Stocks: A Market In Search Of Reasons To Pull Back Finds A Few; M&A, IPO Activity Picking Up A Sign Of Improved Corporate Confidence; U.S./EU Trade Deal A ‘Sell The News’ Event For Eurozone Stocks.

Download Weekly Market Commentary | August 4 2025

What We’re Watching:

- While market participants may be ready to take a breather between now and the lead-up to Nvidia’s release of quarterly earnings on August 27, this coming week we expect just shy of 25% of S&P 500 constituents to post results.

- The ISM (Institute for Supply Management) Services index for July is released Tuesday and is expected to improve to 51.5 from 50.8 in June. A reading above 50 indicates expansion or growth in the services sector of the U.S. economy.

- Initial jobless claims for the week ended August 2 and continuing claims for the week ended July 26 are released on Thursday.

Key Observations

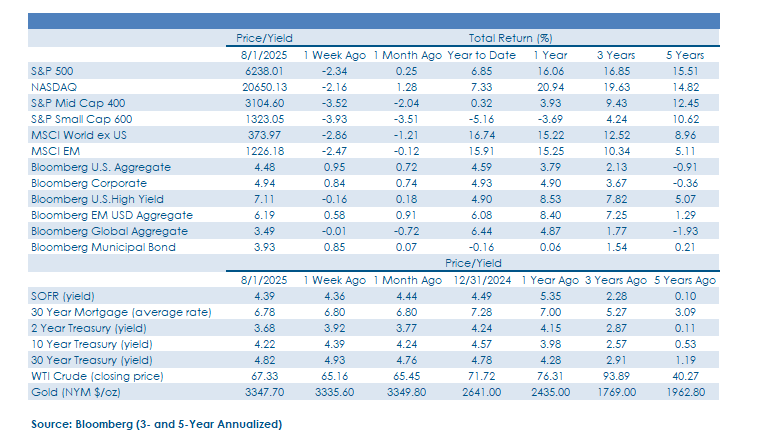

- The S&P 500 closed lower for the first time in three weeks, with the drop attributable to a combination of profit-taking, month-end portfolio rebalancing, and the release of a weaker than expected July nonfarm payrolls report. Quarterly earnings growth out of S&P 500 companies have broadly surprised to the upside and with 25% of the S&P 500 reporting this week, tuning out macro noise and focusing on fundamentals will likely be rewarded.

- The initial public offering (IPO) market remained strong with Figma, a software design firm, going public on Thursday and pricing above the high-end of the expected range due to the offering being 40X oversubscribed. On the mergers and acquisitions (M&A) front, railroad operator Union Pacific announced the purchase of competitor Norfolk Southern in an $83B deal, while Palo Alto Networks announced it would buy smaller cybersecurity peer CyberArk in a $25B transaction. A pick-up in M&A and IPO activity is a sign of improved corporate confidence and should buttress investor sentiment and risk appetite.

- The advance read on 2Q GDP came in at 3.0%, above the 2.6% estimate, and the latest Conference Board Consumer Confidence reading also topped the consensus estimate. But Friday’s release of the July nonfarm payrolls report showed just 73k jobs were created during the month and payrolls growth for the prior two months was revised lower by a total of 258k. On balance, the economic data called into question the health of the U.S. labor market and put substantial downward pressure on Treasury yields into the weekend.

What Happened Last Week:

Stocks: A Market In Search Of Reasons To Pull Back Finds A Few; M&A, IPO Activity Picking Up A Sign Of Improved Corporate Confidence; U.S./EU Trade Deal A ‘Sell The News’ Event For Eurozone Stocks.

A Dip Is Finally Here, Will ‘Locked Out’ Buyers Step In? This has been a market in search of reasons to pullback and last week it found more than a few as the S&P 500 closed out the week with a 2.3% decline as a confluence of events weighed on investor sentiment and drove profit taking at month-end. Last week kicked off on an optimistic note with the announcement of a U.S./EU trade deal or framework, but the S&P 500 failed to hold onto gains and closed Monday with a modest decline. On Wednesday, FOMC Chair Jerome Powell’s post-meeting remarks were taken as ‘hawkish’ and a sign that the Committee was in no hurry to cut rates, again leading to a reversal with gains turning into modest losses. The downside continued to dominate on Thursday as strong earnings reports out of Meta Platforms and Microsoft were unable to buoy the broader index as leadership narrowed. Then on Friday, the S&P 500 fell 1.6% as market participants were rattled by a weaker than expected July jobs report and appeared shocked by the announcement of tariffs on a broad swath of U.S. trading partners, even though the August 1st deadline had been telegraphed for months. After a 28% gain off the April 8th close, the S&P 500 was past due for a breather and last week provided no shortage of data points to rattle even the most dyed in the wool bulls, but we suspect the drawdown will be limited and short-lived. The S&P 500’s 50-day moving average sits around 6,130, or 1.7% below Friday’s close, and that level could provide a floor of support in the lead up to Nvidia’s earnings report on August 27. Many investors have been locked out of the rally due to the ferocity of the move higher and this cohort could be eager to put capital to work after last week’s modest pullback.

Railroad Tie-Up A Potential Sign Of Things To Come On The M&A Front. Last Tuesday, Union Pacific (UNP) announced it would acquire competitor Norfolk Southern (NSC) in a cash and stock transaction valuing the railroad operator at $85B. The combination would create a behemoth and allow the combined entity to move freight across the continental United States, providing formidable competition for CSX and Berkshire Hathaway-owned Burlington Northern Santa Fe. What’s most interesting about this potential tie-up is the fact that management from UNP and NSC have been led to believe the deal would clear the necessary regulatory hurdles to close by early 2027, despite what are likely to be some loud voices stating the deal should be rejected on anti-competitive/monopolistic grounds. This combination has the potential to be a watershed event and embolden other companies operating in relatively concentrated and highly competitive industries to evaluate M&A deals previously viewed as unlikely to clear regulatory hurdles. We have expected M&A transactions to pick-up as tariff/trade-related uncertainty ebbed, but with deals largely occurring in the small- and mid-cap arenas. However, with the UNP/NSC transaction a potential trendsetter, we might need to alter our expectations surrounding larger, more transformative deals in the coming quarters.

U.S./EU Trade Deal A Sell The News Event For Eurozone, Developed Market Stocks Abroad. On Monday, markets opened to the news that the U.S. had struck a trade agreement with the European Union (EU). The deal included a 15% tariff on goods imported from the EU alongside a commitment to invest hundreds of billions of U.S. dollars into the domestic economy in the coming years. While the announcement of a trade deal reduces uncertainty for the EU economy, the MSCI Europe index still fell by 3% on the week in U.S. dollar terms, contributing to a 2.3% weekly drop for the MSCI EAFE developed markets index. While a weak July payrolls report put downward pressure on the U.S. dollar into the weekend, as trade rhetoric dies down and some clarity on the path forward for the U.S. economy comes into view, capital could flow back into the U.S. from abroad. Such a shift would favor U.S. stocks and the S&P 500, specifically, relative to international developed market stocks which fared well in the first half of the year.

Character Change, Or Countertrend Rally For The U.S. Dollar? The U.S. Dollar Index, or DXY, closed out July at 99.96, a high for the month, as economic data proved resilient, trade deals were announced, and the FOMC came across more hawkish than expected and a September rate cut was priced out. But the DXY weakened materially Friday as the tariff pause ended and the U.S. levied higher tariffs on a broad swath of trading partners. The DXY ended the week above its 50-day moving average for the first time since mid-February, and even after Friday’s sharp selloff the DXY remained above the key 98.30 level. A potential reversal of the DXY’s downtrend in place since mid-January is worth watching and would have ramifications for non-U.S. stocks which have benefitted year-to-date from the dollar’s depreciation relative to the euro and British pound, specifically. The DXY making a durable bottom around 97 could spur a reversal of capital flows back into U.S. dollar denominated assets from abroad, benefitting U.S. stocks on a relative basis versus developed market stocks abroad in the coming months/quarters.

Bonds: Treasury Yields Fall As Weak July Payrolls Spur Labor Market Concerns, Rise In September Rate Cut Bets; Riskier Corporate Bonds Sell Off Alongside Lackluster Labor Market Data.

Yields Move Lower As Crosscurrents Abound. U.S. Treasury yields closed out the week lower across the curve with the most sizable downward moves taking place on longer-dated bonds as a weak July payrolls report forced yields lower with market participants betting heavily on a September cut to the Fed funds rate. We continue to view the 4.20% level as a line in the sand for the 10-year Treasury yield with a break below potentially ushering in a move to 4.0% in relatively short order. The Bloomberg Aggregate Bond index turned out a respectable 0.9% weekly gain as the drop in Treasury yields led to gains for higher quality asset-backed securities and investment grade corporates along the way.

Something For Both Hawks And Doves In The Economic Data. While U.S. economic data, on balance, continued to exhibit resiliency, there were some signs of softness in the labor market and some worrisome indicators on the inflation front, providing something for both the hawks and doves on the FOMC to reinforce their stance on the path forward for the Fed funds rate. The job openings and labor turnover survey (JOLTS) for June showed fewer jobs open than expected, and the core PCE price index released alongside the preliminary read on 2Q GDP rose 2.5% quarter over quarter, above the 2.3% estimate. While the advance reading on the 2Q GDP price index showed an annualized rise of just 2.0%, below the 2.2% estimate and the 3.8% reading in the 1Q data.

High Yield Credit Bearing The Brunt Of Labor Market Softness, But Downside Likely Limited. Waning risk appetite that stifled equities spilled over into corporate credit markets late last week as the Bloomberg U.S. Corporate High Yield index fell by just over 0.1%, even as core bonds benefitted from the drop in Treasury yields. The High Yield benchmark held gains early in the week as preliminary 2Q U.S. GDP growth surprised to the upside and consumer confidence readings improved, but those encouraging data points were more than offset by weakness in the July payrolls report on Friday. The July Nonfarm Payrolls miss with just 73k jobs created during the month, well below the consensus estimate of 104k, along with payrolls growth for the prior two months being revised lower by 258k would typically weigh on economically sensitive credit sectors. But expectations for easier monetary policy in the coming months have risen on the heels of the softer labor market data and Fed rate cuts could act as an offset to concerns surrounding economic growth and serve to limit drawdowns for riskier segments of the bond market.

September Rate Cut Gets Priced Out On Hawkish FOMC, Then Gets Priced Back In On Weak Payrolls. The Federal Open Market Committee (FOMC) concluded its two-day meeting on Wednesday and left the Fed funds rate unchanged as expected. Also as anticipated, there were two dissenting voters that lobbied for a quarter-point cut, the first time since 1993 that more than one governor went against the herd/majority. Market-based expectations surrounding a potential September cut to the Fed funds rate bounced around over the balance of the week, falling sharply in the wake of Chair Jerome Powell’s post-meeting press conference from 62% pre-meeting to 40% on Thursday before rising to 87% on Friday on the heels of the weaker July payrolls report. We agree with the market’s assessment that a rate cut in September is more likely than not, but what we don’t yet know is whether the data will deteriorate to the degree required for the Committee to make an outsized half-point rate cut at that time. A pivot away from the FOMC’s preferred 25-basis point move would likely be viewed by market participants as a panic move and potentially evidence that the FOMC believes it is behind the curve and needs to ease policy more aggressively into what is a weaker than anticipated U.S. economic backdrop.

IMPORTANT DISCLOSURES: THIS PUBLICATION HAS BEEN PREPARED BY THE STAFF OF HIGHLAND ASSOCIATES, INC. FOR DISTRIBUTION TO, AMONG OTHERS, HIGHLAND ASSOCIATES, INC. CLIENTS. HIGHLAND ASSOCIATES IS REGISTERED WITH THE UNITED STATES SECURITY AND EXCHANGE COMMISSION UNDER THE INVESTMENT ADVISORS ACT OF 1940. HIGHLAND ASSOCIATES IS A WHOLLY OWNED SUBSIDIARY OF REGIONS BANK, WHICH IN TURN IS A WHOLLY OWNED SUBSIDIARY OF REGIONS FINANCIAL CORPORATION. RESEARCH SERVICES ARE PROVIDED THROUGH MULTI-ASSET SOLUTIONS, A DEPARTMENT OF THE REGIONS ASSET MANAGEMENT BUSINESS GROUP WITHIN REGIONS BANK. THE INFORMATION AND MATERIAL CONTAINED HEREIN IS PROVIDED SOLELY FOR GENERAL INFORMATION PURPOSES ONLY. TO THE EXTENT THESE MATERIALS REFERENCE REGIONS BANK DATA, SUCH MATERIALS ARE NOT INTENDED TO BE REFLECTIVE OR INDICATIVE OF, AND SHOULD NOT BE RELIED UPON AS, THE RESULTS OF OPERATIONS, FINANCIAL CONDITIONS OR PERFORMANCE OF REGIONS BANK. UNLESS OTHERWISE SPECIFICALLY STATED, ANY VIEWS, OPINIONS, ANALYSES, ESTIMATES AND STRATEGIES, AS THE CASE MAY BE (“VIEWS”), EXPRESSED IN THIS CONTENT ARE THOSE OF THE RESPECTIVE AUTHORS AND SPEAKERS NAMED IN THOSE PIECES AND MAY DIFFER FROM THOSE OF REGIONS BANK AND/OR OTHER REGIONS BANK EMPLOYEES AND AFFILIATES. VIEWS AND ESTIMATES CONSTITUTE OUR JUDGMENT AS OF THE DATE OF THESE MATERIALS, ARE OFTEN BASED ON CURRENT MARKET CONDITIONS, AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. ANY EXAMPLES USED ARE GENERIC, HYPOTHETICAL AND FOR ILLUSTRATION PURPOSES ONLY. ANY PRICES/QUOTES/STATISTICS INCLUDED HAVE BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT HIGHLAND ASSOCIATES, INC. DOES NOT WARRANT THEIR COMPLETENESS OR ACCURACY. THIS INFORMATION IN NO WAY CONSTITUTES RESEARCH AND SHOULD NOT BE TREATED AS SUCH. THE VIEWS EXPRESSED HEREIN SHOULD NOT BE CONSTRUED AS INDIVIDUAL INVESTMENT ADVICE FOR ANY PARTICULAR PERSON OR ENTITY AND ARE NOT INTENDED AS RECOMMENDATIONS OF PARTICULAR SECURITIES, FINANCIAL INSTRUMENTS, STRATEGIES OR BANKING SERVICES FOR A PARTICULAR PERSON OR ENTITY. THE NAMES AND MARKS OF OTHER COMPANIES OR THEIR SERVICES OR PRODUCTS MAY BE THE TRADEMARKS OF THEIR OWNERS AND ARE USED ONLY TO IDENTIFY SUCH COMPANIES OR THEIR SERVICES OR PRODUCTS AND NOT TO INDICATE ENDORSEMENT, SPONSORSHIP, OR OWNERSHIP BY REGIONS OR HIGHLAND ASSOCIATES. EMPLOYEES OF HIGHLAND ASSOCIATES, INC., MAY HAVE POSITIONS IN SECURITIES OR THEIR DERIVATIVES THAT MAY BE MENTIONED IN THIS REPORT. ADDITIONALLY, HIGHLAND’S CLIENTS AND COMPANIES AFFILIATED WITH HIGHLAND ASSOCIATES MAY HOLD POSITIONS IN THE MENTIONED COMPANIES IN THEIR PORTFOLIOS OR STRATEGIES. THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR AN INVITATION BY OR ON BEHALF OF HIGHLAND ASSOCIATES TO ANY PERSON OR ENTITY TO BUY OR SELL ANY SECURITY OR FINANCIAL INSTRUMENT OR ENGAGE IN ANY BANKING SERVICE. NOTHING IN THESE MATERIALS CONSTITUTES INVESTMENT, LEGAL, ACCOUNTING OR TAX ADVICE. NON-DEPOSIT PRODUCTS INCLUDING INVESTMENTS, SECURITIES, MUTUAL FUNDS, INSURANCE PRODUCTS, CRYPTO ASSETS AND ANNUITIES: ARE NOT FDIC-INSURED I ARE NOT A DEPOSIT I MAY GO DOWN IN VALUE I ARE NOT BANK GUARANTEED I ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY I ARE NOT A CONDITION OF ANY BANKING ACTIVITY.

NEITHER REGIONS BANK NOR REGIONS ASSET MANAGEMENT (COLLECTIVELY, “REGIONS”) ARE REGISTERED MUNICIPAL ADVISORS NOR PROVIDE ADVICE TO MUNICIPAL ENTITIES OR OBLIGATED PERSONS WITH RESPECT TO MUNICIPAL FINANCIAL PRODUCTS OR THE ISSUANCE OF MUNICIPAL SECURITIES (INCLUDING REGARDING THE STRUCTURE, TIMING, TERMS AND SIMILAR MATTERS CONCERNING MUNICIPAL FINANCIAL PRODUCTS OR MUNICIPAL SECURITIES ISSUANCES) OR ENGAGE IN THE SOLICITATION OF MUNICIPAL ENTITIES OR OBLIGATED PERSONS FOR SUCH SERVICES. WITH RESPECT TO THIS PRESENTATION AND ANY OTHER INFORMATION, MATERIALS OR COMMUNICATIONS PROVIDED BY REGIONS, (A) REGIONS IS NOT RECOMMENDING AN ACTION TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON, (B) REGIONS IS NOT ACTING AS AN ADVISOR TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON AND DOES NOT OWE A FIDUCIARY DUTY PURSUANT TO SECTION 15B OF THE SECURITIES EXCHANGE ACT OF 1934 TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON WITH RESPECT TO SUCH PRESENTATION, INFORMATION, MATERIALS OR COMMUNICATIONS, (C) REGIONS IS ACTING FOR ITS OWN INTERESTS, AND (D) YOU SHOULD DISCUSS THIS PRESENTATION AND ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS WITH ANY AND ALL INTERNAL AND EXTERNAL ADVISORS AND EXPERTS THAT YOU DEEM APPROPRIATE BEFORE ACTING ON THIS PRESENTATION OR ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS.

SOURCE: BLOOMBERG INDEX SERVICES LIMITED. BLOOMBERG® IS A TRADEMARK AND SERVICE MARK OF BLOOMBERG FINANCE L.P. AND ITS AFFILIATES (COLLECTIVELY “BLOOMBERG”). BARCLAYS® IS A TRADEMARK AND SERVICE MARK OF BARCLAYS BANK PLC (COLLECTIVELY WITH ITS AFFILIATES, “BARCLAYS”), USED UNDER LICENSE. BLOOMBERG OR BLOOMBERG’S LICENSORS, INCLUDING BARCLAYS, OWN ALL PROPRIETARY RIGHTS IN THE BLOOMBERG BARCLAYS INDICES. NEITHER BLOOMBERG NOR BARCLAYS APPROVES OR ENDORSES THIS MATERIAL OR GUARANTEES THE ACCURACY OR COMPLETENESS OF ANY INFORMATION HEREIN, OR MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED THEREFROM AND, TO THE MAXIMUM EXTENT ALLOWED BY LAW, NEITHER SHALL HAVE ANY LIABILITY OR RESPONSIBILITY FOR INJURY OR DAMAGES ARISING IN CONNECTION THEREWITH.