Download Asset Allocation | November 2022

It’s the Most Wonderful Time of the Year

Economic Update

U.S. Economy Losing Momentum

By Regions Economic Division

Recall that when the BEA reported that real GDP had contracted in each of the first two quarters of 2022, our reaction was that underlying economic conditions were better than implied by the headline GDP numbers. Lest anyone think we somehow feel vindicated by the BEA reporting that real GDP expanded at an annual rate of 2.6% in Q3, we don’t. Instead, our take is that the Q3 headline print paints an overly upbeat picture of underlying economic conditions. We’ve actually been quite consistent in our reaction to each of the three quarterly GDP reports issued thus far in 2022, our point being that large swings in inventories and trade, as treated in GDP accounting, resulted in quarterly changes in real GDP that were painting a misleading picture of underlying economic conditions.

This is a point we’ve made often over the years, regardless of whether real GDP was reported to be rising or falling. For instance, a significantly smaller trade deficit in Q3 added 2.77 percentage points to top-line real GDP growth, more than accounting for the entire Q3 increase but telling us little about the state of the U.S. economy. From our perspective, private domestic demand – combined household and business spending – is the most relevant gauge of the health of the U.S. economy. On an inflation-adjusted basis, private domestic demand “expanded” at an annual rate of just 0.079% in Q3 which, barring the pandemic-stricken first half of 2020, is the weakest quarterly performance since Q4 2009. Reflecting the toll being taken by elevated inflation and rapidly rising interest rates, growth in real private domestic demand has decelerated sharply over the past three quarters, and we look for it to remain weak over coming quarters.

We have for some time now been discussing a shift in consumer spending patterns – away from goods, toward services – and that shift is apparent in the GDP data. Real consumer spending on goods contracted in each of the first three quarters of 2022, meaning that growth in total consumer spending thus far this year has more than been accounted for by growth in services spending. There are several factors behind fading goods spending, including spending on consumer durable goods having been pulled forward so strongly into 2020 and 2021, elevated inflation weighing on discretionary spending, meaningfully higher interest rates making it more costly to finance purchases of consumer durable goods, and housing-related spending dropping as higher mortgage interest rates batter the housing market.

While spending on services such as travel, tourism, dining out, recreation, and entertainment has been strong, we’ve seen this as consumers making up for time, and experiences, lost during the pandemic, and we expect such spending to slow significantly over coming months. While households across all income groups are still sitting on buffers of savings built up in 2020 and 2021, those buffers have begun to thin out and will thin out further in the months ahead, particularly to the extent inflation remains elevated. As such, we look for growth in real consumer spending to slow further in Q4 before contracting in Q1 2023.

Real business fixed investment grew at an annual rate of 3.7% in Q3, but there are signs that business investment is losing momentum. In an increasingly uncertain economic environment, many firms have started to pull in the reins on capital spending. This is apparent in the data on new orders for “core” capital goods, or nondefense capital goods excluding aircraft, which fell sharply in September. Core capital goods orders are a leading indicator of changes in business investment in equipment and machinery as reported in the GDP data. Unless September’s sharp decline was simply one-off noise, which we do not believe is the case, we can expect this weakness to be apparent in the 1H 2023 GDP data.

The Institute for Supply Management’s (ISM) monthly survey of the manufacturing sector is sending a similar message. The ISM Manufacturing Index fell to 50.2% in October, and while this marks a 29th straight month of expansion in the factory sector, that expansion seems to be on its last legs. The expansion has become slower and less broadly based over the past several months, and the ISM’s measure of new manufacturing orders has contracted in four of the past five months. At the same time, what were once sizable and steadily growing backlogs of unfilled orders have begun to be worked off. The combination of declining new orders and smaller order backlogs bodes poorly for employment and output in the manufacturing sector over coming months.

The housing market has been battered by the sharp increase in mortgage interest rates. New single-family construction has slowed considerably over recent months, as have sales of new and existing homes. Moreover, the effects of mortgage rates pushing above 7% are not yet visible in the housing market data released to date, which only go through September. As such, coming months will see further declines in construction and sales of single-family homes and more pronounced declines in house prices than have been reported to date.

The labor market has not proven to be immune from the slowdown in the broader economy. Total nonfarm payrolls rose by 261,000 jobs in October, with private sector payrolls up by 233,000 jobs and public sector payrolls up by 28,000 jobs, and job growth remains notably broad based across private sector industry groups. Average hourly earnings were up by 0.4% in October, which translates into a year-on-year increase of 4.6%, the smallest such increase since August 2021.

Despite a reported decline in the size of the labor force, the unemployment rate rose to 3.7% from 3.5% in September due to a sharp decline in the level of household employment. Our sense is that the reported increase in the unemployment rate is more noise than signal, in keeping with the inherent volatility in the data from the household survey. For instance, the decline in the labor force is more than accounted for by a decline in participation among females in all but two of the broad age cohorts, which seems highly implausible.

Even with the pace of job growth having slowed, keep in mind that as of September there were 10.717 million open jobs across the U.S. economy, equivalent to 1.9 open jobs for each unemployed person. While there have been some high-profile announcements of job cuts and hiring freezes, the level of layoffs as measured by initial claims for unemployment insurance remains notably low. That continuing claims also remain low is a sign that those who do lose their jobs are finding new jobs in fairly short order.

As the economy loses more and more momentum in the months ahead, we expect that to be reflected in further slowing in job growth and a rising unemployment rate. The FOMC considers this the price to be paid for reining in inflation, which we expect to remain well above the FOMC’s 2.0% target rate through 2023. As such, even though they will soon begin moving in smaller increments, the FOMC is not yet finished raising the Fed funds rate.

Sources: Bureau of Economic Analysis; Bureau of Labor Statistics; U.S. Census Bureau; Institute for Supply Management

Investment Strategy Update

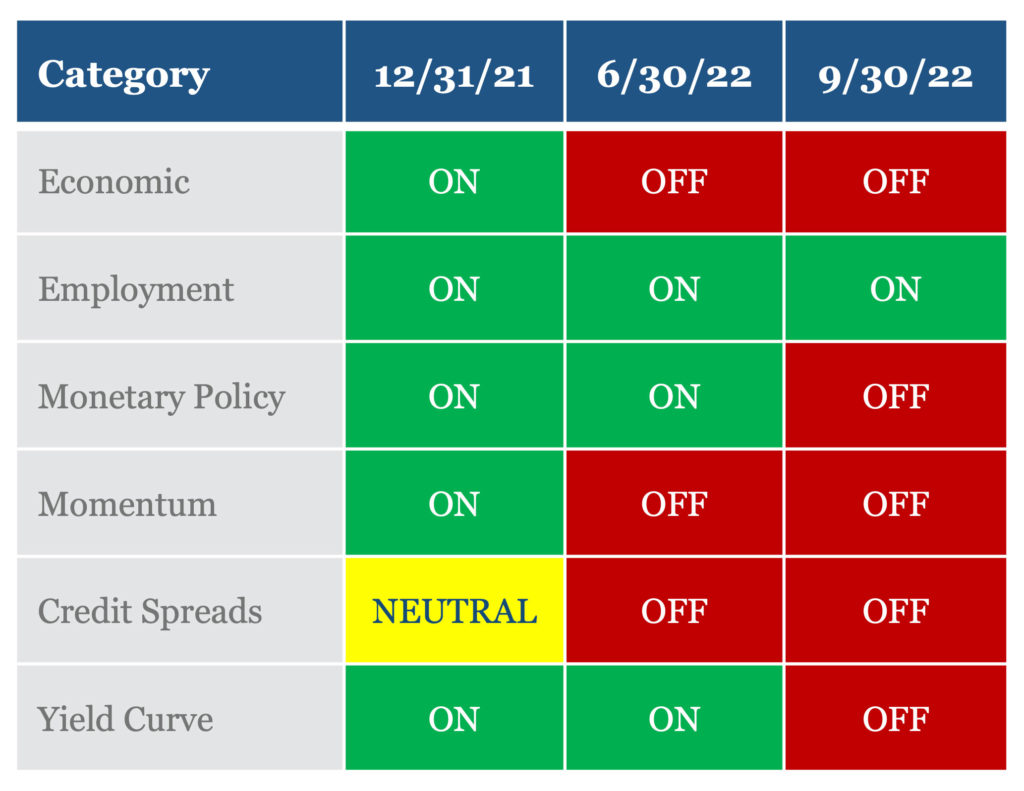

The Highland Investment Working Group adopted a defensive stance in client portfolios in late Q3. Five of the six indicators we monitor as part of our Highland Diffusion Index – economic, yield curve, monetary policy, credit spread, and momentum – continue to signal Risk-Off. Market-based indicators like credit spreads and momentum turned negative earlier in the year as spreads on investment-grade and high-yield bonds increased and equity markets declined. In recent months, economic, yield curve, and monetary policy indicators have also shifted in favor of less risky assets as portions of the yield curve have inverted and the Federal Reserve continues to adopt a more restrictive strategy. Employment remains a bright spot, although labor market strength provides cover for the Fed to tighten policy further.

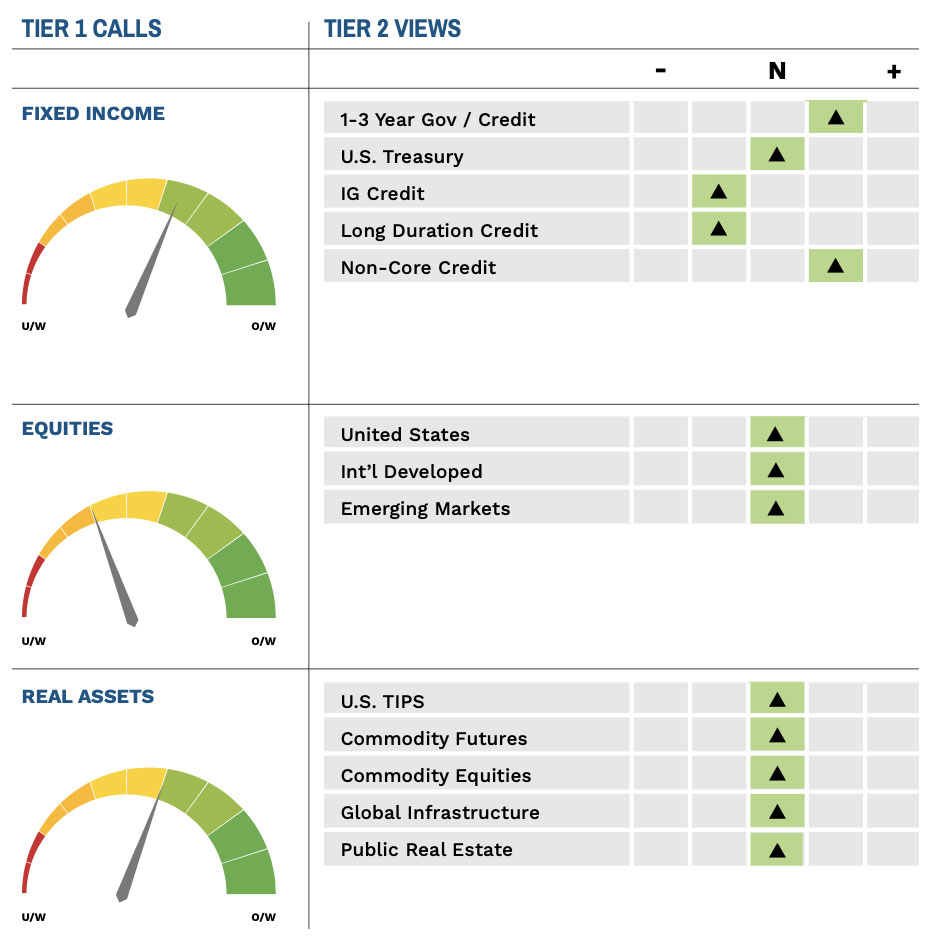

The team recently removed the overweight to U.S. Equity vs. International Equity. After underperforming every major market from 2000 to 2008, U.S. stocks have outperformed the rest of the world by a wide margin. During this time, Highland held an overweight to U.S. equity markets in client accounts from January 2011 to December 2014, August 2018 to February 2021, and November 2021 to November 2022. These allocations served our clients well. However, we are starting to see signs that this long period of U.S. equity market dominance is in the later innings and may be approaching a near-term peak in relative outperformance. Signs include a potential peak in the U.S. dollar after a strong rally and favorable valuation and dividend yield metrics outside the U.S., potentially providing a tailwind for future relative performance.

U.S. Election Update

By Regions Government Affairs

Although the outcome of a handful of House races remains unknown, the balance of power in Washington for the next two years will be divided following the midterm elections. Democrats retained power in the Senate while Republicans flipped the House with a narrower-than-expected majority.

Democrats – who outperformed polling, media, and pundit expectations – scored victories in key battleground states, which helped push them to their Senate majority magic number of 50 seats. Republicans won highly publicized Senate races in Wisconsin (Sen. Johnson), North Carolina (Rep. Budd), and Ohio (Vance), but fell short of their lofty expectations and currently hold 49 Senate seats.

The only outstanding race is in Georgia, where incumbent Sen. Raphael Warnock (D) and challenger Herschel Walker (R) will once again be on the ballot in a runoff on December 6. Even if Walker wins that runoff – obviously possible but a very big if – and the Senate is split 50-50, Democrats will still have the gavels in the upper chamber given the tie-breaking vote of Vice President Kamala Harris. Should Sen. Warnock prevail, Democrats will have gained a seat in the Senate this midterm cycle.

While Republicans will hold a single-digit majority in the House, simply put, the widely predicted “Red Wave” did not materialize. Perhaps it was simply a case of far-too-lofty expectations, bad polling, or policy issues, but there is no doubt the GOP feel they underperformed this cycle. Republicans do note that they won 14 unexpected seats in 2020, and in some House races that they hoped to win, they were competing in districts Biden won by more than 5 points (+10 in some cases).

Instead, this year’s election results indicate that while Americans are displeased with the state of the economy and President Biden’s handling of various high-profile issues, they are once again not eager to hand over control of the federal government to overwhelming majorities in Congress for either party. Electors shied away from many far-right-wing names endorsed by former President Trump, and also voted against some of the progressives seeking office. Instead – especially in the House – voters opted for the more moderate candidate when presented with a choice.

Regardless of the size of the majority, Republicans have the gavels in the House – with likely Speaker Kevin McCarthy (R-CA) leading the way – which almost certainly leads to a stalemate on major partisan legislation such as the Inflation Reduction Act, follow-on stimulus efforts, or tax-related legislation for the next two years. It is notable, however, that a Democrat-controlled Senate clears the way for exercises where simple majorities are required, such as judges or other executive branch nominees. Democrats will see a change in leadership in the House, as current Speaker Nancy Pelosi (D-CA) announced that she would not run for leadership in the 118th Congress, after serving as speaker for eight years and as the Democratic leader in the House for the past two decades. The odds-on favorite to replace Pelosi is current chair of the House Democratic Conference, Rep. Hakeem Jeffries (D-NY). Jeffries, seen as a moderate, will have to shore up votes with the progressive wing of his caucus, but he remains the best bet at present to be the new leader for Democrats in the House.

From his seat in the White House, President Biden will likely continue to empower the financial regulatory agencies to carry out his policy agenda for the next two years. The CFPB and SEC are expected to remain aggressive in their policy pursuits. Business leaders should be aware that a Republican majority in the House will create political crosscurrents that may be challenging to navigate. House Republicans have indicated they plan to focus on concerns with ESG and “woke capital,” firearm MCCs, inflation and its causes, competition with China and the origins of COVID-19, funding for additional IRS agents, the border and illegal immigration, Ukraine funding, and the Afghanistan withdrawal. A GOP-led House Financial Services Committee – with Rep. Patrick McHenry (R-NC) at the helm – will increase oversight and hold more combative hearings on the agencies, but there is little Republicans can do to slow agency action beyond hearings and letters since Democrats control the Senate and executive branch.

Putting election drama and the next session aside, Congress has a remarkable number of items to tackle before the end of this calendar year. The biggest item on the to-do list is preventing a government shutdown after the current stopgap bill expires on December 16. This will require a bipartisan group of at least 60 Senators to ratify any spending package, with hot button issues including domestic spending and funds for Ukraine in their war against Russia.

Also at issue is how to manage the debt ceiling. Early indications from House Speaker Nancy Pelosi and Senate Majority Leader Chuck Schumer (D-NY) are that they favor raising the debt ceiling in the lame duck as part of a year-end appropriations package. Doing so would solve a major potential fiscal showdown before it can be made into a bargaining chip for the far-right wing of the incoming House Republican majority, as it was in 2011 by Republicans seeking spending cuts. Raising the debt ceiling to a specific number could be done unilaterally by the Democrats without GOP help through reconciliation, but doing so could be a political challenge.

Other headline items on the to-do list include passing the annual National Defense Authorization Act, managing an energy permitting reform effort led by Sen. Joe Manchin (D-WV), legislation that would codify the right to same-sex marriage, efforts to reach a bipartisan compromise on a version of the SAFE Banking Act (which deals with banks providing services to the cannabis industry), and votes on more than 20 judges.

Highland Associates Cross Asset Views

As of 11/23/2022