Stocks: Growth-Oriented Areas Take A Backseat As Policy Uncertainty, Corporate Investment Concerns Spur A Rotation Into Value; Chinese Tech Earnings, Implied Government Support Boosting Sentiment; Policy Risks Cool The European Stock Upswing.

Download Weekly Market Commentary | February 24 2025

What We’re Watching:

- The Conference Board releases its Consumer Confidence Survey for February on Tuesday which is expected to weaken modestly to 102.7 from 104.1 in January.

- Personal Consumption Expenditure, the FOMC’s preferred inflation gauge, for January is released Friday. Headline PCE is expected to rise 0.3% month over month and 2.5% year over year versus 0.3% and 2.6% readings from December. Core PCE, which tends to be more closely watched, is expected to rise 0.3% month over month and 2.6% year over year versus 0.2% and 2.8% readings in the prior month.

- Semiconductor behemoth and artificial intelligence darling Nvidia is set to post quarterly results on Wednesday and could dictate the near-term direction for U.S. stocks. More upbeat guidance/commentary could boost any/all AI- related plays after a rocky start to the year for many stocks tied to this theme.

Key Observations

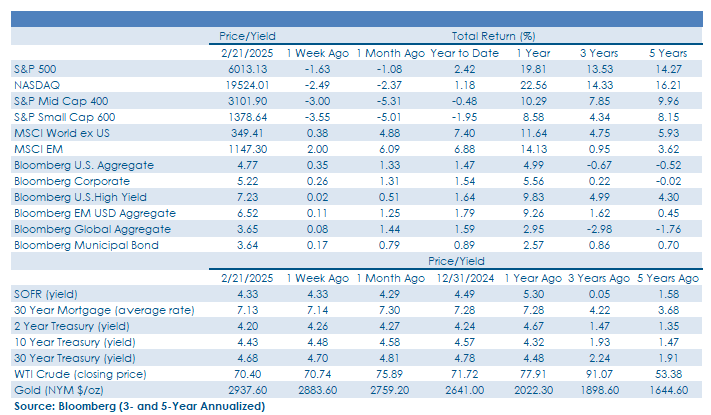

- U.S. stocks gave ground last week as strength out of value-oriented sectors such as consumer staples and energy weren’t enough to offset declines in MAG7 communication services and consumer discretionary names. Some high-profile consumer staples names struggled as well, although the sector still managed to close the week in positive territory.

- Chinese markets kicked off the week focused on a rare meeting between President Xi and the country’s tech leaders in a very visible vote of confidence for the country’s ‘national champions,’ which along with positive earnings and trade remarks, boosted investor sentiment and sent the MSCI China Index higher by just shy of 4% on the week.

- Interest rates in the U.S. remained rangebound, ebbing and flowing with the introduction of reciprocal tariffs which pushed yields higher, while softer jobless claims data and a surprisingly weak Services PMI from February in the back- half of the week forced Treasury yields modestly lower for the sixth consecutive week, buoying interest rate sensitive segments.

What Happened Last Week:

Stocks: Growth-Oriented Areas Take A Backseat As Policy Uncertainty, Corporate Investment Concerns Spur A Rotation Into Value; Chinese Tech Earnings, Implied Government Support Boosting Sentiment; Policy Risks Cool The European Stock Upswing.

Value Outperforms Growth With Consumer Staples, Energy Leading The Way. The S&P 500 traded in a narrow band throughout the balance of last week, closing at an all-time high Tuesday and Wednesday before ceding ground into the weekend and ultimately falling 1.6% after a sharp selloff on Friday. The ‘Magnificent 7’ names that led the charge throughout 2023 and much of 2024 haven’t fared so well year-to-date and continued to lag the broader S&P 500 and the S&P 500 Value Index last week with Apple the only constituent to end the week with a gain. The energy sector played a role in last week’s outperformance of value relative to growth with the sector gaining 1.3% in part due to hopes for a quick resolution and potential ceasefire on the Russia/Ukraine front being dashed, which pushed energy prices higher. Fundamental underpinnings for energy stocks have noticeably improved with the sector generating a double-digit positive earnings surprise, on average, during 4Q reporting season. On the growth side of the earnings ledger, large-cap growth companies have fallen short of lofty expectations as information technology stocks have posted a positive earnings surprise of just 3%, providing unfavorable comparisons versus areas like consumer discretionary and financials which have put up double-digit surprises. Walmart, which carries a sizable weight on many growth-oriented indices, garnered headlines last week as the stock sold off after topping estimates for the quarter as forward guidance was lowered with the company citing uncertainty around how potential changes to trade/tariff policy will impact the business. Consumer staples are often viewed as the canary in the coal mine for the U.S. economy, but in the case of Walmart, specifically, the company could just be attempting to under promise with the hope of overdelivering as the company elected to raise the dividend while reiterating that consumer behavior wasn’t part of the drag on future growth expectations. It’s worth noting that while economic data was sparse last week, the S&P Global Services PMI slipped back into contraction territory on Friday, providing market participants with more fuel to the economic ‘growth scare’ fire and more reason to trim consumer discretionary and consumer staples stocks, broadly speaking.

China Seeks To Thaw Investor Sentiment By Warming Up To Tech Giants. The MSCI China index advanced by 3.8% last week as tailwinds piled up after President Xi met with some of the nation’s premier technology leaders, including Alibaba founder Jack Ma, who had previously faced the ire of the CCP, fostering hopes the government is attempting to mend fences in support of the private sector. Recent AI developments including DeepSeek caused a ruckus and recalibration of expectations surrounding U.S. tech names last month and prompted analysts to upgrade the outlook for China’s technology sector, a view that appears more justified after Alibaba posted an earnings beat last week and stated that their primary objective is pursuing artificial general intelligence (AGI), the step beyond current AI models. The tech behemoth’s stock was up over 15% over the balance of the week, even as it announced heavy investment in AI infrastructure, a pronouncement that has been less-well received from U.S. companies in recent months. Trade winds were also blowing in favor of the world’s second largest economy as the Trump administration brought up the prospect of a new trade deal with China. Trading volume in Chinese stocks has been well above the 12-month median in each of the past four weeks, a sign these movements are worth watching with more upside potentially in the cards.

Next Round of Tariffs, Ukraine/Russia Leaves European Equities On Edge. The euro oscillated against the dollar last week as the U.S. announced reciprocal 25% tariffs on autos, chips, and pharmaceutical imports that rippled through European stocks. Selling pressure was limited and the broader MSCI EAFE Index closed down 0.1% on the week despite five of the top ten names in the index being entangled in the newly announced tariffs. The MSCI Europe Index also fell by 0.1% over the balance of the week as uncertainty surrounding the path forward for the war in Ukraine was added back into the mix, but with one potential byproduct of the war being stepped-up spending by the EU to increase military spending, this could provide a potential boost to economic growth along the way. From a technical perspective, the MSCI Europe Index has been in overbought territory for much of February and would stand to benefit from some consolidation after making a new all-time high midway through last week.

Bonds: Treasury Yields Fall As Lackluster Economic Data Spurs A Flight To Safety; FOMC Minutes Open Door For Maturity Shift and Signal Extended Pause; Corporate Credit Spreads Anchored As Demand Remains Strong.

Fears Of A Growth Scare Force Treasury Yields Lower.

Benchmark 10-year Treasury yields drifted lower last week, closing lower by 5-basis points at 4.42%, the sixth consecutive weekly drop and the lowest weekly close for the 10-year yield since mid-December. Yields rose midweek on newly announced reciprocal tariffs before settling lower on softer economic data. The high end for the 10-year yield came on Wednesday at 4.55%, alongside the announcement that 25% tariffs would be levied on autos, chips, and pharmaceuticals coming from Europe. The rise in Treasury yields proved short-lived after a slight uptick in jobless claims and softer services PMI, led the Bloomberg US Aggregate Bond Index to a 0.3% gain on the week. The Treasury market’s muted response to the tariff announcement could signal that investors are growing accustomed to the rhetoric surrounding trade policies, but inflation break-evens, on the other hand, rose for the fourth consecutive week. Notably, inflation protected securities were pricing 2-year inflation at 3.2% by the weekend, a rise from 2.5% at the beginning of the year and ahead of the most recent CPI print at 3.0%. At the same time, St. Louis Fed President and voting FOMC member Musalem made hawkish comments around the increased risk that progress on inflation could stall or reverse course, citing material shifts in government policy, while reiterating the FOMC’s base-case remains a return to 2%. At present, uncertainty around the impact of tariffs, government layoffs, and downstream effects on spending are keeping U.S. government yields hovering around fair value in the 4.40% to 4.60% zone.

January FOMC Minutes Confirm The Committee Is On Hold Until Further Notice. As expected, the FOMC reinforced the Committee’s data-dependent and wait and see approach regarding the path forward for monetary policy. The “vast majority” of members view the current state of monetary policy as still restrictive while noting future upside inflation risks such as “potential changes in trade and immigration policy”. There was also balance sheet discussion in the minutes with many participants supporting the idea of shifting the maturity profile of the System Open Market Account (SOMA) portfolio to look more like that of the overall Treasury market. The SOMA Treasury portfolio currently has a longer maturity profile relative to the overall Treasury portfolio which would suggest that, if implemented, the Fed would direct future mortgage-backed securities (MBS) paydowns into shorter- dated T-bills rather than longer-dated Treasuries. The net result would be a higher term premium and a need from private investors to absorb the incremental supply of longer-dated Treasury bonds.

Investment Grade Credit Spreads Steady Amid Strong Demand. Investment grade credit spreads have traded within a relatively tight range post-election with moves in Treasury yields driving performance for the asset class. Issuance in investment grade corporate bonds has been strong year to date but the increased supply has been met with equally strong demand. While demand has been strong thus far in 2025, mutual fund and ETF flows along with foreign demand slowed last week suggesting a reduced appetite for corporate credit in the short-term. An interesting dynamic we’re currently watching within the investment grade corporate space is the upcoming maturity of 5-year corporate bonds issued in March-May 2020 as $790 billion in corporate bonds was issued in that timeframe. With such short maturities currently, money- markets hold most of these assets but there is a segment of buyers, such as insurance companies and retail clients, who are more willing to hold until maturity. The net result would be positive for investment grade corporate spreads as investors reinvest those proceeds.

U.K. Inflation Jumps To 10-Month High But Is Unlikely To Alter The Path Forward For The Bank Of England. Headline U.K. Inflation climbed to its highest level since March 2024 rose a paltry 0.1% in 4Q24 and just 0.7% year over year in 2024. The FOMC remains in an enviable position relative to many other central banks around the world after 4Q GDP rose 2.3% year over year and the Committee’s preferred inflation gauge, core PCE, rose 0.2% month over month and 2.8% year over year in January, in-line with expectations. This combination of continued strong economic growth and sticky inflation should allow the Fed to stand pat and in ‘wait and see mode’ into mid-year, and the market views June as the most likely meeting for another rate cut.

IMPORTANT DISCLOSURES: THIS PUBLICATION HAS BEEN PREPARED BY THE STAFF OF HIGHLAND ASSOCIATES, INC. FOR DISTRIBUTION TO, AMONG OTHERS, HIGHLAND ASSOCIATES, INC. CLIENTS. HIGHLAND ASSOCIATES IS REGISTERED WITH THE UNITED STATES SECURITY AND EXCHANGE COMMISSION UNDER THE INVESTMENT ADVISORS ACT OF 1940. HIGHLAND ASSOCIATES IS A WHOLLY OWNED SUBSIDIARY OF REGIONS BANK, WHICH IN TURN IS A WHOLLY OWNED SUBSIDIARY OF REGIONS FINANCIAL CORPORATION. RESEARCH SERVICES ARE PROVIDED THROUGH MULTI-ASSET SOLUTIONS, A DEPARTMENT OF THE REGIONS ASSET MANAGEMENT BUSINESS GROUP WITHIN REGIONS BANK. THE INFORMATION AND MATERIAL CONTAINED HEREIN IS PROVIDED SOLELY FOR GENERAL INFORMATION PURPOSES ONLY. TO THE EXTENT THESE MATERIALS REFERENCE REGIONS BANK DATA, SUCH MATERIALS ARE NOT INTENDED TO BE REFLECTIVE OR INDICATIVE OF, AND SHOULD NOT BE RELIED UPON AS, THE RESULTS OF OPERATIONS, FINANCIAL CONDITIONS OR PERFORMANCE OF REGIONS BANK. UNLESS OTHERWISE SPECIFICALLY STATED, ANY VIEWS, OPINIONS, ANALYSES, ESTIMATES AND STRATEGIES, AS THE CASE MAY BE (“VIEWS”), EXPRESSED IN THIS CONTENT ARE THOSE OF THE RESPECTIVE AUTHORS AND SPEAKERS NAMED IN THOSE PIECES AND MAY DIFFER FROM THOSE OF REGIONS BANK AND/OR OTHER REGIONS BANK EMPLOYEES AND AFFILIATES. VIEWS AND ESTIMATES CONSTITUTE OUR JUDGMENT AS OF THE DATE OF THESE MATERIALS, ARE OFTEN BASED ON CURRENT MARKET CONDITIONS, AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. ANY EXAMPLES USED ARE GENERIC, HYPOTHETICAL AND FOR ILLUSTRATION PURPOSES ONLY. ANY PRICES/QUOTES/STATISTICS INCLUDED HAVE BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT HIGHLAND ASSOCIATES, INC. DOES NOT WARRANT THEIR COMPLETENESS OR ACCURACY. THIS INFORMATION IN NO WAY CONSTITUTES RESEARCH AND SHOULD NOT BE TREATED AS SUCH. THE VIEWS EXPRESSED HEREIN SHOULD NOT BE CONSTRUED AS INDIVIDUAL INVESTMENT ADVICE FOR ANY PARTICULAR PERSON OR ENTITY AND ARE NOT INTENDED AS RECOMMENDATIONS OF PARTICULAR SECURITIES, FINANCIAL INSTRUMENTS, STRATEGIES OR BANKING SERVICES FOR A PARTICULAR PERSON OR ENTITY. THE NAMES AND MARKS OF OTHER COMPANIES OR THEIR SERVICES OR PRODUCTS MAY BE THE TRADEMARKS OF THEIR OWNERS AND ARE USED ONLY TO IDENTIFY SUCH COMPANIES OR THEIR SERVICES OR PRODUCTS AND NOT TO INDICATE ENDORSEMENT, SPONSORSHIP, OR OWNERSHIP BY REGIONS OR HIGHLAND ASSOCIATES. EMPLOYEES OF HIGHLAND ASSOCIATES, INC., MAY HAVE POSITIONS IN SECURITIES OR THEIR DERIVATIVES THAT MAY BE MENTIONED IN THIS REPORT. ADDITIONALLY, HIGHLAND’S CLIENTS AND COMPANIES AFFILIATED WITH HIGHLAND ASSOCIATES MAY HOLD POSITIONS IN THE MENTIONED COMPANIES IN THEIR PORTFOLIOS OR STRATEGIES. THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR AN INVITATION BY OR ON BEHALF OF HIGHLAND ASSOCIATES TO ANY PERSON OR ENTITY TO BUY OR SELL ANY SECURITY OR FINANCIAL INSTRUMENT OR ENGAGE IN ANY BANKING SERVICE. NOTHING IN THESE MATERIALS CONSTITUTES INVESTMENT, LEGAL, ACCOUNTING OR TAX ADVICE. NON-DEPOSIT PRODUCTS INCLUDING INVESTMENTS, SECURITIES, MUTUAL FUNDS, INSURANCE PRODUCTS, CRYPTO ASSETS AND ANNUITIES: ARE NOT FDIC-INSURED I ARE NOT A DEPOSIT I MAY GO DOWN IN VALUE I ARE NOT BANK GUARANTEED I ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY I ARE NOT A CONDITION OF ANY BANKING ACTIVITY.

NEITHER REGIONS BANK NOR REGIONS ASSET MANAGEMENT (COLLECTIVELY, “REGIONS”) ARE REGISTERED MUNICIPAL ADVISORS NOR PROVIDE ADVICE TO MUNICIPAL ENTITIES OR OBLIGATED PERSONS WITH RESPECT TO MUNICIPAL FINANCIAL PRODUCTS OR THE ISSUANCE OF MUNICIPAL SECURITIES (INCLUDING REGARDING THE STRUCTURE, TIMING, TERMS AND SIMILAR MATTERS CONCERNING MUNICIPAL FINANCIAL PRODUCTS OR MUNICIPAL SECURITIES ISSUANCES) OR ENGAGE IN THE SOLICITATION OF MUNICIPAL ENTITIES OR OBLIGATED PERSONS FOR SUCH SERVICES. WITH RESPECT TO THIS PRESENTATION AND ANY OTHER INFORMATION, MATERIALS OR COMMUNICATIONS PROVIDED BY REGIONS, (A) REGIONS IS NOT RECOMMENDING AN ACTION TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON, (B) REGIONS IS NOT ACTING AS AN ADVISOR TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON AND DOES NOT OWE A FIDUCIARY DUTY PURSUANT TO SECTION 15B OF THE SECURITIES EXCHANGE ACT OF 1934 TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON WITH RESPECT TO SUCH PRESENTATION, INFORMATION, MATERIALS OR COMMUNICATIONS, (C) REGIONS IS ACTING FOR ITS OWN INTERESTS, AND (D) YOU SHOULD DISCUSS THIS PRESENTATION AND ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS WITH ANY AND ALL INTERNAL AND EXTERNAL ADVISORS AND EXPERTS THAT YOU DEEM APPROPRIATE BEFORE ACTING ON THIS PRESENTATION OR ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS.

SOURCE: BLOOMBERG INDEX SERVICES LIMITED. BLOOMBERG® IS A TRADEMARK AND SERVICE MARK OF BLOOMBERG FINANCE L.P. AND ITS AFFILIATES (COLLECTIVELY “BLOOMBERG”). BARCLAYS® IS A TRADEMARK AND SERVICE MARK OF BARCLAYS BANK PLC (COLLECTIVELY WITH ITS AFFILIATES, “BARCLAYS”), USED UNDER LICENSE. BLOOMBERG OR BLOOMBERG’S LICENSORS, INCLUDING BARCLAYS, OWN ALL PROPRIETARY RIGHTS IN THE BLOOMBERG BARCLAYS INDICES. NEITHER BLOOMBERG NOR BARCLAYS APPROVES OR ENDORSES THIS MATERIAL OR GUARANTEES THE ACCURACY OR COMPLETENESS OF ANY INFORMATION HEREIN, OR MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED THEREFROM AND, TO THE MAXIMUM EXTENT ALLOWED BY LAW, NEITHER SHALL HAVE ANY LIABILITY OR RESPONSIBILITY FOR INJURY OR DAMAGES ARISING IN CONNECTION THEREWITH.