Stocks: U.S. Markets Falter As Tariffs, Cautious Consumers Weigh On Sentiment, Risk Appetite; Eurozone, U.K. Indices Largely Shrug Off Potential U.S. Tariffs, German Elections To Turn Out Gains; China, Mexico See Profit Taking As Tariffs Are Set To Go Into Effect This Week.

Download Weekly Market Commentary | March 03 2025

What We’re Watching:

- Initial Jobless Claims for the week ended March 1 and Continuing Jobless Claims for the week ended February 22 are released Thursday and are worth watching after initial claims for unemployment insurance came in above expectations the prior week. Given weak consumer confidence readings of late, some signs of stabilization in the labor market would be most welcome by equity bulls.

- The Institute for Supply Management (ISM) Services Index for February is released Wednesday and is expected to fall modestly to 52.7 from 52.8 in January. This release will likely be closely watched after the initial release of the S&P Global U.S. Services PMI fell into contraction territory in February. For reference, a reading above 50 indicates growth/expansion in the services sector of the U.S. economy, while a reading below 50 indicates slowing or contraction.

- The February Nonfarm Payrolls Report is released Friday with 160k jobs expected to have been created during the month, while the unemployment rate is projected to be unchanged month over month at 4.0%. This metric, along with initial and continuing claims earlier in the week, should be closely watched amid a series of lackluster consumer confidence readings in recent weeks which could see additional downside if the labor market weakens materially.

Key Observations

- Headline risks and cautious U.S. consumers continued to put downward pressure on U.S. stocks for the 2nd straight week as sentiment and risk appetite remained fragile.

- U.S. stocks sold off mid-week as the U.S. announced it was prepared to implement 25% tariffs on goods imported from the European Union in early April, and that 25% tariffs on imported goods from Canada and Mexico would go into effect on March 4. Not to be forgotten, the Trump administration also announced it would also be levying an additional 10% tariff on Chinese imports, on top of the 10% announced a few weeks back. Despite this news, most euro area country indices outperformed their U.S. counterparts on the week, while indices tied to China and Mexico lagged, partially due to the U.S. dollar strengthening.

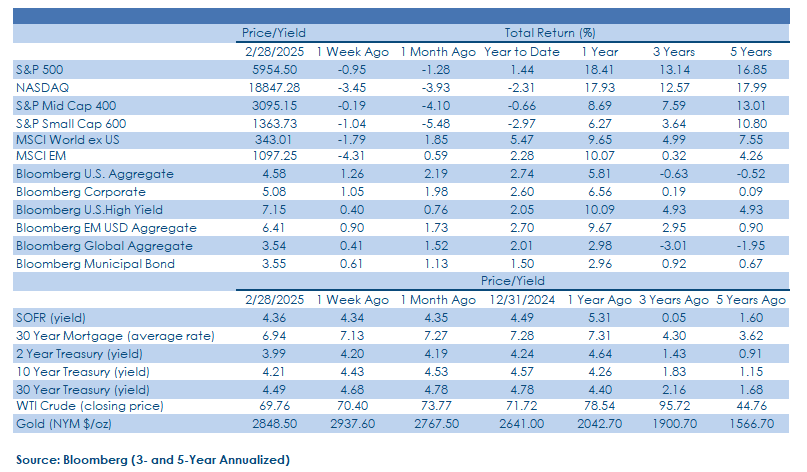

- Broadly speaking, it was a good week for bonds with core investment-grade fixed income faring best as the downward move in Treasury yields continued. There was modest widening of credit spreads for corporate bonds over the balance of the week and investment- grade corporates outperformed their riskier, higher yielding counterparts as investors required higher yields to compensate for taking credit risk amid a more uncertain economic backdrop.

What Happened Last Week:

Stocks: Growth-Oriented Areas Take A Backseat As Policy Uncertainty, Corporate Investment Concerns Spur A Rotation Into Value; Chinese Tech Earnings, Implied Government Support Boosting Sentiment; Policy Risks Cool The European Stock Upswing.

Consumer Staples, Health Care, Real Estate Holding Up As ‘Risk-Off’ Dominates. After closing at an all-time high of 6,144 on February 19, the S&P 500 has now fallen by 2.6%, due in large part to broad-based weakness out of high-flying ‘Magnificent 7’ names in the communication services (GOOGL, META), consumer discretionary (AMZN, TSLA), and information technology (APPL, NVDA) sectors. For comparison, the comm services, discretionary, and IT sectors are lower by 2.3%, 4.1%, and 6.7%, respectively, over the same time frame. Given the sizable downdrafts in these three key areas, which together account for over 50% of the S&P 500, it is encouraging that the headline index isn’t off by more than 2.6%. While the ‘Mag 7’ has struggled, some of the classically defensive sectors that have lagged in the post- COVID bull market have caught a bid of late, with consumer staples rising 2.5%, real estate higher by 2.6%, and the health care sector the biggest winner, up 2.9% since market close on February 19, propping up the broader market.

What’s Next For The S&P 500? The S&P 500 ended last week lower by just 0.9% but did close below its 50-day moving average for the 2nd consecutive week. Encouragingly, index managed to stage an impressive late-day comeback on Friday and closed a couple of points above its 100-day – a potentially noteworthy move should the bulls wrestle control back from the bears in the coming week(s). However, with the CBOE Volatility Index, or VIX, still below 20 last Friday, we question whether investors will feel they are adequately hedged for the uncertainty that lies ahead, and as a result we believe selling and de-risking of portfolios could resume in short order. A spike into the high 20’s or low 30’s would be more representative of a selling crescendo and ‘peak-fear,’ not last week’s half-hearted move into the low-20’s which is around the 30-year average level for the VIX. In the lead-up to the November election, the S&P 500 traded between 5,700 and 5,715, or some 4% below Friday’s close, and is a potential downside target if sellers return and remain in control.

Euro Area Country Indices Shrug Off U.S. Tariff Talk, German Elections To End The Week Unchanged.The MSCI EAFE closed lower by 0.8% on the week as upside was capped by a rebound in the U.S. dollar. Developed market indices abroad fared relatively well despite President Trump’s proclamation that tariffs on Canada and Mexico would go into effect this week, and that a 25% tariff on Eurozone exports to the U.S. could be coming in April. Peripheral Eurozone countries including Spain and Italy that had surged early in the new year maintained their leadership with the pair gaining 2.7% and 0.1% last week, respectively. Country indices for these two nations in particular tilt toward domestic industries or sectors less impacted by tariffs such as financials which account for roughly 30-40% of each index, which keeps this duo out of the limelight on trade, for now anyway. In Germany, conservatives prevailed against the far-right wing opposition, easing political concerns and providing a boost to the German DAX index that gained as much as 2.2% midweek before settling for a 0.9% weekly gain after tariff headwinds were priced in. The U.K. stock market outperformed vs. the broader Eurozone, returning 1.5% due to the fact the U.S. runs a trade surplus Britain, which may leave it above the tariff fray.

China, Mexico In The Trade Crosshairs, But Stimulus Efforts Provide A Ballast. Trade headlines had a broad reach last week, with Chinese exports catching an additional 10% tariff as the relationship between the world’s two largest economies remains tenuous at best. Trade rhetoric led the MSCI China index lower by 3.9% over the course of the week, even as capital injections for some of the country’s largest banks totaling $55B were set to begin in the coming months. The act of recapitalizing the banks shows follow- through from broader stimulus packages that were unveiled late last year, but further stimulus could be required if U.S. import duties move higher. Trade uncertainty is making for a volatile backdrop for country indices tied to our largest trading partners, including China, with no firm direction as each week brings with it fits and starts on the tariff front. Economic data out of China remains less than encouraging, but corporate earnings appear to be firming up, broadly speaking. Confirmation that Canada and Mexico would incur previously delayed tariffs on March 4th sent a shiver through the MSCI Mexico Index as the nation’s equity barometer fell by 3.1% for the week. Further escalation would undoubtedly hurt Mexico’s industrial- and material- heavy equity market, but the U.S. is also the biggest exporter to Mexico, with both countries likely to incur economic damage from a full-on trade war.

Bonds: Flight To Quality/Safety Forces Treasury Yields Lower For 6th Consecutive Week; Credit Spreads Widen Modestly, Approach Mid-January Levels As Investors Require Higher Yields From Riskier Corporate Bonds.

Treasury Yields Fall Further On Growth Concerns; 10-Yr. Yield Has Its Lowest Weekly Close Since Mid-December. Treasury yields continued to drop last week with fears of slower U.S. economic growth the most often cited reason behind the move, while some also attributed the cost- cutting efforts out of the Department of Government Efficiency (DOGE) as a secondary contributor to the rally in prices of U.S. Treasury bonds. Weaker consumer confidence data, along with trade/tariff uncertainty, has stoked fears of an economic slowdown in the past month, and last Friday’s release out of the Bureau of Economic Analysis (BEA) on Personal Income and Spending for January did little to alter the narrative that the U.S. consumer was growing increasingly nervous. Personal Income rose a robust 0.9% month over month in January, well above the 0.4% estimate, but Personal Spending fell 0.2% month over month, well below the expectation of a 0.2% rise. The savings rate embedded in the release rose to 4.6% from 3.5% the prior month, providing further evidence that consumers appear to be battening down the hatches in preparation for leaner times. On balance, recent data points toward downside risks for U.S. economic growth in the coming quarters, while inflation data, evidenced by the release of Personal Consumption Expenditure (PCE) from January, which came in as expected but pointed toward inflationary pressures remaining sticky with progress stalling out, which has led to fears of stagflation. Fixed income investors appear to be taking their cue from the ‘stag’ portion of the word while ignoring the ‘inflation’ part, possibly due to expectations that year over year inflation comparisons get easier in the coming months. We believe uncertainty surrounding tariffs have forced businesses to halt investment until some clarity is found, which could lead to a soft patch for economic growth and put downward pressure on Treasury yields over the near-term. Despite continued weak readings on the U.S. economy last week, it’s worth noting that the U.S. Dollar Index (DXY) actually rose last week, a divergence worth watching that could signal the demise of the U.S. economy may be greatly exaggerated at present. After the drop in yields, long-dated U.S. Treasuries are now less attractive and total return potential limited, with the 10-year Treasury, specifically, now trading rich to our fair value estimate of around 4.50%.

Small Cracks Forming In Credit Worth Watching. Valuations on high yield bonds cheapened again last week with the credit spread over the Treasury curve for the Bloomberg U.S. Corporate High Yield Index widened by 10-basis points last week, taking its two-week total to 22-basis points as skittish investors reduced exposure to riskier assets on the heels of recent downside surprises on the economic data front. Despite some spread widening, the Bloomberg High Yield Corporate index still returned 0.4% last week, but the headline return for the Index masks some underlying cracks that may be forming in the credit markets. The longer duration profile of investment-grade corporate bonds has been a tailwind as rates have fallen, and IG corporates generated a 1.0% return on the week, but this segment wasn’t completely immune as investment grade names also saw spreads widen by around 7-basis points on the week. Given a more uncertain economic landscape and the lack of yield-based compensation for taking credit risk at present, we suspect investors will continue to favor Treasuries relative to corporates in the near-term.

Another ‘Soft’ Survey Points Toward A Nervous U.S. Consumer. The Conference Board released its February Consumer Confidence survey last Tuesday, and the reading of 98.3 fell short of the 102.5 estimate as well as the 104.1 reading from January. The Present Situation component of the survey improved month over month, while the Expectations piece deteriorated materially from the January release. While we hesitate to put too much stock in ‘soft’ survey data, the Conference Board’s survey aligned with the University of Michigan release earlier in the month which pointed toward a sharp rise in the outlook for inflation over the coming year, which weighed on the Expectations component of the survey. With the U.S. economy being two-thirds consumption-based, consumer confidence readings are well worth watching, but basing one’s economic view and outlook solely on these surveys can lead to missteps, i.e. getting too defensive, and positioning shakeouts. At present, the flight to safety and rally in U.S. Treasuries over the past month due to fears of an economic downturn appears overdone to us, and yields may reverse higher in the coming months as investors get more comfortable that the economy isn’t on the brink of recession.

Softer Consumer Confidence Readings Raise Odds Of A June Rate Cut. The Conference Board’s Consumer Confidence survey was just another in a recent string of less than encouraging readings on the state of the U.S. consumer, and market participants have repriced the odds of further policy of further policy easing in the coming year because of these datapoints. In mid-January, in the wake of the FOMC’s monthly meeting, Fed Funds futures were pricing in around 40-basis points of rate cuts this calendar year, with the June/July timeframe viewed as the most likely spot in the calendar for a quarter-point cut this year. However, in the past six weeks, amid some softer consumer confidence readings, the futures market has shifted and now projects 58-basis points of cuts over the balance of this year, with June the odds-on favorite for the first cut with an 84% probability. We have expected the FOMC to cut the funds rate by a total of 50-basis points in ’25 and have not altered that view despite some signs of a shakier U.S. consumer. As stated above, these surveys have contributed to fears of an economic slowdown and forced Treasury yields lower, but we believe the move to be overdone and see the rally in Treasuries as an opportune time to revisit and potentially reposition fixed income portfolios with the expectation the rally/move lower in yields will reverse to some degree in the coming months.

IMPORTANT DISCLOSURES: THIS PUBLICATION HAS BEEN PREPARED BY THE STAFF OF HIGHLAND ASSOCIATES, INC. FOR DISTRIBUTION TO, AMONG OTHERS, HIGHLAND ASSOCIATES, INC. CLIENTS. HIGHLAND ASSOCIATES IS REGISTERED WITH THE UNITED STATES SECURITY AND EXCHANGE COMMISSION UNDER THE INVESTMENT ADVISORS ACT OF 1940. HIGHLAND ASSOCIATES IS A WHOLLY OWNED SUBSIDIARY OF REGIONS BANK, WHICH IN TURN IS A WHOLLY OWNED SUBSIDIARY OF REGIONS FINANCIAL CORPORATION. RESEARCH SERVICES ARE PROVIDED THROUGH MULTI-ASSET SOLUTIONS, A DEPARTMENT OF THE REGIONS ASSET MANAGEMENT BUSINESS GROUP WITHIN REGIONS BANK. THE INFORMATION AND MATERIAL CONTAINED HEREIN IS PROVIDED SOLELY FOR GENERAL INFORMATION PURPOSES ONLY. TO THE EXTENT THESE MATERIALS REFERENCE REGIONS BANK DATA, SUCH MATERIALS ARE NOT INTENDED TO BE REFLECTIVE OR INDICATIVE OF, AND SHOULD NOT BE RELIED UPON AS, THE RESULTS OF OPERATIONS, FINANCIAL CONDITIONS OR PERFORMANCE OF REGIONS BANK. UNLESS OTHERWISE SPECIFICALLY STATED, ANY VIEWS, OPINIONS, ANALYSES, ESTIMATES AND STRATEGIES, AS THE CASE MAY BE (“VIEWS”), EXPRESSED IN THIS CONTENT ARE THOSE OF THE RESPECTIVE AUTHORS AND SPEAKERS NAMED IN THOSE PIECES AND MAY DIFFER FROM THOSE OF REGIONS BANK AND/OR OTHER REGIONS BANK EMPLOYEES AND AFFILIATES. VIEWS AND ESTIMATES CONSTITUTE OUR JUDGMENT AS OF THE DATE OF THESE MATERIALS, ARE OFTEN BASED ON CURRENT MARKET CONDITIONS, AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. ANY EXAMPLES USED ARE GENERIC, HYPOTHETICAL AND FOR ILLUSTRATION PURPOSES ONLY. ANY PRICES/QUOTES/STATISTICS INCLUDED HAVE BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT HIGHLAND ASSOCIATES, INC. DOES NOT WARRANT THEIR COMPLETENESS OR ACCURACY. THIS INFORMATION IN NO WAY CONSTITUTES RESEARCH AND SHOULD NOT BE TREATED AS SUCH. THE VIEWS EXPRESSED HEREIN SHOULD NOT BE CONSTRUED AS INDIVIDUAL INVESTMENT ADVICE FOR ANY PARTICULAR PERSON OR ENTITY AND ARE NOT INTENDED AS RECOMMENDATIONS OF PARTICULAR SECURITIES, FINANCIAL INSTRUMENTS, STRATEGIES OR BANKING SERVICES FOR A PARTICULAR PERSON OR ENTITY. THE NAMES AND MARKS OF OTHER COMPANIES OR THEIR SERVICES OR PRODUCTS MAY BE THE TRADEMARKS OF THEIR OWNERS AND ARE USED ONLY TO IDENTIFY SUCH COMPANIES OR THEIR SERVICES OR PRODUCTS AND NOT TO INDICATE ENDORSEMENT, SPONSORSHIP, OR OWNERSHIP BY REGIONS OR HIGHLAND ASSOCIATES. EMPLOYEES OF HIGHLAND ASSOCIATES, INC., MAY HAVE POSITIONS IN SECURITIES OR THEIR DERIVATIVES THAT MAY BE MENTIONED IN THIS REPORT. ADDITIONALLY, HIGHLAND’S CLIENTS AND COMPANIES AFFILIATED WITH HIGHLAND ASSOCIATES MAY HOLD POSITIONS IN THE MENTIONED COMPANIES IN THEIR PORTFOLIOS OR STRATEGIES. THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR AN INVITATION BY OR ON BEHALF OF HIGHLAND ASSOCIATES TO ANY PERSON OR ENTITY TO BUY OR SELL ANY SECURITY OR FINANCIAL INSTRUMENT OR ENGAGE IN ANY BANKING SERVICE. NOTHING IN THESE MATERIALS CONSTITUTES INVESTMENT, LEGAL, ACCOUNTING OR TAX ADVICE. NON-DEPOSIT PRODUCTS INCLUDING INVESTMENTS, SECURITIES, MUTUAL FUNDS, INSURANCE PRODUCTS, CRYPTO ASSETS AND ANNUITIES: ARE NOT FDIC-INSURED I ARE NOT A DEPOSIT I MAY GO DOWN IN VALUE I ARE NOT BANK GUARANTEED I ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY I ARE NOT A CONDITION OF ANY BANKING ACTIVITY.

NEITHER REGIONS BANK NOR REGIONS ASSET MANAGEMENT (COLLECTIVELY, “REGIONS”) ARE REGISTERED MUNICIPAL ADVISORS NOR PROVIDE ADVICE TO MUNICIPAL ENTITIES OR OBLIGATED PERSONS WITH RESPECT TO MUNICIPAL FINANCIAL PRODUCTS OR THE ISSUANCE OF MUNICIPAL SECURITIES (INCLUDING REGARDING THE STRUCTURE, TIMING, TERMS AND SIMILAR MATTERS CONCERNING MUNICIPAL FINANCIAL PRODUCTS OR MUNICIPAL SECURITIES ISSUANCES) OR ENGAGE IN THE SOLICITATION OF MUNICIPAL ENTITIES OR OBLIGATED PERSONS FOR SUCH SERVICES. WITH RESPECT TO THIS PRESENTATION AND ANY OTHER INFORMATION, MATERIALS OR COMMUNICATIONS PROVIDED BY REGIONS, (A) REGIONS IS NOT RECOMMENDING AN ACTION TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON, (B) REGIONS IS NOT ACTING AS AN ADVISOR TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON AND DOES NOT OWE A FIDUCIARY DUTY PURSUANT TO SECTION 15B OF THE SECURITIES EXCHANGE ACT OF 1934 TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON WITH RESPECT TO SUCH PRESENTATION, INFORMATION, MATERIALS OR COMMUNICATIONS, (C) REGIONS IS ACTING FOR ITS OWN INTERESTS, AND (D) YOU SHOULD DISCUSS THIS PRESENTATION AND ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS WITH ANY AND ALL INTERNAL AND EXTERNAL ADVISORS AND EXPERTS THAT YOU DEEM APPROPRIATE BEFORE ACTING ON THIS PRESENTATION OR ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS.

SOURCE: BLOOMBERG INDEX SERVICES LIMITED. BLOOMBERG® IS A TRADEMARK AND SERVICE MARK OF BLOOMBERG FINANCE L.P. AND ITS AFFILIATES (COLLECTIVELY “BLOOMBERG”). BARCLAYS® IS A TRADEMARK AND SERVICE MARK OF BARCLAYS BANK PLC (COLLECTIVELY WITH ITS AFFILIATES, “BARCLAYS”), USED UNDER LICENSE. BLOOMBERG OR BLOOMBERG’S LICENSORS, INCLUDING BARCLAYS, OWN ALL PROPRIETARY RIGHTS IN THE BLOOMBERG BARCLAYS INDICES. NEITHER BLOOMBERG NOR BARCLAYS APPROVES OR ENDORSES THIS MATERIAL OR GUARANTEES THE ACCURACY OR COMPLETENESS OF ANY INFORMATION HEREIN, OR MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED THEREFROM AND, TO THE MAXIMUM EXTENT ALLOWED BY LAW, NEITHER SHALL HAVE ANY LIABILITY OR RESPONSIBILITY FOR INJURY OR DAMAGES ARISING IN CONNECTION THEREWITH.