Stocks: An “Almost Everything” Rally Ensues As The FOMC Strikes A Surprisingly Dovish Tone; Bounce In Interest Rate Sensitive Sectors May Be Overdone; Markets Abroad Rally As The U.S. Dollar Drops On More Dovish FOMC Tone.

Download Weekly Market Commentary | January 29 2024

Key Observations

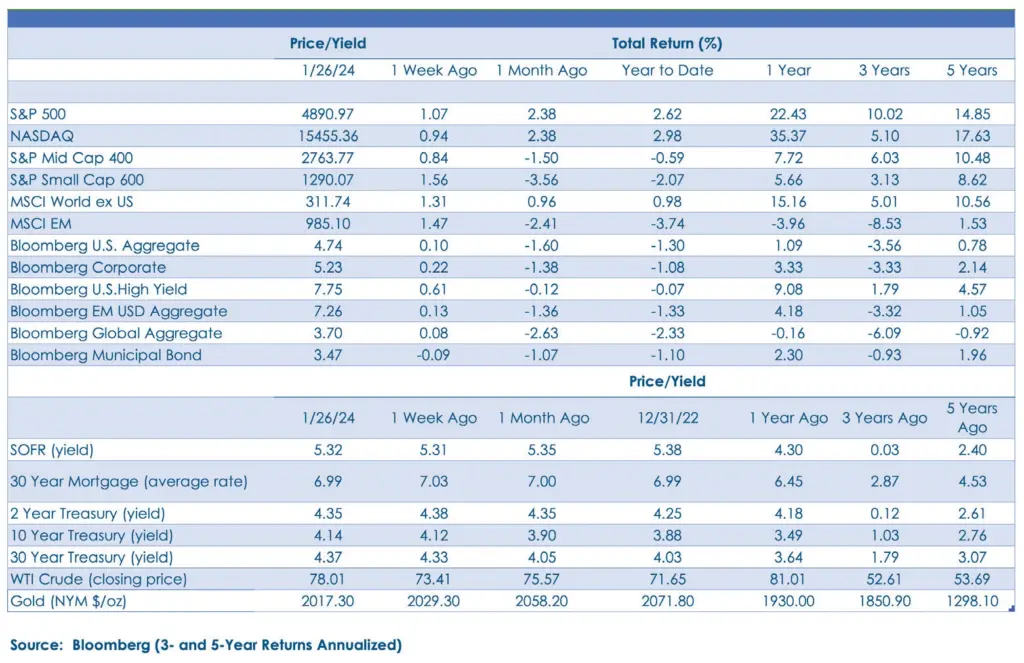

- Information Technology and Communication Services sector earnings bolstered equities, while firmer than expected GDP and PMI data also contributed to the S&P 500 making new highs on the week.

- Chinese equities snapped a three-week losing streak as The People’s Bank of China cut reserve requirements for banks amounting to roughly 1 trillion yuan in newly accessible funds. Government officials are also said to be weighing another 2 trillion yuan in rescue plan funds for equity markets to restore both domestic investor sentiment.

- The 10-year treasury yield briefly surged as high as 4.18%, cresting above its 50-day moving average for the first time since November before moderating on promising inflation data surfaced in the GDP and Core PCE numbers.

What We’re Watching:

- The JOLTS Job Openings data is set to be released on Tuesday with 8700k openings anticipated, a slight decline from the prior month reading and the quits rate expected to hold steady at 2.2%, below pre-pandemic levels.

- FOMC rate decision is expected to go unchanged with guidance around quantitative tightening in focus for the January meeting on Wednesday, with Fed Chair Powell set to address the media in the post-meeting press conference.

- The Institute for Supply Management (ISM) survey data for New Orders, Employment, and Manufacturing, are due on Thursday to provide further insight on economic activity in manufacturing and services sectors.

- Average Hourly Earnings month-over-month are expected on Friday with the consensus projecting a decline to 0.3% from 0.4% in the previous month, while average weekly hours and the unemployment rate are expected to remain flat at 34.3 and 3.7%, respectively.

What Happened Last Week:

Stocks: An “Almost Everything” Rally Ensues As The FOMC Strikes A Surprisingly Dovish Tone; Bounce In Interest Rate Sensitive Sectors May Be Overdone; Markets Abroad Rally As The U.S. Dollar Drops On More Dovish FOMC Tone.

US Equities Make New Highs On Earnings and Sales Growth From Early Results. The S&P 500 saw a tapered gain of 1.07% compared to weeks prior but closed at a new high of 4,890, marking its third consecutive weekly advance. Positive economic data piled up over the course of the week with manufacturing PMI surprising to the upside and crossing into expansion while the initial read on 4th quarter GDP and the underlying consumption data also registered as a boon for equities. Technical conditions on the verge of overbought for the large-cap index suggests sideways price action would promote more sustainable gains going forward, but these considerations are likely on the backburner until markets get a more complete view of corporate earnings. Tech earnings have surprised to the upside thus far with 16/18 companies beating estimates but guidance around growth has been mixed highlighted by a handful of household names including Tesla and Intel. Next week five of the Magnificent Seven report earnings and should provide a more all-encompassing view of how management teams view the landscape within last year’s heavyweights. The energy sector was a surprise standout, outpacing all other sectors returning 5.15%, within the Oil and Gas industry group 4/5 companies bested analyst estimates and we could see strength persist here if global growth expectations turn out better than expected.

Small Company Segment Sees Value Rally Take Hold.

The S&P 600 Small Cap Index finished the week up 1.56% the top performer across major asset classes we track, largely due to positive movement in more value- oriented, cyclicals including Energy, and Industrials. Higher returns in the energy sector proved to be a theme across the cap spectrum returning 4.06%, with far fewer earnings announcements to go on here it remains to be seen if this is a fundamental rally or momentum trade. The surge in industrials was more earnings oriented, as 85% of companies reported thus far surprised to the upside, making the subset a heavy contributor with the second largest weight in the index at 17.4%. All told, the environment continues to shape up nicely for small companies with a valuation bent as growth continues to impress above expectations, while lower rates would ease financing pressures and a steepening yield curve could improve the outlook for financials more broadly.

China’s Central Bank Lowers Reserve Requirement With Further Stimulus In Tow. Monetary policymakers captured headlines and propelled Chinese equities to a 3.35% gain last week in the Chinese government’s latest attempt to stimulate the economy with self-described ‘forceful’ measures, including lowering reserve requirements for banks. The 0.5% cut to reserve requirements amounts to roughly 1 trillion yuan in newly accessible funds for lending, and government officials are said to be mulling another 2 trillion yuan in stock market rescue funding aimed at restoring domestic confidence that currently stands at the lowest reading on record. The most tangible representation of on the ground sentiment is rampant Chinese investor interest in US equity funds driving them to substantial premiums as high as 18% on certain days this month. Local asset managers have taken measures resembling a ‘soft- close’ where applicable and limited daily purchases, but the ETF versions are still able to be bought directly. In 2015 the Chinese government enacted similar stimulus to stem the equity market decline, but it wasn’t until sweeping economic reforms were implemented that markets regained confidence. For now, the government maintains its nationalist ‘retail first’ mentality, but from our perspective they may be undervaluing the confidence international investors can bring to domestic markets.

Bonds: Treasury Yields Continue To Fall As The FOMC Moves Closer To The Market’s Expectations For Rate Cuts In The Coming Year; November Core Inflation Remained Sticky, Leading Us To Question The Market’s Expectation For A Rate Cut In March.

Treasury Yields Trend Marginally Higher On Spending and Inflation. Fixed income markets were nearly flat on the week with the Aggregate Bond Index losing 1bp as yields bounced around before landing modestly higher at 4.14% on the 10-year note. Bond traders had a host of economic data to parse through this week, with the initial reading of fourth quarter GDP besting forecasts at 3.3%. This datapoint alongside better than anticipated PMIs suggests that growth may not hit the wall some expected heading into 2024. Core PCE inflation, the FOMC’s preferred gauge, fell to just 2.9% on the week but was seemingly offset by higher than consensus personal spending numbers. While those datapoints send mixed signals, the broader trend of lower inflation and continued spending despite subdued income shouldn’t meaningfully alter the path of monetary policy heading into their meeting this week. The January 31 meeting isn’t expected to result in a change to the policy rate, but insight around changes to quantitative tightening and the dispersion of opinions amongst Fed officials are well worth monitoring.

Demand For Corporates Pushing Spreads Tighter On Lean Issuance. Investment grade corporate bonds eked out positive performance of 0.22% last week, a trend reversal from the week prior, as spreads tightened by 2bps to just 0.92% over comparable treasury securities. That sinking spread is the culmination of slow issuance over the week as only $18.5B in new deals came to market, well short of the $25B projected with slightly better volume anticipated in the following week. In all fairness, corporate borrowers still have strong pricing power and are likely just pausing to catch their breath with issuance still on track to break prior January records. Strong demand was another determining factor in tighter spreads, illustrated by investors demanding just 37bps of spread on Proctor & Gamble’s debt deal this week, the smallest premium on a 10-year corporate bond since 2000. Below investment grade bonds outperformed on the week returning 0.61% due to their more modest duration profiles and stronger ties to corporate earnings, but also saw spreads drift lower alongside high-grade debt.

ECB Still Cautioning on Cut Expectations But Can’t Delay For Long. The European Central Bank elected to keep rates unchanged last week as expected but struck a more dovish tone in the statements with language around ‘declining trend’ inflation and prior remarks around price pressures were omitted this go around. Hawks remain at the helm for the ECB and President Lagarde continued to stonewall on when cuts could occur, ruling our March for now but keeping April and June in play. A downdraft in either inflation or wages could increase the odds of an April cut, with markets squarely undecided on implied policy rates, refraining from pricing a full cut in April but pricing in more than one cut by June. The euro declined over the course of the week to 1.08 on the dollar, a continuation of its trend thus far in 2024. The euro’s stall could turn around should the ECB hawks win out and hold cuts while the FOMC begins easing policy. Both institutions are likely paying more attention to what the other is saying than they let on, and we tend to think the ECB has less flexibility and a greater necessity to cut compared to the Fed.

IMPORTANT DISCLOSURES: THIS PUBLICATION HAS BEEN PREPARED BY THE STAFF OF HIGHLAND ASSOCIATES, INC. FOR DISTRIBUTION TO, AMONG OTHERS, HIGHLAND ASSOCIATES, INC. CLIENTS. HIGHLAND ASSOCIATES IS REGISTERED WITH THE UNITED STATES SECURITY AND EXCHANGE COMMISSION UNDER THE INVESTMENT ADVISORS ACT OF 1940. HIGHLAND ASSOCIATES IS A WHOLLY OWNED SUBSIDIARY OF REGIONS BANK, WHICH IN TURN IS A WHOLLY OWNED SUBSIDIARY OF REGIONS FINANCIAL CORPORATION. RESEARCH SERVICES ARE PROVIDED THROUGH MULTI-ASSET SOLUTIONS, A DEPARTMENT OF THE REGIONS ASSET MANAGEMENT BUSINESS GROUP WITHIN REGIONS BANK. THE INFORMATION AND MATERIAL CONTAINED HEREIN IS PROVIDED SOLELY FOR GENERAL INFORMATION PURPOSES ONLY. TO THE EXTENT THESE MATERIALS REFERENCE REGIONS BANK DATA, SUCH MATERIALS ARE NOT INTENDED TO BE REFLECTIVE OR INDICATIVE OF, AND SHOULD NOT BE RELIED UPON AS, THE RESULTS OF OPERATIONS, FINANCIAL CONDITIONS OR PERFORMANCE OF REGIONS BANK. UNLESS OTHERWISE SPECIFICALLY STATED, ANY VIEWS, OPINIONS, ANALYSES, ESTIMATES AND STRATEGIES, AS THE CASE MAY BE (“VIEWS”), EXPRESSED IN THIS CONTENT ARE THOSE OF THE RESPECTIVE AUTHORS AND SPEAKERS NAMED IN THOSE PIECES AND MAY DIFFER FROM THOSE OF REGIONS BANK AND/OR OTHER REGIONS BANK EMPLOYEES AND AFFILIATES. VIEWS AND ESTIMATES CONSTITUTE OUR JUDGMENT AS OF THE DATE OF THESE MATERIALS, ARE OFTEN BASED ON CURRENT MARKET CONDITIONS, AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. ANY EXAMPLES USED ARE GENERIC, HYPOTHETICAL AND FOR ILLUSTRATION PURPOSES ONLY. ANY PRICES/QUOTES/STATISTICS INCLUDED HAVE BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT HIGHLAND ASSOCIATES, INC. DOES NOT WARRANT THEIR COMPLETENESS OR ACCURACY. THIS INFORMATION IN NO WAY CONSTITUTES RESEARCH AND SHOULD NOT BE TREATED AS SUCH. THE VIEWS EXPRESSED HEREIN SHOULD NOT BE CONSTRUED AS INDIVIDUAL INVESTMENT ADVICE FOR ANY PARTICULAR PERSON OR ENTITY AND ARE NOT INTENDED AS RECOMMENDATIONS OF PARTICULAR SECURITIES, FINANCIAL INSTRUMENTS, STRATEGIES OR BANKING SERVICES FOR A PARTICULAR PERSON OR ENTITY. THE NAMES AND MARKS OF OTHER COMPANIES OR THEIR SERVICES OR PRODUCTS MAY BE THE TRADEMARKS OF THEIR OWNERS AND ARE USED ONLY TO IDENTIFY SUCH COMPANIES OR THEIR SERVICES OR PRODUCTS AND NOT TO INDICATE ENDORSEMENT, SPONSORSHIP, OR OWNERSHIP BY REGIONS OR HIGHLAND ASSOCIATES. EMPLOYEES OF HIGHLAND ASSOCIATES, INC., MAY HAVE POSITIONS IN SECURITIES OR THEIR DERIVATIVES THAT MAY BE MENTIONED IN THIS REPORT. ADDITIONALLY, HIGHLAND’S CLIENTS AND COMPANIES AFFILIATED WITH HIGHLAND ASSOCIATES MAY HOLD POSITIONS IN THE MENTIONED COMPANIES IN THEIR PORTFOLIOS OR STRATEGIES. THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR AN INVITATION BY OR ON BEHALF OF HIGHLAND ASSOCIATES TO ANY PERSON OR ENTITY TO BUY OR SELL ANY SECURITY OR FINANCIAL INSTRUMENT OR ENGAGE IN ANY BANKING SERVICE. NOTHING IN THESE MATERIALS CONSTITUTES INVESTMENT, LEGAL, ACCOUNTING OR TAX ADVICE. NON-DEPOSIT PRODUCTS INCLUDING INVESTMENTS, SECURITIES, MUTUAL FUNDS, INSURANCE PRODUCTS, CRYPTO ASSETS AND ANNUITIES: ARE NOT FDIC-INSURED I ARE NOT A DEPOSIT I MAY GO DOWN IN VALUE I ARE NOT BANK GUARANTEED I ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY I ARE NOT A CONDITION OF ANY BANKING ACTIVITY.

NEITHER REGIONS BANK NOR REGIONS ASSET MANAGEMENT (COLLECTIVELY, “REGIONS”) ARE REGISTERED MUNICIPAL ADVISORS NOR PROVIDE ADVICE TO MUNICIPAL ENTITIES OR OBLIGATED PERSONS WITH RESPECT TO MUNICIPAL FINANCIAL PRODUCTS OR THE ISSUANCE OF MUNICIPAL SECURITIES (INCLUDING REGARDING THE STRUCTURE, TIMING, TERMS AND SIMILAR MATTERS CONCERNING MUNICIPAL FINANCIAL PRODUCTS OR MUNICIPAL SECURITIES ISSUANCES) OR ENGAGE IN THE SOLICITATION OF MUNICIPAL ENTITIES OR OBLIGATED PERSONS FOR SUCH SERVICES. WITH RESPECT TO THIS PRESENTATION AND ANY OTHER INFORMATION, MATERIALS OR COMMUNICATIONS PROVIDED BY REGIONS, (A) REGIONS IS NOT RECOMMENDING AN ACTION TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON, (B) REGIONS IS NOT ACTING AS AN ADVISOR TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON AND DOES NOT OWE A FIDUCIARY DUTY PURSUANT TO SECTION 15B OF THE SECURITIES EXCHANGE ACT OF 1934 TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON WITH RESPECT TO SUCH PRESENTATION, INFORMATION, MATERIALS OR COMMUNICATIONS, (C) REGIONS IS ACTING FOR ITS OWN INTERESTS, AND (D) YOU SHOULD DISCUSS THIS PRESENTATION AND ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS WITH ANY AND ALL INTERNAL AND EXTERNAL ADVISORS AND EXPERTS THAT YOU DEEM APPROPRIATE BEFORE ACTING ON THIS PRESENTATION OR ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS.

SOURCE: BLOOMBERG INDEX SERVICES LIMITED. BLOOMBERG® IS A TRADEMARK AND SERVICE MARK OF BLOOMBERG FINANCE L.P. AND ITS AFFILIATES (COLLECTIVELY “BLOOMBERG”). BARCLAYS® IS A TRADEMARK AND SERVICE MARK OF BARCLAYS BANK PLC (COLLECTIVELY WITH ITS AFFILIATES, “BARCLAYS”), USED UNDER LICENSE. BLOOMBERG OR BLOOMBERG’S LICENSORS, INCLUDING BARCLAYS, OWN ALL PROPRIETARY RIGHTS IN THE BLOOMBERG BARCLAYS INDICES. NEITHER BLOOMBERG NOR BARCLAYS APPROVES OR ENDORSES THIS MATERIAL OR GUARANTEES THE ACCURACY OR COMPLETENESS OF ANY INFORMATION HEREIN, OR MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED THEREFROM AND, TO THE MAXIMUM EXTENT ALLOWED BY LAW, NEITHER SHALL HAVE ANY LIABILITY OR RESPONSIBILITY FOR INJURY OR DAMAGES ARISING IN CONNECTION THEREWITH.