Stocks: Profit-Taking Hits U.S. Stocks As Investors Take Some Chips Off The Table After Last Week’s Post-Election Rally; Deteriorating Breadth Measures For Developed Markets Abroad Cause For Concern; Broad-Based Weakness Across Emerging Markets As Dollar Strength, Trade Uncertainty Weigh.

Download Weekly Market Commentary | November 18 2024

What We’re Watching:

- ‘Magnificent 7’ member and $3.5T semiconductor behemoth Nvidia is set to report quarterly earnings after the market closes Wednesday. Nvidia’s guidance is likely to dictate the near-term direction for U.S. large cap stocks due to the stock’s sizable weighting within the S&P 500 as well as what it could portend for the broader artificial intelligence (AI) theme and related areas.

- Initial jobless claims for the week ended November 16 and continuing claims for the week ended November 9 are released Thursday.

- U.S. Purchasing Managers Index (PMI) for November is released Friday with the Services PMI expected to rise to 55.3 from 55.0 in October, while the Manufacturing PMI is expected to also rise to 48.8 from 48.5 the prior month. A reading above 50 is indicative of expansion or growth, while a reading below 50 indicates contraction.

Key Observations

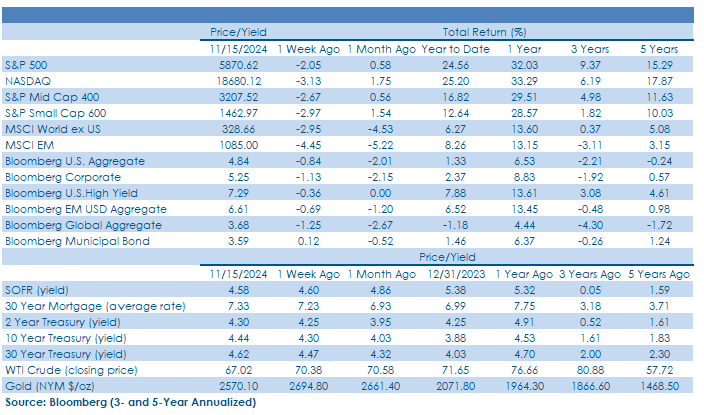

- Profit taking hit U.S. stocks as market participants took chips off the table after a sizable post-election rally pushed many stocks into overbought territory. Large-caps outperformed small- and mid-cap (SMid) on the week and domestic indices fared better than markets tied to developed and developing countries abroad.

- Even after pulling back on the week, the S&P 500 remains on firmer footing from a breadth perspective than country indices tied to developed markets abroad. With the U.K.’s FTSE 100, German DAX, CAC 40 in France, and Japan’s Nikkei 225 all seeing a significant narrowing of leadership in recent weeks, professional investors needing to play catch-up with benchmarks into year-end are likely to do so via U.S. large-cap stocks, likely leading to a widening of the performance gap between U.S. stocks and the rest of the world over the next six or so weeks.

- The 10-year U.S. Treasury yield made another push higher on the week but again encountered resistance around the 4.50% level as buyers stepped in to take advantage of the back-up in rates. This was the 10-year yield’s 3rd attempt to break above the 4.50% level since May, reinforcing our view that this remains the key level worth watching for fixed income investors and a close above 4.50% could bring 4.75% into play in short order.

What Happened Last Week:

Stocks: Profit-Taking Hits U.S. Stocks As Investors Take Some Chips Off The Table After Last Week’s Post-Election Rally; Deteriorating Breadth Measures For Developed Markets Abroad Cause For Concern; Broad-Based Weakness Across Emerging Markets As Dollar Strength, Trade Uncertainty Weigh.

U.S. Large-Cap Stocks Pare Gains Amid Overbought Conditions With Nvidia Earnings On Deck. The S&P 500 traded sideways for most of last week before selling pressure intensified into the weekend with the Index closing out the week 2% lower. Putting last week’s decline into proper context, the S&P 500 is still higher by 2.9% month-to-date and sits less than 3% below its all-time high. After staging an impressive post-election rally, many U.S. large cap stocks reached overbought territory, so we view last week’s pullback as little more than a much-needed healthy and orderly pullback. ‘Magnificent 7’ member Nvidia is slated to post quarterly results this week and could go a long way toward determining whether the S&P 500 challenges its all- time high or tests support at its 100-day moving average around 5,640 prior to December.

Technical Backdrop Deteriorating For International Developed Stocks. The MSCI EAFE underperformed the S&P 500 for the sixth time in the last seven weeks after a 2.5% weekly drop as a rising U.S. dollar (USD) and global trade uncertainty have market participants reducing exposure to this segment of stocks. At the same time, the Japanese yen has been trading in lockstep with the USD in recent weeks and fell to ¥155 to one USD last week which partially offset the slump in the country’s equity market, but investors remain hesitant to buy into Japanese stocks as the Bank of Japan (BoJ) is increasingly likely to step in to support the currency. The yen’s rapid decline relative to the dollar in recent weeks could force the central bank into action, weighing on Japan’s export-driven economy and Japanese stocks which account for roughly 25% of the developed international benchmark. Valuations for Japanese equities have improved since the yen carry unwind shook out traders in early August, but paltry breadth statistics are reason for more caution at this point as only 44% of Nikkei 225 constituents are trading above their 200- day moving average. The technical landscape is equally as concerning for euro area exposures in the MSCI EAFE index as both the U.K. FTSE 100 and German DAX have less than 50% of constituents above their 200-day moving average and for France’s CAC 40 less than 30% of index constituents can make that claim. It’s increasingly difficult to see near- term upside in international developed stocks until we get more clarity on the trade front, and as a result we see little in the way of upside catalysts through the end of the year at a minimum.

Broad-Based Weakness For Emerging Markets As A Post- Election Fog Sets In. Weakness in equity markets tied to developing economies was broad based last week, but Asia Pacific nations were the biggest laggards due to uncertainty around the potential impact of U.S. trade policy shifts. Country indices tied to China, Taiwan, and South Korea each declined by 4% or more, pulling the MSCI Emerging Equity index lower by 4.4% on the week with emerging market currencies continuing to fall against the greenback. Regarding China specifically, there are signs that prior stimulus efforts are reaching consumers as retail sales reached its highest level of the year last week, but future stimulus could be held in reserve to act as an offset for additional tariffs levied down the line. Emerging market currencies, broadly speaking, have fallen back to levels seen before staging a sizable rally in August and September, a sharp reversal that could be running out of steam as the EM currency index rarely stays in its current oversold state for very long. While we see signs that the U.S. dollar could fall from overbought levels and provide a near-term reprieve for stocks tied to the developing world, the trade-related ‘fog’ currently hovering over EM is likely to remain well into 2025 and as a result we are incrementally less constructive on developing market stocks abroad until some clarity on this front can be found.

Bonds: Treasury Yields End The Week Higher Despite Decent Demand For Newly Issued 5- And 7-Year Notes At Auction; September Inflation Data Still ‘Sticky;’ U.K. Budget Proposal Puts Upward Pressure On Sovereign Bond Yields Abroad.

10-Year U.S. Treasury Yield Rises, Retests Resistance In The 4.45%/4.50% Zone As Trade Uncertainty, Deficit Concerns Dominate. Long-dated U.S. Treasury bonds rallied post- election with yields moving lower and bond prices moving higher as political uncertainty subsided. But the move lower in yields proved short-lived as last week was a rough one for investors in higher quality bonds as Treasury yields resumed their ascent with investors turning their attention to uncertainty on the trade/tariff front and what it might imply for the inflation outlook and the budget deficit in the coming quarters and years. Markets rarely give an investor very long to either sell a top or buy a bottom, and with this being the 10-year’s 3rd attempt to break above the 4.45%/4.50% zone since May, we suspect it will ultimately do so and could make a run at 4.75%, which could prove problematic for stocks and longer duration bonds until yields stabilize.

October Inflation Data Comes In As Expected With ‘Core’ Measures Stubbornly Sticky. The October U.S. Consumer Price Index (CPI) was released Wednesday and was followed by the Producer Price Index (PPI) on Thursday. Headline CPI rose 0.2% month over month and 2.6% year over year, in-line with expectations, while core CPI rose 0.3% month over month and 3.3% year over year, in-line with estimates and the prior month’s readings. Headline PPI rose 0.2% month over month which was in-line with expectations, but the year over year reading was a touch hotter at 2.4% versus the 2.3% estimate and was well ahead of the 1.9% reading from September. Core PPI excluding food and energy rose 0.3% month over month and 3.1% year over year with both reading 0.1% above the consensus estimate. Both the October CPI and PPI ‘core’ readings remained sticky, and with PPI ultimately flowing into CPI in the coming months, inflation readings are likely to remain above the FOMC’s 2% target for the foreseeable future. Fed funds futures placed around an 80% probability on a 25-basis point cut in December on the heels of the CPI and PPI releases, up from closer to 58% prior, but reversed course on hawkish remarks made by FOMC Chair Jerome Powell and ended the week placing a 62% probability on a cut next month. We still expect another quarter-point cut in December, but a pause after can be easily justified by the Committee as it awaits more data on the state of the labor market and inflation before easing policy further.

Credit Spreads Drift Higher As Corporate Debt Issuance Ramps Up. Investment grade borrowers were eager to float new debt issues last week, making up for lost time by topping dealer estimates by over $10B as the pre-election lull turned into a rush to tap capital markets. In total, issuers floated $45B in new bonds over just four trading days as bond markets took Veteran’s Day off, bringing month to date issuance to $47B, or put another way 95% of November’s new paper came last week alone. With that in mind, the modest spread widening witnessed should have been expected, especially after spreads tightened meaningfully over the two weeks prior. With the credit spread over the Treasury curve for the Bloomberg U.S. Corporate Index landing at 77-basis points by weeks’ end, high grade credits appear ‘rich’ based on that metric, but in the last 20-years valuations have been as low as 51bps, making it difficult to say spreads can’t grind tighter. Tighter valuations could be problematic, but the index yield-to-worst of 5.25% and growing government debt burden should keep demand for high quality corporate bonds robust.

IMPORTANT DISCLOSURES: THIS PUBLICATION HAS BEEN PREPARED BY THE STAFF OF HIGHLAND ASSOCIATES, INC. FOR DISTRIBUTION TO, AMONG OTHERS, HIGHLAND ASSOCIATES, INC. CLIENTS. HIGHLAND ASSOCIATES IS REGISTERED WITH THE UNITED STATES SECURITY AND EXCHANGE COMMISSION UNDER THE INVESTMENT ADVISORS ACT OF 1940. HIGHLAND ASSOCIATES IS A WHOLLY OWNED SUBSIDIARY OF REGIONS BANK, WHICH IN TURN IS A WHOLLY OWNED SUBSIDIARY OF REGIONS FINANCIAL CORPORATION. RESEARCH SERVICES ARE PROVIDED THROUGH MULTI-ASSET SOLUTIONS, A DEPARTMENT OF THE REGIONS ASSET MANAGEMENT BUSINESS GROUP WITHIN REGIONS BANK. THE INFORMATION AND MATERIAL CONTAINED HEREIN IS PROVIDED SOLELY FOR GENERAL INFORMATION PURPOSES ONLY. TO THE EXTENT THESE MATERIALS REFERENCE REGIONS BANK DATA, SUCH MATERIALS ARE NOT INTENDED TO BE REFLECTIVE OR INDICATIVE OF, AND SHOULD NOT BE RELIED UPON AS, THE RESULTS OF OPERATIONS, FINANCIAL CONDITIONS OR PERFORMANCE OF REGIONS BANK. UNLESS OTHERWISE SPECIFICALLY STATED, ANY VIEWS, OPINIONS, ANALYSES, ESTIMATES AND STRATEGIES, AS THE CASE MAY BE (“VIEWS”), EXPRESSED IN THIS CONTENT ARE THOSE OF THE RESPECTIVE AUTHORS AND SPEAKERS NAMED IN THOSE PIECES AND MAY DIFFER FROM THOSE OF REGIONS BANK AND/OR OTHER REGIONS BANK EMPLOYEES AND AFFILIATES. VIEWS AND ESTIMATES CONSTITUTE OUR JUDGMENT AS OF THE DATE OF THESE MATERIALS, ARE OFTEN BASED ON CURRENT MARKET CONDITIONS, AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. ANY EXAMPLES USED ARE GENERIC, HYPOTHETICAL AND FOR ILLUSTRATION PURPOSES ONLY. ANY PRICES/QUOTES/STATISTICS INCLUDED HAVE BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT HIGHLAND ASSOCIATES, INC. DOES NOT WARRANT THEIR COMPLETENESS OR ACCURACY. THIS INFORMATION IN NO WAY CONSTITUTES RESEARCH AND SHOULD NOT BE TREATED AS SUCH. THE VIEWS EXPRESSED HEREIN SHOULD NOT BE CONSTRUED AS INDIVIDUAL INVESTMENT ADVICE FOR ANY PARTICULAR PERSON OR ENTITY AND ARE NOT INTENDED AS RECOMMENDATIONS OF PARTICULAR SECURITIES, FINANCIAL INSTRUMENTS, STRATEGIES OR BANKING SERVICES FOR A PARTICULAR PERSON OR ENTITY. THE NAMES AND MARKS OF OTHER COMPANIES OR THEIR SERVICES OR PRODUCTS MAY BE THE TRADEMARKS OF THEIR OWNERS AND ARE USED ONLY TO IDENTIFY SUCH COMPANIES OR THEIR SERVICES OR PRODUCTS AND NOT TO INDICATE ENDORSEMENT, SPONSORSHIP, OR OWNERSHIP BY REGIONS OR HIGHLAND ASSOCIATES. EMPLOYEES OF HIGHLAND ASSOCIATES, INC., MAY HAVE POSITIONS IN SECURITIES OR THEIR DERIVATIVES THAT MAY BE MENTIONED IN THIS REPORT. ADDITIONALLY, HIGHLAND’S CLIENTS AND COMPANIES AFFILIATED WITH HIGHLAND ASSOCIATES MAY HOLD POSITIONS IN THE MENTIONED COMPANIES IN THEIR PORTFOLIOS OR STRATEGIES. THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR AN INVITATION BY OR ON BEHALF OF HIGHLAND ASSOCIATES TO ANY PERSON OR ENTITY TO BUY OR SELL ANY SECURITY OR FINANCIAL INSTRUMENT OR ENGAGE IN ANY BANKING SERVICE. NOTHING IN THESE MATERIALS CONSTITUTES INVESTMENT, LEGAL, ACCOUNTING OR TAX ADVICE. NON-DEPOSIT PRODUCTS INCLUDING INVESTMENTS, SECURITIES, MUTUAL FUNDS, INSURANCE PRODUCTS, CRYPTO ASSETS AND ANNUITIES: ARE NOT FDIC-INSURED I ARE NOT A DEPOSIT I MAY GO DOWN IN VALUE I ARE NOT BANK GUARANTEED I ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY I ARE NOT A CONDITION OF ANY BANKING ACTIVITY.

NEITHER REGIONS BANK NOR REGIONS ASSET MANAGEMENT (COLLECTIVELY, “REGIONS”) ARE REGISTERED MUNICIPAL ADVISORS NOR PROVIDE ADVICE TO MUNICIPAL ENTITIES OR OBLIGATED PERSONS WITH RESPECT TO MUNICIPAL FINANCIAL PRODUCTS OR THE ISSUANCE OF MUNICIPAL SECURITIES (INCLUDING REGARDING THE STRUCTURE, TIMING, TERMS AND SIMILAR MATTERS CONCERNING MUNICIPAL FINANCIAL PRODUCTS OR MUNICIPAL SECURITIES ISSUANCES) OR ENGAGE IN THE SOLICITATION OF MUNICIPAL ENTITIES OR OBLIGATED PERSONS FOR SUCH SERVICES. WITH RESPECT TO THIS PRESENTATION AND ANY OTHER INFORMATION, MATERIALS OR COMMUNICATIONS PROVIDED BY REGIONS, (A) REGIONS IS NOT RECOMMENDING AN ACTION TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON, (B) REGIONS IS NOT ACTING AS AN ADVISOR TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON AND DOES NOT OWE A FIDUCIARY DUTY PURSUANT TO SECTION 15B OF THE SECURITIES EXCHANGE ACT OF 1934 TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON WITH RESPECT TO SUCH PRESENTATION, INFORMATION, MATERIALS OR COMMUNICATIONS, (C) REGIONS IS ACTING FOR ITS OWN INTERESTS, AND (D) YOU SHOULD DISCUSS THIS PRESENTATION AND ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS WITH ANY AND ALL INTERNAL AND EXTERNAL ADVISORS AND EXPERTS THAT YOU DEEM APPROPRIATE BEFORE ACTING ON THIS PRESENTATION OR ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS.

SOURCE: BLOOMBERG INDEX SERVICES LIMITED. BLOOMBERG® IS A TRADEMARK AND SERVICE MARK OF BLOOMBERG FINANCE L.P. AND ITS AFFILIATES (COLLECTIVELY “BLOOMBERG”). BARCLAYS® IS A TRADEMARK AND SERVICE MARK OF BARCLAYS BANK PLC (COLLECTIVELY WITH ITS AFFILIATES, “BARCLAYS”), USED UNDER LICENSE. BLOOMBERG OR BLOOMBERG’S LICENSORS, INCLUDING BARCLAYS, OWN ALL PROPRIETARY RIGHTS IN THE BLOOMBERG BARCLAYS INDICES. NEITHER BLOOMBERG NOR BARCLAYS APPROVES OR ENDORSES THIS MATERIAL OR GUARANTEES THE ACCURACY OR COMPLETENESS OF ANY INFORMATION HEREIN, OR MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED THEREFROM AND, TO THE MAXIMUM EXTENT ALLOWED BY LAW, NEITHER SHALL HAVE ANY LIABILITY OR RESPONSIBILITY FOR INJURY OR DAMAGES ARISING IN CONNECTION THEREWITH.