Heat of the Moment

In recent days, Russian President Vladimir Putin has made clear through both words and actions his desire to restore Russian glory via a full-scale invasion of Ukraine. As we write this note, reports of airstrikes in the capital city of Kyiv and many other Ukrainian cities continue to pour in.

At the same time, calls of condemnation and announcements of new punitive sanctions against Russia are pouring in from Europe and the United States at a similarly frenetic pace. For investors, it can be tempting to migrate to the extremes and either 1) completely dismiss the current provocation or 2) assume that we are somehow on the precipice of World War III. The answer is likely somewhere in between.

So what has happened, what could happen, and what does it all mean for your investment portfolio? Here’s what we know with certainty:

- As has been the case historically in times of geopolitical uncertainty, the U.S. dollar remains a preferred safe haven for investors. Yields on 10-year Treasuries fell roughly 20 basis points in just a few trading sessions before rallying sharply off today’s lows.

- Relative to their emerging market peers, U.S. equities appear significantly advantaged in the current environment. This is owing partly to the aforementioned flight to safety, but also to the fact that the U.S. economy remains the most resilient in all of the developed world (not to mention the least energy dependent). Investors certainly agree, as the S&P 500 has outperformed broad emerging market equity indices by over 450 basis points in the last three trading sessions alone.

- The crisis in Ukraine appears to have given cover to the Federal Reserve to slow the anticipated pace of interest rate hikes. As of last Friday, investors were pricing in a roughly 54% chance that the Fed would hike interest rates by a full 50 basis points at its meeting next month, while today that probability has plummeted to just below 19%. This reflects the fact that these military operations are by their very nature debilitating to economic activity, which is exactly what interest rate hikes are intended to accomplish.

- Given Russia’s importance to global oil and gas supply, the recent invasion seems likely to further stoke the fires on inflation. Germany has already suspended the certification process for the vast Nord Stream 2 pipeline, and what is already an energy supply conundrum in Europe could devolve into a real crisis if the current conflict continues beyond the short term.

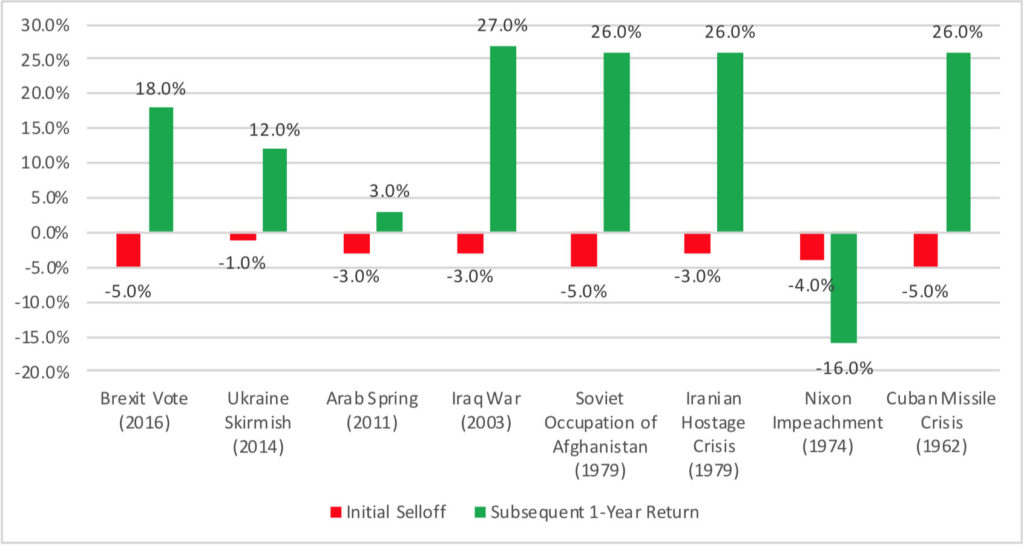

Lastly, investors will likely find it helpful to study prior periods of intense geopolitical uncertainty and instability to unearth clues about the potential impact to capital markets beyond the immediate term. The chart following examines eight such events in the modern era and illustrates clearly that most geopolitical conflicts typically lack staying power.

Market Performance During and Following Prior Geopolitical Crises

Source: VANGUARD

Of course, there are plenty of things we don’t yet know about the Russia-Ukraine struggle, including the length of the conflict and the associated economic disruptions. On that point, it seems reasonable to assume that Putin has only a small window to make big advances before 1) Russian support deteriorates and 2) the Western response (including both sanctions against Russia and military support for Ukraine) overwhelms Mr. Putin’s ambitions. And even if this current conflict is quickly and positively resolved, risks and uncertainties remain in the geopolitical sphere (China and Taiwan), as well as in the future direction of monetary and fiscal policy in the U.S. and abroad.

The situation in Ukraine has clearly introduced new risks that the market is working to digest. At Highland, we continue to rely on data-driven, probabilistic decision making to drive positive outcomes for clients. Based on our analysis, we remain constructive on both our broad asset allocation positioning and framework, as well as the ability of our trusted managers to navigate volatile and unpredictable environments. Specifically, we continue to strongly favor U.S. equities over emerging markets in this heightened risk environment based on a combination of superior relative momentum, fundamentals, and governance. We also continue to underweight fixed income, as developments in Ukraine are unlikely to meaningfully derail the Fed’s path to policy normalization. Lastly, we continue to favor inflation-sensitive assets that are simultaneously exposed to secular growth stories, including and especially investments in multifamily and industrial private real estate assets.