Download Asset Allocation | March 2022

After reviewing the economic and market environment, Highland offers the following comments on the current landscape:

Economic Update

The human cost of the situation in Ukraine is immeasurable and, for most of us, unfathomable. While by no means trying to diminish the human cost, it is nonetheless our task to try and process the economic and financial implications, the main ones we touch on here. It is of course too soon to know how long the situation in Ukraine may last, whether it will spread, or how it will end and, in the interim, we can expect considerable volatility in the economy and financial markets.

What does seem clear is that the U.S. economy went into this suddenly uncertain and volatile environment on solid footing. After the rapid and wide spread of the Omicron variant in December and January led to significant disruptions in economic activity, February saw a marked decline in case counts, which was accompanied by a rebound in economic activity. Total nonfarm employment rose by 678,000 jobs in February, while prior estimates of job growth in December and January were revised up by a net 92,000 jobs for the two-month period. More tellingly, job growth was notably broader based in February. The one-month hiring diffusion index, which gauges the breadth of hiring across private sector industry groups, rose to 76.6% in February after having slipped to 61.1% in January. At the same time, the length of the average private sector workweek increased in February, another sign of continued strong growth in the demand for labor, while the unemployment rate fell to 3.8%.

The Institute for Supply Management’s monthly surveys showed further expansion in the manufacturing and services sectors in February, with the pace of expansion in the factory sector picking up from January. At the same time, however, firms in both broad sectors continue to report intense input price pressures, and what appeared to have been some progress in starting to clear global supply chains seems to have come to a halt in February. With inflation as measured by the Consumer Price Index having hit 7.5% in January, lack of additional progress in clearing global supply chains would have been a concern even prior to Russia’s invasion of Ukraine

Coming into this year, our outlook called for inflation to slow from the elevated rate seen at year-end 2021 but would nonetheless remain above the FOMC’s 2.0% target rate into 2023. With global supply chain and logistics bottlenecks expected to ease over the course of 2022, global flows of goods would begin to normalize at a time when demand would be easing, at least here in the U.S. As a result, our expectation was that over 2H 2022 we would see meaningful deceleration in goods price inflation if not outright goods price deflation. At the same time, however, we anticipated faster rates of increases in services prices as consumer demand rotated away from goods and toward services. As such, even with goods prices rising at a significantly slower pace if not declining, faster services price inflation would sustain overall inflation above the FOMC’s 2.0% target rate. Our expectation was that rents and medical care costs would be key drivers of faster services price inflation. Continued robust growth in labor costs was also expected to be a support for inflation in 2022.

Russia’s invasion of Ukraine casts considerable uncertainty over the path of inflation and means inflation likely rises further and is more persistent than had been expected coming into 2022. Russia is a key exporter of crude oil, and in the wake of the invasion crude oil prices have pushed over $100 per barrel and there has already been pass-through to retail gasoline prices, which will add to measured inflation. Both Russia and Ukraine are key global suppliers of grains, and in the wake of the invasion prices for food commodities have risen significantly, which will be reflected in higher retail food prices. Both Russia and Ukraine are also key global producers of industrial commodities, including materials used to manufacture semiconductor chips and materials used to manufacture catalytic converters used in motor vehicles. Moreover, global shipping networks have been further disrupted in the wake of the invasion and global shipping costs have risen significantly.

[We provide further detail on these challenges below.]

In short, the economic fallout from Russia’s invasion of Ukraine is that global supply chain and logistics bottlenecks, which had shown signs of easing prior to the invasion, may become more intractable. To the extent this is the case, already lean inventories of consumer durable goods and certain industrial goods will become even more so, which will add to upward pressure on prices. As such, goods price inflation will likely be higher and more persistent than had been anticipated at the start of 2022, meaning overall inflation will follow suit.

As expected, the FOMC raised the Fed funds rate by 25 bps at their March meeting. With inflation elevated and the labor market at or close to full employment, it was no longer appropriate for the FOMC to provide the degree of monetary accommodation in place since the onset of the pandemic, and the FOMC’s intent was to move the Fed funds rate closer to their estimate of neutral, or around 2.5%. The FOMC’s view was that supply chain and logistics bottlenecks were the primary source of elevated inflation, and while these supply-side constraints would not be directly impacted by monetary policy, the committee nonetheless felt it appropriate to begin withdrawing the high degree of monetary accommodation.

While Russia’s invasion of Ukraine will unambiguously add to inflation, that does not mean the FOMC will feel compelled to be more aggressive in raising the Fed funds rate. Instead, the committee must also be mindful of the downside risks to economic growth and the heightened risks posed to financial stability. As such, while the FOMC will not be deterred from raising the funds rate, they are likely to move at a measured pace, i.e., raising the funds rate in 25-basis point increments, until there is more clarity as to the economic fallout from Russia’s invasion of Ukraine.

Sources: Regions Economic Division; Bureau of Labor Statistics;

Institute for Supply Management

Investment Strategy Update

While the Highland Investment Working Group remains constructive on equity and equity-like assets, we are watching for signs that this long period of outperformance is nearing an end. Fundamental indicators have softened somewhat, specifically within the economic and monetary policy areas. Manufacturing orders and consumer expectations remain weak while new building permits and ISM orders have risen, providing mixed signals within our economic signals. We expect the Fed’s hiking cycle to restrict monetary policy, which could ultimately lead to risk-off scores within the monetary policy indicators. Market-based indicators may also be affected by the hiking cycle. Spreads have tightened as the intermediate portion of the curve has risen faster than the long. The 5-year yield on Treasuries now sits level with the 10-year yield, and an inversion would be a bearish signal that could lead to a risk-off posture. We will continue to assess the risk landscape and will shift portfolio positioning accordingly.

Commodities Update

Key Takeaways:

- Global supply shortages are likely to persist over the near term, keeping global commodity prices elevated.

- U.S. consumers are less exposed to supply shortages than Europe and the rest of world.

- As inflation rises, the increased cost of goods leads to demand destruction. Risks of stagflation have increased with the Federal Reserve raising interest rates

In 2020, the balance of the world’s supply and demand was thrown off by a black swan event. The COVID pandemic exposed the delicate system of logistics that held together global shipping and perhaps was the spark that ignited a new flame of inflation. The Federal Reserve believed rising prices were a transitory result of supply chain constraints and that labor shortages related to the pandemic would ease over time. As the unemployment rate has dropped back to 3.8% and capacity utilization has returned to pre pandemic levels, it is apparent that inflation was not transitory.

Two years later, the world faces another black swan event with the war between Russia and Ukraine. These two countries pose the greatest commodity shock to markets since the 1973 Oil Embargo. The repricing is due to the shift in supply, with potential Russian and Ukrainian exports creating shortfalls across sectors.

Russia alone accounts for more than one-tenth of the world’s oil production and 17% of natural gas production. European energy markets are dependent on Russian energy, as Russia supplies Europe with over 30% of their natural gas and just under 20% of oil demand. Oil markets face a significant supply shock as global OECD inventories are nearing 10-year lows. Capacity to bring new oil online to fill the gap is limited, as the largest oil-producing countries (Saudi Arabia, UAE, and Iran) only have an estimated 3% additional combined spare capacity to utilize. While the U.S. is also one of the largest oil producers, it does not maintain enough spare capacity and forecasted growth (0.6 million barrels per day prior to the invasion) to make a meaningful difference. This highlights one key difference between the current cycle and the 1970s: the fact that the U.S. is nearly energy independent. As a net exporter of energy production, the U.S. is less likely to face the same supply-side shortages as Europe.

Prices for European natural gas have risen to all-time highs based on fears that the flow of gas could be disrupted. Current levels appear to be pricing in this worst-case scenario, although the logistical difficulty of stopping gas flow might be difficult for Russia. Russia supplies over one-third of Europe’s natural gas. Countries like Germany, Italy, and Hungary depend on Russia for more than 40% of their supply. A full disruption is unlikely, as Russia is near current storage capacity and would face costly production halts once full. Bringing on new gas supplies is a challenge due to transportation constraints, but Europe does have some regasification capacity to help absorb pipeline flows. While the U.S. can help partially, a new greenfield project to export liquefied natural gas to Europe would take 10 years to complete.

It’s not just energy markets that have been affected by the events in Ukraine. Russia is one of the leading metals exporters in the world, and industrial metals are up 30% year-to-date. Combined, Russia and Ukraine account for 19% of global palladium supply, 13% of global platinum supply, 14% of global nickel supply, and 6% of global aluminum supply. Auto manufacturers across Europe are already feeling the effects and have lowered production forecasts based on concerns they will not be able to source the parts and materials needed.

Major shipping disruptions in the Black Sea have led to a large increase in the price of grains, specifically wheat, as Russia and Ukraine account for 28% of global wheat exports. As Ukraine closed their ports at the end of February, dry bulk vessels stopped moving cargo to areas such as the Middle East, where countries like Turkey and Lebanon depend on Ukraine for more than 70% of the country’s grain imports. From a supply perspective, spring planting season in Ukraine is likely to be affected, and the shortfalls are unlikely to be made up by other large exporters including the U.S., Canada, and Australia. Rerouting supplies from other areas will lead to increased shipping costs that will impact consumers. The same story is also playing out in corn and soybeans, all of which are at risk of lower crop yields due to La Niña trends. Aside from transportation increases, input costs, such as fertilizer, have ballooned in recent months as Russia suspended exports.

We’ve long advocated clients strategically allocate to sectors like private real estate, listed real estate (REITs), natural resource equities, Treasury Inflation-Protected Securities (TIPS), and commodities. An allocation to a diversified basket of these assets leads to higher returns over time while protecting investors from inflation shocks and preserving purchasing power during periods of above-average inflation. The last two years have been a good test for this approach, and it passed with flying colors.

As crypto has become mainstream and slowly becomes an accepted store of value, the liquidity in these markets has grown very deep and able to handle billions in daily volume. As sanctions were imposed on Russian banks and rubles, crypto market participants began bidding up assets such as bitcoin and ethereum on the belief that Russian citizens would convert their assets into digital currencies. This appeared to play out initially as volumes of ruble pairs hit 52-week highs.

In mid-March, the Biden administration issued an executive order addressing cryptocurrencies and digital assets. The order outlined a whole-of-government approach to policy across six key priorities. Those priorities are consumer and investor protection, financial stability, illicit finance, U.S. leadership in the global financial system and economic competitiveness, financial inclusion, and responsible innovation. It directs the various agencies to issue a report within 180 days on the future of money and the payment systems, and urges the Federal Reserve to continue its research and development of a U.S. Central Bank Digital Currency (CBDC). It also directs the DOJ to determine whether federal legislation is needed to create a CBDC, and if so, to propose draft legislation. This E.O. follows the Federal Reserve’s recent report on CBDC and rising concerns that Russia is evading sanctions through its use of cryptocurrency, elevating the importance of national security and foreign policy concerns in future debates about the role of digital assets.

Sources: Regions Government Affairs

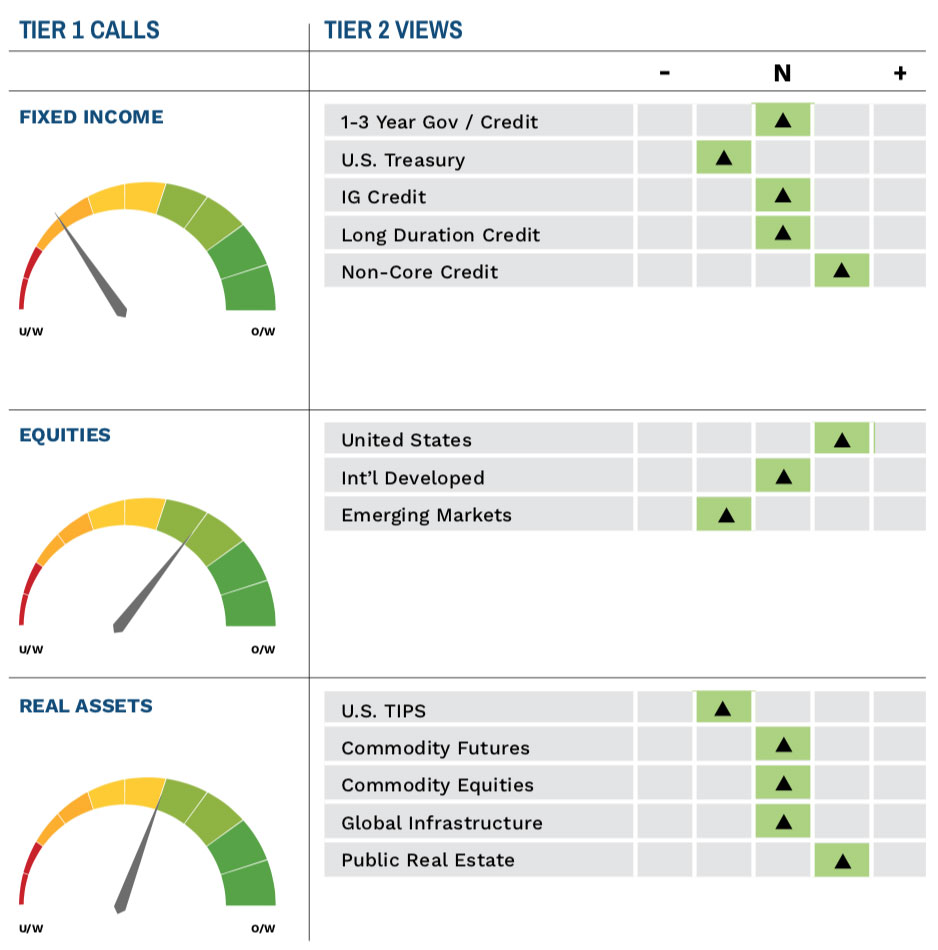

Highland Associates Cross Asset Views

As of 2/14/2022

IMPORTANT DISCLOSURES: This publication has been prepared by the staff of Highland Associates, Inc. for distribution to, among others, Highland Associates, Inc. clients. Highland Associates is registered with the United States Security and Exchange Commission under the Investment Advisors Act of 1940. Highland Associates is a wholly owned subsidiary of Regions Bank, which in turn is a wholly owned subsidiary of Regions Financial Corporation. Research services are provided through Multi-Asset Solutions, a department of the Regions Asset Management business group within Regions Bank. The information and material contained herein is provided solely for general information purposes only. To the extent these materials reference Regions Bank data, such materials are not intended to be reflective or indicative of, and should not be relied upon as, the results of operations, financial conditions or performance of Regions Bank. Unless otherwise specifically stated, any views, opinions, analyses, estimates and strategies, as the case may be (“views”), expressed in this content are those of the respective authors and speakers named in those pieces and may differ from those of Regions Bank and/or other Regions Bank employees and affiliates. Views and estimates constitute our judgment as of the date of these materials, are often based on current market conditions, and are subject to change without notice. Any examples used are generic, hypothetical and for illustration purposes only. Any prices/quotes/statistics included have been obtained from sources believed to be reliable, but Highland Associates, Inc. does not warrant their completeness or accuracy. This information in no way constitutes research and should not be treated as such. The views expressed herein should not be construed as individual investment advice for any particular person or entity and are not intended as recommendations of particular securities, financial instruments, strategies or banking services for a particular person or entity. The names and marks of other companies or their services or products may be the trademarks of their owners and are used only to identify such companies or their services or products and not to indicate endorsement, sponsorship, or ownership by Regions or Highland Associates. Employees of Highland Associates, Inc., may have positions in securities or their derivatives that may be mentioned in this report. Additionally, Highland’s clients and companies affiliated with Highland Associates may hold positions in the mentioned companies in their portfolios or strategies. This material does not constitute an offer or an invitation by or on behalf of Highland Associates to any person or entity to buy or sell any security or financial instrument or engage in any banking service. Nothing in these materials constitutes investment, legal, accounting or tax advice. Non-deposit products including investments, securities, mutual funds, insurance products, crypto assets and annuities: Are Not FDIC-Insured I Are Not a Deposit I May Go Down in Value I Are Not Bank Guaranteed I Are Not Insured by Any Federal Government Agency I Are Not a Condition of Any Banking Activity.

Neither Regions Bank nor Regions Asset Management (collectively, “Regions”) are registered municipal advisors nor provide advice to municipal entities or obligated persons with respect to municipal financial products or the issuance of municipal securities (including regarding the structure, timing, terms and similar matters concerning municipal financial products or municipal securities issuances) or engage in the solicitation of municipal entities or obligated persons for such services. With respect to this presentation and any other information, materials or communications provided by Regions, (a) Regions is not recommending an action to any municipal entity or obligated person, (b) Regions is not acting as an advisor to any municipal entity or obligated person and does not owe a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934 to any municipal entity or obligated person with respect to such presentation, information, materials or communications, (c) Regions is acting for its own interests, and (d) you should discuss this presentation and any such other information, materials or communications with any and all internal and external advisors and experts that you deem appropriate before acting on this presentation or any such other information, materials or communications.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.