Stocks: Retail Sales Surprise To The Upside But Can’t Offset Higher Rates And Geopolitical Risk; Shift In Leadership Evident In Foreign Developed Markets As The Japanese Yen Struggles To Find Support; China’s Relative Surge Strengthens The Case For Emerging

Download Weekly Market Commentary | April 22 2024

What We’re Watching:

- U.S. Purchasing Managers Index (PMI) for April is released Tuesday with a 52.5 Composite reading expected, which would be an improvement from 52.1 in March. Manufacturing PMI is expected to improve to 52.2 from 51.9 in March, while Services PMI is expected to rise modestly to 52 from 51.7. A reading above 50 indicates expansion, while below 50 indicates contraction.

- Eurozone Purchasing Managers Index (PMI) Composite for April is also set for release Tuesday with a 50.8 reading expected, which would be a modest uptick from the 50.3 reading in March. Manufacturing PMI is expected to rise to 46.7 from 46.1 the prior month, while Services PMI is expected to rise to 51.8 from 51.5 in March.

- March Core PCE Deflator, the FOMC’s preferred inflation gauge, is released Friday with the headline reading expected to rise 0.30% month over month and 2.6% year over year. Core PCE, which is viewed as more impactful for the purposes of setting monetary policy, is expected to rise 0.30% month over month versus 0.26% in February, and 2.7% year over year, which would be 0.1% below the prior month’s reading.

- The first read on 1Q24 GDP comes out on Thursday, with the expectation that GDP annualized quarter over quarter decline to 2.3% from the prior quarter print at 3.4%. Growth expectations continue to grind higher since the start of the year, setting a high bar for the US economy that still seems well within reach.

Key Observations

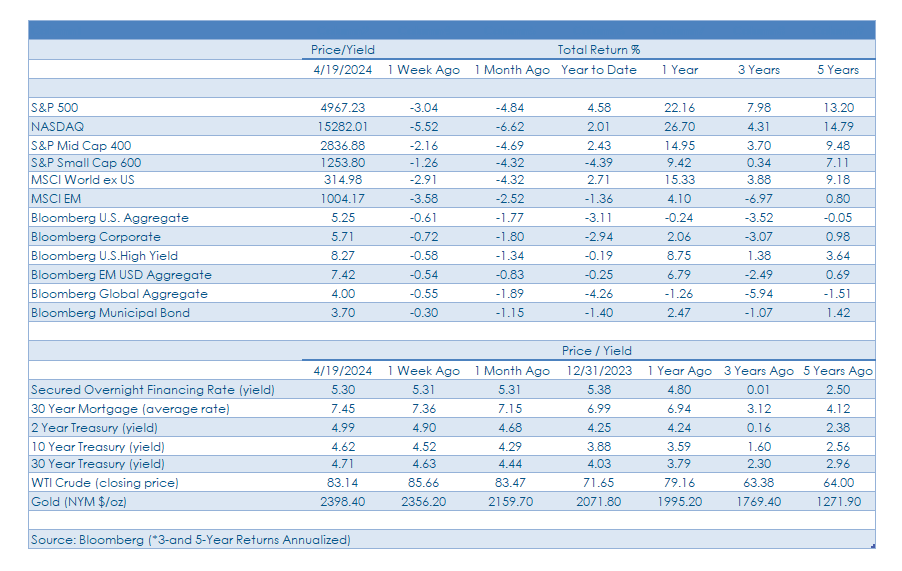

- Domestic equities faced selling pressure yet again as higher interest rates and geopolitical tensions put investors on high alert with technology stocks experiencing the deepest drawdown.

- Bond markets faltered for the third consecutive week, the longest slide since October, with yields rising across the curve as CPI carry over effects were emphasized by Fed speakers over the balance of the week, leaving the market to again push out hopes for monetary policy easing.

- Riskier corporate bonds experienced price declines and wider option-adjusted spreads (OAS) by the most in a week since January and before that October, but indicators of market health like steady issuance and low concessions looks more like profit-taking behavior than panic selling.

What Happened Last Week:

Stocks: Retail Sales Surprise To The Upside But Can’t Offset Higher Rates And Geopolitical Risk; Shift In Leadership Evident In Foreign Developed Markets As The Japanese Yen Struggles To Find Support; China’s Relative Surge Strengthens The Case For Emerging

Stocks Reeling As Rising Rates And Geopolitical Angst Keep Dip-Buyers At Bay. Stocks and bonds traded in concert last week, impacted by carry-over inflation concerns that led the S&P 500 to a 3% decline. Equity market participants attempted to buy overnight dips, leading to gains at the open on multiple occasions throughout the week, but early morning positive price action failed to be sustained and selling pressure returned, centered around earnings and economic releases. The retail sales numbers on Monday provided a catalyst for gains as consumers appeared to begrudgingly continue spending, but optimism proved fleeting after the bond market only took the hot retail sales report to imply that inflation readings would likely remain elevated, which again put upward pressure on Treasury yields and equity valuations. After a 5% peak-to- trough drawdown in the S&P 500, we continue to see/hear numerous calls that the pullback should be bought, but a garden variety 5% pullback feels too easy, and sentiment may need to swing more toward pessimism/fear before a durable bottom can be found. We remain constructive on stocks for 2024, but until the liquidity backdrop improves in May and Treasury yields back off a bit, bounces may be limited as investors are more likely to sell into strength.

Leadership Shift In Developed Markets Abroad As Yen Weakness Becomes A Headwind. The Japanese yen continued to slide relative to the U.S. dollar last week and hit ¥155 to $1 last Wednesday, a level last seen in 1990. Yen weakness over the balance of 2023 contributed in a big way to improved performance out of Japanese stocks, but of late the yen’s slide has proven problematic and has begun to weigh on the Nikkei 225. Market participants have been pressing their bets against the yen as the Bank of Japan’s attempts to prop-up the currency have so far fallen on deaf ears, and without action, it’s likely the yen’s slide will continue, weighing on Japanese equities, broadly speaking. This past week Japanese equities notched a 3.7% decline, while UK equities fell a far less dramatic 0.7%, a continuation of the rotation out of Japan we’ve observed in recent weeks. That trend is likely to persist should the BoE and ECB ease monetary policy as expected in June. An improved economic growth outlook and interest rate differentials favor the U.K. and Eurozone; however, growth in shareholder friendly practices in Japan provide reasons for investors to maintain allocations to the country, albeit with more reasonable return expectations moving forward.

China The Lone Bright Spot In An Otherwise Challenging Emerging Market Tape. After performing surprisingly well in the prior week, the MSCI Emerging Markets (EM) appeared to hit another rough patch last week before economic and market data out of China boosted the index up 0.2%. China first quarter GDP grew at 5.3% annualized, above the consensus estimate of 4.8% and the country’s own 5% target, but markets appeared critical of that number, and it wasn’t until regulators announced they would support mainland companies listing in Hong Kong that financial sector stocks gained ground. While Chinese stocks rallied due to country- specific factors, breadth within the MSCI EM index was .poor as India, South Korea, Brazil, and Taiwan, which combined account for over 50% of the index, each fell 2% or more on the week. Emerging markets have been and remain a country selection story, and while relative outperformers were tough to come by last week, we remain relatively constructive on the asset class and expect improved absolute and relative performance over the balance of 2024 as the dollar’s trend reverses and hopefully geopolitical tensions ebb allowing energy prices to normalize.

Dollar Upside Likely From Here. The U.S. Dollar Index, or DXY, has rallied sharply since bottoming in mid-March at 102.71, but the DXY churned last week landing around 105.97. The impetus for the move higher in the dollar over the past five-plus weeks has been two-fold, driven by heightened geopolitical tensions pushing capital into the greenback as a safe haven asset, and sticky U.S. inflation readings which have led market participants to ratchet down expectations for rate cuts this year.What’s most striking is that the dollar has been strong versus not just the Japanese yen, but also the British pound and euro as the Bank of England and European Central Bank are expected to begin cutting rates sooner than the FOMC. Even with a handful of catalysts in place to facilitate a push higher in the DXY over the past month or so, the index has been unable to break above 107, it’s October of 2023 high. After peaking at 106.50 last week, from here, upside for the dollar is likely limited, even if Treasury yields rise further and retest September/October 2023 highs. A stable dollar, even if remaining relatively strong, could spur buying interest in developed and developing market stocks abroad in the coming months and we continue to see diversification benefits from holding foreign stocks as a relative value play at present and with a clearer path forward for the dollar could be driving inflows.

Bonds: A Resilient Consumer Equates To Bad News For Treasury Bonds; Fed Chair’s Comments Send 2-Year Yield Toward 5%; Credit Cheapens As Spreads Widen, But Do So In An Orderly Fashion.

Strong Consumer Spending Pushes Yields Higher Still. The bond market barely had time to open on Monday before retail sales surprised to the upside, another indicator that consumers are showing little signs of slowing their spending. Robust retail sales pushed yields on inflation break evens higher to levels last seen in October. After a lull in March, interest rate volatility has returned with the BofA MOVE Index, commonly thought of as the VIX, or volatility index for the bond market, nearing early January highs. Long-term Treasuries and investment grade corporates continued their month-to-date slide with the former declining 1.1% and the latter closing the week down by 1.4%. Elevated daily volume last week and market voices calling for 4.75% to be the line in the sand for the 10-year Treasury yield suggest we’re far closer to a near-term ceiling than a floor, even if the peak is modestly above last weeks close of 4.62%. Another consideration for bond investors is upcoming near-term catalysts including this Friday’s Core Personal Consumption Expenditure (PCE), which could shed light on just how concerned the Fed should be with the recent bout of inflation. If that number posts a positive surprise and comes in below the 2.7% estimate, Treasury bonds could catch a bid and bond markets might get a much-needed reprieve.

Fed Speakers Spark Move Higher In Short-Term Treasury Yields. Shorter duration securities were also subject to price declines last week as FOMC Chair Jerome Powell’s public comments did little to calm jittery markets. The 2-year Treasury yield, specifically, approached 5% multiple times last week before closing the week just below that level at 4.98%. The Fed Chairman’s remarks were lacking in new information, in our opinion, but market participants took his remarks as hawkish, leading some to speculate that Chair Powell could be bracing markets for inflation to remain sticky and elevated for longer. Along those lines, monetary policymakers would likely prefer to see modestly tighter financial conditions in the wake of recent inflation data, thus, a message of patience is prudent and warranted. Hawkish undertones from other Fed speakers were evident throughout the week with a barrage of regional Fed presidents reiterating their resolve and talking down the prospect of near-term cuts to the Fed funds rate, with one keeping the idea of additional hikes on the table. Sentiment within the Fed could shift abruptly if the labor market or economic growth show signs of faltering, but until the data shifts there appears to be little reason to expect rate cuts to materialize in the near-term, and with inflation remaining sticky, upward pressure on short-term yields could persist.

Credit Markets Caught Up In Duration Drama. High yield credit spreads experienced their sharpest weekly jump since January, widening mid-week before buyers stepped in and spreads narrowed, perhaps surprisingly, into the weekend. High yield bonds appear to be the ‘best house in a bad neighborhood’ but the unyielding demand we saw in the first quarter was absent last week as the Bloomberg High Yield Index fell just shy of 0.6%. Outflows have plagued high yield mutual funds in seven of the last ten weeks. The steepest decline last week was in CCC-rated securities that dropped 1.1% as investors are likely taking profits after sizable gains in lower quality credits over the prior two quarters. Conversely, more liquid BB-rated bonds ended the week lower by 0.4%. General signs of market health like continued elevated issuance remained in place last week as roughly $11B in new deals entered the market at or below expected prices. The steady stream of issuance and few offerings getting shelved signals that companies are willing to accept current spreads while buyers seem less concerned about credit spreads widening materially from here and prefer to lock-in some of the best yields seen year-here andto-date. High yield spreads could push out modestly from here but total return potential over the next 12-months or so remains appealing with yields approaching 8.3%.

The content and any portion of this newsletter is for personal use only and may not be reprinted, sold or redistributed without the written consent of Regions Bank. Regions, the Regions logo and other Regions marks are trademarks of Regions Bank. The names and marks of other companies or their services or products may be the trademarks of their owners and are used only to identify such companies or their services or products and not to indicate endorsement or sponsorship of Regions or its services or products. The information and material contained herein is provided solely for general information purposes.

Regions does not make any warranty or representation relating to the accuracy, completeness or timeliness of any information contained in the newsletter and shall not be liable for any damages of any kind relating to such information nor as to the legal, regulatory, financial or tax implications of the matters referred herein. This material is not intended to be investment advice nor is this information intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only current as of the stated date of their issue. Regions Asset Management is a business group within Regions Bank that provides investment management services to customers of Regions Bank. Employees of Regions Asset Management may have positions in securities or their derivatives that may be mentioned in this report or in their personal accounts. Additionally, affiliated companies may hold positions in the mentioned companies in their portfolios or strategies. The companies mentioned specifically are sample companies, noted for illustrative purposes only.

The mention of the companies should not be construed as a recommendation to buy, hold or sell positions in your investment portfolio. Neither Regions Bank nor Regions Asset Management (collectively, “Regions”) are registered municipal advisors nor provide advice to municipal entities or obligated persons with respect to municipal financial products or the issuance of municipal securities (including regarding the structure, timing, terms and similar matters concerning municipal financial products or municipal securities issuances) or engage in the solicitation of municipal entities or obligated persons for such services.

With respect to this presentation and any other information, materials or communications provided by Regions, (a) Regions is not recommending an action to any municipal entity or obligated person, (b) Regions is not acting as an advisor to any municipal entity or obligated person and does not owe a fiduciary duty pursuant to Section 15 B of the Securities Exchange Act of 1934 to any municipal entity or obligated person with respect to such presentation, information, materials or communications, (c) Regions is acting for its own interests, and (d) you should discuss this presentation and any such other information, materials or communications with any and all internal and external advisors and experts that you deem appropriate before acting on this presentation or any such other information, materials or communications. Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The information provided herein is for informational purposes only and is intended to report on various investment views held by Multi-Asset Solutions (MAS) and Highland Associates. Opinions, estimates, forecasts, and statements of financial market trends are based on current market conditions that constitute the judgement of MAS and Highland Associates and are subject to change. The information is received from third parties, which is believed to be accurate, but no representation is made that the information provided is accurate and complete. The information is given as of the date indicated and believed to be reliable. While MAS and Highland have tried to provide accurate and timely information, there may be inadvertent technical or factual inaccuracies or typographical errors for which we apologize. The information provided herein does not constitute a solicitation or offer by Highland or its affiliates, to buy or sell any securities or other financial instrument, or to provide investment advice or service. Nothing contained herein should be construed as investment advice or a recommendation to purchase or sell a particular security. Investing involves a high degree of risk, and all investors should carefully consider their investment objective and the suitability of any investments.

Research services are provided through Multi-Asset Solutions, a department of the Regions Asset Management business group within Regions Bank. Highland is a wholly owned subsidiary of Regions Bank, which in turn is a wholly owned subsidiary of Regions Financial Corporation.

Past performance is not indicative of future results. Investments are subject to loss.