Stocks: U.S. Equity Indices Take A Breather As Rising Treasury Yields And A ‘Buyers Strike’ Weigh; The Double-Edged Sword Of Momentum Investing On Display; China Stimulus Hopes Briefly Boost Emerging Markets, But The Rally Quickly Faded As Investors Remain Skeptical.

Download Weekly Market Commentary | December 16 2024

What We’re Watching:

- Retail Sales for November are released Tuesday with 0.4% to 0.5% month over month growth expected to be reported across various measures.

- The Federal Open Market Committee (FOMC) concludes its two-day meeting on Wednesday and is expected to lower the Fed funds rate by 25-basis points to a target range of 4.25% to 4.50%. The Committee will provide an updated Summary of Economic Projections, or dot-plot, which will provide a lens into the median Committee member’s view on the outlook for inflation and the path forward for monetary policy in the year(s) to come.

- November U.S. Personal Consumption Expenditure (PCE), the FOMC’s preferred inflation gauge, is released Friday. Headline PCE is expected to rise 0.2% month over month and 2.5% year over year during the month, versus 0.2% and 2.3% readings in October. Core PCE, which is more closely watched by the FOMC, is expected to rise 0.2% month over month and 2.9% year over year, this compares to 0.3% and 2.8% the prior month. Should readings be in-line with expectations, this would provide further evidence that inflation is ‘stuck’ at an elevated level.

Key Observations

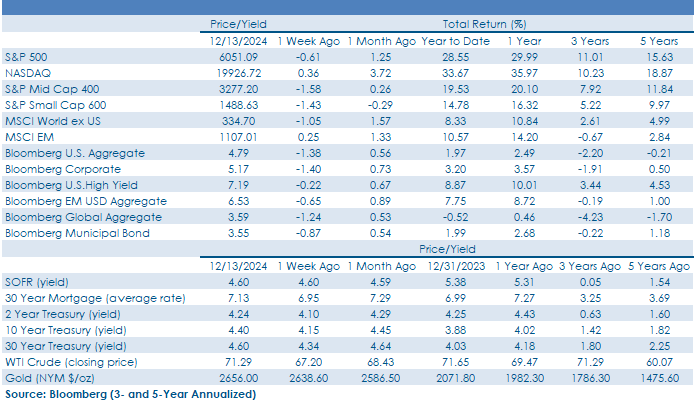

- U.S. large-cap stocks chopped around and moved sideways over the balance of the week as breadth narrowed. Capital moved out of some of the areas that have performed best post-election in a significant way and market participants appeared eager to crowd back into the ‘Magnificent 7.’ Alphabet (Google), Amazon, Apple, Meta Platforms (Facebook), and Tesla all reached a new all-time high at some point during the week, moves likely driven to some degree by window dressing on the part of portfolio managers desiring to show clients and prospects they held some of 2024’s biggest winners at year-end.

- Participation within the S&P 500 has trailed off in recent weeks and further deterioration in breadth measures in the near-term, a period in which stocks typically rally, would be noteworthy and potentially sign that a pullback could be in the offing. Over 65% of S&P 500 constituents remained above their 200-day moving average at the end of last week, and so long as this metric stays above 60%, the broader market should remain on solid footing into January.

- Treasury yields rose sharply week over week as November inflation data and ramped up trade rhetoric between the U.S. and China dominated, bringing sellers back into the market, and serving to more than offset strong demand for 10-year Treasuries at auction mid-week.

What Happened Last Week:

Stocks: U.S. Equity Indices Take A Breather As Rising Treasury Yields And A ‘Buyers Strike’ Weigh; The Double-Edged Sword Of Momentum Investing On Display; China Stimulus Hopes Briefly Boost Emerging Markets, But The Rally Quickly Faded As Investors Remain Skeptical.

The ‘Magnificent 7’ Rally Rolls On, But Narrowing Market Breadth Is Worth Watching. Among the anointed Magnificent 7 group of stocks, Nvidia and Meta Platforms (Facebook) finished the week lower, but Alphabet (Google), Amazon, Apple, Meta Platforms (Facebook), and Tesla all reached a new all-time high at some point during the week. Semiconductor stocks, an important and closely watched group of stocks that has lagged the broader market in the last couple of months, caught a bid on Friday as Broadcom (AVGO) provided upbeat guidance and buoyed the group, an encouraging development as we move into 2025. ‘Mag 7’ strength buoyed communication services and consumer discretionary on the week, while economically sensitive sectors such as financial services, industrials, and real estate underperformed on the week, as did defensive areas such as health care and utilities. Participation continued to narrow and fewer S&P 500 constituents traded above their 10-, 50-, and 200-day moving average at the close of the week than at the beginning. But historically that hasn’t been an uncommon occurrence in the lead-up to Christmas and breadth has often improved as the year wraps up and investors position for a Santa Claus rally.

The Double-Edged Sword Of Momentum Investing On Display. Last Monday, market participants appeared eager to sell out of year-to-date winners to reallocate capital into some of the biggest names in the market, along with some of 2024’s laggards to take advantage of what could be a year-end beta rally. This repositioning proved painful for strategies relying heavily on the momentum factor to allocate capital, and the iShares Momentum ETF (MTUM) fell by 1.5% for the week. Optimism still appears to be on the menu for the remainder of the month, but December has historically been a month where performance dispersion between individual stocks widens, and with correlations falling in recent weeks that could play out this time around as well. In that environment, changing allocations to stock up on companies that have done well over the course of this year could backfire as factor winds shift rapidly amid low trading volume in the coming weeks.

China Stimulus Hopes Briefly Boost Emerging Market Stocks But Sizable Gains Quickly Fade. Sentiment surrounding Chinese equities improved early last week, evidenced by the iShares MSCI China ETF (MCHI) rallying 7.8% on Monday as the country’s government reiterated its intention to further stimulate the economy. That lift proved short-lived and Chinese equities gave back most of that gain over the remainder of the week, even as officials met for an annual economic forum with easier monetary policy a topic of debate and discussion. The conference yielded statements that the country’s currency should be held stable, but the market’s reaction to last week’s news shows us investors remain skeptical that efforts to stimulate growth will work after prior attempts have fallen short, making the case that larger and more focused policy changes might be needed to spur consumer spending. China’s economic recovery thus far has been grueling, and while PMIs have shown some signs of life of late, the economy is on shaky footing that likely requires stepped up stimulus that is currently being held back to offset trade uncertainty and the prospect of U.S. tariffs being raised on Chinese imports. Chinese stocks have rather quietly generated sizable gains in 2024 with the MSCI China Large Cap ETF (FXI) returning over 29% year-to- date through last Friday, outperforming the S&P 500 over that time frame. However, most investors with dedicated exposure to the country were likely shaken out long ago, while those taking a more diversified approach to investing in emerging markets have been more capable of staying the course, and we don’t see that dynamic shifting much in 2025.

Bonds: Treasury Yields Rise As ‘Sticky’ Inflation Points Toward Less Fed Easing Coming Down The Pike; High Yield Outperforms High Grade As Credit Risk Remains Favored Over Interest Rate Risk.

Trade Rhetoric, November Inflation Data Bring Sellers Back Into The Treasury Market. U.S. Treasury rates took the elevator up last week after taking the stairs lower since mid- November with the 10-year rising by 25-basis points to 4.40% over the balance of the week as trade tensions flared and progress on inflation appeared to stall. Early in the week, China announced an investigation into U.S. semiconductor behemoth Nvidia’s business practices within the country, just the latest in a string of back-and-forth actions taken by the world’s two largest economies to undermine each country’s national champions. Stateside, Treasury bonds were also negatively impacted by a November CPI number which came in in-line with expectations despite owners’ equivalent rent, one of the stubborn contributors to CPI over the last year, recording its softest reading since March of 2021. November Producer Price Inflation (PPI) released the following day put continued upward pressure on yields and Treasuries failed to find buyers throughout the week. These inflation readings shouldn’t cause a knee jerk reaction to sell Treasuries as we see a mix of improving long-term signals and discouraging short-term readings that suggest fears of structurally higher inflation may subside. Rising Treasury yields put pressure on higher quality investment grade corporate bonds, evidenced by the Bloomberg U.S. Corporate Index falling 1.4% on the week due to the longer duration profile of these bonds. Conversely, lower quality credits, which carry less duration/ interest rate risk, fared far better with the Bloomberg U.S. Corporate High Yield Index falling 0.2%.

10-Year Treasury Auction Well Received Mid-Week But Yields Rise As Inflation Concerns Dominate. The U.S. Treasury auctioned off $39B of 10-year notes last Wednesday, and the issue was met by strong demand from both direct (pension plans, insurers) and indirect (foreign central banks) bidders. Primary dealers took down 10.5% of the issue, below the 13.3% average of the prior six auctions, while direct bidders received 19.5% compared to 16% on average in the prior six auctions. Indirect bidders received the remaining 70%, which falls in-line with the six-auction average. While demand for the 10-year issue was strong, it wasn’t enough to prevent yields on Treasury bonds maturing between 2- and 30-years in the future from moving noticeably higher week over week as an in-line CPI and ‘hot’ PPI pointed toward inflationary pressures stalling out and again raised questions surrounding rate cuts in the coming year.

More Evidence Of ‘Sticky’ Inflation In The November CPI, PPI Releases. Last week brought with it the release of two closely watched inflation readings from November with the Consumer Price Index (CPI) on Wednesday and the Producer Price Index (PPI) on Thursday. Headline CPI rose 2.7%, year over year, up from 2.6% in October, while the more closely monitored core CPI rose 3.3% year over year last month, in-line with the October, reading. While both headline and core CPI fell in-line with expectations, both continued to point toward progress on bringing down inflation stalling out in recent months. The release of November PPI the following day did little to ease concerns that inflation was stalling out well above the FOMC’s stated 2% target. PPI, a measure of wholesale prices that flow into CPI to some degree in the following months, rose 0.4% month over month and 3.0% year over year in November, well above the 0.2% and 2.6% estimates, while PPI, ex food and energy, rose 0.2% month over month and 3.4% year over year.

On the heels of the CPI release, Fed funds futures began to price in a higher likelihood of a quarter-point cut in December and ended the week with a 98% chance of a cut this week despite the elevated PPI reading. Assuming a cut materializes this week, the futures market still expects between two and three 25-basis point rate cuts by year- end 2025. Based upon our expectations for economic growth and inflation in the coming year, we would lean toward two at this time.

IMPORTANT DISCLOSURES: THIS PUBLICATION HAS BEEN PREPARED BY THE STAFF OF HIGHLAND ASSOCIATES, INC. FOR DISTRIBUTION TO, AMONG OTHERS, HIGHLAND ASSOCIATES, INC. CLIENTS. HIGHLAND ASSOCIATES IS REGISTERED WITH THE UNITED STATES SECURITY AND EXCHANGE COMMISSION UNDER THE INVESTMENT ADVISORS ACT OF 1940. HIGHLAND ASSOCIATES IS A WHOLLY OWNED SUBSIDIARY OF REGIONS BANK, WHICH IN TURN IS A WHOLLY OWNED SUBSIDIARY OF REGIONS FINANCIAL CORPORATION. RESEARCH SERVICES ARE PROVIDED THROUGH MULTI-ASSET SOLUTIONS, A DEPARTMENT OF THE REGIONS ASSET MANAGEMENT BUSINESS GROUP WITHIN REGIONS BANK. THE INFORMATION AND MATERIAL CONTAINED HEREIN IS PROVIDED SOLELY FOR GENERAL INFORMATION PURPOSES ONLY. TO THE EXTENT THESE MATERIALS REFERENCE REGIONS BANK DATA, SUCH MATERIALS ARE NOT INTENDED TO BE REFLECTIVE OR INDICATIVE OF, AND SHOULD NOT BE RELIED UPON AS, THE RESULTS OF OPERATIONS, FINANCIAL CONDITIONS OR PERFORMANCE OF REGIONS BANK. UNLESS OTHERWISE SPECIFICALLY STATED, ANY VIEWS, OPINIONS, ANALYSES, ESTIMATES AND STRATEGIES, AS THE CASE MAY BE (“VIEWS”), EXPRESSED IN THIS CONTENT ARE THOSE OF THE RESPECTIVE AUTHORS AND SPEAKERS NAMED IN THOSE PIECES AND MAY DIFFER FROM THOSE OF REGIONS BANK AND/OR OTHER REGIONS BANK EMPLOYEES AND AFFILIATES. VIEWS AND ESTIMATES CONSTITUTE OUR JUDGMENT AS OF THE DATE OF THESE MATERIALS, ARE OFTEN BASED ON CURRENT MARKET CONDITIONS, AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. ANY EXAMPLES USED ARE GENERIC, HYPOTHETICAL AND FOR ILLUSTRATION PURPOSES ONLY. ANY PRICES/QUOTES/STATISTICS INCLUDED HAVE BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT HIGHLAND ASSOCIATES, INC. DOES NOT WARRANT THEIR COMPLETENESS OR ACCURACY. THIS INFORMATION IN NO WAY CONSTITUTES RESEARCH AND SHOULD NOT BE TREATED AS SUCH. THE VIEWS EXPRESSED HEREIN SHOULD NOT BE CONSTRUED AS INDIVIDUAL INVESTMENT ADVICE FOR ANY PARTICULAR PERSON OR ENTITY AND ARE NOT INTENDED AS RECOMMENDATIONS OF PARTICULAR SECURITIES, FINANCIAL INSTRUMENTS, STRATEGIES OR BANKING SERVICES FOR A PARTICULAR PERSON OR ENTITY. THE NAMES AND MARKS OF OTHER COMPANIES OR THEIR SERVICES OR PRODUCTS MAY BE THE TRADEMARKS OF THEIR OWNERS AND ARE USED ONLY TO IDENTIFY SUCH COMPANIES OR THEIR SERVICES OR PRODUCTS AND NOT TO INDICATE ENDORSEMENT, SPONSORSHIP, OR OWNERSHIP BY REGIONS OR HIGHLAND ASSOCIATES. EMPLOYEES OF HIGHLAND ASSOCIATES, INC., MAY HAVE POSITIONS IN SECURITIES OR THEIR DERIVATIVES THAT MAY BE MENTIONED IN THIS REPORT. ADDITIONALLY, HIGHLAND’S CLIENTS AND COMPANIES AFFILIATED WITH HIGHLAND ASSOCIATES MAY HOLD POSITIONS IN THE MENTIONED COMPANIES IN THEIR PORTFOLIOS OR STRATEGIES. THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR AN INVITATION BY OR ON BEHALF OF HIGHLAND ASSOCIATES TO ANY PERSON OR ENTITY TO BUY OR SELL ANY SECURITY OR FINANCIAL INSTRUMENT OR ENGAGE IN ANY BANKING SERVICE. NOTHING IN THESE MATERIALS CONSTITUTES INVESTMENT, LEGAL, ACCOUNTING OR TAX ADVICE. NON-DEPOSIT PRODUCTS INCLUDING INVESTMENTS, SECURITIES, MUTUAL FUNDS, INSURANCE PRODUCTS, CRYPTO ASSETS AND ANNUITIES: ARE NOT FDIC-INSURED I ARE NOT A DEPOSIT I MAY GO DOWN IN VALUE I ARE NOT BANK GUARANTEED I ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY I ARE NOT A CONDITION OF ANY BANKING ACTIVITY.

NEITHER REGIONS BANK NOR REGIONS ASSET MANAGEMENT (COLLECTIVELY, “REGIONS”) ARE REGISTERED MUNICIPAL ADVISORS NOR PROVIDE ADVICE TO MUNICIPAL ENTITIES OR OBLIGATED PERSONS WITH RESPECT TO MUNICIPAL FINANCIAL PRODUCTS OR THE ISSUANCE OF MUNICIPAL SECURITIES (INCLUDING REGARDING THE STRUCTURE, TIMING, TERMS AND SIMILAR MATTERS CONCERNING MUNICIPAL FINANCIAL PRODUCTS OR MUNICIPAL SECURITIES ISSUANCES) OR ENGAGE IN THE SOLICITATION OF MUNICIPAL ENTITIES OR OBLIGATED PERSONS FOR SUCH SERVICES. WITH RESPECT TO THIS PRESENTATION AND ANY OTHER INFORMATION, MATERIALS OR COMMUNICATIONS PROVIDED BY REGIONS, (A) REGIONS IS NOT RECOMMENDING AN ACTION TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON, (B) REGIONS IS NOT ACTING AS AN ADVISOR TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON AND DOES NOT OWE A FIDUCIARY DUTY PURSUANT TO SECTION 15B OF THE SECURITIES EXCHANGE ACT OF 1934 TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON WITH RESPECT TO SUCH PRESENTATION, INFORMATION, MATERIALS OR COMMUNICATIONS, (C) REGIONS IS ACTING FOR ITS OWN INTERESTS, AND (D) YOU SHOULD DISCUSS THIS PRESENTATION AND ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS WITH ANY AND ALL INTERNAL AND EXTERNAL ADVISORS AND EXPERTS THAT YOU DEEM APPROPRIATE BEFORE ACTING ON THIS PRESENTATION OR ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS.

SOURCE: BLOOMBERG INDEX SERVICES LIMITED. BLOOMBERG® IS A TRADEMARK AND SERVICE MARK OF BLOOMBERG FINANCE L.P. AND ITS AFFILIATES (COLLECTIVELY “BLOOMBERG”). BARCLAYS® IS A TRADEMARK AND SERVICE MARK OF BARCLAYS BANK PLC (COLLECTIVELY WITH ITS AFFILIATES, “BARCLAYS”), USED UNDER LICENSE. BLOOMBERG OR BLOOMBERG’S LICENSORS, INCLUDING BARCLAYS, OWN ALL PROPRIETARY RIGHTS IN THE BLOOMBERG BARCLAYS INDICES. NEITHER BLOOMBERG NOR BARCLAYS APPROVES OR ENDORSES THIS MATERIAL OR GUARANTEES THE ACCURACY OR COMPLETENESS OF ANY INFORMATION HEREIN, OR MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED THEREFROM AND, TO THE MAXIMUM EXTENT ALLOWED BY LAW, NEITHER SHALL HAVE ANY LIABILITY OR RESPONSIBILITY FOR INJURY OR DAMAGES ARISING IN CONNECTION THEREWITH.