Stocks: U.S. Indices Build On May’s Momentum, Kick Off June In Melt-Up Mode; Eurozone Equities Rise Even As The ECB Hints The End Of The Easing Cycle Is Near; Strength Out Of South Korea Propels Emerging Markets Index To A Weekly Gain.

Download Weekly Market Commentary | June 9 2025

What We’re Watching:

- U.S. Consumer Price Index (CPI) for May is released Wednesday. Headline CPI is expected to rise 0.2% month over month and 2.5% year over year, compared to 0.2% and 2.3% readings from April. Core CPI, which is more closely monitored by policymakers, is expected to rise 0.3% month over month and 2.9% year over year versus 0.2% and 2.8% readings the prior month.

- Initial Jobless Claims for the week ended June 7 and Continuing Claims from the week ended May 31 are released Thursday. Initial claims of 240k are expected, which would be a modest improvement compared to 247k the prior week.

- The University of Michigan’s June preliminary Consumer Sentiment Index is released Friday with a reading of 53.3 expected, which would be a notable improvement from 52.2 in May.

Key Observations

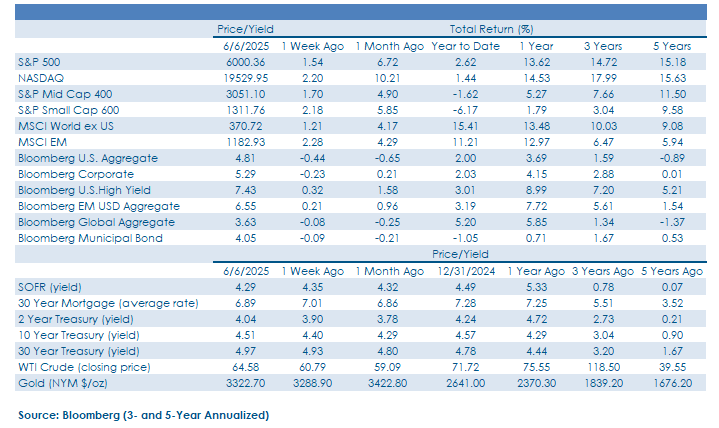

- U.S. equity indices built off May’s momentum to turn out another week of gains as smaller capitalization stocks outpaced their large- and mid-cap peers. The information technology and communication services sectors were the top performers as select ‘Mag 7’ names and semiconductor stocks broadly were leading contributors.

- Emerging market stocks and bonds performed well on the week as the U.S. dollar weakened and plumbed year-to-date lows amid lackluster economic data, while constructive U.S./China trade talks and the outcome of the presidential election in South Korea boosted sentiment surrounding assets tied to developing countries.

- Treasury yields fell throughout much of the week before rising sharply Friday as the May nonfarm payrolls report was better than feared. Abroad, the European Central Bank (ECB) hinted at a pause in July and less policy easing ahead, a policy shift that should be supportive of prices of longer-term euro area sovereign bonds in the coming quarters. This reinforces our view that foreign bonds, broadly speaking, remain well positioned to provide diversification and yield benefits to portfolios.

What Happened Last Week:

Stocks: U.S. Indices Build On May’s Momentum, Kick Off June In Melt-Up Mode; Eurozone Equities Rise Even As The ECB Hints The End Of The Easing Cycle Is Near; Strength Out Of South Korea Propels Emerging Markets Index To A Weekly Gain.

U.S. Large Cap Indices Ride Semiconductor Stocks, Select ‘Mag 7’ Names To A Weekly Gain. The S&P 500 rode the coattails of mega-cap technology names to close out the week with a 1.5% gain. The S&P 500 information technology sector rose 3% on the week and the communication services sector turned out a 3.1% gain as strength out of semiconductor names, specifically Nvidia, and bellwethers such as Meta Platforms (Facebook) were leading contributors. The continued rally in semiconductor stocks is notable as this industry is often viewed as a ‘tell’ on the health of the global economy. With the VanEck Semiconductor ETF (SMH) rising 5.4% last week and 19.6% since the end of April, this as an encouraging sign that the global economy may be in better shape and is more resilient than economic data might lead one to believe it is.

S&P 500 Above Key Moving Averages, Closes The Week 2.5% Below The February All-Time High. From a technical perspective, the S&P 500 is in fine shape with the index above its key 200-day moving average, while shorter-term moving averages have hooked higher, potentially raising the floor of support for the index should it breach its 200-day moving average to the downside. With the index closing last week less than 2.5% below its February all-time high, a retest of the 6,144 level feels all but inevitable in the coming month(s), but we expect fits and starts in the near-term as the index might need to build up the necessary energy to make another move higher after the sharp rise off the April 9th lows.

Eurozone Stocks Rise Even As The ECB Hints At Less Policy Easing Ahead. The MSCI Europe index turned out a 1.3% weekly gain as investors initially cheered another rate cut out of the ECB mid-week before turning less enthusiastic as ECB President Christine Lagarde prepared markets for a pause in July. The ECB foresees a constructive backdrop for the euro area economy, headlined by inflation at-target and economic growth that remains slow but in positive territory, allowing the central bank to stand pat in the coming months. On the heels of the ECB cut and forward guidance which calls for less easing ahead, the euro strengthened versus the U.S. dollar, which could present a headwind for euro area exports to the U.S. in the near-term. The momentum behind the year-to-date move in Eurozone stocks is difficult to fade, but after sizable inflows in recent months, there is some tactical risk that the bulk of capital outflows from the U.S. and into the euro area are now in the rearview mirror, and with loftier valuations and improved sentiment versus at the start of the year, consolidation or weakness in the near-term wouldn’t be surprising.

Emerging Markets Finish The Week Higher With China, South Korea, Taiwan Standout Performers. Stocks tied to developing markets abroad were noticeably strong last week, evidenced by the 2.2% weekly gain posted by the MSCI Emerging Markets (EM) index. There was broad-based strength out of Asia with South Korea the big winner on the week as the country’s benchmark KOSPI index rose 6.2% after a new president was elected who pledged to unite the country. Most notably, around 80% of the KOSPI’s constituents traded above their 20-day moving average as of last Friday, evidence of broad-based momentum behind the move which could have some staying power, allowing the KOSPI to play catch-up. Elsewhere in Asia, China and Taiwan were also strong performers on the week, with the MSCI China and MSCI Taiwan indices rising 2.8% and 1.8%, respectively. The catalyst behind the move higher across Asia appeared to be hopes that a trade deal between the U.S. and China was increasingly possible after a call between President Trump and China’s President Xi Jinping took place on Thursday in just the latest sign that the two sides are putting their best foot forward in an attempt to iron out details between now and mid-August.

Bonds: Treasury Yields Initially Drop On Lackluster Economic Data, But Rise Into The Weekend As May Payrolls Surprise To The Upside; European Central Bank Cuts Rates Again But Hints That The End Of Easing Is Near; Emerging Market Debt With Another Good Week, Carrying Over Momentum From May.

Treasury Yields Slide On Lackluster U.S. Economic Data, Bounce On Better Than Feared Nonfarm Payrolls. Yields on long-term U.S. Treasuries moved lower throughout the bulk of last week as economic data, on balance, fell short of expectations and led to a bid for safe-haven assets, but yields moved sharply higher into the weekend as the May nonfarm payrolls report surprised to the upside.On Monday, the May Manufacturing ISM came in at 48.5, below the 49.5 estimate, evidence the manufacturing sector of the U.S. remained in contraction last month. The release of the Services ISM for May on Wednesday told an equally sour story as the reading underdelivered by falling into contraction territory at 49.9, below the 52.0 estimate. Then on Thursday initial jobless claims for the week ended May 31 rose 247k on the week, above the 235k estimate, evidence of some softening in the labor market, although it’s notable that seasonal factors likely played a role in the uptick in claims. Finally, on Friday, the May nonfarm payrolls report surprised to the upside and called into question the narrative that U.S. economic growth was at risk of slowing materially in the near-term. While the ISM readings contributed to angst surrounding the outlook for the U.S. economy in the coming quarters, the payrolls data doesn’t yet confirm that view and we suspect Treasury yields may have found a near-term bottom last week and could trend higher in the coming weeks.

May Nonfarm Payrolls Better Than Feared, But Revisions To Prior Months Worrisome. The May nonfarm payrolls report was released last Friday and showed 139k jobs were created during the month, above the consensus estimate of 126k and well north of the 37k jobs created in the May ADP report. Notably, jobs growth in the prior two months were revised lower by 95k in aggregate, one notable crack in an otherwise solid release. The unemployment rate was unchanged month over month at 4.2%, while average hourly earnings rose 0.4% month over month and 3.9% year over year, above the consensus estimate of 0.3% and 3.7%, respectively.

Services Sector Of The U.S. Economy Slows In May While Prices Paid Surprise To The Upside. The Institute for Supply Management (ISM) Services Index for May was released last Wednesday and pointed toward a mild contraction in the services sector of the U.S. economy month over month. The index reading of 49.9 fell just below 50, the level that separates expansion from contraction, as the new orders component of the index fell sharply month over month to 46.4 from 52.3 in April, likely a result of tariff/trade uncertainty. The prices paid component of the index surprised to the upside, jumping from an already elevated 65.1 the prior month to 68.7 in May, throwing fuel on the fire for those already viewing stagflation as the base-case for the U.S. economy in the coming quarters.

European Central Bank Cuts Rates Again But ECB President Lagarde Hints At Less Easing Ahead. The European Central Bank (ECB) cut its Deposit Rate by 25-basis points to 2.0% as expected last Thursday. The ECB has now cut this key rate by 200-basis points or 2% in the past year and 100-basis points this calendar year as the central bank has been solely focused on spurring economic growth as inflation data has continued to cool. Eurozone Consumer Price Index (CPI) for May was released last Tuesday and came in flat month over month, a significant deceleration from 0.6% in April, while year over year core CPI rose 2.3%, below the 2.4% estimate and the 2.7% reading from the prior month. Inflation data out of the euro area could continue to cool in the coming months, and with the ECB is preparing markets for the end of the current easing cycle, this policy shift should support prices of long-term euro area sovereign bonds in the coming months.

Emerging Market Debt Rally Confirming The Move Higher In Stocks. Turning attention to bond markets abroad, securities tied to emerging economies continued to perform relatively well last week with the Bloomberg EM USD Aggregate index rising 0.2%. Investors in both stocks and bonds tied to emerging markets should cheer tighter credit spreads as they are indicative of improving sentiment around these sub-asset classes.The advance in emerging debt was centered around some of the largest index constituents with Mexio and Turkey rallying by 1.1% and 0.7% respectively, while gains in peripheral areas like Egypt offset weakness in Argentinian debt. The U.S. dollar’s weakness last week had a hand in the push higher for emerging market assets as local currency bonds outperformed by a healthy margin, but we retain the mindset that the dollar is carving out a near-term floor of support, barring signs of further economic deterioration and a potential recession on the horizon in the U.S.

Receipt of this report is intended for institutional investors and/or their representatives; it is for informational purposes only and is intended to report on various investment views held by Highland Associates. This report may not be reprinted, sold or redistributed without the written consent of Highland Associates. The names and marks of other companies or their services or products may be the trademarks of their owners and are used only to identify such companies or their services or products and not to indicate endorsement or sponsorship of Highland Associates or any of their affiliates. The information and material contained herein is solely for general information purposes. The information herein was obtained from various sources and is believed to be reliable. Highland does not guarantee the accuracy or completeness of such information provided by third parties. While Highland has tried to provide accurate and timely information, there may be inadvertent technical or factual inaccuracies or typographical errors for which we apologize. This material is not intended to be investment advice nor is this information intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only current as of the stated date of their issue. References to indices or benchmarks are provided exclusively for comparison purposes only. Highland is a wholly owned subsidiary of Regions Bank, which in turn is a wholly owned subsidiary of Regions Financial Corporation. Research services are provided through Multi-Asset Solutions, a department of the Regions Asset Management business group within Regions Bank. Investing involves a high degree of risk, and all investors should carefully consider their investment objective and the suitability of any investments. Forward looking statement are based upon assumptions which may differ materially from actual events. Past performance is not indicative of future results. Investments are subject to loss. Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.