Stocks: U.S. Stocks Shrug Off Tariff Headlines, Close The Week Higher On Improved Breadth; Earnings Revisions Favor International Relative To Domestic Exposures; Chinese Stocks Rally Amid Conflicting Reports Of Trade Discussions With The U.S.

Download Weekly Market Commentary | April 28 2025

What We’re Watching:

- The Conference Board releases results from its April Consumer Confidence survey on Tuesday with the headline reading expected to fall to 87.6 from 92.9 in March. The Expectations component of the survey is worth watching for a reading as to how consumers expect tariffs to impact their spending habits.

- March Personal Consumption Expenditure (PCE), the FOMC’s preferred inflation gauge, is released Wednesday. Headline PCE is expected to be flat month over month and rise 2.2% year over year, which would be notable drops from 0.3% and 2.5% readings in February. Core PCE, which is more closely watched, is expected to rise 0.1% month over month and 2.6% year over year versus 0.4% and 2.8% readings the prior month. There will be little/no impact from tariffs included in the March PCE readings, and market participants could dismiss this release as a result, but it’s worth watching, nonetheless.

- April Nonfarm Payrolls are released Friday with the consensus estimate calling for 130k jobs to have been created during the month vs. 228k in March. The unemployment rate is expected to remain unchanged from the 4.2% reading in March. Average hourly earnings are expected to rise 0.3% month over month and 3.9% year over year, compared to 0.3% and 3.8% increases in March.

Key Observations

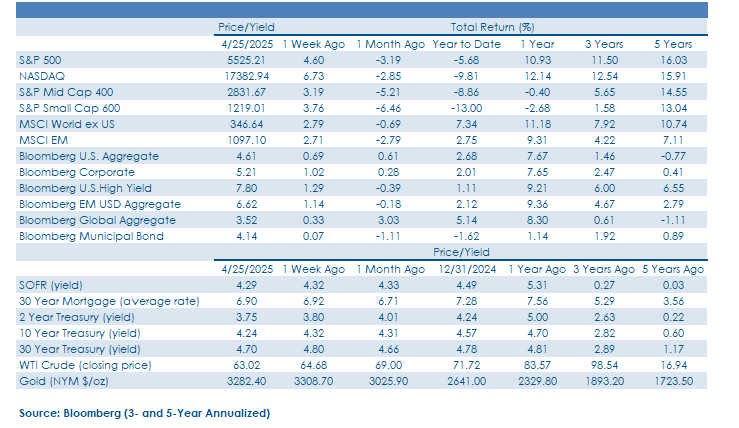

- U.S. stocks staged a broad-based rally despite continued saber rattling on the trade front between the U.S. and China. The S&P 500 was propelled by ‘Mag 7’ strength, which led to outperformance out of the consumer discretionary, and information technology sectors, specifically. Breadth, or participation, has improved meaningfully in recent weeks and trend following strategies, as well as an uptick in corporate buyback activity, could be supportive of further gains into May.

- The S&P 500 closed above 5,450, a closely watched technical level that provided a ceiling of resistance on April 9 when President Trump announced a 90-day hiatus on reciprocal tariffs. This level is worth watching as potential support, possibly providing a springboard for additional upside in the coming weeks. We are watching the S&P 500’s 200-day moving average around 5,650 which could provide resistance and cap upside in the near-term.

- Treasury yields closed out the week modestly lower, driving respectable gains for core, investment-grade bonds, but it was lower quality corporate bonds that were the big winner on the week. Credit spreads narrowed materially over the balance of the week as investors appeared eager to scoop up riskier, higher yielding credits even as issuance ticked up after coming to a standstill amid tariff uncertainty in early April. The rally in high yield bonds shows that risk appetite has returned in recent weeks, and further spread compression would likely provide a continued tailwind for U.S. stocks in the coming weeks.

What Happened Last Week:

Stocks: U.S. Stocks Shrug Off Tariff Headlines, Close The Week Higher On Improved Breadth; Earnings Revisions Favor International Relative To Domestic Exposures; Chinese Stocks Rally Amid Conflicting Reports Of Trade Discussions With The U.S.

Rally In U.S. Large-Caps Has The Look Of More Than Just Short Covering. The S&P 500 ended the week higher by 4.6% and, importantly from a technical perspective, closed above 5,450, a level where the index was turned away on April 9 when President Trump announced a 90-day reprieve on reciprocal tariffs. Short covering appeared to initially provide a powerful catalyst for stocks early in the week as some of the most beaten down stocks year-to-date led the charge. But as the week progressed there were some obvious signs of accumulation and buyers stepping in, despite continued saber rattling and little in the way of obvious progress on the tariff front. When individual stocks or broader indices rally either on bad news or in the absence of good news we take note, and that’s what appeared to materialize last week. Breadth/participation has improved materially in recent weeks and just shy of 70% of S&P 500 constituents were trading above their 20- day moving average as of last Friday, up from closer to 30% a couple weeks ago. We would like to see longer- term breadth measures improve in the coming weeks as only around 1/3 of S&P 500 constituents are trading above their 100- and 200-day moving average, but last week’s price action was a good start. Signals for systematic trend following strategies flipping bullish, along with a return of corporate buyback activity as the blackout period around earnings ends, could spur additional demand for stocks in the coming weeks and drive further gains. At the sector level, leadership was constructive as defensive pockets of the market such as consumer staples, health care, and utilities all lagged while communication services, consumer discretionary, and information technology all outperformed the broader S&P 500.

Earnings Estimates Falling Stateside But Are Rising Abroad, Supportive Of Improved Relative Performance Out Of Foreign Stocks. On balance, early returns from earnings season have been encouraging, but unfortunately analysts are forecasting a tougher environment going forward and have begun to ratchet lower earnings estimates as a result. Stateside, the consensus estimate for 2025 S&P 500 earnings has fallen from $272 to $265 since the start of the year, with likely further downside to go. This stands in stark contrast to what we’re seeing abroad with the estimate for MSCI EAFE earnings moving higher to $166 from $162 at the start of the year. Those adjustments now have earnings growth between the S&P 500 and EAFE roughly 1% apart, a much tighter gap than we’ve seen in recent years. This is a downstream impact of divergent monetary policies, and shifts we’ve seen in the outlook for fiscal policy, as well as trade uncertainty weighing on the U.S. dollar.

Japanese Yen Worth Watching As An Indicator Of Risk Appetite. On the currency front, the Japanese yen retested the ¥140 to $1 level from last September early last week and again found support at that level. The yen weakened versus the dollar over the balance of the week and closed at ¥143.73 to $1. Why does what the Japanese yen is doing matter to stock investors? The yen is often viewed as a haven currency and tends to rally in risk off environments, while a weaker yen can contribute to rising stock prices as foreign investors borrow cheap capital in the weaker currency and then buy riskier assets with it. Thus, a weakening of the yen is, in essence, a vote of confidence for riskier assets such as stocks and corporate bonds. The U.S. dollar remains a key barometer of where market participants believe the U.S. economy is headed, and some stabilization or modest strengthening of the greenback would be welcomed by investors in U.S. stocks.

Rumors Of U.S./China Trade Discussions Boost Emerging Markets. Despite conflicting accounts that trade talks between the U.S. and China were ongoing, investors chose to take a glass half-full approach to the tariff discussions and bid-up Chinese stocks, leading to a 5.3% weekly gain for the MSCI China index, while the broader MSCI Emerging Market index notched a 2.7% advance. Rumors of conversations between the two nations align with our belief that neither stands to benefit from embargo-level tariffs for an extended period, a message business leaders reinforced to President Trump last week. The impact of trade barriers has already influenced the number of container ships departing China for the U.S., with traffic down 30% from where it was at the start of April and likely to slow further. Notably, these container ships take ~27 days to travel from China to the U.S., creating a delay in delivery that could lead to shortages of goods. Both countries have incentives to work something out, and hopefully happens in the near-term to avoid more economic pain.

Bonds: Tariff Headlines, Treasury Auctions Leading To Fits And Starts For U.S. Rates; Credit Well-Bid In Recent Rally; Automobile Sales Strong In March, But Few Signs Of Demand Pull Forward Elsewhere; U.S. Labor Market Looks Stable, Making A Mid-June Rate Cut Less Likely.

Treasury Yields Chop Around, End The Week Modestly Lower. Last Monday, the Treasury market was rattled by tweets from President Trump calling into question Chair Jerome Powell’s standing as the head of the Federal Open Market Committee (FOMC). A potential Powell ouster led to concerns surrounding whether he could be fired and, if so, what would that imply for Fed independence from the executive branch. Fears that the President could attempt to fire the Fed Chair initially put upward pressure on Treasury yields early in the week, that receded over the back-half of the week as President Trump stated he would not try to force Chair Powell out. Treasury auctions took a backset to trade headlines and flew under the radar last week, but demand from abroad for $69B of 2-year notes on Tuesday, $70B of 5-year notes Wednesday, and $44B of 7-year notes on Thursday was encouraging and contributed to the drift lower for yields into the weekend. All told, yields on 2- and 10-year U.S. Treasuries fell 5- and 8-basis points, respectively, on the week. The move lower in yields contributed to a 0.6% weekly gain out of the Bloomberg Aggregate Bond index and a more sizable 1% return out of the more interest rate sensitive Bloomberg U.S. Corporate index. Riskier, higher yielding corporate bonds were the big winner on the week as the Bloomberg U.S. Corporate High Yield index gained 1.2% as credit spreads narrowed from 398-basis points over similar duration Treasuries to 360-basis points, the biggest move in a single week since November of 2023. A break below 350-basis points could signal a more durable return of risk appetite. Below investment grade issuance was encouraging as the three primary deals that came to market were met with robust demand, but barring a flurry of last-minute deals this week, issuance for April is still on track for the lowest volume in the last 5-years.

Demand Pull Forward For Automobiles Evident In March Durable Goods Orders, But Few Signs Of Inventory Building Elsewhere During The Month. Durable goods orders for March were released last Thursday with the headline reading rising 9.2%, well ahead of the 2.0% estimate. But excluding transportation, primarily automobiles, that figure dropped to 0.0%, which fell short of the 0.3% estimate. Bigger ticket items such as automobiles, consumer electronics, furniture, and home appliances account for the bulk of durable goods orders, many of which are imported. Economists were expecting a pull forward of demand in March as companies attempted to build up inventory in advance of tariffs on a broad swath of goods going into effect in early April, but outside of automobiles, that didn’t appear to be the case.

Initial, Continuing Jobless Claims Show A Stable Labor Market In The Lead-Up To April Nonfarm Payrolls This Friday. Initial and continuing claims for unemployment insurance were released last Thursday. Initial jobless claims for the week ending April 19 rose 7k week over week to 222k, in- line with the consensus estimate, while continuing jobless claims for the week ended April 12 fell by 44k week over week to 1,841k, below the consensus estimate. All told, jobless claims data have remained steady in recent months and haven’t shown signs of materially cooling despite tariff turmoil. Market participants will be closely watching the April nonfarm payrolls report released this Friday for evidence to the contrary, as the current consensus estimate calls for 130k jobs to have been created during the month, which would be a notable drop from 228k in March, but the unemployment rate is expected to remain static month over month at 4.2%. Barring substantial deterioration in the labor market between now and the FOMC’s mid-June meeting, we don’t see Powell & Company feeling the need to come to the market’s rescue anytime soon. Fed funds futures are currently pricing in around a 60% chance of a quarter-point cut by mid-June and a 75% chance of one by the end of July, However, if layoffs don’t materially tick up in the near- term, tariff/trade uncertainty will likely keep the FOMC in wait and see mode for longer as the price stability portion of its dual mandate continues to take precedent over the full employment component.

IMPORTANT DISCLOSURES: THIS PUBLICATION HAS BEEN PREPARED BY THE STAFF OF HIGHLAND ASSOCIATES, INC. FOR DISTRIBUTION TO, AMONG OTHERS, HIGHLAND ASSOCIATES, INC. CLIENTS. HIGHLAND ASSOCIATES IS REGISTERED WITH THE UNITED STATES SECURITY AND EXCHANGE COMMISSION UNDER THE INVESTMENT ADVISORS ACT OF 1940. HIGHLAND ASSOCIATES IS A WHOLLY OWNED SUBSIDIARY OF REGIONS BANK, WHICH IN TURN IS A WHOLLY OWNED SUBSIDIARY OF REGIONS FINANCIAL CORPORATION. RESEARCH SERVICES ARE PROVIDED THROUGH MULTI-ASSET SOLUTIONS, A DEPARTMENT OF THE REGIONS ASSET MANAGEMENT BUSINESS GROUP WITHIN REGIONS BANK. THE INFORMATION AND MATERIAL CONTAINED HEREIN IS PROVIDED SOLELY FOR GENERAL INFORMATION PURPOSES ONLY. TO THE EXTENT THESE MATERIALS REFERENCE REGIONS BANK DATA, SUCH MATERIALS ARE NOT INTENDED TO BE REFLECTIVE OR INDICATIVE OF, AND SHOULD NOT BE RELIED UPON AS, THE RESULTS OF OPERATIONS, FINANCIAL CONDITIONS OR PERFORMANCE OF REGIONS BANK. UNLESS OTHERWISE SPECIFICALLY STATED, ANY VIEWS, OPINIONS, ANALYSES, ESTIMATES AND STRATEGIES, AS THE CASE MAY BE (“VIEWS”), EXPRESSED IN THIS CONTENT ARE THOSE OF THE RESPECTIVE AUTHORS AND SPEAKERS NAMED IN THOSE PIECES AND MAY DIFFER FROM THOSE OF REGIONS BANK AND/OR OTHER REGIONS BANK EMPLOYEES AND AFFILIATES. VIEWS AND ESTIMATES CONSTITUTE OUR JUDGMENT AS OF THE DATE OF THESE MATERIALS, ARE OFTEN BASED ON CURRENT MARKET CONDITIONS, AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. ANY EXAMPLES USED ARE GENERIC, HYPOTHETICAL AND FOR ILLUSTRATION PURPOSES ONLY. ANY PRICES/QUOTES/STATISTICS INCLUDED HAVE BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT HIGHLAND ASSOCIATES, INC. DOES NOT WARRANT THEIR COMPLETENESS OR ACCURACY. THIS INFORMATION IN NO WAY CONSTITUTES RESEARCH AND SHOULD NOT BE TREATED AS SUCH. THE VIEWS EXPRESSED HEREIN SHOULD NOT BE CONSTRUED AS INDIVIDUAL INVESTMENT ADVICE FOR ANY PARTICULAR PERSON OR ENTITY AND ARE NOT INTENDED AS RECOMMENDATIONS OF PARTICULAR SECURITIES, FINANCIAL INSTRUMENTS, STRATEGIES OR BANKING SERVICES FOR A PARTICULAR PERSON OR ENTITY. THE NAMES AND MARKS OF OTHER COMPANIES OR THEIR SERVICES OR PRODUCTS MAY BE THE TRADEMARKS OF THEIR OWNERS AND ARE USED ONLY TO IDENTIFY SUCH COMPANIES OR THEIR SERVICES OR PRODUCTS AND NOT TO INDICATE ENDORSEMENT, SPONSORSHIP, OR OWNERSHIP BY REGIONS OR HIGHLAND ASSOCIATES. EMPLOYEES OF HIGHLAND ASSOCIATES, INC., MAY HAVE POSITIONS IN SECURITIES OR THEIR DERIVATIVES THAT MAY BE MENTIONED IN THIS REPORT. ADDITIONALLY, HIGHLAND’S CLIENTS AND COMPANIES AFFILIATED WITH HIGHLAND ASSOCIATES MAY HOLD POSITIONS IN THE MENTIONED COMPANIES IN THEIR PORTFOLIOS OR STRATEGIES. THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR AN INVITATION BY OR ON BEHALF OF HIGHLAND ASSOCIATES TO ANY PERSON OR ENTITY TO BUY OR SELL ANY SECURITY OR FINANCIAL INSTRUMENT OR ENGAGE IN ANY BANKING SERVICE. NOTHING IN THESE MATERIALS CONSTITUTES INVESTMENT, LEGAL, ACCOUNTING OR TAX ADVICE. NON-DEPOSIT PRODUCTS INCLUDING INVESTMENTS, SECURITIES, MUTUAL FUNDS, INSURANCE PRODUCTS, CRYPTO ASSETS AND ANNUITIES: ARE NOT FDIC-INSURED I ARE NOT A DEPOSIT I MAY GO DOWN IN VALUE I ARE NOT BANK GUARANTEED I ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY I ARE NOT A CONDITION OF ANY BANKING ACTIVITY.

NEITHER REGIONS BANK NOR REGIONS ASSET MANAGEMENT (COLLECTIVELY, “REGIONS”) ARE REGISTERED MUNICIPAL ADVISORS NOR PROVIDE ADVICE TO MUNICIPAL ENTITIES OR OBLIGATED PERSONS WITH RESPECT TO MUNICIPAL FINANCIAL PRODUCTS OR THE ISSUANCE OF MUNICIPAL SECURITIES (INCLUDING REGARDING THE STRUCTURE, TIMING, TERMS AND SIMILAR MATTERS CONCERNING MUNICIPAL FINANCIAL PRODUCTS OR MUNICIPAL SECURITIES ISSUANCES) OR ENGAGE IN THE SOLICITATION OF MUNICIPAL ENTITIES OR OBLIGATED PERSONS FOR SUCH SERVICES. WITH RESPECT TO THIS PRESENTATION AND ANY OTHER INFORMATION, MATERIALS OR COMMUNICATIONS PROVIDED BY REGIONS, (A) REGIONS IS NOT RECOMMENDING AN ACTION TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON, (B) REGIONS IS NOT ACTING AS AN ADVISOR TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON AND DOES NOT OWE A FIDUCIARY DUTY PURSUANT TO SECTION 15B OF THE SECURITIES EXCHANGE ACT OF 1934 TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON WITH RESPECT TO SUCH PRESENTATION, INFORMATION, MATERIALS OR COMMUNICATIONS, (C) REGIONS IS ACTING FOR ITS OWN INTERESTS, AND (D) YOU SHOULD DISCUSS THIS PRESENTATION AND ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS WITH ANY AND ALL INTERNAL AND EXTERNAL ADVISORS AND EXPERTS THAT YOU DEEM APPROPRIATE BEFORE ACTING ON THIS PRESENTATION OR ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS.

SOURCE: BLOOMBERG INDEX SERVICES LIMITED. BLOOMBERG® IS A TRADEMARK AND SERVICE MARK OF BLOOMBERG FINANCE L.P. AND ITS AFFILIATES (COLLECTIVELY “BLOOMBERG”). BARCLAYS® IS A TRADEMARK AND SERVICE MARK OF BARCLAYS BANK PLC (COLLECTIVELY WITH ITS AFFILIATES, “BARCLAYS”), USED UNDER LICENSE. BLOOMBERG OR BLOOMBERG’S LICENSORS, INCLUDING BARCLAYS, OWN ALL PROPRIETARY RIGHTS IN THE BLOOMBERG BARCLAYS INDICES. NEITHER BLOOMBERG NOR BARCLAYS APPROVES OR ENDORSES THIS MATERIAL OR GUARANTEES THE ACCURACY OR COMPLETENESS OF ANY INFORMATION HEREIN, OR MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED THEREFROM AND, TO THE MAXIMUM EXTENT ALLOWED BY LAW, NEITHER SHALL HAVE ANY LIABILITY OR RESPONSIBILITY FOR INJURY OR DAMAGES ARISING IN CONNECTION THEREWITH.