Stocks: Better Market Breadth Encouraging, But May Be Too Much Of A Good Thing; ‘Magnificent 7’ Earnings On Deck; U.S. Dollar Drop Boosts Developed Market Stocks Abroad.

Download Weekly Market Commentary | January 27 2025

What We’re Watching:

- The Conference Board will release results from its January Consumer Confidence Survey on Tuesday with a reading of 105.6 expected, which would be a modest uptick from the 104.7 reading in December. This survey is released two weeks to the day after the December National Federation of Independent Business (NFIB) Optimism Index which came in above expectations. Both small business optimism and consumer confidence surprising to the upside and rising month over month would be a noteworthy change in trend and tone to start the new year.

- The Federal Open Market Committee (FOMC) will conclude its two-day meeting on Wednesday. The FOMC is expected to leave the Fed funds rate unchanged with the upper bound of the current range sitting at 4.50%.

- December Personal Consumption Expenditure (PCE), the FOMC’s preferred inflation gauge, is set for release Friday. Headline PCE is expected to rise 0.3% month over month and 2.5% year over year, which compares to 0.1% and 2.4% readings in November. Core PCE, which is more closely watched by monetary policymakers, is expected to rise 0.2% month over month and 2.8% year over year, which compares to readings of 0.1% and 2.8% last month.

Key Observations

- U.S. large-cap stocks set a new all-time closing high on the back of strength out of the communication services, health care, industrials, and information technology sectors, among others. Market breadth has improved in recent weeks with more stocks participating in the rally, but the S&P 500 may now be stretched as it approaches overbought territory.

- The majority of the Magnificent 7 is set to post quarterly results in the coming week, which along with the release of the December Personal Consumption Expenditure (PCE) could prove market moving. Market participants will likely remain eager to reward companies mapping out a path to profits from leveraging artificial intelligence (AI) by driving up share prices, while potentially shunning those continuing to invest heavily in the technology without being able to lessen concerns surrounding the timing and/ or magnitude of any upside to be derived from AI.

- Riskier, higher yielding segments of the bond market continue to fare well on a relative basis as investors remain willing to take on credit risk despite historically tight credit spreads and little in the way of additional yield to compensate them for doing so. We don’t see much in the way of storm clouds on the horizon to drastically alter our view on corporate bonds, but fixed income investors should remain diversified across segments and geographies as rich valuations for credit have the potential to limit appreciation and total return while increasing portfolio volatility.

What Happened Last Week:

Stocks: Better Market Breadth Encouraging, But May Be Too Much Of A Good Thing; ‘Magnificent 7’ Earnings On Deck; U.S. Dollar Drop Boosts Developed Market Stocks Abroad.

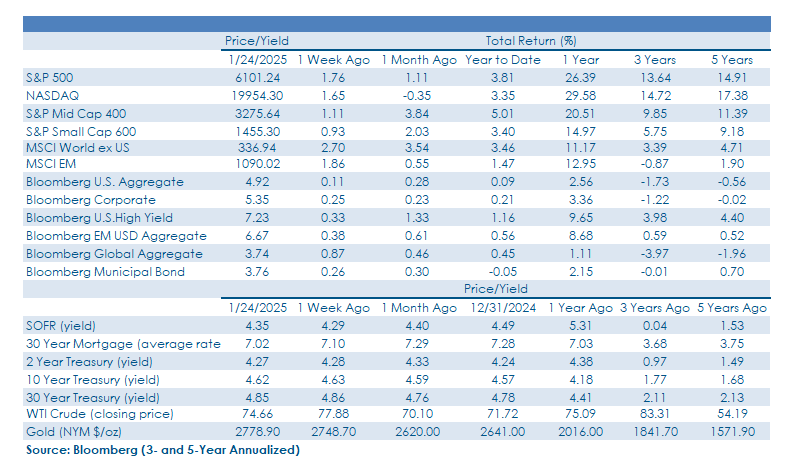

Marked Improvement In Breadth/Participation Stateside Encouraging, But U.S. Stocks Could Be Tactically Stretched. We have harped on market breadth for months now and have noted that we wanted to see 60% or more of S&P 500 constituents trade above their 200-day moving average as evidence that the S&P 500 remains on firm footing. In early January, that figure fell to below 50%, a level we viewed as a potentially worrisome sign for the near-term direction of U.S. large cap stocks, although we believed sentiment could improve with buyers stepping back in in the lead- up to President Trump’s inauguration on January 20. This appears to have played out with the S&P 500 rising 1.7% last week, while the S&P Midcap 400 and S&P Small Cap 600 also turned out respectable 1.1% and 0.9% weekly gains. While this is an encouraging development, with 80% of S&P 500 constituents now trading above their 10-day moving average as of last Friday’s close, tactical upside may be limited as many stocks approach short-term overbought levels. This doesn’t alter our view that U.S. stocks should perform relatively well in the year ahead, but with the S&P 500 already higher by 3.8% year-to-date, some backing and filling would likely be healthy after a sharp two-week rally. However, with the Magnificent 7 earnings on deck, volatility is unlikely to do anything but rise in the coming week(s).

Fireworks Potentially In The Offing With ‘Magnificent 7’ Earnings On Deck. Five of the illustrious ‘Mag 7’ are set to report this week while Alphabet (Google) and Nvidia are slated to post results in February. Earnings and forward guidance out of this cohort of stocks could dictate the near-term path of travel for the S&P 500 as investors will be locked in on the group’s ability, or lack thereof, to monetize artificial intelligence (AI) and guidance related to capital spending/investment on AI initiatives in the coming year(s). Earnings/sales beats and/or lowered spending guidance could lead to a breakout to new all-time highs for the S&P 500, while disappointments/inability to monetize AI could lead to a quick trip back to the S&P 500’s 100-day moving average around 5,850.

Earnings Season A Success So Far As 4Q24 Estimates Move Higher. Quarterly reporting season is still in its infancy with just under 20% of the S&P 500 having posted results as of last Friday’s close. But with 81% of the 90 companies having already reported topping or meeting the consensus earnings per share estimate, and with the average positive earnings surprise by an impressive 13%, we view earnings season up to this point as a success, particularly given how little fanfare there was surrounding this quarter’s releases entering January. Notably, the magnitude of the earnings beats up to this point have forced the consensus estimate for 4Q24 S&P 500 earnings per share higher from $62.25 on January 15 to $62.62 as of last Friday. While this may appear to be a relatively modest upward revision, the trend is encouraging, leading market participants to question whether expectations for 2025 earnings growth, which calls for 11.4% year over year growth, might be understated and could be revised higher in the coming quarters.

Dollar Drop Provides A Most Welcome Tailwind For Developed Market Stocks Abroad. The prospect of a more measured approach to tariffs out of the Trump administration, along with a rate hike out of the Bank of Japan on Friday, forced the U.S. Dollar Index (DXY) lower on the week. The dollar’s weakness provided a lifeline for EAFE equities which generated a 3.1% return on the week, outpacing the S&P 500 by 1.4% in the process. The reversal in the U.S. dollar’s rise isn’t all that surprising considering the magnitude of the dollar’s appreciation post-election and the support levels seen in some of the major components of the U.S. Dollar index, namely the euro. A bounce in the euro has contributed to the strong performance we’ve seen out of Eurozone stocks to start the year, with the German DAX and French CAC 40 returning 4.6% and 5.1% in U.S. dollar terms last week alone. The DAX made a series of new all-time highs while Japan, the largest country exposure in the EAFE, also outperformed the broader developed index returning 4.1% as the Japanese yen strengthened modestly on the heels of the widely expected BoJ rate hike. The uptick in performance for foreign stocks is certainly welcomed by investors with globally diversified portfolios, but we’ve yet to see the kind of fundamental or macro improvement that would shift our intermediate- term outlook for the sub-asset class.

Bonds: Rates Still Range Bound, But Economic Data Could Deliver Sizable Swings In The Coming Week; Riskier Bonds Have Outperformed Year-To-Date, But Investors Should Temper Total Return Expectations.

Long-Term Treasuries Remain Range Bound, But Rate Volatility Could Ramp Up This Week. The 10-year U.S. Treasury yield moved lower early last week, closing at 4.57% on Tuesday as market participants appeared to be encouraged by President Trump’s more measured approach to levying tariffs on China, specifically, but the 10-year yield ultimately rose a mere 2-basis points on the week to close at 4.63%. After gapping higher in mid- December on the heels of the FOMC’s monthly meeting, the 10-year yield has been stuck between 4.50% and 4.80%. Offsides positioning has been a big driver of some sharp moves in both directions for yields so far this year as market participants eager to press short positions into the 4.80% level were forced to aggressively cover those positions on a cooler than expected December Consumer Price Index (CPI) reading on January 15, which contributed to a 12-basis point drop in a single day. This week we are eagerly awaiting the release of the December Personal Consumption Expenditure (PCE), which is the FOMC’s preferred inflation gauge. A reading close to in-line with what the CPI showed a few weeks back could put additional downward pressure on yields and generate a rally in long-term Treasuries, while a hotter reading could embolden shorts to reenter positions, pushing rates back to the high-end of the 4.5% to 4.8% trading range.

Credit More Expensive As Spreads Narrow, More Than Offsetting The Move Higher In Rates. U.S. corporate high yield and emerging market bonds were two of the best performing fixed income segments last week as rates again moved higher, and credit risk found favor relative to interest rate risk. Market participants were aggressively picking up below investment grade credits into mid- January, driving the spread on the Bloomberg High Yield index to just 256-basis points over the Treasury curve, just 3-basis points above the 10-year low reached back in November. A big driver of the move lower in credit spreads/yields on credit has been absent supply as just $8.8B in new issuance has come to market thus far in January, on pace for the slowest start of the year since 2016. Investors are presently being paid to stand pat with little incentive to move new money into credit as price appreciation should be viewed as limited from here, even though the economy remains on stable footing. Emerging market bonds have benefitted from improved risk appetite early in the new year as well, with credit spreads back to 10-year lows as these bonds have largely shrugged off tariff concerns. Emerging market debt has gained ground due to a combination of individual country improvements that paints the sub-asset class in a positive light from lower inflation in Mexico, rate cuts in Turkey, and the runup in Brazilian rates showing signs of exhaustion. From our perspective debt from emerging countries looks stretched based on valuation, but select exposures still have ample upside, particularly if U.S. rates and the dollar retreat.

In A Light Week For Economic Data, There Were A Couple Readings That Caught Our Eye. Initial jobless claims for the week ended January 18 rose 6k week over week and came in 3k above the consensus estimate, while continuing claims from the week ended January 11 jumped 40k week over week and were 33k above the consensus estimate. In isolation, initial and continuing claims do little to alter our view that the U.S. labor market remains on firm footing, but we will continue to monitor the trend in these two readings for signs of weakness into the spring. On Friday, the University of Michigan released its January consumer sentiment index which surprisingly dropped to 71.1 from 73.2 in December and came in below the consensus estimate. ‘Soft’ surveys such as this one are prone to sizable shifts month to month, and the January reading could, on some level, be tied or linked to the rise in initial and continuing claims as consumers tend to be more optimistic when they have a job or believe they can easily find one.

IMPORTANT DISCLOSURES: THIS PUBLICATION HAS BEEN PREPARED BY THE STAFF OF HIGHLAND ASSOCIATES, INC. FOR DISTRIBUTION TO, AMONG OTHERS, HIGHLAND ASSOCIATES, INC. CLIENTS. HIGHLAND ASSOCIATES IS REGISTERED WITH THE UNITED STATES SECURITY AND EXCHANGE COMMISSION UNDER THE INVESTMENT ADVISORS ACT OF 1940. HIGHLAND ASSOCIATES IS A WHOLLY OWNED SUBSIDIARY OF REGIONS BANK, WHICH IN TURN IS A WHOLLY OWNED SUBSIDIARY OF REGIONS FINANCIAL CORPORATION. RESEARCH SERVICES ARE PROVIDED THROUGH MULTI-ASSET SOLUTIONS, A DEPARTMENT OF THE REGIONS ASSET MANAGEMENT BUSINESS GROUP WITHIN REGIONS BANK. THE INFORMATION AND MATERIAL CONTAINED HEREIN IS PROVIDED SOLELY FOR GENERAL INFORMATION PURPOSES ONLY. TO THE EXTENT THESE MATERIALS REFERENCE REGIONS BANK DATA, SUCH MATERIALS ARE NOT INTENDED TO BE REFLECTIVE OR INDICATIVE OF, AND SHOULD NOT BE RELIED UPON AS, THE RESULTS OF OPERATIONS, FINANCIAL CONDITIONS OR PERFORMANCE OF REGIONS BANK. UNLESS OTHERWISE SPECIFICALLY STATED, ANY VIEWS, OPINIONS, ANALYSES, ESTIMATES AND STRATEGIES, AS THE CASE MAY BE (“VIEWS”), EXPRESSED IN THIS CONTENT ARE THOSE OF THE RESPECTIVE AUTHORS AND SPEAKERS NAMED IN THOSE PIECES AND MAY DIFFER FROM THOSE OF REGIONS BANK AND/OR OTHER REGIONS BANK EMPLOYEES AND AFFILIATES. VIEWS AND ESTIMATES CONSTITUTE OUR JUDGMENT AS OF THE DATE OF THESE MATERIALS, ARE OFTEN BASED ON CURRENT MARKET CONDITIONS, AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. ANY EXAMPLES USED ARE GENERIC, HYPOTHETICAL AND FOR ILLUSTRATION PURPOSES ONLY. ANY PRICES/QUOTES/STATISTICS INCLUDED HAVE BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT HIGHLAND ASSOCIATES, INC. DOES NOT WARRANT THEIR COMPLETENESS OR ACCURACY. THIS INFORMATION IN NO WAY CONSTITUTES RESEARCH AND SHOULD NOT BE TREATED AS SUCH. THE VIEWS EXPRESSED HEREIN SHOULD NOT BE CONSTRUED AS INDIVIDUAL INVESTMENT ADVICE FOR ANY PARTICULAR PERSON OR ENTITY AND ARE NOT INTENDED AS RECOMMENDATIONS OF PARTICULAR SECURITIES, FINANCIAL INSTRUMENTS, STRATEGIES OR BANKING SERVICES FOR A PARTICULAR PERSON OR ENTITY. THE NAMES AND MARKS OF OTHER COMPANIES OR THEIR SERVICES OR PRODUCTS MAY BE THE TRADEMARKS OF THEIR OWNERS AND ARE USED ONLY TO IDENTIFY SUCH COMPANIES OR THEIR SERVICES OR PRODUCTS AND NOT TO INDICATE ENDORSEMENT, SPONSORSHIP, OR OWNERSHIP BY REGIONS OR HIGHLAND ASSOCIATES. EMPLOYEES OF HIGHLAND ASSOCIATES, INC., MAY HAVE POSITIONS IN SECURITIES OR THEIR DERIVATIVES THAT MAY BE MENTIONED IN THIS REPORT. ADDITIONALLY, HIGHLAND’S CLIENTS AND COMPANIES AFFILIATED WITH HIGHLAND ASSOCIATES MAY HOLD POSITIONS IN THE MENTIONED COMPANIES IN THEIR PORTFOLIOS OR STRATEGIES. THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR AN INVITATION BY OR ON BEHALF OF HIGHLAND ASSOCIATES TO ANY PERSON OR ENTITY TO BUY OR SELL ANY SECURITY OR FINANCIAL INSTRUMENT OR ENGAGE IN ANY BANKING SERVICE. NOTHING IN THESE MATERIALS CONSTITUTES INVESTMENT, LEGAL, ACCOUNTING OR TAX ADVICE. NON-DEPOSIT PRODUCTS INCLUDING INVESTMENTS, SECURITIES, MUTUAL FUNDS, INSURANCE PRODUCTS, CRYPTO ASSETS AND ANNUITIES: ARE NOT FDIC-INSURED I ARE NOT A DEPOSIT I MAY GO DOWN IN VALUE I ARE NOT BANK GUARANTEED I ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY I ARE NOT A CONDITION OF ANY BANKING ACTIVITY.

NEITHER REGIONS BANK NOR REGIONS ASSET MANAGEMENT (COLLECTIVELY, “REGIONS”) ARE REGISTERED MUNICIPAL ADVISORS NOR PROVIDE ADVICE TO MUNICIPAL ENTITIES OR OBLIGATED PERSONS WITH RESPECT TO MUNICIPAL FINANCIAL PRODUCTS OR THE ISSUANCE OF MUNICIPAL SECURITIES (INCLUDING REGARDING THE STRUCTURE, TIMING, TERMS AND SIMILAR MATTERS CONCERNING MUNICIPAL FINANCIAL PRODUCTS OR MUNICIPAL SECURITIES ISSUANCES) OR ENGAGE IN THE SOLICITATION OF MUNICIPAL ENTITIES OR OBLIGATED PERSONS FOR SUCH SERVICES. WITH RESPECT TO THIS PRESENTATION AND ANY OTHER INFORMATION, MATERIALS OR COMMUNICATIONS PROVIDED BY REGIONS, (A) REGIONS IS NOT RECOMMENDING AN ACTION TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON, (B) REGIONS IS NOT ACTING AS AN ADVISOR TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON AND DOES NOT OWE A FIDUCIARY DUTY PURSUANT TO SECTION 15B OF THE SECURITIES EXCHANGE ACT OF 1934 TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON WITH RESPECT TO SUCH PRESENTATION, INFORMATION, MATERIALS OR COMMUNICATIONS, (C) REGIONS IS ACTING FOR ITS OWN INTERESTS, AND (D) YOU SHOULD DISCUSS THIS PRESENTATION AND ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS WITH ANY AND ALL INTERNAL AND EXTERNAL ADVISORS AND EXPERTS THAT YOU DEEM APPROPRIATE BEFORE ACTING ON THIS PRESENTATION OR ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS.

SOURCE: BLOOMBERG INDEX SERVICES LIMITED. BLOOMBERG® IS A TRADEMARK AND SERVICE MARK OF BLOOMBERG FINANCE L.P. AND ITS AFFILIATES (COLLECTIVELY “BLOOMBERG”). BARCLAYS® IS A TRADEMARK AND SERVICE MARK OF BARCLAYS BANK PLC (COLLECTIVELY WITH ITS AFFILIATES, “BARCLAYS”), USED UNDER LICENSE. BLOOMBERG OR BLOOMBERG’S LICENSORS, INCLUDING BARCLAYS, OWN ALL PROPRIETARY RIGHTS IN THE BLOOMBERG BARCLAYS INDICES. NEITHER BLOOMBERG NOR BARCLAYS APPROVES OR ENDORSES THIS MATERIAL OR GUARANTEES THE ACCURACY OR COMPLETENESS OF ANY INFORMATION HEREIN, OR MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED THEREFROM AND, TO THE MAXIMUM EXTENT ALLOWED BY LAW, NEITHER SHALL HAVE ANY LIABILITY OR RESPONSIBILITY FOR INJURY OR DAMAGES ARISING IN CONNECTION THEREWITH.