Download Asset Allocation | October 2024

The Waiting

Economic Update

The Wait Isn’t Over, at Least Not for US

By Regions Economic Division

In last month’s edition, we noted that it would take some time to know whether the pace of economic activity is finally normalizing after the significant disruptions/distortions brought about by the pandemic and the policy response to it, as we believe to be the case, or whether something less benign is underway and will end in recession. The body of economic data released since then seems to suggest that the wait for the answer wasn’t so long after all, with generally stronger than expected data pointing to further normalization, if not reacceleration, in the pace of economic activity. We do not, however, think the recent run of seemingly solid data settles anything. To be sure, our premise remains the same, i.e., that the economy is normalizing back toward the trend rate of growth that prevailed over the decade prior to the onset of the pandemic. We simply think it far too soon to have a definitive answer.

The third estimate from the U.S. Bureau of Economic Analysis (BEA) shows real GDP grew at an annual rate of 3.0% during Q2, but the bigger news here is that the BEA’s third estimate of Q2 GDP incorporated the results of their annual revisions to the recent historical data. The revised data show faster growth in both real GDP and real Gross Domestic Income (GDI) over the period from Q1 2019 through Q2 2024 than had previously been reported. For instance, real GDP is now reported to have grown by 2.5% in 2022 and by 2.9% in 2023, compared to prior estimates of 1.9% and 2.5% growth, respectively. The upward revision to real GDI was even larger, with growth in both personal income and corporate profits revised meaningfully higher.

At first glance, the September employment report would seem to allay concerns over the state of the labor market and the broader economy. Total nonfarm payrolls rose by 254,000 jobs in September, while prior estimates of job growth in July and August were revised up by a net 72,000 jobs for the two-month period, and September job growth was broadly based across private sector industry groups. At the same time, the unemployment rate fell to 4.1%. Indeed, in the wake of the release of the September employment report, some analysts went so far as to argue that the Federal Open Market Committee (FOMC) had made a mistake by cutting the Fed funds rate by 50 basis points at their September meeting and, as such, should keep the funds rate unchanged at their November meeting. And to think, it was only two months ago that, in the wake of a surprisingly weak July employment report, many took to the airwaves to call for “emergency” Fed funds rate cuts on the order of 50 or 75 basis points.

As for us, we reacted to the September employment report as we react to every data release, which is to go to the details of the data to try and put the headline numbers into proper context. For openers, continuing a pattern that has plagued the employment reports since the onset of the pandemic, the initial collection to the U.S. Bureau of Labor Statistics’ (BLS) September establishment survey was 62.2%, the lowest rate for the month of September since 2002. As we have been noting for far too long, these low collection rates lay a path for sizable revisions, either in subsequent months or in the annual benchmark revision process. Additionally, the upward revisions to prior estimates of job growth in July and August mainly reflect upward revisions in the education segments of state and local governments, reflecting the difficulty in adjusting the data to account for changes in the timing of the school year from one calendar year to the next.

To us, however, the much bigger issue is that the September data are riddled with seasonal adjustment noise, which flattered the headline job growth number. In our preview of the September employment report, we noted that we thought there would be strong seasonal adjustment effects stemming from what we expected would be a smaller than normal September decline in private sector payrolls. We pointed to construction, retail trade, and leisure and hospitality services as potential sources of seasonal adjustment noise. That proved to be the case, with leisure and hospitality services the most obvious instance. The unadjusted data show payrolls in leisure and hospitality services fell by 471,000 jobs, a hefty decline to be sure, but in percentage change terms, this was smaller than the typical September decline. As such, the seasonally adjusted data show payrolls in this industry group rose by 78,000 jobs. We can point to similar, albeit smaller, effects in both construction and retail trade.

The reported decline in the unemployment rate is also a gift from seasonal adjustment. The entire increase in the labor force and nearly all the increase in household employment in September are accounted for by those in the 16-to-24-year-old age cohort. This reflects nothing more than the not seasonally adjusted data showing much smaller than normal September outflows, which in turn are the flip side of much larger than normal August outflows among this age cohort. This is merely another illustration of how changes in the timing of the school year from one year to the next can confound the seasonal adjustment process.

The one-month hiring diffusion index, a gauge of the breadth of hiring across private sector industry groups, rose to 57.6% in September, the highest reading since January. The diffusion index, however, measures the breadth, not the intensity, of hiring. In other words, though most industry groups continue to add jobs, they are doing so at a slower rate, and job growth remains highly concentrated among three industry groups: leisure and hospitality services, government, and healthcare. Through September, these three industry groups accounted for just over 70% of all nonfarm job growth in 2024. At some point, the pace of hiring in these industry groups will slow, which will have an outsized impact on overall job growth.

To the extent there is such a thing, we see the “truth” about labor market conditions as being somewhere between the July and September employment reports. More specifically, we think it is clear that the trend rate of job growth is slowing, but the weekly data on initial claims for unemployment insurance and the data from the Job Openings and Labor Turnover Survey (JOLTS) tell us that this remains a function of a slowing pace of hiring as opposed to a rising pace of layoffs. While the slowing pace of hiring has put some upward pressure on the unemployment rate, the bigger driver of the increase in the unemployment rate over the past several months has been notably rapid growth in the labor force, growth which at some point we expect to slow.

Further cooling in the labor market is consistent with what we expect will be a pronounced slowdown in real GDP growth over the back half of 2024 extending into 2025. Growth in consumer spending is clearly slowing; while overall financial conditions in the household sector remain solid, lower-to-middle-income households continue to feel financial stress from the cumulative effects of elevated inflation over the past few years. Moreover, the Conference Board’s monthly survey of consumer confidence shows consumers taking an increasingly less favorable view of labor market conditions, which is likely weighing on discretionary spending among a broader range of households.

While the Institute for Supply Management’s (ISM) Non- Manufacturing Index rose to 54.9% in September, the highest reading since February 2023 and suggesting continued expansion in the broad services sector, the ISM Manufacturing Index remains mired below the 50.0% break between contraction and expansion. Uncertainty over the outlook for fiscal, trade, and regulatory policy is contributing to malaise in the manufacturing sector, with many businesses having put capital spending plans on hold until there is some clarity on the policy front. This will limit the contribution from business fixed investment to real GDP growth over the next few quarters.

Even with real GDP growth slowing and the labor market cooling, inflation is not going away quietly. The prices paid index from the ISM Non-Manufacturing Index continues to show steady, and broadly based, increases in prices for non-labor inputs across the services sector. At the same time, should the recent increases in crude oil prices in response to ongoing tensions in the Middle East stick, let alone intensify, the recent run of falling retail gasoline prices will likely reverse, meaning energy would contribute to headline inflation after having been a net drag over recent months.

In short, the paths of economic growth, the labor market, and inflation are far from clear, further complicating the FOMC’s efforts to properly calibrate monetary policy. As we noted last month, it seems that each and every economic data release is being interpreted as though it provides definitive evidence of where the economy is heading. Given the mixed signals being sent by the various data releases, this is contributing to volatility in the equity and fixed income markets as well as rapidly shifting expectations around the path of monetary policy. This is something that may not change any time soon.

Sources: U.S. Bureau of Economic Analysis; U.S. Bureau of Labor Statistics; Institute for Supply Management; The Conference Board

Investment Strategy Update

Stocks: September Better Than Feared, but Headwinds Remain

Regions Multi-Asset Solutions & Highland Associates

With the S&P 500 already higher by 19.5% year-to-date and this being a presidential election year, September kicked off many prognosticators, us included, voicing concerns that the month could live up to its historical billing as a challenging one for U.S. stocks. With the benefit of perfect hindsight, however, there was nothing to fear but fear itself, as the S&P 500 turned out a 2% gain during the month, while the S&P Mid Cap 400 and S&P Small Cap 600 eked out 0.9% and 0.6% returns, respectively. At month-end, over 75% of S&P 500 constituents were trading above their 50- and 200-day moving averages, a sign of broad market participation and a bullish market condition leaving us relatively constructive on U.S. large- cap stocks as October begins. That said, many hurdles remain between now and year-end.

The resilience of the broader U.S. equity market and its ability so far to buck the trend of poor historical performance in September and October in presidential election years is most welcome. While we expect a customary year-end lift, as the November through January time frame has historically proven to be the best consecutive three-month stretch for U.S. stocks, we aren’t out of the woods just yet. Negative seasonality in election years often persists into the back-half of October and is one reason to be on guard for a pullback in the lead-up to the election in November. But U.S. stocks have historically performed best amid divided government, which we see as the most likely election outcome.

Aside from seasonality and political uncertainty, rising Treasury yields and the quarterly earnings season could also potentially act as near-term hurdles for stocks. Yields on U.S. Treasuries rose sharply to start October as economic and labor market data forced investors to revisit their expectations of U.S. economic growth, inflation and, in turn, just how aggressively the FOMC may be willing or able to cut the funds rate in the coming months. Yields rising for the “right” reason – i.e., an improving economic growth outlook – should be supportive of further gains for cyclical stocks/sectors, but valuations come under pressure, and Treasury bonds would become greater competition for capital should yields rise much above current levels with the 10-year yield around 4%.

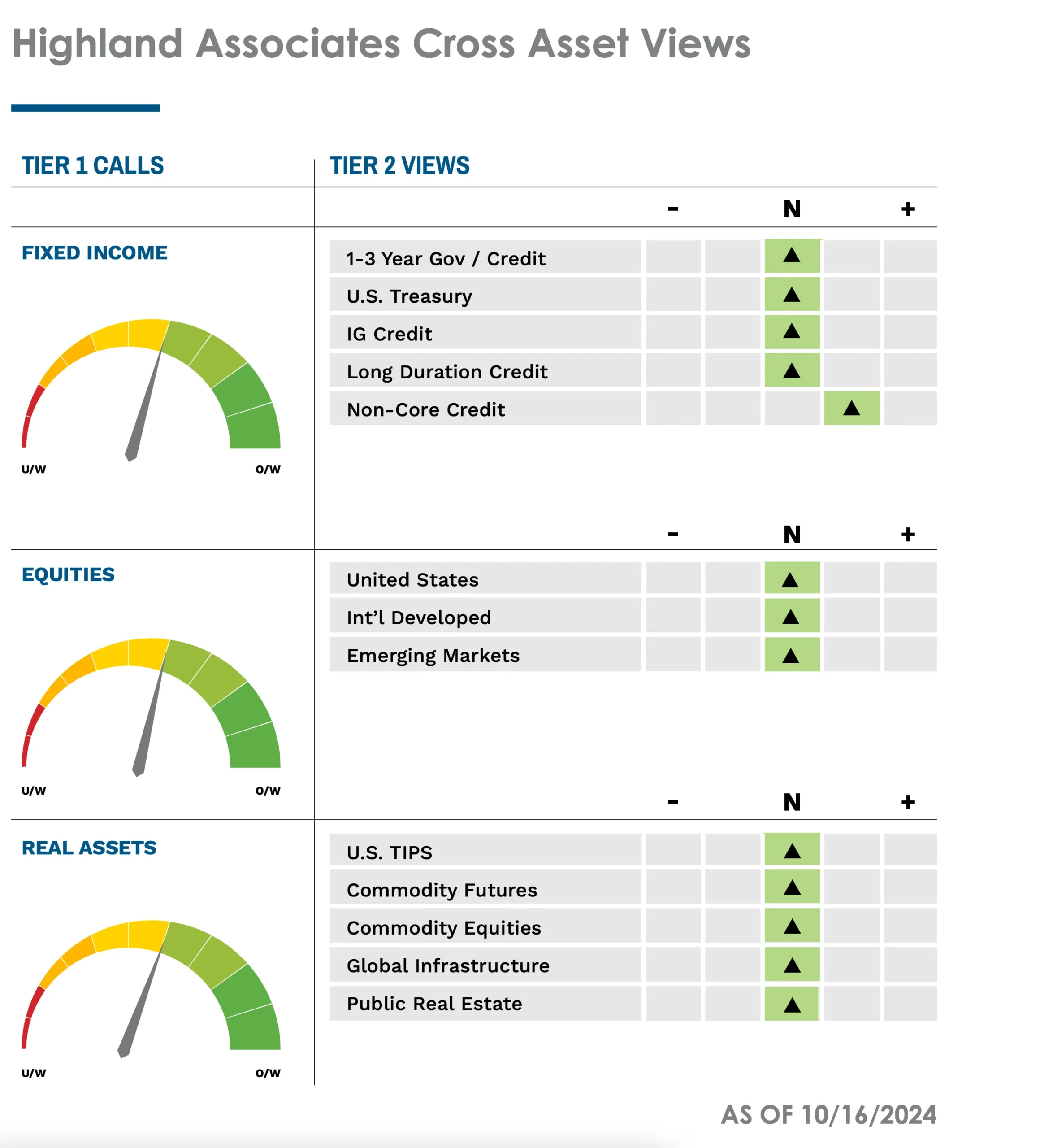

Lastly, while this is no different than it is at the start of any other quarterly reporting season, it’s worth mentioning that over half of S&P 500 constituents report quarterly results this month and will be barred from repurchasing their own shares until after posting quarterly results. Consequently, corporations, which have been an active market participant and significant buyer of their own shares year- to-date, will be unable to step in and opportunistically prop up prices should volatility ramp up. Taken together, these potential market headwinds aren’t reason enough to reallocate out of stocks and into less risky assets but are reason to temper expectations over the coming weeks, albeit with the knowledge that investors will likely be well served to lean into any near-term weakness in U.S. stocks in preparation for year-end. Against this backdrop, we remain Neutral risk from an allocation standpoint. In periods such as this one where the range of potential outcomes is wide, our preference is to remain closer to longer-term strategic portfolio targets.

Emerging market equities, on the other hand, have been building momentum in recent months. The fundamental outlook outside of China has improved as the U.S. dollar has weakened. Additionally, relatively attractive valuation metrics, including a one-year earnings growth estimate of 31.9% and a 12-month forward price-to-earnings (P/E) ratio of just 13, have garnered interest from relative value and growth investors alike. Although we’re receiving positive signals out of the broader EM asset class, dispersion at the country level leads us to favor a more active approach as even in August the best performing EM country, Brazil, posted a 5.5% gain, while the worst performer, Mexico, notched a 5.4% decline. The remaining pieces of the puzzle to make us more bullish on emerging market assets lie with better technical breadth and improved relative strength readings, which would be signs that investors are appreciating recent fundamental improvements in the space and are allocating capital accordingly.

Emerging Markets Making a Strong Case for Investor Capital

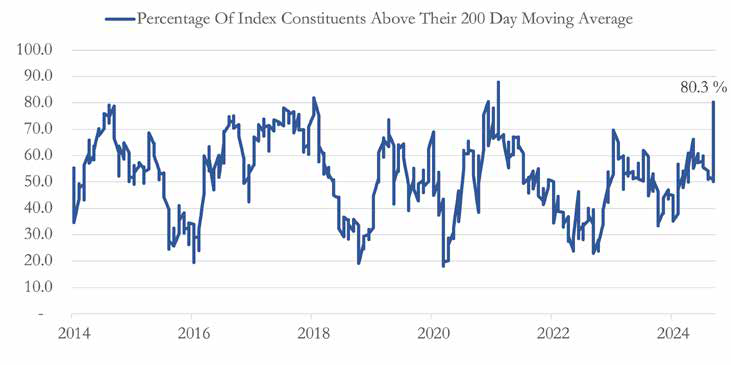

The MSCI Emerging Markets Index advanced 5.7% in September, more than doubling the S&P 500. A welcome advance with gains broad-based, as 20 of the 28 countries represented in the index generated a positive return on the month. Underlying market breadth also improved with 80% of the stocks in the EM Index finishing the month above their 200-day moving average, a three-year high and a marked improvement from 52% at the start of the month. The MSCI EM Index has also closed what was a wide performance gap versus global stocks in a big way, with a 17.1% year-to- date return, while the MSCI All-Country World Index returned 19% over the same time frame.

The MSCI Emerging Markets Index may not present the same rock-bottom valuation as in past periods but does trade at a relatively attractive 12.1 times forward earnings with earnings growth over the next year projected to be approximately 31%. Forecasted earnings growth estimate will likely prove to be too high, but we still see a path to substantial year- over-year earnings growth in the coming year as central banks make monetary policy less restrictive. This should help relieve some of the strain on emerging market currencies, allowing EM issuers to pay down debt at a lower cost while improving global liquidity that will need to be deployed, potentially into riskier asset classes with a higher expected return, such as emerging market stocks. A tectonic shift in investor sentiment due to recent Chinese stimulus and the promise of further action to come has generated sizable returns for investors in EM in a short period of time.

Emerging Market Breadth Improves to 3-Year High

Source: Bloomberg

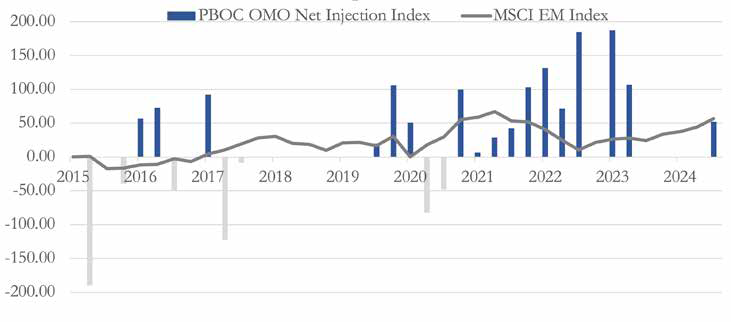

China’s Stimulus Efforts Are a Good Start, but Skepticism Is Still Warranted

Historically, exposure to Chinese stocks has been a source of volatility for equity portfolios with high peaks and deep drawdowns expected, with this year being no different. Country leadership within the MSCI Emerging Markets (EM) Index made an about-face in September as China announced a long-awaited wave of stimulus measures aimed at rebooting the economy, leading the MSCI China Index up 20.7% during the month. The September surge in Chinese stocks propelled China into second place in the MSCI EM country rankings year-to- date between first-place India and third-place Taiwan.

The parabolic move in Chinese stocks has investors rightfully asking: “Is this another head fake to be sold or a sign of more upside to come?” While the break above year-to-date highs for Chinese stocks shouldn’t be ignored, the initial surge can be chalked up largely to short covering. Short interest in some of the most heavily traded Chinese indices and fund proxies was closing in on five-year highs midway through September. Prices of Chinese stocks appear to now be pricing in a pronounced policy pivot and potentially even more quantitative easing (QE) out of the People’s Bank of China (PBoC), tethering their hopes to the belief that additional stimulus of some sort is still in the pipeline as promised by regulators. However, whether there will be additional measures aimed at reviving the Chinese consumer will be the true test of the government’s resolve. Investors should not be easily convinced recent stimulus efforts will be successful, or sustained for that matter, and we would like to see the MSCI China index hold recent gains over the coming weeks/months as a sign that institutional investors are finally willing to buy and not just rent exposure to stocks tied to one of the least shareholder friendly nations in the world. While we remain China skeptics for now, the country’s stimulus efforts serve to raise the floor on global growth to some degree, which should improve sentiment surrounding EM broadly, leaving us relatively constructive on emerging market stocks and bonds.

China Stimulus Historically Helpful for Broader Emerging Equities

Source: Bloomberg

Investment Strategy Update

Bonds: Treasuries and High-Grade Corporates Hold Greater Appeal After Recent Back-Up in Yields

Regions Multi-Asset Solutions, Highland Associates

After five consecutive positive months out of the Bloomberg Aggregate Bond index, Treasury yields were strongly hinting at a potentially pronounced economic slowdown as October began. However, those fears have faded as more recent economic and labor market data point to an orderly slowdown back toward pre-COVID trends, not an economy at risk of a recession. As a result, market participants have been forced to ratchet up their economic growth and inflation expectations, thus putting upward pressure on yields across the Treasury curve. At the time of this writing, the 10- year yield is now back above 4%, a level last seen in late July, providing investors looking to lock in longer-term yields with a far more appealing income stream versus mid-September.

The move higher in Treasury yields has pulled corporate bond yields higher as well, and the Bloomberg Investment Grade Corporate Index now carries a yield-to-worst just shy of 5%. That yield-to-worst may not seem too impressive given where even money market yields have been over the trailing 12 to 18 months. But, with the FOMC expected to cut the funds rate further in the coming months, investors looking to lock in yields a few years out at/around the current Fed funds rate may find a lot to like in higher quality corporate bonds. It’s worth mentioning that with a yield just shy of 5% at present, investment-grade corporate bonds are one of the few segments of the fixed income market with a current yield above the 30-year average for the asset class, even if it is by just a few basis points.

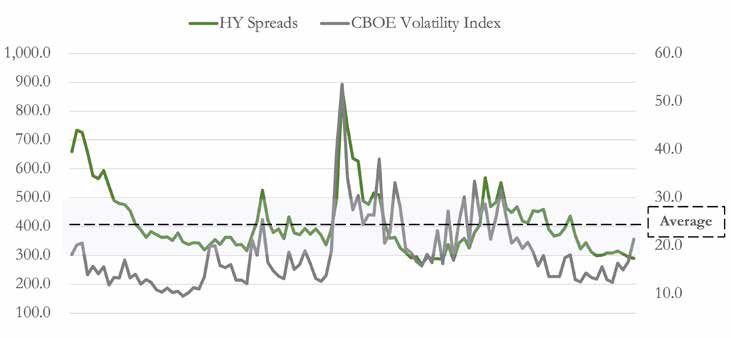

October Volatility Could Bring About Better Valuations, Opportunities in High Yield

September was a rocky month for high-yield corporate bonds, but falling U.S. Treasury yields contributed to a 1.6% gain for the Bloomberg U.S. Corporate High Yield Index. Credit spreads also round tripped and ended the month virtually unchanged. Treasury yields have reversed course and moved higher so far in October, while interest rate volatility has also contributed to elevated equity volatility. The CBOE Volatility Index, or VIX, rising to above 20 to start the month is evidence of increased demand for put options to hedge against a drawdown in stocks. Interestingly, while equity volatility has increased, which tends to happen when investors fear a sell-off and risk appetite wanes, high-yield bonds have held up surprisingly well. The credit spread over comparable duration U.S. Treasuries for the U.S. Corporate High Yield Index was just 283 basis points at the time of this writing, a year-to-date tight level and evidence that investors still require little in the way of compensation for taking credit risk in the current environment. With quarterly earnings season beginning and less than one month remaining until election day, we expect volatility in stocks to remain elevated in the near-term. This could bring about wider credit spreads and a modest improvement in valuations for higher yielding corporate bonds.

Near-Term Volatility Could Bring Discounts in High Yield

Source: Bloomberg

IMPORTANT DISCLOSURES: This publication has been prepared by the staff of Highland Associates, Inc. for distribution to, among others, Highland Associates, Inc. clients. Highland Associates is registered with the United States Security and Exchange Commission under the Investment Advisors Act of 1940. Highland Associates is a wholly owned subsidiary of Regions Bank, which in turn is a wholly owned subsidiary of Regions Financial Corporation. Research services are provided through Multi-Asset Solutions, a department of the Regions Asset Management business group within Regions Bank. The information and material contained herein is provided solely for general information purposes only. To the extent these materials reference Regions Bank data, such materials are not intended to be reflective or indicative of, and should not be relied upon as, the results of operations, financial conditions or performance of Regions Bank. Unless otherwise specifically stated, any views, opinions, analyses, estimates and strategies, as the case may be (“views”), expressed in this content are those of the respective authors and speakers named in those pieces and may differ from those of Regions Bank and/or other Regions Bank employees and affiliates. Views and estimates constitute our judgment as of the date of these materials, are often based on current market conditions, and are subject to change without notice. Any examples used are generic, hypothetical and for illustration purposes only. Any prices/quotes/statistics included have been obtained from sources believed to be reliable, but Highland Associates, Inc. does not warrant their completeness or accuracy. This information in no way constitutes research and should not be treated as such. The views expressed herein should not be construed as individual investment advice for any particular person or entity and are not intended as recommendations of particular securities, financial instruments, strategies or banking services for a particular person or entity. The names and marks of other companies or their services or products may be the trademarks of their owners and are used only to identify such companies or their services or products and not to indicate endorsement, sponsorship, or ownership by Regions or Highland Associates. Employees of Highland Associates, Inc., may have positions in securities or their derivatives that may be mentioned in this report. Additionally, Highland’s clients and companies affiliated with Highland Associates may hold positions in the mentioned companies in their portfolios or strategies. This material does not constitute an offer or an invitation by or on behalf of Highland Associates to any person or entity to buy or sell any security or financial instrument or engage in any banking service. Nothing in these materials constitutes investment, legal, accounting or tax advice. Non-deposit products including investments, securities, mutual funds, insurance products, crypto assets and annuities: Are Not FDIC-Insured I Are Not a Deposit I May Go Down in Value I Are Not Bank Guaranteed I Are Not Insured by Any Federal Government Agency I Are Not a Condition of Any Banking Activity.

Neither Regions Bank nor Regions Asset Management (collectively, “Regions”) are registered municipal advisors nor provide advice to municipal entities or obligated persons with respect to municipal financial products or the issuance of municipal securities (including regarding the structure, timing, terms and similar matters concerning municipal financial products or municipal securities issuances) or engage in the solicitation of municipal entities or obligated persons for such services. With respect to this presentation and any other information, materials or communications provided by Regions, (a) Regions is not recommending an action to any municipal entity or obligated person, (b) Regions is not acting as an advisor to any municipal entity or obligated person and does not owe a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934 to any municipal entity or obligated person with respect to such presentation, information, materials or communications, (c) Regions is acting for its own interests, and (d) you should discuss this presentation and any such other information, materials or communications with any and all internal and external advisors and experts that you deem appropriate before acting on this presentation or any such other information, materials or communications.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.