Stocks: Rally Stalls As Geopolitical Risks Rise; The “Performance Chase” Is On; Small-Caps Likely To Remain Challenged.

Download Weekly Market Commentary | October 16 2023

Key Observations

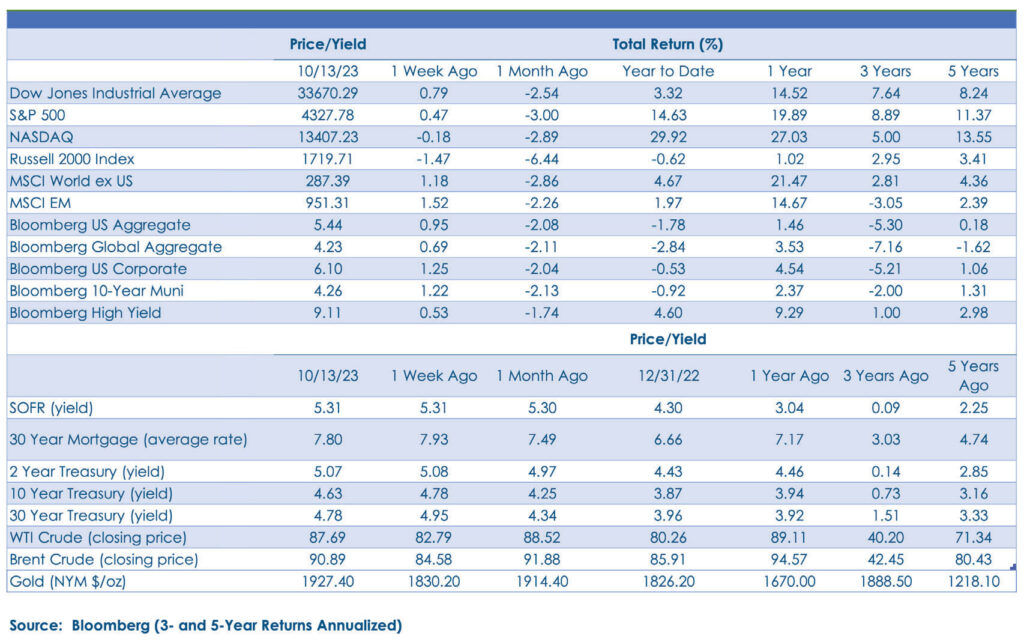

- Stocks ended last week little changed even as the onset of the Israel/Hamas war spurred a flight to safe-haven assets such as U.S. Treasuries and gold. Domestic large-cap stocks (S&P 500) were a relative port in the storm as energy and defensive growth stocks garnered inflows.

- Last week had a ‘risk off’ tone to it due to geopolitical fears, but we still would have expected small cap stocks to fare a bit better given falling Treasury yields and revenue streams heavily tied to the U.S. The poor showing out of small caps month-to-date is likely to persist as investors ‘chase’ returns in large-cap growth stocks into year-end.

- Yields on long-term U.S. Treasury bonds ended the week lower, but the move appeared to be driven more by short covering than it was by investors clamoring for safety in long-dated Treasury bonds.

- The U.S. Treasury auctioned 10- and 30-year notes last week, and both issues were poorly received with indirect bidders, primarily foreign central banks, falling short and dealers forced to take down a larger percentage of each offering than has been typical in recent auctions. This doesn’t bode well into month-end as Treasury is expected to issue approximately $175B of bonds between now and the end of October, which could put upward pressure on yields.

What We’re Watching:

- U.S. September retail sales are released Tuesday and are expected to rise 0.3% month over month, down from 0.6% month over month in August. Excluding fuel and motor vehicle sales, retail sales are expected to rise 0.2% month over month, modestly above the 0.16% month over month increase in August.

- Eurozone Consumer Price Index (CPI) for September is released Wednesday with a 4.3% year over year headline reading expected, in-line with the reading from August. Core CPI is expected to have risen 4.5% year over year during the month, also in-line with the August reading.

- On Thursday, the Conference Board will release its index of leading economic indicators for September with a -0.4% reading expected, which would fall in-line with the August reading.

- Japan’s core CPI for September is released Thursday and a 2.7% reading is expected, which would be well below the 3.1% reading from August. The Bank of Japan will be closely monitoring this data point as upward pressure on inflation subsiding somewhat could take some of the pressure off the Japanese yen and could afford policymakers with some breathing room regarding the timing of further adjustments to the current yield curve control program.

What Happened Last Week:

Stocks: Rally Stalls As Geopolitical Risks Rise; The “Performance Chase” Is On; Small-Caps Likely To Remain Challenged.

Economically Sensitive Sectors Outperform With Energy Leading The Way. The S&P 500 turned out a 0.4% weekly gain with the energy, industrials, and real estate sectors outperforming. The energy sector rallied 4.5% on the week, buoyed by the onset of the Israel/Hamas war, which led to fears that the conflict could spill over to Iran and/ or other parts of the Middle East and potentially weigh heavily on global supply for a prolonged period. Not to be ignored, the U.S. also levied new sanctions on crude oil exports from Russia last week, which, in theory, would also curb supply and put upward pressure on prices. A geopolitical risk premium will likely put a floor under West Texas Intermediate (WTI) and Brent crude in the low-to- mid $80’s per barrel over the near-term, and investors, or perhaps more accurately, traders could deploy capital into energy stocks in a bigger way over coming months as a hedge against inflationary pressures reaccelerating into year-end.

Performance Chasing” Appears To Have Already Commenced. It’s been well documented that a select number of large-cap stocks in the communication services, consumer discretionary, and information technology sectors have driven the bulk of the S&P 500’s gain in 2023. Into year-end we expect portfolio managers to ‘chase’ those winners higher as they desire to show investors how ‘smart’ or prophetic they were to hold these names during the quarter/year. Judging by month-to- date sector performance, it appears as though typical year-end “performance chasing” may have started early as the information technology and communication services sectors are the best performers, rising 2.8% and 2.2%, respectively, outpacing the S&P 500’s 0.9% return. While it’s likely that large-cap growth continues to lead on a relative basis into year-end, we are left to question how much upside might be left into year-end after the October rally in many of these names. We want to stay invested and participate in any Santa Claus rally into year- end, but our expectations for gains are tempered as the Israel/Hamas war could put upward pressure on energy prices should it spread throughout the region, and when combined with the prospect of higher for longer interest rates, could weigh on consumer confidence and spending as well as investor sentiment into year-end.

Small-Cap Struggles Continue. The Russell 2000 index of small-cap companies fell 1.4% on the week, which is notable given the drop in Treasury yields and decline in energy prices over the balance of the week which we would have expected to be a tailwind for this cohort of stocks. The Russell 2000 is now lower by 3.6% month-to- date, underperforming the S&P 500’s 0.9% monthly gain, and year-to-date the Russell 2000 is lower by 2.3%. While small-cap stocks, broadly speaking, are attractively valued relative to their own history and relative to the S&P 500, valuation alone isn’t a reason to increase allocations to small and mid-cap (SMid) stocks at the present time. A challenging fundamental backdrop is likely to remain in place for smaller companies into year-end 2024, with headwinds from higher/rising interest rates, elevated energy prices, and continued tightness in the labor market, all of which will pressure free cash flow generation and profit margins for small caps to varying degrees over the near-term.

Bonds: Short Covering Amid ‘Flight To Safety’ Flows Force Treasury Yields Lower; Weak Treasury Auction Results Highlight Limited Demand For Long-Term Bonds At Current Yields.

Short Covering Behind The Rally In Treasuries Last Week.

Short covering in Treasuries driven by ‘flight to safety’ flows as the Israel/Hamas war broke out forced yields lower early last week, despite hotter than expected inflation readings and a couple of poorly received Treasury auctions. After a rollercoaster ride of a week, the closely watched 10-year Treasury yield closed at 4.63% last Friday, down 15 basis points on the week. We attribute much of the move lower in yields last week to short covering as investors betting on interest rates continuing to rise took profits and moved to the sidelines as they feared a wave of ‘safe haven’ buying in Treasuries amid the onset of the Israel/Hamas war. It’s notable that even as a flurry of short covering forced yields lower, the 10-year yield never broke below the 4.50% level and given weak 10-and 30- year Treasury auctions mid-week, it appears as though buyers for long-dated U.S. Treasury paper are only willing to deploy capital at higher yields. We continue to view 4.50% as key support for the 10-year yield and struggle to identify near-term catalysts capable of pushing yields lower in a meaningful way. Thus, the 10-year yield could rise back toward its early October intra-day high around 4.85% as Treasury issuance ramps up in the coming weeks with approximately $175B of Treasury paper slated to hit the market prior to month-end.

Inflation Is Coming Down, But Perhaps Not Fast Enough For The FOMC’s Liking. Both September CPI (Consumer Price Index) and PPI (Producer Price Index) came in hotter than expected last week. CPI was released Thursday with a headline reading of 3.7% year over year and 0.4% month over month, both 0.1% above the consensus estimate. Core CPI, which excludes volatile food and energy prices, rose 4.1% year over year and 0.3% month over month, in-line with the consensus estimate. Wholesale prices, evidenced by PPI, rose 2.2% year over year in September, well above the 1.6% expected, and excluding food/energy rose 2.7%, above the 2.3% expectation. The core CPI reading will continue to give the FOMC some heartburn as it is moving in the right direction, but at a painfully slow pace, and with the hotter PPI reading likely to flow into consumer prices over coming months, CPI and the Fed’s preferred inflation gauge, Personal Consumption Expenditure (PCE) could remain elevated into year-end. September inflation data is problematic for an FOMC that wants to be finished hiking rates/ tightening monetary policy as the path to 2% inflation remains painfully slow. However, with long-term Treasury yields rising sharply in the past three-plus weeks, serving to tighten monetary policy, it’s likely that the Committee will leave the Fed funds rate where it is when it meets in November as it awaits additional data. It’s too soon to say if the FOMC is done raising rates, and the Committee will avoid stating such after its November meeting as it seeks, above all else, to keep its options open.

Lackluster Demand For Long-Term U.S. Treasuries At Auction.

The U.S. Treasury auctioned off $35B of 10-year notes last Wednesday and $20B of 30-year notes on Thursday, and the response to both auctions was underwhelming at best. For the 10-year auction, specifically, indirect bidders, primarily central banks abroad, took down just 60% of the issue, below recent auction averages, and primary dealers were forced to ‘eat’ just shy of 19% of the issue, above the recent average. Takeaways from the 30-year auction were nearly identical, with indirect bidders taking down a below average allocation and primary dealers forced to take down an above average allocation. Results from both auctions are evidence of weak demand for long-dated Treasuries despite the lift in yields that has taken place since the FOMC’s September 20 meeting, and with sizable issuance expected prior to month-end, we see few catalysts for yields to move markedly lower over the near-term.

IMPORTANT DISCLOSURES: THIS PUBLICATION HAS BEEN PREPARED BY THE STAFF OF HIGHLAND ASSOCIATES, INC. FOR DISTRIBUTION TO, AMONG OTHERS, HIGHLAND ASSOCIATES, INC. CLIENTS. HIGHLAND ASSOCIATES IS REGISTERED WITH THE UNITED STATES SECURITY AND EXCHANGE COMMISSION UNDER THE INVESTMENT ADVISORS ACT OF 1940. HIGHLAND ASSOCIATES IS A WHOLLY OWNED SUBSIDIARY OF REGIONS BANK, WHICH IN TURN IS A WHOLLY OWNED SUBSIDIARY OF REGIONS FINANCIAL CORPORATION. RESEARCH SERVICES ARE PROVIDED THROUGH MULTI-ASSET SOLUTIONS, A DEPARTMENT OF THE REGIONS ASSET MANAGEMENT BUSINESS GROUP WITHIN REGIONS BANK. THE INFORMATION AND MATERIAL CONTAINED HEREIN IS PROVIDED SOLELY FOR GENERAL INFORMATION PURPOSES ONLY. TO THE EXTENT THESE MATERIALS REFERENCE REGIONS BANK DATA, SUCH MATERIALS ARE NOT INTENDED TO BE REFLECTIVE OR INDICATIVE OF, AND SHOULD NOT BE RELIED UPON AS, THE RESULTS OF OPERATIONS, FINANCIAL CONDITIONS OR PERFORMANCE OF REGIONS BANK. UNLESS OTHERWISE SPECIFICALLY STATED, ANY VIEWS, OPINIONS, ANALYSES, ESTIMATES AND STRATEGIES, AS THE CASE MAY BE (“VIEWS”), EXPRESSED IN THIS CONTENT ARE THOSE OF THE RESPECTIVE AUTHORS AND SPEAKERS NAMED IN THOSE PIECES AND MAY DIFFER FROM THOSE OF REGIONS BANK AND/OR OTHER REGIONS BANK EMPLOYEES AND AFFILIATES. VIEWS AND ESTIMATES CONSTITUTE OUR JUDGMENT AS OF THE DATE OF THESE MATERIALS, ARE OFTEN BASED ON CURRENT MARKET CONDITIONS, AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. ANY EXAMPLES USED ARE GENERIC, HYPOTHETICAL AND FOR ILLUSTRATION PURPOSES ONLY. ANY PRICES/QUOTES/STATISTICS INCLUDED HAVE BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT HIGHLAND ASSOCIATES, INC. DOES NOT WARRANT THEIR COMPLETENESS OR ACCURACY. THIS INFORMATION IN NO WAY CONSTITUTES RESEARCH AND SHOULD NOT BE TREATED AS SUCH. THE VIEWS EXPRESSED HEREIN SHOULD NOT BE CONSTRUED AS INDIVIDUAL INVESTMENT ADVICE FOR ANY PARTICULAR PERSON OR ENTITY AND ARE NOT INTENDED AS RECOMMENDATIONS OF PARTICULAR SECURITIES, FINANCIAL INSTRUMENTS, STRATEGIES OR BANKING SERVICES FOR A PARTICULAR PERSON OR ENTITY. THE NAMES AND MARKS OF OTHER COMPANIES OR THEIR SERVICES OR PRODUCTS MAY BE THE TRADEMARKS OF THEIR OWNERS AND ARE USED ONLY TO IDENTIFY SUCH COMPANIES OR THEIR SERVICES OR PRODUCTS AND NOT TO INDICATE ENDORSEMENT, SPONSORSHIP, OR OWNERSHIP BY REGIONS OR HIGHLAND ASSOCIATES. EMPLOYEES OF HIGHLAND ASSOCIATES, INC., MAY HAVE POSITIONS IN SECURITIES OR THEIR DERIVATIVES THAT MAY BE MENTIONED IN THIS REPORT. ADDITIONALLY, HIGHLAND’S CLIENTS AND COMPANIES AFFILIATED WITH HIGHLAND ASSOCIATES MAY HOLD POSITIONS IN THE MENTIONED COMPANIES IN THEIR PORTFOLIOS OR STRATEGIES. THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR AN INVITATION BY OR ON BEHALF OF HIGHLAND ASSOCIATES TO ANY PERSON OR ENTITY TO BUY OR SELL ANY SECURITY OR FINANCIAL INSTRUMENT OR ENGAGE IN ANY BANKING SERVICE. NOTHING IN THESE MATERIALS CONSTITUTES INVESTMENT, LEGAL, ACCOUNTING OR TAX ADVICE. NON-DEPOSIT PRODUCTS INCLUDING INVESTMENTS, SECURITIES, MUTUAL FUNDS, INSURANCE PRODUCTS, CRYPTO ASSETS AND ANNUITIES: ARE NOT FDIC-INSURED I ARE NOT A DEPOSIT I MAY GO DOWN IN VALUE I ARE NOT BANK GUARANTEED I ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY I ARE NOT A CONDITION OF ANY BANKING ACTIVITY.

NEITHER REGIONS BANK NOR REGIONS ASSET MANAGEMENT (COLLECTIVELY, “REGIONS”) ARE REGISTERED MUNICIPAL ADVISORS NOR PROVIDE ADVICE TO MUNICIPAL ENTITIES OR OBLIGATED PERSONS WITH RESPECT TO MUNICIPAL FINANCIAL PRODUCTS OR THE ISSUANCE OF MUNICIPAL SECURITIES (INCLUDING REGARDING THE STRUCTURE, TIMING, TERMS AND SIMILAR MATTERS CONCERNING MUNICIPAL FINANCIAL PRODUCTS OR MUNICIPAL SECURITIES ISSUANCES) OR ENGAGE IN THE SOLICITATION OF MUNICIPAL ENTITIES OR OBLIGATED PERSONS FOR SUCH SERVICES. WITH RESPECT TO THIS PRESENTATION AND ANY OTHER INFORMATION, MATERIALS OR COMMUNICATIONS PROVIDED BY REGIONS, (A) REGIONS IS NOT RECOMMENDING AN ACTION TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON, (B) REGIONS IS NOT ACTING AS AN ADVISOR TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON AND DOES NOT OWE A FIDUCIARY DUTY PURSUANT TO SECTION 15B OF THE SECURITIES EXCHANGE ACT OF 1934 TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON WITH RESPECT TO SUCH PRESENTATION, INFORMATION, MATERIALS OR COMMUNICATIONS, (C) REGIONS IS ACTING FOR ITS OWN INTERESTS, AND (D) YOU SHOULD DISCUSS THIS PRESENTATION AND ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS WITH ANY AND ALL INTERNAL AND EXTERNAL ADVISORS AND EXPERTS THAT YOU DEEM APPROPRIATE BEFORE ACTING ON THIS PRESENTATION OR ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS.

SOURCE: BLOOMBERG INDEX SERVICES LIMITED. BLOOMBERG® IS A TRADEMARK AND SERVICE MARK OF BLOOMBERG FINANCE L.P. AND ITS AFFILIATES (COLLECTIVELY “BLOOMBERG”). BARCLAYS® IS A TRADEMARK AND SERVICE MARK OF BARCLAYS BANK PLC (COLLECTIVELY WITH ITS AFFILIATES, “BARCLAYS”), USED UNDER LICENSE. BLOOMBERG OR BLOOMBERG’S LICENSORS, INCLUDING BARCLAYS, OWN ALL PROPRIETARY RIGHTS IN THE BLOOMBERG BARCLAYS INDICES. NEITHER BLOOMBERG NOR BARCLAYS APPROVES OR ENDORSES THIS MATERIAL OR GUARANTEES THE ACCURACY OR COMPLETENESS OF ANY INFORMATION HEREIN, OR MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED THEREFROM AND, TO THE MAXIMUM EXTENT ALLOWED BY LAW, NEITHER SHALL HAVE ANY LIABILITY OR RESPONSIBILITY FOR INJURY OR DAMAGES ARISING IN CONNECTION THEREWITH.