Stocks: Sellers In Control As Buyers Go On Strike; Profit-Taking To Pay Taxes, Rising Geopolitical Tensions Spur Low-Volume Selloff; A Lackluster Start To Earnings Season; Emerging Markets Fare Better Than Feared.

Download Weekly Market Commentary | April 15 2024

What We’re Watching:

- U.S. Industrial Production for March is released Tuesday and is expected to rise 0.4% month over month, which would be a sizable jump from 0.1% month over month growth in February if it comes in as expected.

- The final read on the Eurozone Consumer Price Index (CPI) for March is released Wednesday with headline CPI expected to rise 0.8% month over month and 2.4% year over year, while core CPI is expected to rise 2.9% year over year.

- Japan’s Consumer Price Index (CPI) is released Thursday with the headline reading expected to rise 2.8% year over year, in-line with the February reading. CPI ex Fresh Food and Energy is expected to rise 2.7% year over year, which would be a welcome deceleration from a 3.2% year over year rise in February. The Bank of Japan will be closely watching these figures for signs that inflation may be decelerating, allowing them to stand pat on policy despite significant weakness in the Japanese yen over recent weeks.

- The Philadelphia Fed Manufacturing Index for April is released Thursday with a 5.0 reading expected, which would be a notable improvement from a 3.2 reading in March and positive signal that the manufacturing segment of the U.S. economy could be picking up steam into the summer months.

Key Observations

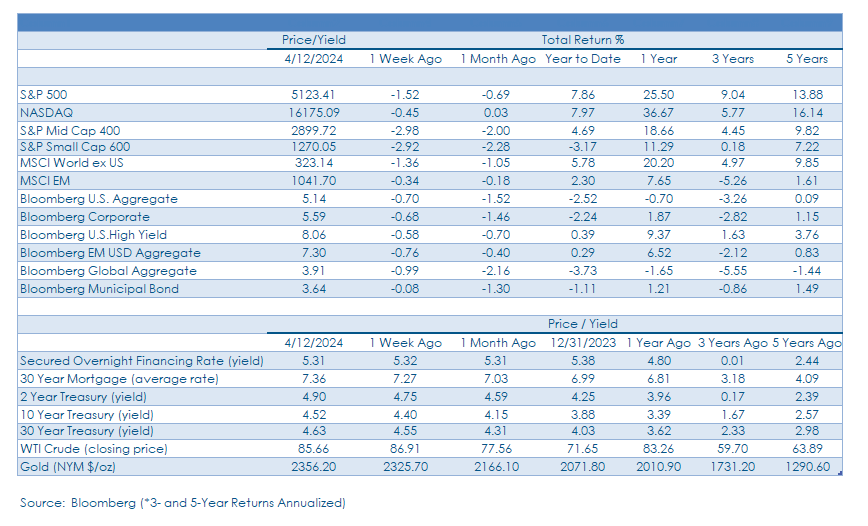

- Global equities sold off last week as a confluence of events contributed to a buyer’s strike. With the April 15th deadline to file taxes looming, investors appeared to take profits from some of their biggest winners to pay their tax bill, which along with a hotter than expected March CPI reading and escalating tensions in the Middle East, served to limit risk appetite.

- Small caps continued to lag the S&P 500 as the March CPI reading forced investors to lower expectations for Fed funds rate cuts over the balance of this year, which led to a sharp move higher in short-term Treasury yields. Smaller companies tend to issue debt on the front-end of the yield curve for various reasons, and with fewer rate cuts expected, borrowing costs are expected to remain elevated for longer, potentially weighing on profits over coming quarters.

- An uptick in the March CPI reading initially put upward pressure on Treasury yields in the middle of last week, but yields rose further into Thursday as auctions for 10- and 30-year U.S. Treasury bonds were poorly received as higher yields failed to attract buyers. Tensions flaring in the Middle East generated a safe haven bid for Treasuries on Friday, but it appears as though market participants have little desire to buy longer duration Treasury bonds when presented with an outlook of resilient U.S. economic growth headlined by sticky inflation.

What Happened Last Week:

Stocks: Sellers In Control As Buyers Go On Strike; Profit-Taking To Pay Taxes, Rising Geopolitical Tensions Spur Low-Volume Selloff; A Lackluster Start To Earnings Season; Emerging Markets Fare Better Than Feared.

Profit-Taking To Pay Taxes, ‘Hot’ March Inflation Data, Geopolitical Fears Drive Low Volume Pullback: Last week, the New York Stock Exchange saw some of its lowest trading volume of the year thus far as market participants sold winners to pay taxes while buyers went on strike amid rising tensions in the Middle East between Israel and Iran. Notably, some of the best performers year-to-date were some of last week’s worst as investors took gains to pay taxes, but buyers appeared to step in late in the week to pick up some of the ‘Mag 7.’ From here, we’re eyeing the S&P 500’s 50-day moving average which sits around 5,110 as an area to watch for support. If the S&P 500 closes below that level, then the 100-day at 4,910 could come into play. Assuming tensions in the Middle East don’t lead to a spike above $100 for crude oil, a sell-off of that magnitude would likely be viewed by cash-rich investors as an opportunity to put capital to work.

Earnings Season Gets Underway With The ‘Big Banks’ Kicking Things Off : A host of the largest financial institutions reported earnings last Friday, including J.P. Morgan, Citigroup, and Wells Fargo, along with the world’s largest asset manager, BlackRock. The banks in the above group had each delivered double-digit year-to-date gains leading up to last Friday, outperforming the S&P 500 in the process. Earnings out of the banks topped the consensus estimate across the board, but market participants keyed off of lackluster guidance, with J.P. Morgan, specifically, guiding below street expectations for net interest income, leading to a 6.4% daily drop for the S&P 500’s 10th largest holding. The financial services sector followed the broader market lower, ending the week off by 3.6% and giving up its year-to-date lead over the S&P 500 in the process. After a tough close to last week for the financial services sector and the S&P 500 overall, earnings out of Bank of America, Goldman Sachs, and Morgan Stanley, among others, this

coming week could go a long way toward shifting the tide and counteracting last week’s negativity. It’s way too early in the quarterly reporting cycle to come to any conclusions surrounding the backdrop for the U.S. economic or corporate profits, but we will be closely watching forthcoming releases out of the consumer discretionary, industrials, and information technology sectors, specifically, for clues as to where stocks might be headed into the summer months.

Still No End To The Small-Cap Selloff In Sight: The rise in Treasury yields accelerated early last week as March CPI topped the consensus estimate, putting small caps back in the crosshairs of sellers as the S&P 600 Small Cap index fell 2.9%. Pressure from rates is an all-too-familiar story for small- caps as this cohort of companies is often limited to borrowing by issuing shorter-term debt or in the below investment grade market. Elevated borrowing costs combined with a squeeze on profit margins stemming from higher wages being paid due to continued strength in the labor market could weigh on small-cap sentiment for a few more months. Earnings could hold up better than feared and alleviate some of the selling pressure on these stocks should they turn positive as predicted, a trend we saw play out last quarter for mid-cap indices. From a technical standpoint, we’ve seen powerful reversion trends in small caps in recent quarters, but the index has room to fall further before reaching oversold territory and piquing our interest.

Emerging Markets Fall But Hold Up Better Than Feared On The Week: The MSCI Emerging Markets (EM) Index fell just 0.3% on the week, but things could have been much worse, all things considered. U.S. economic data and geopolitical concerns pushed crude oil prices and the U.S. dollar higher in tandem, a combination that would typically be a death knell for emerging markets, broadly speaking, so the MSCI EM index outperforming the S&P 500 by 1.2% on the week could be viewed as a shocking turn of events. Managers allocated heavily to India and Taiwan fared relatively well on the week, while those carrying outsized exposures to Mexico and South Korea were likely glad to see the week wrap up. As has been the case so far this year, country selection remains of the utmost importance as there was a 4.6% spread between the best performing developing market we track (India, -0.7%) and the worst performing (South Korea, -5.3%) last week. Active management remains the way to go for emerging market equity, and debt, exposure, in our view.

Bonds: Treasury Yields Rise As Consumer Prices Rise More Than Expected In March, Then Fall As Israel/Iran Tensions Escalate; Corporate Credit Well Behaved, All Things Considered.

Treasury Yields Rise As March Consumer Inflation Comes In Above Expectations: The March Consumer Price Index (CPI) was released last Wednesday, and the closely watched inflation measure surprised to the upside for the third consecutive month. Headline CPI rose 0.4% month over month and 3.5% year over year, while core CPI rose 0.4% month over month and 3.8% year over year. Both the month over month headline and core measures were 0.1% above expectations, but in-line with the February readings, further evidence that inflationary pressures remain sticky. Treasury yields responded to the release by rising sharply, with the 2-year Treasury yield spiking 20 basis points and the 10-year Treasury yield rising 18 basis points on the day. Notably, the yield on both the 2-year and the 10-year ended last Wednesday at a year-to-date high and continued to rise into the weekend, despite a cooler than expected PPI reading on Thursday. Yields on longer duration bonds better compensate investors for taking interest rate risk after the back-up in yields. However, Treasuries, broadly speaking, appear fairly valued, not yet ‘cheap’ given our view that U.S. economic growth will be above-trend (2%) in ‘24 and that inflation will remain sticky. Market participants appear to be debating/asking themselves if the March CPI implies the FOMC’s next move might ultimately be a hike, not a cut. We don’t believe that to be the case as the CPI release appears to have some large/outsized increases in some of the underlying metrics that could reverse over the near- term, thus we still expect two rate cuts this calendar year with June/July still likely.

Some Signs Of Stress In Credit Markets, But Fundamentals Remain Supportive: In a week where global equities traded sharply lower, the Bloomberg US High Yield Index fell by just 0.5% as credit spreads only widened by 7 basis points versus similar maturity U.S. Treasury bonds. That shift in spreads came toward the end of the week as geopolitical tensions ramped up, which reflects a market functioning as expected. In our view, high yield investors are not ignoring signs of turbulence but are also struggling to find a reason to meaningfully lighten up on exposure as a significant uptick in defaults is unlikely based on current economic and market fundamentals. Earnings season could bring with it more volatility, particularly in the middle of the quarter when smaller companies report, but recent upgrades to analyst estimates for companies farther down the cap spectrum could be a feather in the cap for credit investors and limit drawdowns for high yield.

Fed Funds Futures Take A June Rate Cut Off The Table After CPI And Now Favor September: Fed funds futures quickly lowered expectations for rate cuts over the balance of 2024 on the heels of the CPI release. The likelihood of a 25-basis point cut in June fell from 53% prior to the CPI release to less than 20% in the immediate aftermath of the release. At the end of the week, Fed funds futures expected just 1.8 quarter-point rate cuts this calendar year, down from 2.8 leading up to the release, with September the new odds-on favorite for the first rate cut, but even that’s close to a coin- flip at this point.

Treasury Auctions Poorly Received On The Heels Of ‘Hot’ March Inflation Reading: The U.S. Treasury auctioned off $58B of 3-year notes on Tuesday, an issue that was poorly received, albeit justifiably so as the March CPI was released the following day. Indirect bidders took down just 60% of the issue vs. over 64% of recent auctions, evidence that central banks balking at buying even shorter-term Treasuries leading up to the closely watched CPI release on Wednesday. The U.S. Treasury followed the weak 3-year auction with a $39B issue of 10-year notes the following day which required a relatively large 3-basis point yield concession to attract buyers, which forced the 10-year yield to what was then a fresh 2024 high of 4.56%. The apparent lack of demand last week could just be a one-off and a function of when the auctions took place, but with the next quarterly refunding announcement (QRA) expected on May 1, Treasury may need to again shift issuance to higher yielding, short-dated bonds to find enough willing buyers.

The content and any portion of this newsletter is for personal use only and may not be reprinted, sold or redistributed without the written consent of Regions Bank. Regions, the Regions logo and other Regions marks are trademarks of Regions Bank. The names and marks of other companies or their services or products may be the trademarks of their owners and are used only to identify such companies or their services or products and not to indicate endorsement or sponsorship of Regions or its services or products. The information and material contained herein is provided solely for general information purposes.

Regions does not make any warranty or representation relating to the accuracy, completeness or timeliness of any information contained in the newsletter and shall not be liable for any damages of any kind relating to such information nor as to the legal, regulatory, financial or tax implications of the matters referred herein. This material is not intended to be investment advice nor is this information intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only current as of the stated date of their issue. Regions Asset Management is a business group within Regions Bank that provides investment management services to customers of Regions Bank. Employees of Regions Asset Management may have positions in securities or their derivatives that may be mentioned in this report or in their personal accounts. Additionally, affiliated companies may hold positions in the mentioned companies in their portfolios or strategies. The companies mentioned specifically are sample companies, noted for illustrative purposes only.

The mention of the companies should not be construed as a recommendation to buy, hold or sell positions in your investment portfolio. Neither Regions Bank nor Regions Asset Management (collectively, “Regions”) are registered municipal advisors nor provide advice to municipal entities or obligated persons with respect to municipal financial products or the issuance of municipal securities (including regarding the structure, timing, terms and similar matters concerning municipal financial products or municipal securities issuances) or engage in the solicitation of municipal entities or obligated persons for such services.

With respect to this presentation and any other information, materials or communications provided by Regions, (a) Regions is not recommending an action to any municipal entity or obligated person, (b) Regions is not acting as an advisor to any municipal entity or obligated person and does not owe a fiduciary duty pursuant to Section 15 B of the Securities Exchange Act of 1934 to any municipal entity or obligated person with respect to such presentation, information, materials or communications, (c) Regions is acting for its own interests, and (d) you should discuss this presentation and any such other information, materials or communications with any and all internal and external advisors and experts that you deem appropriate before acting on this presentation or any such other information, materials or communications. Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The information provided herein is for informational purposes only and is intended to report on various investment views held by Multi-Asset Solutions (MAS) and Highland Associates. Opinions, estimates, forecasts, and statements of financial market trends are based on current market conditions that constitute the judgement of MAS and Highland Associates and are subject to change. The information is received from third parties, which is believed to be accurate, but no representation is made that the information provided is accurate and complete. The information is given as of the date indicated and believed to be reliable. While MAS and Highland have tried to provide accurate and timely information, there may be inadvertent technical or factual inaccuracies or typographical errors for which we apologize. The information provided herein does not constitute a solicitation or offer by Highland or its affiliates, to buy or sell any securities or other financial instrument, or to provide investment advice or service. Nothing contained herein should be construed as investment advice or a recommendation to purchase or sell a particular security. Investing involves a high degree of risk, and all investors should carefully consider their investment objective and the suitability of any investments.

Research services are provided through Multi-Asset Solutions, a department of the Regions Asset Management business group within Regions Bank. Highland is a wholly owned subsidiary of Regions Bank, which in turn is a wholly owned subsidiary of Regions Financial Corporation.

Past performance is not indicative of future results. Investments are subject to loss.