Stocks: S&P 500 Was ‘Due’ For A Pullback, But Signs Of Resiliency Remain Encouraging; Small-Caps Struggling Amid Rising Treasury Yields, Tight Labor Market; Strength In Eurozone, U.K. Equities Pointing Toward Brighter Economic Days Ahead.

Download Weekly Market Commentary | April 08 2024

What We’re Watching:

- The National Federation of Independent Business (NFIB) Small Business Index for March is released Tuesday on the heels of an 89.4 reading in February.

- Consumer Price Index (CPI) for March is released Wednesday. Core CPI, which excludes food and energy, is expected to rise 0.30% month over month, which would be a modest deceleration from the 0.40% reading in February. Headline CPI is also expected to rise 0.30% month over month, which would also be a drop from the 0.40% reading in February. While CPI isn’t the FOMC’s preferred inflation gauge, should readings come in as expected or ‘cooler,’ Fed funds futures would likely respond by raising the odds of a June rate cut.

- Minutes from the FOMC’s March meeting are released Wednesday which could prove market moving should there be any significant discrepancies between what the Committee discussed and the market’s interpretation/takeaways from Chair Jerome Powell’s post-meeting remarks.

- The University of Michigan’s Consumer Sentiment index for April is released Friday with a modest improvement to 80.0 from the 79.4 reading in March expected.

Key Observations

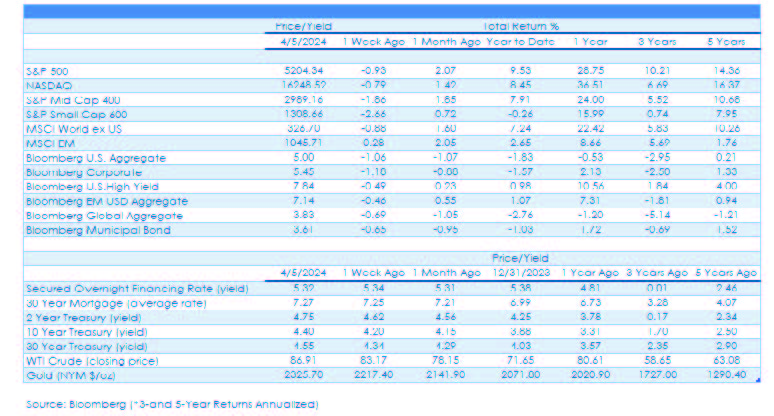

- Stocks spent the week attempting to digest an unsettling rise in Treasury yields which dampened bullish sentiment for the first time in months and spurred a modest selloff in large-cap domestic stocks and a more pronounced decline in small- caps.

- Strong economic data, specifically the March Manufacturing ISM release last Monday and Nonfarm Payrolls report last Friday, combined with higher commodity prices puts upward pressure on Treasury yields over the balance of the week and leave the FOMC in a difficult spot.

- Heightened geopolitical tensions on several fronts (Middle East, China, Russia) put upward pressure on prices of crude oil and gold over the balance of the week, but, perhaps surprisingly, didn’t generate a rally in the U.S. dollar and only spurred a brief, half-hearted bid for safe-haven long duration U.S. Treasuries.

What Happened Last Week:

Stocks: S&P 500 Was ‘Due’ For A Pullback, But Signs Of Resiliency Remain Encouraging; Small-Caps Struggling Amid Rising Treasury Yields, Tight Labor Market; Strength In Eurozone, U.K. Equities Pointing Toward Brighter Economic Days Ahead.

A Market In Search of Reasons To Retreat Finds A Few: Geopolitical tensions, rising interest rates, and higher energy prices from one day to the next were all cited as culprits behind last week’s modest pullback. While those reasons are as good as any, it may be as simple as the S&P 500, specifically, being long past due for a pullback after a remarkable four-month rally. This period of consolidation and digestion of gains could stretch into mid/late-April and the direction of the market’s next move could hinge upon forthcoming quarterly earnings, which we expect to be solid.

Rising Treasury Yields, Labor Market Strength Present Near-Term Problems For Small Caps: While the S&P 500 experienced a modest 0.9% pullback last week, the S&P 600 small-cap index had a deeper 2.6% drawdown, driven primarily by rising Treasury yields and continued labor market strength contributing to profit margin concerns. It has felt like ‘two steps forward, three steps back’ for small-caps year-to-date as the S&P 600 has turned out a -0.2% return, well shy of the S&P 500’s 9.5% gain, and the next couple months could continue to be tough sledding for smaller companies. However, continued U.S. economic strength should remain supportive, and the FOMC beginning to normalize monetary policy by cutting the Fed funds rate could be the catalyst that allows investors to focus an improved fundamental outlook for the asset class, but such a sea change may still be a few months away.

Eurozone, U.K. Equities Strongly Hinting At Easier Monetary Policy And An Improved Economic Growth Outlook: Last Monday in the U.K., the BRC-Nielsen Shop Price Index for March was released, which showed that prices for 500 of the most commonly bought items in the country rose just 1.3% year over year, below the estimate of 2.2% and a steep drop from 2.5% in February. Last week also brought with it the release of Eurozone Consumer Price Index (CPI) for March which rose 0.8% month over month and 2.4% year over year, with both metrics falling more than the consensus estimate. All told, recent inflation and wage data out of the U.K. and Eurozone continue to trend in a desirable direction for policymakers, making it increasingly likely that both the BoE and ECB ease monetary policy by mid-year, perhaps sooner. Eurozone and U.K. equities have sniffed out the prospect of less restrictive monetary policy and an improved economic growth outlook in recent months and country indices tied to Germany, Italy, Spain, and the U.K., among others, have been some of the best performers we can find over the past month. While we’re far from bullish on the Eurozone or U.K. economies, sometimes ‘less bad’ is good enough and with investor sentiment and positioning ‘light’ at best, a modestly more constructive outlook on equities domiciled there could be warranted over the near- term.

The U.S. Dollar Encounters Resistance Again Last Week: The rise in Treasury yields last week contributed to strength in the U.S. Dollar index, or DXY, which hit a year-to-date high at 105 last Monday before again encountering resistance and turning lower into the weekend. The 105 level has now proven to be a formidable ceiling for the greenback twice this year, first in mid-February and again last week. A break above that level would have been noteworthy and would have called into question our thesis that the DXY should weaken over the balance of 2024. However, a failure to break above 105 despite heightened geopolitical tensions and a slew of strong economic data releases last week is telling, in our view, and we see little reason to alter that call. With the U.S. economy strong, inflation sticky, and the timing of any rate cuts still in question, it’s likely that the dollar will remain strong leading up to the FOMC’s June meeting with the DXY potentially range bound between 103 and 105.

Escalating Middle East Tensions Another Tailwind For Crude Oil Into The Summer Driving Season: After rising 3.8% last week, the S&P 500 energy sector has now turned out a 17% year-to-date gain and is the 2nd best performing sector year-to-date, trailing only communication services. The sector rallied alongside crude oil last week as Ukraine struck Russian oil refineries and tensions in the Middle East escalated, sparking fears of continued depressed crude oil supply as we prepare to enter the summer driving season. Last Monday, an Israeli airstrike in Syria killed multiple high- ranking Iranian generals, sparking fears of retaliation by Iran which could potentially lead to a broadening of the conflict beyond Israel/Palestine borders. This dynamic could curtail crude oil exports out of the Middle East over coming months and inject a sizable geopolitical risk premium into the commodity, setting up a supportive backdrop for crude oil prices, particularly with stockpiles already running below typical levels for this time of the year. For West Texas Intermediate (WTI) crude, a move above $90 per barrel, a level that acted as a ceiling of resistance last October, would be notable, but energy-related equities might not reap much of a benefit from such a move as it would likely be viewed as fleeting or short-lived. However, energy stocks should continue to fare well on an absolute and relative basis if WTI stabilizes in the $80-$90 per barrel zone.

Bonds: Strong March Manufacturing Data, Nonfarm Payrolls Put Upward Pressure On Treasury Yields; Odds Of June Rate Cut End The Week Little Changed Despite A Flood Of Strong Economic Data.

Good Manufacturing Data Not Good News For Bonds: While The March Manufacturing ISM was released last Monday and improved significantly month over month to 50.3 from 47.8 in February. Notably, for the first time since September of 2022, the reading above 50 showed expansion in the manufacturing sector of the U.S. economy. While the Manufacturing PMI above 50 is good news for the U.S. economy, the prices paid index jumping to 55.8 from 52.5 in February was the opposite for Treasury yields and fixed income investors as yields rose/bond prices fell as higher goods prices in the coming months is expected to flow through and put upward pressure on upcoming inflation data.

In-Line February Inflation Data Overshadowed By Economic Data, Fed Speakers: February Personal Consumption Expenditure (PCE) Deflator, the FOMC’s preferred inflation gauge, was released on Good Friday, but market participants barely seemed to notice. Both the core and headline readings came in in-line with the consensus estimate with headline PCE rising 0.33% month over month and 2.8% year over year, while core PCE rose 0.26% month over month and 2.8% year over year. Core PCE is the most closely watched/monitored by policymakers and market participants, and while that measure decelerated both month over month and year over year, a 2.8% year over year increase remains a far cry from the FOMC’s 2% target.

March Payrolls Growth Impressive, But Revisions Are Worth Watching: The March nonfarm payrolls report was released Friday and a healthy labor market surprised to the upside again. Payrolls grew 303k during the month, well above the 205k consensus estimate, while the unemployment rate remained unchanged at 3.8%. Average hourly earnings rose 0.3% month over month and 4.1% year over year, with both readings in-line with the consensus estimate. The labor force participation rate ticked higher to 62.7 from 62.5 the prior month. While the payrolls report appears solid/strong on its surface, recent releases have been followed by significant downward revisions to payrolls growth, so we will remain somewhat skeptical and will be closely watching to see if that will be the case this time around as well.

First FOMC Rate Cut Still Expected In June, But It’s Close To A Coin-Flip: Last week brought with it a flurry of Fed speakers, and while there was one lone exception to the rule, the prevailing theme was that most policymakers still expected inflation to trend lower, allowing the FOMC to cut rates at some point this year. Fed funds futures undulated as economic data rolled in, but ultimately ended the week little changed with a 53% chance of a 25-basis point rate cut in June, down from 57% at the end of March. There’s still a long way to go with two monthly PCE (Personal Consumption Expenditure) readings and a litany of other potentially impactful economic data points to be released between now and then that could further muddy the waters surrounding the path forward for the FOMC.

IMPORTANT DISCLOSURES: THIS PUBLICATION HAS BEEN PREPARED BY THE STAFF OF HIGHLAND ASSOCIATES, INC. FOR DISTRIBUTION TO, AMONG OTHERS, HIGHLAND ASSOCIATES, INC. CLIENTS. HIGHLAND ASSOCIATES IS REGISTERED WITH THE UNITED STATES SECURITY AND EXCHANGE COMMISSION UNDER THE INVESTMENT ADVISORS ACT OF 1940. HIGHLAND ASSOCIATES IS A WHOLLY OWNED SUBSIDIARY OF REGIONS BANK, WHICH IN TURN IS A WHOLLY OWNED SUBSIDIARY OF REGIONS FINANCIAL CORPORATION. RESEARCH SERVICES ARE PROVIDED THROUGH MULTI-ASSET SOLUTIONS, A DEPARTMENT OF THE REGIONS ASSET MANAGEMENT BUSINESS GROUP WITHIN REGIONS BANK. THE INFORMATION AND MATERIAL CONTAINED HEREIN IS PROVIDED SOLELY FOR GENERAL INFORMATION PURPOSES ONLY. TO THE EXTENT THESE MATERIALS REFERENCE REGIONS BANK DATA, SUCH MATERIALS ARE NOT INTENDED TO BE REFLECTIVE OR INDICATIVE OF, AND SHOULD NOT BE RELIED UPON AS, THE RESULTS OF OPERATIONS, FINANCIAL CONDITIONS OR PERFORMANCE OF REGIONS BANK. UNLESS OTHERWISE SPECIFICALLY STATED, ANY VIEWS, OPINIONS, ANALYSES, ESTIMATES AND STRATEGIES, AS THE CASE MAY BE (“VIEWS”), EXPRESSED IN THIS CONTENT ARE THOSE OF THE RESPECTIVE AUTHORS AND SPEAKERS NAMED IN THOSE PIECES AND MAY DIFFER FROM THOSE OF REGIONS BANK AND/OR OTHER REGIONS BANK EMPLOYEES AND AFFILIATES. VIEWS AND ESTIMATES CONSTITUTE OUR JUDGMENT AS OF THE DATE OF THESE MATERIALS, ARE OFTEN BASED ON CURRENT MARKET CONDITIONS, AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. ANY EXAMPLES USED ARE GENERIC, HYPOTHETICAL AND FOR ILLUSTRATION PURPOSES ONLY. ANY PRICES/QUOTES/STATISTICS INCLUDED HAVE BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT HIGHLAND ASSOCIATES, INC. DOES NOT WARRANT THEIR COMPLETENESS OR ACCURACY. THIS INFORMATION IN NO WAY CONSTITUTES RESEARCH AND SHOULD NOT BE TREATED AS SUCH. THE VIEWS EXPRESSED HEREIN SHOULD NOT BE CONSTRUED AS INDIVIDUAL INVESTMENT ADVICE FOR ANY PARTICULAR PERSON OR ENTITY AND ARE NOT INTENDED AS RECOMMENDATIONS OF PARTICULAR SECURITIES, FINANCIAL INSTRUMENTS, STRATEGIES OR BANKING SERVICES FOR A PARTICULAR PERSON OR ENTITY. THE NAMES AND MARKS OF OTHER COMPANIES OR THEIR SERVICES OR PRODUCTS MAY BE THE TRADEMARKS OF THEIR OWNERS AND ARE USED ONLY TO IDENTIFY SUCH COMPANIES OR THEIR SERVICES OR PRODUCTS AND NOT TO INDICATE ENDORSEMENT, SPONSORSHIP, OR OWNERSHIP BY REGIONS OR HIGHLAND ASSOCIATES. EMPLOYEES OF HIGHLAND ASSOCIATES, INC., MAY HAVE POSITIONS IN SECURITIES OR THEIR DERIVATIVES THAT MAY BE MENTIONED IN THIS REPORT. ADDITIONALLY, HIGHLAND’S CLIENTS AND COMPANIES AFFILIATED WITH HIGHLAND ASSOCIATES MAY HOLD POSITIONS IN THE MENTIONED COMPANIES IN THEIR PORTFOLIOS OR STRATEGIES. THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR AN INVITATION BY OR ON BEHALF OF HIGHLAND ASSOCIATES TO ANY PERSON OR ENTITY TO BUY OR SELL ANY SECURITY OR FINANCIAL INSTRUMENT OR ENGAGE IN ANY BANKING SERVICE. NOTHING IN THESE MATERIALS CONSTITUTES INVESTMENT, LEGAL, ACCOUNTING OR TAX ADVICE. NON-DEPOSIT PRODUCTS INCLUDING INVESTMENTS, SECURITIES, MUTUAL FUNDS, INSURANCE PRODUCTS, CRYPTO ASSETS AND ANNUITIES: ARE NOT FDIC-INSURED I ARE NOT A DEPOSIT I MAY GO DOWN IN VALUE I ARE NOT BANK GUARANTEED I ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY I ARE NOT A CONDITION OF ANY BANKING ACTIVITY.

NEITHER REGIONS BANK NOR REGIONS ASSET MANAGEMENT (COLLECTIVELY, “REGIONS”) ARE REGISTERED MUNICIPAL ADVISORS NOR PROVIDE ADVICE TO MUNICIPAL ENTITIES OR OBLIGATED PERSONS WITH RESPECT TO MUNICIPAL FINANCIAL PRODUCTS OR THE ISSUANCE OF MUNICIPAL SECURITIES (INCLUDING REGARDING THE STRUCTURE, TIMING, TERMS AND SIMILAR MATTERS CONCERNING MUNICIPAL FINANCIAL PRODUCTS OR MUNICIPAL SECURITIES ISSUANCES) OR ENGAGE IN THE SOLICITATION OF MUNICIPAL ENTITIES OR OBLIGATED PERSONS FOR SUCH SERVICES. WITH RESPECT TO THIS PRESENTATION AND ANY OTHER INFORMATION, MATERIALS OR COMMUNICATIONS PROVIDED BY REGIONS, (A) REGIONS IS NOT RECOMMENDING AN ACTION TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON, (B) REGIONS IS NOT ACTING AS AN ADVISOR TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON AND DOES NOT OWE A FIDUCIARY DUTY PURSUANT TO SECTION 15B OF THE SECURITIES EXCHANGE ACT OF 1934 TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON WITH RESPECT TO SUCH PRESENTATION, INFORMATION, MATERIALS OR COMMUNICATIONS, (C) REGIONS IS ACTING FOR ITS OWN INTERESTS, AND (D) YOU SHOULD DISCUSS THIS PRESENTATION AND ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS WITH ANY AND ALL INTERNAL AND EXTERNAL ADVISORS AND EXPERTS THAT YOU DEEM APPROPRIATE BEFORE ACTING ON THIS PRESENTATION OR ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS.

SOURCE: BLOOMBERG INDEX SERVICES LIMITED. BLOOMBERG® IS A TRADEMARK AND SERVICE MARK OF BLOOMBERG FINANCE L.P. AND ITS AFFILIATES (COLLECTIVELY “BLOOMBERG”). BARCLAYS® IS A TRADEMARK AND SERVICE MARK OF BARCLAYS BANK PLC (COLLECTIVELY WITH ITS AFFILIATES, “BARCLAYS”), USED UNDER LICENSE. BLOOMBERG OR BLOOMBERG’S LICENSORS, INCLUDING BARCLAYS, OWN ALL PROPRIETARY RIGHTS IN THE BLOOMBERG BARCLAYS INDICES. NEITHER BLOOMBERG NOR BARCLAYS APPROVES OR ENDORSES THIS MATERIAL OR GUARANTEES THE ACCURACY OR COMPLETENESS OF ANY INFORMATION HEREIN, OR MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED THEREFROM AND, TO THE MAXIMUM EXTENT ALLOWED BY LAW, NEITHER SHALL HAVE ANY LIABILITY OR RESPONSIBILITY FOR INJURY OR DAMAGES ARISING IN CONNECTION THEREWITH.