND EXPERTS THAT YOU DEEM APPROPRIATE BEFORE ACTING ON THIS PRESENTATION OR ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS.

SOURCE: BLOOMBERG INDEX SERVICES LIMITED. BLOOMBERG® IS A TRADEMARK AND SERVICE MARK OF BLOOMBERG FINANCE L.P. AND ITS AFFILIATES (COLLECTIVELY “BLOOMBERG”). BARCLAYS® IS A TRADEMARK AND SERVICE MARK OF BARCLAYS BANK PLC (COLLECTIVELY WITH ITS AFFILIATES, “BARCLAYS”), USED UNDER LICENSE. BLOOMBERG OR BLOOMBERG’S LICENSORS, INCLUDING BARCLAYS, OWN ALL PROPRIETARY RIGHTS IN THE BLOOMBERG BARCLAYS INDICES. NEITHER BLOOMBERG NOR BARCLAYS APPROVES OR ENDORSES THIS MATERIAL OR GUARANTEES THE ACCURACY OR COMPLETENESS OF ANY INFORMATION HEREIN, OR MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED THEREFROM AND, TO THE MAXIMUM EXTENT ALLOWED BY LAW, NEITHER SHALL HAVE ANY LIABILITY OR RESPONSIBILITY FOR INJURY OR DAMAGES ARISING IN CONNECTION THEREWITH.