Stocks: Safety Trade Goes Global as European Banks Face Funding Concerns; Breadth Remains Narrow and Worrisome Stateside.

Download Weekly Market Commentary | March 27 2023

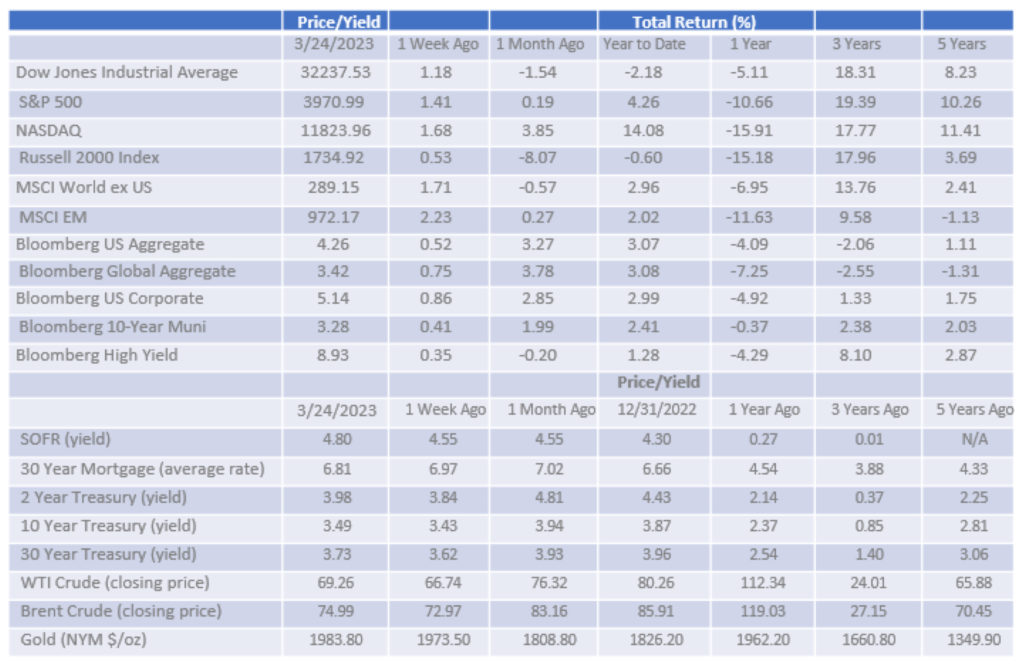

It was another choppy week for the S&P 500, but the index ultimately ended the week with a 1.4% gain as equities digested another FOMC rate hike, falling Treasury yields, and liquidity concerns surrounding European banks. From a technical perspective, the S&P 500 closing last week at 3,970 and above its 200-day moving average of 3,923 is notable and remains worth watching as that level has provided a floor of support of late. Large-caps fared better than small-caps as the Russell 2000 rose just 0.5% on the week and after a strong start to the year in January is now down 0.6% year-to-date after falling 8% over the past month. Relative weakness in small-caps over the past three-plus weeks has been tied to concerns surrounding a contraction in credit availability with a U.S. economic downturn of some magnitude a likely byproduct. The backdrop for smaller companies less capable of tapping or accessing the capital markets to meet funding needs is a fragile one and higher quality, profitable companies in the small-cap space are likely to outperform, at least on a relative basis, over coming quarters as a result. Abroad, euro area equities fell sharply into the weekend as Deutsche Bank made headlines for the wrong reason, i.e., liquidity/funding concerns. With the euro area still facing elevated inflation and forcing the Bank of England (BoE) and European Central Bank (ECB) to tighten policy, economic growth in Europe is likely to remain challenged.

- The Russell 1000 Growth index outpaced the 1000 Value index by 1% last week as market breadth/leadership broadened out somewhat relative to prior weeks but remained quite narrow. Communication services and information technology again outperformed the S&P 500 and were joined by the materials sector, while consumer staples and energy modestly underperformed. Market participants continue to flock to the largest and most liquid mega-cap technology names such as Apple, Microsoft, and Nvidia, which are, in their view, capable of growth independent of the economic backdrop. However, this group is far from immune to an economic slowdown and tighter credit conditions, and current lofty valuations increase the magnitude of any drawdown should economic weakness call for earnings expectations to be revised lower for this cohort of stocks.

- U.K. and euro area equity indices sold off into the weekend as Deutsche Bank made headlines amid unsubstantiated rumors that the bank was experiencing funding issues Credit default swaps (CDS) or insurance purchased by bondholders that would pay out/off if Deutsche Bank defaulted on its debt obligations, jumped higher over the balance of last week, capturing elevated concerns surrounding the bank’s financial health. Deutsche Bank’s capital and liquidity metrics far exceed Credit Suisse’s and are indicative of a bank in a solid position to weather deposit outflows, but this is the latest example of guilty by association in the banking space and will likely lead to weakness in euro area stocks over the near-term as counterparty risk remains of concern. The MSCI ACWI ex. U.S. index and most euro area country indices ended last week in positive territory despite the Deutsche Bank rumors, but solvency and liquidity concerns could plague European financial institutions and weigh on consumer confidence/spending as well as corporate capital expenditures and economic growth over coming quarters.

- The MSCI Emerging Markets (EM) index rose 2.2% on the week as China staged a 3.7% rally, while Mexico, South Korea, and Taiwan were also strong performers as a bout of U.S. dollar weakness provided a tailwind. Brazil was a notable laggard falling 2.7% on the week.

Bonds: FOMC Takes The Path of Least Resistance; Central Banks Abroad Remain On Guard As Well.

The rates market remained volatile last week as central banks in the U.S. and Europe tightened monetary policy further amid stubbornly elevated inflation pressures. The Federal Open Market Committee (FOMC) and Bank of England (BoE) hiked key rates by 25-basis points, while the European Central Bank (ECB) moved even more aggressively, following through with a 50-basis point hike as it had previously indicated. For the FOMC, on balance, the post-meeting statement and Chair Jerome Powell’s comments were taken as dovish. The Committee again raised the Fed funds rate by 25-basis points to a range of 4.75% to 5% but softened its message by removing language surrounding policy tightening and revising it to state that “some additional policy firming may be appropriate” to get monetary policy to a sufficiently restrictive level to return inflation to 2% over time. While the FOMC’s own updated dot plot does not point toward rate cuts until 2024, Treasury yields and Fed funds futures disagree with that assessment and expect rate cuts by mid-year as the Fed is forced to respond to tighter credit conditions, reduced economic activity, and rising unemployment by easing policy. Ongoing interest rate volatility is the most likely byproduct of monetary policy uncertainty and will likely weigh on appetite for riskier bonds, forcing credit spreads wider and yields higher to compensate and attract investors.

- Last Wednesday, the FOMC unanimously voted to raise the US policy rate by 25bps after to a mid-point target of 4.875%, the most conservative option from our seat leaving the least room for interpretation by markets while also reinforcing the committee’s commitment to stamping out inflation. The FOMC’s Summary of Economic Projections, or dot plot, pointed toward one more quarter-point hike in 2023 with a year-end funds rate of 5.125%, in-line with what was laid forth in the Committee’s December projections. Fed funds futures were pricing in north of an 80% chance of a quarter-point hike in March, which proved to be correct, but where the market disagrees most with the Fed’s projections is in the outlook for rate cuts over the balance of 2023. The FOMC’s updated dot plot points to three quarter-point rate cuts, but not until 2024; however, in the wake of last week’s meeting, Fed funds futures expects four 25-basis point rate cuts in 2023, with the first potentially occurring as early as June. This is a notable discrepancy as the market expects the Fed to be forced to cut much sooner than the Committee’s own projections, a difference of opinion likely to lead to ongoing uncertainty in interest rates.

- Abroad, the U.K. Consumer Prices Index (CPI) for February was released Wednesday. Year over year CPI rose 10.4% vs. the consensus estimate of 9.9% and the prior reading of 10.1%. Month over month, CPI rose 1.1%, exceeding the 0.5% consensus estimate. The Bank of England (BoE) met the following day and with hot inflation data in hand voted to increase key deposit rates by 25-basis points. The U.K is largely experiencing commodity-driven inflation that could prove short-term in nature as more volatile segments like electricity and gas along with food were primary contributors although services inflation which tends to be stickier also rose year over year. While the BoE would prefer to pause at its May meeting, an upside CPI surprise in March would impede its ability to do so. Both the European Central Bank (ECB) and BoE could remain in policy tightening mode due to stubbornly elevated inflation over coming months, a dynamic likely to weigh on euro area economic growth and put upward pressure on European sovereign bond yields. We remain underweight international fixed income relative to our strategic target.

- After a week-long issuance hiatus in the investment-grade (IG) corporate bond market, two A-rated utilities broke the gridlock and priced debt offerings on Monday, with both deals notably priced wider than expectations, indicative of investors requiring greater compensation for taking credit risk. Predicted corporate issuance for the week of around $25B failed to materialize and while we find it encouraging that IG credit markets took very little time off, recent events have had negative macro implications than could present fundamental credit concerns and lead to subdued issuance. A sliver of optimism was all corporate borrowers required to tap credit markets midweek and shore up financing in advance of additional potential credit volatility stemming from fresh jitters surrounding Deutsche Bank. The Bloomberg Corporate index finished the week higher by 0.8%, a fourth consecutive weekly gain despite credit spreads moving wider in recent weeks as those moves were offset by sharply lower Treasury rates.

What We’re Watching:

- The Conference Board’s Consumer Confidence Survey for March is released Tuesday and is expected to fall to 100.9 from 102.9 in February.

- Eurozone Consumer Price Index (CPI) for March is released Friday and is expected to show a year over year rise of 7.1% versus 8.5% in February. A core CPI reading of 5.7% is expected after rising 5.6% year over year in February.

- February Personal Consumption Expenditure (PCE), the FOMC’s preferred inflation gauge, is released Friday and is expected to rise 0.30% after a 0.62% month over month rise in January. Core PCE is expected to rise 0.40% after a 0.57% rise in January.

- The University of Michigan’s Consumer Sentiment Index for March is released Friday and is expected to remain static month over month at 63.4.

The content and any portion of this newsletter is for personal use only and may not be reprinted, sold or redistributed without the written consent of Regions Bank. Regions, the Regions logo and other Regions marks are trademarks of Regions Bank. The names and marks of other companies or their services or products may be the trademarks of their owners and are used only to identify such companies or their services or products and not to indicate endorsement or sponsorship of Regions or its services or products. The information and material contained herein is provided solely for general information purposes.

Regions does not make any warranty or representation relating to the accuracy, completeness or timeliness of any information contained in the newsletter and shall not be liable for any damages of any kind relating to such information nor as to the legal, regulatory, financial or tax implications of the matters referred herein. This material is not intended to be investment advice nor is this information intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only current as of the stated date of their issue. Regions Asset Management is a business group within Regions Bank that provides investment management services to customers of Regions Bank. Employees of Regions Asset Management may have positions in securities or their derivatives that may be mentioned in this report or in their personal accounts. Additionally, affiliated companies may hold positions in the mentioned companies in their portfolios or strategies. The companies mentioned specifically are sample companies, noted for illustrative purposes only.

The mention of the companies should not be construed as a recommendation to buy, hold or sell positions in your investment portfolio. Neither Regions Bank nor Regions Asset Management (collectively, “Regions”) are registered municipal advisors nor provide advice to municipal entities or obligated persons with respect to municipal financial products or the issuance of municipal securities (including regarding the structure, timing, terms and similar matters concerning municipal financial products or municipal securities issuances) or engage in the solicitation of municipal entities or obligated persons for such services.

With respect to this presentation and any other information, materials or communications provided by Regions, (a) Regions is not recommending an action to any municipal entity or obligated person, (b) Regions is not acting as an advisor to any municipal entity or obligated person and does not owe a fiduciary duty pursuant to Section 15 B of the Securities Exchange Act of 1934 to any municipal entity or obligated person with respect to such presentation, information, materials or communications, (c) Regions is acting for its own interests, and (d) you should discuss this presentation and any such other information, materials or communications with any and all internal and external advisors and experts that you deem appropriate before acting on this presentation or any such other information, materials or communications. Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The information provided herein is for informational purposes only and is intended to report on various investment views held by Multi-Asset Solutions (MAS) and Highland Associates. Opinions, estimates, forecasts, and statements of financial market trends are based on current market conditions that constitute the judgement of MAS and Highland Associates and are subject to change. The information is received from third parties, which is believed to be accurate, but no representation is made that the information provided is accurate and complete. The information is given as of the date indicated and believed to be reliable. While MAS and Highland have tried to provide accurate and timely information, there may be inadvertent technical or factual inaccuracies or typographical errors for which we apologize. The information provided herein does not constitute a solicitation or offer by Highland or its affiliates, to buy or sell any securities or other financial instrument, or to provide investment advice or service. Nothing contained herein should be construed as investment advice or a recommendation to purchase or sell a particular security. Investing involves a high degree of risk, and all investors should carefully consider their investment objective and the suitability of any investments.

Research services are provided through Multi-Asset Solutions, a department of the Regions Asset Management business group within Regions Bank. Highland is a wholly owned subsidiary of Regions Bank, which in turn is a wholly owned subsidiary of Regions Financial Corporation.

Past performance is not indicative of future results. Investments are subject to loss.