Download Asset Allocation | June 2022

Kill the Headlights and Put It in Neutral

After reviewing the economic and market environment, Highland offers the following comments on the current landscape:

Economic Update

The FOMC raised the Fed funds rate target range by 75 basis points this week, a move largely thought to be off the table a week ago but put in play by the recent inflation data. To that point, the updated dot plot implies a much more aggressive course of funds rate hikes than was expected after the March projections, which is curious because the updated economic projections show a higher Q4 2022 rate of inflation than the March projections did, but virtually no change to the expected Q4 rates in 2023 and 2024. At the same time, the updated projections suggest a not-so-soft landing for the U.S. economy, with a pronounced slowdown in the anticipated path of real GDP growth and a higher unemployment rate relative to the March projections. Clearly, the FOMC was late to the game in responding to elevated inflation, and just as clearly, they seem intent on making up for lost time. What is far less clear, however, is how far the FOMC will ultimately go and what the effects will be on the labor market and the broader economy.

It is said that a job well done is its own reward. Whether or not that will apply to the FOMC and their quest to tame inflation remains to be seen. In his press conference following the May FOMC meeting, Chairman Powell noted that, as many of the factors responsible for elevated inflation stem from the supply side of the economy, the only way the FOMC can impact inflation is to “do a job on demand.” The premise is that higher interest rates will curb the demand side of the economy and that inflation pressures will ease as demand becomes more closely aligned with supply.

There are a few channels through which higher interest rates can lead to diminished demand. For instance, spending in interest-sensitive sectors, such as consumer durable goods and housing, will slow as financing costs increase. To the extent that higher interest rates lead to further declines in equity prices, wealth effects will induce lower levels of discretionary consumer spending. As firms respond to signals that growth in the broader economy is slowing, that should lead to diminished demand for labor, which in turn would ease wage pressures.

The reward for a job well done in this case would be a “soft landing,” meaning the economy continues to grow, albeit at a slower pace, and inflation pressures subside. But the “reward” for a job done too well, i.e., the FOMC going too far in raising interest rates, would be a sharper than expected slowdown if not an outright recession, while the “reward” for a job not done well enough, i.e., the FOMC not going far enough, would be slower growth and persistently elevated inflation. The risk-reward calculus is made even more complicated by the fact that most of the drivers of rapid inflation are beyond the FOMC’s reach. Lingering global supply chain and logistics bottlenecks made even worse by the latest round of lockdowns across China, depressed labor force participation, and the boost to already rapidly rising food and energy prices resulting from Russia’s invasion of Ukraine won’t be remedied by higher interest rates.

The more stubborn these supply-side factors prove to be, the further the FOMC will have to go in raising interest rates. Further complicating matters is that central banks around the globe are also working, at different speeds, to remove high degrees of monetary accommodation from economies with varying degrees of capacity to absorb higher interest rates. Moreover, the FOMC began allowing the Fed’s balance sheet to wind down on June 1, and it is far too soon to know whether, or to what extent, this will push market interest rates higher than they would otherwise go in response to a rising Fed funds rate.

So, while “doing a job on demand” via higher interest rates may sound nice and neat, the reality is that this is a blunt, imprecise, and indirect approach, thus raising the risk of a policy mistake leading to a more pronounced slowdown than anticipated. There are signs that, even though the FOMC is just getting started, the U.S. economy is slowing. Higher prices for necessities are causing lower- to middle-income households to cut back on discretionary spending on goods. The Institute for Supply Management’s (ISM) monthly surveys of the manufacturing and services sectors indicate a slower pace of expansion. The housing market has slowed markedly, with both single-family construction and home sales slowing sharply in what is typically the peak intra-year period. Slower global economic growth will weigh on U.S. exports, particularly in conjunction with the U.S. dollar being pushed higher by expectations of the FOMC acting aggressively to rein in inflation.

Even collectively, however, these things do not point to a recession being inevitable, as some are arguing is the case. Consumer spending on services is growing rapidly, and households continue to harbor higher than normal balances in deposit accounts. Although the ISM’s surveys indicate a slower pace of growth, survey respondents remain notably upbeat about prospects for continued growth in demand. And, while higher mortgage rates are curbing demand for home purchases, this should bring welcome relief from runaway house price appreciation. Obviously, the higher interest rates go, the remaining capacity to absorb higher interest rates diminishes, and the more pronounced the slowdown in growth becomes.

While there are signs that economic growth is slowing, there are few signs that inflation is doing the same. The May data on the Consumer Price Index showed a third straight month of inflation above 8.0%. Energy prices will rise further as we hit peak summer demand for gasoline, and upward pressure on food prices is likely to persist for some time to come. While China has emerged from its latest round of lockdowns, it will take some time for the nation’s manufacturing and shipping channels to get fully up and running, and in the interim upward pressure on goods prices will be sustained. While a slowing pace of job growth and rising labor force participation will take some of the edge off, we nonetheless expect wage growth to settle into a faster pace than was the norm prior to the pandemic.

Sources: Regions Economic Division; Bureau of Economic Analysis; Bureau of Labor Statistics; Institute for Supply Management

Investment Strategy Update

With each passing month this year, the balance of economic data, corporate earnings releases, and consumer sentiment has slowly shifted to the downside. We are increasingly concerned we’ve hit an inflection point where the current inflation environment is dampening demand. Consider that for every American, the cost to fill a tank of gasoline has risen anywhere from 50%-100% just since the beginning of the year. On the housing front, home prices themselves aren’t the only things that’ve gotten expensive; the cost of a 30-year fixed mortgage has doubled from 3.1% in January to over 6% currently. That means that it will now cost a prospective homebuyer an extra $560 per month to borrow $300,000, or a total of over $203,000 over the entire life of the loan.

Corporations are feeling the pinch as well. Retailers, of both the online and brick-and-mortar variety, have begun to report significantly higher levels of inventories. This was partly planned in an effort to transition from a just-in-time to a just-in-case delivery model, but the persistence of inflation – and particularly necessities like food and shelter – seems increasingly likely to compel Amazon, Target, Walmart, and a host of others to begin discounting. This will further threaten historically high profit margins already under pressure from sharply accelerating wage pressures and transportation costs. At the same time, supply chain dynamics continue to wreak havoc. Consider Sherwin-Williams, which has successfully passed along multiple price increases in recent quarters, but which is now struggling to secure supply of basic paint colors.

The Highland Diffusion Index has captured this deteriorating environment, with many economic and market-based indicators showing continued signs of weakness. As with last month, weakness is most pronounced in the market-based indicators, especially momentum measures and credit spreads. Monetary policy indicators remain positive in our current framework, but we do expect them to weaken soon in the face of further telegraphed rate hikes and the gradual reduction of the Fed’s balance sheet. Employment remains a bright spot, as labor appears to have more employment options and more bargaining power than they’ve had in generations. This too, of course, is inflationary and ultimately likely to lower corporate profit margins. In total, the Diffusion Index is currently signaling a Risk Neutral stance, and we are watching closely for further deterioration.

So, where do we go and what do we do from here? We are looking at incremental, but not wholesale, shifts in portfolio allocations to reflect an anticipated environment of persistently high inflation and limited growth prospects. Specifically, we are assessing current portfolio positioning in terms of quality, elasticity, and defensibility. Within equities, for example, we continue to like sectors that may benefit from – or are least disadvantaged by – persistent inflation. This could include more cyclically sensitive sectors like traditional energy and materials, as well as more defensive areas like utilities. These are sectors in which we gain exposure through a continued emphasis on inflation-sensitive allocations. Within equities, we are also looking at the tradeoffs between growth, quality, and valuations. High-quality stocks are often characterized by recurring revenues and limited debt, which makes them great companies but not necessarily great stocks. Indeed, despite the recent carnage, many high-quality stocks still carry relatively rich valuations. For now, anyway, it appears that cheaper valuations are more important to investors than high quality, and portfolios may need to reflect that.

Lastly, fixed income is beginning to appear more palatable, even if not for the best reasons. Specifically, yields have risen aggressively as the Fed and the broader market digest continually elevated inflation data. Yields on 2-year Treasury bonds closed at 3.45% on Tuesday, June 14, up from just 0.78% to start the year. This means that bonds – including and especially short-term bonds – may finally begin to offer an attractive alternative to the inherent riskiness of equities. However, yields are still well below inflation, which ensures that any current investment in short-term bonds will generate a negative real (inflation-adjusted) rate of return. So, while admitting that bonds still have limitations in reaching portfolio return targets, we must also acknowledge their advantages in achieving a level of stability simply not found in riskier assets. It may seem counterintuitive to willingly commit capital to assets with no hope of keeping up with inflation, but it could be entirely necessary for clients to maintain superior credit ratings and liquidity characteristics on their balance sheets.

It’s murky and muddy out there right now. We’re working tirelessly to position our clients for success, and currently success is as much about preserving your capital as it is growing it. In these periods where the range of outcomes is so wide, we believe it’s best to stay closer to neutral or strategic policy targets. Our goal is to build diversified portfolios that can achieve long-term results in any type of market environment. Since last year, we have been increasing our allocations toward real assets as our view of inflation is that it’s more persistent. These assets have been one of the only areas that have produced positive returns in this difficult environment. We will continue to monitor the investment landscape and reevaluate positioning as we get more clarity.

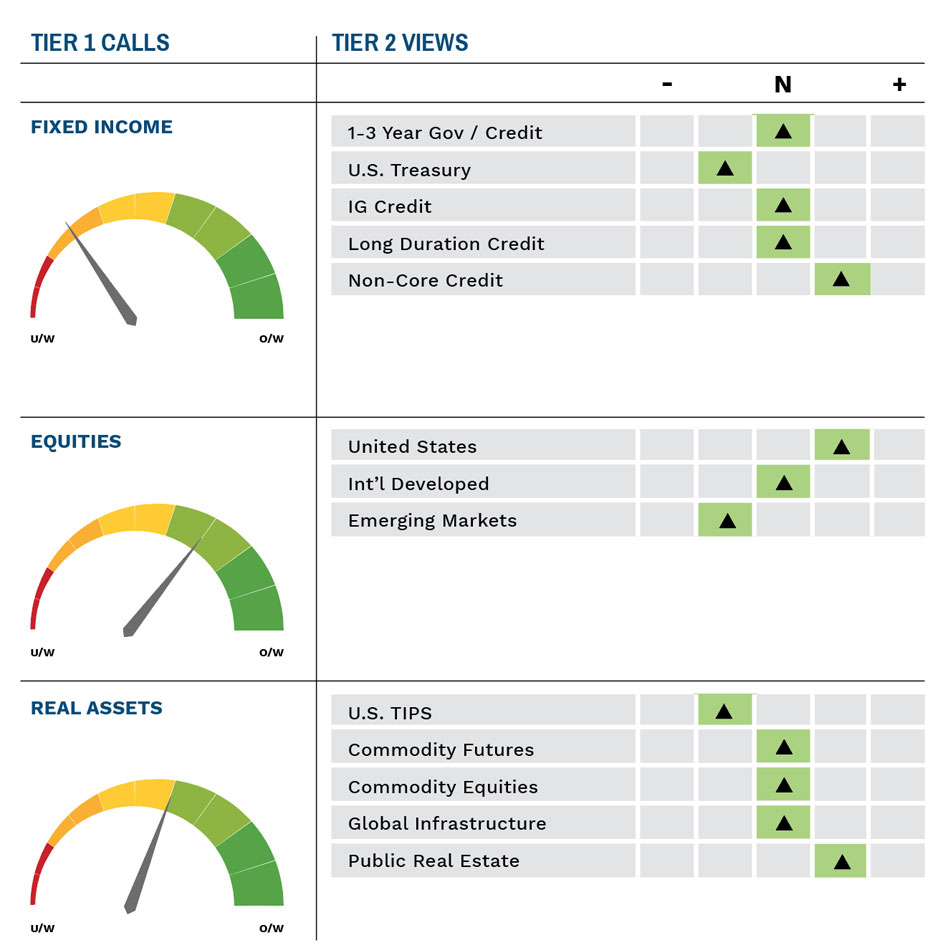

Highland Associates Cross Asset Views

As of 5/16/2022

IMPORTANT DISCLOSURES: This publication has been prepared by the staff of Highland Associates, Inc. for distribution to, among others, Highland Associates, Inc. clients. Highland Associates is registered with the United States Security and Exchange Commission under the Investment Advisors Act of 1940. Highland Associates is a wholly owned subsidiary of Regions Bank, which in turn is a wholly owned subsidiary of Regions Financial Corporation. Research services are provided through Multi-Asset Solutions, a department of the Regions Asset Management business group within Regions Bank. The information and material contained herein is provided solely for general information purposes only. To the extent these materials reference Regions Bank data, such materials are not intended to be reflective or indicative of, and should not be relied upon as, the results of operations, financial conditions or performance of Regions Bank. Unless otherwise specifically stated, any views, opinions, analyses, estimates and strategies, as the case may be (“views”), expressed in this content are those of the respective authors and speakers named in those pieces and may differ from those of Regions Bank and/or other Regions Bank employees and affiliates. Views and estimates constitute our judgment as of the date of these materials, are often based on current market conditions, and are subject to change without notice. Any examples used are generic, hypothetical and for illustration purposes only. Any prices/quotes/statistics included have been obtained from sources believed to be reliable, but Highland Associates, Inc. does not warrant their completeness or accuracy. This information in no way constitutes research and should not be treated as such. The views expressed herein should not be construed as individual investment advice for any particular person or entity and are not intended as recommendations of particular securities, financial instruments, strategies or banking services for a particular person or entity. The names and marks of other companies or their services or products may be the trademarks of their owners and are used only to identify such companies or their services or products and not to indicate endorsement, sponsorship, or ownership by Regions or Highland Associates. Employees of Highland Associates, Inc., may have positions in securities or their derivatives that may be mentioned in this report. Additionally, Highland’s clients and companies affiliated with Highland Associates may hold positions in the mentioned companies in their portfolios or strategies. This material does not constitute an offer or an invitation by or on behalf of Highland Associates to any person or entity to buy or sell any security or financial instrument or engage in any banking service. Nothing in these materials constitutes investment, legal, accounting or tax advice. Non-deposit products including investments, securities, mutual funds, insurance products, crypto assets and annuities: Are Not FDIC-Insured I Are Not a Deposit I May Go Down in Value I Are Not Bank Guaranteed I Are Not Insured by Any Federal Government Agency I Are Not a Condition of Any Banking Activity.

Neither Regions Bank nor Regions Asset Management (collectively, “Regions”) are registered municipal advisors nor provide advice to municipal entities or obligated persons with respect to municipal financial products or the issuance of municipal securities (including regarding the structure, timing, terms and similar matters concerning municipal financial products or municipal securities issuances) or engage in the solicitation of municipal entities or obligated persons for such services. With respect to this presentation and any other information, materials or communications provided by Regions, (a) Regions is not recommending an action to any municipal entity or obligated person, (b) Regions is not acting as an advisor to any municipal entity or obligated person and does not owe a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934 to any municipal entity or obligated person with respect to such presentation, information, materials or communications, (c) Regions is acting for its own interests, and (d) you should discuss this presentation and any such other information, materials or communications with any and all internal and external advisors and experts that you deem appropriate before acting on this presentation or any such other information, materials or communications.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.