Stocks: The S&P 500 Rides The Coattails Of Mega-Cap Technology Stocks To A New All-Time High; Small Cap Stocks Continue To Lag Despite Receiving A Tailwind From Lower Treasury Yields; Country Selection, Diversification Crucial When Investing In Emerging Markets.

Download Weekly Market Commentary | June 10 2024

What We’re Watching:

- The National Federation of Independent Business (NFIB) will release its small business optimism index for May on Tuesday after an 89.7 reading in April.

- U.S. Consumer Price Index (CPI) for May is released Wednesday with headline CPI expected to rise 0.1% month over month and 3.4% year over year, while core CPI, which excludes food and energy prices, is expected to rise 0.3% month over month and 3.5% year over year.

- The Federal Open Market Committee (FOMC) concludes its two-day meeting on Wednesday. We do not expect the FOMC to cut the Fed funds rate at this meeting, but market participants will be closely monitoring Chair Jerome Powell’s post-meeting remarks for any hints as to when the Committee is leaning toward easing monetary policy. The Committee’s revised Summary of Economic Projections, or dot-plot, will also be dissected for any changes related to how the FOMC at-large views the outlook for rates and inflation.

- U.S. Producer Price Index (PPI) for May is released on Thursday with the headline PPI expected to rise 0.1% month over month and 2.5% year over year. PPI is worth watching as wholesale or producer prices flow into CPI and personal consumption expenditure (PCE) in future months.

- The University of Michigan will release its consumer sentiment index for June on Friday, with the reading expected to rise/ improve to 73.0 from 69.1 in May.

Key Observations

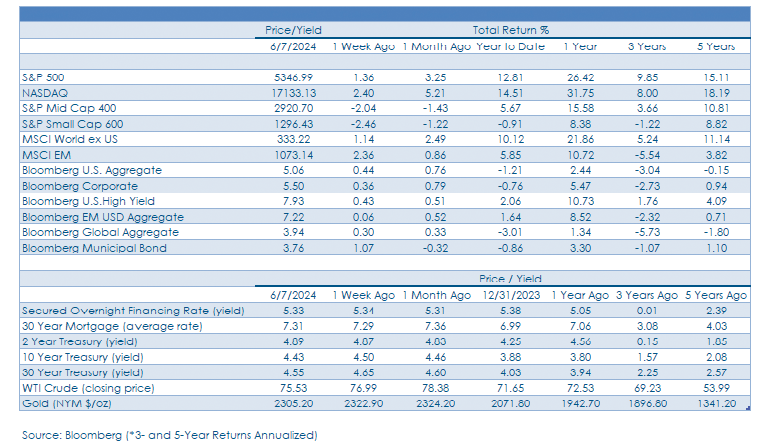

- The S&P 500 rode the coattails of mega-cap technology stocks to a fresh all-time high as fears of an economic slowdown continued to push capital into shares of companies viewed as most capable of weathering a downturn. Small cap stocks remain in a precarious position and have been unable to outperform the S&P 500 despite falling Treasury yields. Smaller companies will remain under pressure from higher for longer interest rates and continued tightness in the labor market, both of which could weigh on profit margins.

- Election results out of India and Mexico led to a volatile week for emerging market stocks, again highlighting the importance of country selection and diversification within the asset class.

- Treasury yields ended the week lower as a well telegraphed rate cut out of the European Central Bank (ECB) and economic slowdown fears put downward pressure on yields and outweighed continued signs of tightness in the labor market.

What Happened Last Week:

Stocks: The S&P 500 Rides The Coattails Of Mega-Cap Technology Stocks To A New All-Time High; Small Cap Stocks Continue To Lag Despite Receiving A Tailwind From Lower Treasury Yields; Country Selection, Diversification Crucial When Investing In Emerging Markets.

The Usual Suspects Lift The S&P 500 To A New All-Time High.

The S&P 500 turned out a respectable 1.4% weekly gain as the communication services and information technology sectors led the charge followed closely by consumer discretionary and health care, which both outperformed the broader S&P 500. While last week’s leadership mix was encouraging, participation remains narrow with just 50% of S&P 500 constituents trading above their 10-day moving average. It’s not lost on us that the consumer discretionary, energy, industrials, and materials sectors are all in the red over the past month and have drastically underperformed versus the S&P 500’s 3.2% gain.

Labor Market Remains Tight As Economic Growth Fears Build, A Tough Combo For Small Caps. The S&P Small Cap 600 index fell 1.3% last week, well behind the S&P 500’s 1.4% weekly gain, and the 600 now trails the 500 by 12.7% year-to-date. Entering this year, we expected small and mid-cap (SMid) to play catch-up, driven by a combination of relatively attractive valuations, the expectation of less restrictive monetary policy, and continued robust U.S. economic growth. Since the end of April, Treasury yields have fallen sharply, which should have provided a tailwind for SMid by lowering financing costs. But while the S&P 600 has posted a respectable 4% return since the end of April, the S&P 500 has done even better, turning out a 6.5% gain as yields have fallen due in large part to concerns surrounding a potential U.S. economic slowdown. As a result, investors have chosen to hide out in mega-cap growth stocks in the S&P 500, bidding up share prices of companies with fortress balance sheets capable of weathering a U.S. economic slowdown. We understand the motivation behind this capital reallocation, but on the heels of last week’s hot May payrolls report, we believe fears of an economic slowdown are overblown at present, and as the liquidity backdrop improves in July, small- and mid-cap indices could be some of the biggest beneficiaries.

Housing-Related Plays Have Yet To Catch A Bid Despite The Drop In Rates/Yields. Since the end of April, the yield on the 10-year U.S. Treasury has now fallen by 26-basis points and ended last week at 4.43%. Over the same time frame, the average 30-year mortgage rate has fallen from 7.49% to 7.31%. The iShares U.S. Home Construction ETF (ITB), which holds 44 stocks running the gamut from homebuilders, home improvement retailers, building products, and other housing-related plays, has failed to rally even as yields have fallen with ITB unchanged since the end of April. The resounding yawn from investors over the past five or so weeks as rates have fallen is a bit surprising as housing- related plays typically respond positively to such a move as investors price-in an uptick in building and renovation activity, but that has not happened this time around and it may take a move to the psychologically important 7% level or below on the average 30-year mortgage rate to improve sentiment and drive inflows into this area.

Election Results Lead To A Volatile Week For Emerging Markets. Government elections in both India and Mexico took place and garnered headlines last week. In India, Prime Minister Modi failed to garner a true majority and will now have to rely on fickle political allies to continue funding infrastructure projects, a reality that led to a brief dip in Indian stocks before a recovery into the weekend, with the iShares MSCI India ETF (INDA) ending the week higher by 1.8%. In Mexico, the leader in the polls, Claudia Sheinbaum, was elected as the first female president in the country’s history, but her party’s overwhelming victory led to a continuation of the recent slide in Mexican equities and generated an 11.7% weekly decline. Sheinbaum is viewed as a symbol of continuity within the country and the current president threw his support behind her, but markets fear an erosion of checks and balances that could come with such a sweeping majority, particularly if her government prioritizes social spending over infrastructure and growth. Selloffs around orderly political transitions in developing markets have historically been buying opportunities, but we still believe active country selection can help investors sidestep volatility and improve volatility-adjusted returns. In a week where two major elections rattled markets, diversification prevailed as the MSCI Emerging Markets (EM) index ended the week higher by 2.3% due to strong performance out of Asia, specifically, South Korea and Taiwan.

Bonds: Treasuries Remain Stuck In A Trading Range With 4.30% Still The Level To Watch On The 10-Year; Euro Area Sovereign Bond Yields Rise As The European Central Bank Delivers A ‘Hawkish Cut.’

10-Year Treasury Yield Remains Stuck As The Lower End Of Our Expected Range Holds. The 10-year U.S. Treasury yield closed a basis point or two below the 4.30% level on two occasions last week before bouncing 14-basis points on Friday to end the week at 4.43%. The 10-year yield has fallen from 4.69% at the end of April due largely to fears of a U.S. economic slowdown, fears which were alleviated somewhat by the May nonfarm payrolls report released last Friday. We see the 10-year as fairly valued at the current yield, but still see risks skewed to the upside for yields as economic data should remain resilient over the coming months, and with inflation remaining sticky, we see little room for Treasury yields to move materially lower over the near-term.

ECB Cuts Rates As Expected, Euro Area Sovereign Yields Rise Alongside Inflation Expectations.. Last Thursday, the European Central Bank (ECB) met and as expected, voted to lower two key policy rates by 25-basis points, the first rate cut since 2019. What’s most noteworthy about the move is that the ECB eased monetary policy despite raising its own estimate/outlook for inflation in both 2025 and 2026, highlighting just how desperate/intent the ECB was to cut rates. Sovereign bond yields across the Eurozone responded to the ECB’s decision by moving modestly higher on the heels of the announcement as raised inflation expectations point toward fewer potential rate cuts in the coming months/quarters. The yield on the 10-year German bund, which is the standard-bearer when it comes to euro area sovereigns, rose 3-basis points on Thursday and followed that up with a 6-basis point jump on Friday. Upward pressure on euro area sovereign yields are another reason we don’t expect yields stateside to move much lower.

May Payrolls Rise More Than Expected, Pushing Treasury Yields Higher. The May nonfarm payrolls report was released last Friday and showed 272k jobs were created during the month, well above the consensus estimate of 180k. Average hourly earnings rose 0.4% month over month, ahead of the 0.3% estimate, and 4.1% year over year, also above the 3.9% estimate. While job creation blew away estimates during May, the unemployment rate rose to 4.0% from 3.9% the prior month, calling into question just how tight/strong the labor market continues to be. Yields on long-term U.S. Treasuries rose sharply on Friday on the heels of the payrolls report with the 10-year yield rising 13 basis points on the day to 4.42%, ending the week 9 basis points below the prior Friday’s close. Yields have trended lower since reaching a year-to-date peak in late April as economic data has increasingly pointed toward a slowdown ahead, and while we believe the May payrolls report likely overstates labor market strength, even so, we don’t see a protracted economic slowdown ahead. As a result of this view, we see the 10-year Treasury as fairly valued with a yield in the 4.30% to 4.50% range, but a breakdown below the lower end of that range would be notable and lead us to revisit our economic growth assumptions.

WIth The ECB In The Rearview, Attention Turns To The FOMC. The The Federal Open Market Committee (FOMC) will be in the spotlight mid-week with market participants closely watching Chair Jerome Powell’s post-meeting press conference for any clues as to whether recent economic data could alter the path forward for monetary policy. Despite there being a near-zero chance that the FOMC makes any meaningful change to policy next week, the groundwork could be laid for a potential shift in forthcoming meeting as we saw out of the ECB in April in the lead-up to last week’s rate cut. The Job Openings and Labor Turnover Survey (JOLTS) from May as well as the ADP Employment report pointed towards a softening labor market which increased the odds of a September rate cut with Fed funds futures shifting from implying a 45% chance of a cut in September to as high as 65%. However, an upside surprise to May nonfarm payrolls report Friday tempered expectations as the likelihood of a cut fell from 61% to 45% by the weekend. We still favor the first 25-basis point cut occurring in September, and last week’s strong May payrolls report does nothing to alter that view, but the release of May’s consumer price index (CPI) this Wednesday, the same day the FOMC concludes its two-day meeting, is worth watching and could alter the tone of FOMC Chair Jerome Powell’s post-meeting press conference.

IMPORTANT DISCLOSURES: THIS PUBLICATION HAS BEEN PREPARED BY THE STAFF OF HIGHLAND ASSOCIATES, INC. FOR DISTRIBUTION TO, AMONG OTHERS, HIGHLAND ASSOCIATES, INC. CLIENTS. HIGHLAND ASSOCIATES IS REGISTERED WITH THE UNITED STATES SECURITY AND EXCHANGE COMMISSION UNDER THE INVESTMENT ADVISORS ACT OF 1940. HIGHLAND ASSOCIATES IS A WHOLLY OWNED SUBSIDIARY OF REGIONS BANK, WHICH IN TURN IS A WHOLLY OWNED SUBSIDIARY OF REGIONS FINANCIAL CORPORATION. RESEARCH SERVICES ARE PROVIDED THROUGH MULTI-ASSET SOLUTIONS, A DEPARTMENT OF THE REGIONS ASSET MANAGEMENT BUSINESS GROUP WITHIN REGIONS BANK. THE INFORMATION AND MATERIAL CONTAINED HEREIN IS PROVIDED SOLELY FOR GENERAL INFORMATION PURPOSES ONLY. TO THE EXTENT THESE MATERIALS REFERENCE REGIONS BANK DATA, SUCH MATERIALS ARE NOT INTENDED TO BE REFLECTIVE OR INDICATIVE OF, AND SHOULD NOT BE RELIED UPON AS, THE RESULTS OF OPERATIONS, FINANCIAL CONDITIONS OR PERFORMANCE OF REGIONS BANK. UNLESS OTHERWISE SPECIFICALLY STATED, ANY VIEWS, OPINIONS, ANALYSES, ESTIMATES AND STRATEGIES, AS THE CASE MAY BE (“VIEWS”), EXPRESSED IN THIS CONTENT ARE THOSE OF THE RESPECTIVE AUTHORS AND SPEAKERS NAMED IN THOSE PIECES AND MAY DIFFER FROM THOSE OF REGIONS BANK AND/OR OTHER REGIONS BANK EMPLOYEES AND AFFILIATES. VIEWS AND ESTIMATES CONSTITUTE OUR JUDGMENT AS OF THE DATE OF THESE MATERIALS, ARE OFTEN BASED ON CURRENT MARKET CONDITIONS, AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. ANY EXAMPLES USED ARE GENERIC, HYPOTHETICAL AND FOR ILLUSTRATION PURPOSES ONLY. ANY PRICES/QUOTES/STATISTICS INCLUDED HAVE BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT HIGHLAND ASSOCIATES, INC. DOES NOT WARRANT THEIR COMPLETENESS OR ACCURACY. THIS INFORMATION IN NO WAY CONSTITUTES RESEARCH AND SHOULD NOT BE TREATED AS SUCH. THE VIEWS EXPRESSED HEREIN SHOULD NOT BE CONSTRUED AS INDIVIDUAL INVESTMENT ADVICE FOR ANY PARTICULAR PERSON OR ENTITY AND ARE NOT INTENDED AS RECOMMENDATIONS OF PARTICULAR SECURITIES, FINANCIAL INSTRUMENTS, STRATEGIES OR BANKING SERVICES FOR A PARTICULAR PERSON OR ENTITY. THE NAMES AND MARKS OF OTHER COMPANIES OR THEIR SERVICES OR PRODUCTS MAY BE THE TRADEMARKS OF THEIR OWNERS AND ARE USED ONLY TO IDENTIFY SUCH COMPANIES OR THEIR SERVICES OR PRODUCTS AND NOT TO INDICATE ENDORSEMENT, SPONSORSHIP, OR OWNERSHIP BY REGIONS OR HIGHLAND ASSOCIATES. EMPLOYEES OF HIGHLAND ASSOCIATES, INC., MAY HAVE POSITIONS IN SECURITIES OR THEIR DERIVATIVES THAT MAY BE MENTIONED IN THIS REPORT. ADDITIONALLY, HIGHLAND’S CLIENTS AND COMPANIES AFFILIATED WITH HIGHLAND ASSOCIATES MAY HOLD POSITIONS IN THE MENTIONED COMPANIES IN THEIR PORTFOLIOS OR STRATEGIES. THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR AN INVITATION BY OR ON BEHALF OF HIGHLAND ASSOCIATES TO ANY PERSON OR ENTITY TO BUY OR SELL ANY SECURITY OR FINANCIAL INSTRUMENT OR ENGAGE IN ANY BANKING SERVICE. NOTHING IN THESE MATERIALS CONSTITUTES INVESTMENT, LEGAL, ACCOUNTING OR TAX ADVICE. NON-DEPOSIT PRODUCTS INCLUDING INVESTMENTS, SECURITIES, MUTUAL FUNDS, INSURANCE PRODUCTS, CRYPTO ASSETS AND ANNUITIES: ARE NOT FDIC-INSURED I ARE NOT A DEPOSIT I MAY GO DOWN IN VALUE I ARE NOT BANK GUARANTEED I ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY I ARE NOT A CONDITION OF ANY BANKING ACTIVITY.

NEITHER REGIONS BANK NOR REGIONS ASSET MANAGEMENT (COLLECTIVELY, “REGIONS”) ARE REGISTERED MUNICIPAL ADVISORS NOR PROVIDE ADVICE TO MUNICIPAL ENTITIES OR OBLIGATED PERSONS WITH RESPECT TO MUNICIPAL FINANCIAL PRODUCTS OR THE ISSUANCE OF MUNICIPAL SECURITIES (INCLUDING REGARDING THE STRUCTURE, TIMING, TERMS AND SIMILAR MATTERS CONCERNING MUNICIPAL FINANCIAL PRODUCTS OR MUNICIPAL SECURITIES ISSUANCES) OR ENGAGE IN THE SOLICITATION OF MUNICIPAL ENTITIES OR OBLIGATED PERSONS FOR SUCH SERVICES. WITH RESPECT TO THIS PRESENTATION AND ANY OTHER INFORMATION, MATERIALS OR COMMUNICATIONS PROVIDED BY REGIONS, (A) REGIONS IS NOT RECOMMENDING AN ACTION TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON, (B) REGIONS IS NOT ACTING AS AN ADVISOR TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON AND DOES NOT OWE A FIDUCIARY DUTY PURSUANT TO SECTION 15B OF THE SECURITIES EXCHANGE ACT OF 1934 TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON WITH RESPECT TO SUCH PRESENTATION, INFORMATION, MATERIALS OR COMMUNICATIONS, (C) REGIONS IS ACTING FOR ITS OWN INTERESTS, AND (D) YOU SHOULD DISCUSS THIS PRESENTATION AND ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS WITH ANY AND ALL INTERNAL AND EXTERNAL ADVISORS AND EXPERTS THAT YOU DEEM APPROPRIATE BEFORE ACTING ON THIS PRESENTATION OR ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS.

SOURCE: BLOOMBERG INDEX SERVICES LIMITED. BLOOMBERG® IS A TRADEMARK AND SERVICE MARK OF BLOOMBERG FINANCE L.P. AND ITS AFFILIATES (COLLECTIVELY “BLOOMBERG”). BARCLAYS® IS A TRADEMARK AND SERVICE MARK OF BARCLAYS BANK PLC (COLLECTIVELY WITH ITS AFFILIATES, “BARCLAYS”), USED UNDER LICENSE. BLOOMBERG OR BLOOMBERG’S LICENSORS, INCLUDING BARCLAYS, OWN ALL PROPRIETARY RIGHTS IN THE BLOOMBERG BARCLAYS INDICES. NEITHER BLOOMBERG NOR BARCLAYS APPROVES OR ENDORSES THIS MATERIAL OR GUARANTEES THE ACCURACY OR COMPLETENESS OF ANY INFORMATION HEREIN, OR MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED THEREFROM AND, TO THE MAXIMUM EXTENT ALLOWED BY LAW, NEITHER SHALL HAVE ANY LIABILITY OR RESPONSIBILITY FOR INJURY OR DAMAGES ARISING IN CONNECTION THEREWITH.