Download Asset Allocation | July 2022

Summer of Jay

After reviewing the economic and market environment, Highland offers the following comments on the current landscape:

Economic Update

A Little Context Can Go A Long Way

We’ve always considered providing context to be an important part of our job—perhaps the most important part. With a constant flow of economic data releases, we think it important to explain not only why the numbers in a given data release are what they are, but also how a given data release connects with other releases and what it all might mean for the path of the economy. Doing so is at times neither easy nor straightforward, particularly when some of the numbers we see don’t make a lot of sense to us, and by no means do we claim to always be correct in our interpretation of the data. The main problem with trying to provide context, however, is that so few people do context these days.

With what over recent weeks has been a steady barrage of recession talk, we think a little context may go a long way toward understanding where the U.S. economy is, and where it might be heading. While the U.S. economy has clearly slowed in the face of elevated inflation and rising interest rates, there is a difference between decelerating growth and recession. Part of the confusion at present stems from real GDP having contracted in Q1 2022 and the distinct possibility that it may have done so again in Q2. Given that two consecutive quarterly declines in real GDP is a commonly cited definition of recession, many are declaring that the U.S. economy is already in recession, seeing no need to wait for the July 28 release of the first estimate of Q2 GDP from the Bureau of Economic Analysis (BEA).

The National Bureau of Economic Research (NBER), the unofficial arbiter of turns in the business cycle, defines recession as “a significant decline in economic activity that is spread across the economy and lasts more than a few months.” Recall that two of the past three U.S. recessions didn’t include two consecutive quarterly declines in real GDP, and the brief recession of 2020 is an obvious exception to the “lasts more than a few months” clause, which illustrates that to some extent NBER is making judgment calls when dating turns in the business cycle. To help them make these calls, NBER focuses on a range of indictors, including real consumer spending, real personal income excluding transfer payments, real business sales, industrial production, and nonfarm and household employment, placing the greatest emphasis on nonfarm employment and real personal income excluding transfer payments.

On the whole, these indicators are not pointing to the economy being in or close to recession. That said, the economy has clearly slowed over the past several weeks in the face of elevated inflation and higher interest rates. Housing market activity has slowed, and that is weighing on consumer spending related to housing, such as furniture and appliances. The Institute for Supply Management’s (ISM) monthly surveys of the manufacturing and services sectors show continued expansion in the two broad sectors but at a slower pace than seen over prior months, and the ISM’s June survey of the factory sector showed the first decline in orders for manufactured goods in more than two years. This stems in part from unwanted builds in inventories in the retail sector as consumer spending on goods is fading. Firms in technology/information services are scaling back plans for growth to better align with scaled down expectations of overall economic growth.

These are some of the adjustments underway in the broader economy, each of which has implications for the labor market. For instance, providers of mortgage finance are scaling back head counts as home sales have slowed and higher mortgage interest rates have crushed refinancing activity. Some retailers are finding that they hired too aggressively when consumer spending on goods was surging, and providers of transportation and warehousing services and technology/information service providers are making the same sorts of assessments. In some cases, this entails job cuts, and in other cases, it entails scaled-down hiring plans, but the net result is a slower pace of job growth.

There seems to be a tendency, however, to extrapolate a slowing pace of growth all the way to recession, but we’re just not there yet. To be sure, the pace of job growth has slowed, but the pace of growth seen over the past year, with average monthly gains of over 500,000 jobs, was just not sustainable. With nonfarm payrolls rising by 372,000 jobs in June, the economy still added 1.124 million jobs in Q2, and, for many firms, the problem is not being able to hire enough workers rather than having too many workers. Private sector balance sheets remain notably strong, with households and businesses sitting on significant liquidity buffers in the form of elevated cash balances, with data from the Federal Reserve’s Distributional Financial Accounts showing this to be the case for households across all levels of income and net worth. While consumer spending on goods has slowed, this is part of the long-awaited rotation away from spending on goods and toward spending on services, which at present is growing at a rapid pace. While the demand for home purchases has softened as mortgage rates have further stressed affordability, the reality is that the housing market has been chronically undersupplied for the past several years. As such, rather than triggering a collapse in the housing market, higher mortgage rates are more likely to restore some semblance of normalcy to the housing market, which clearly has been absent the past two-plus years.

We can make the same point more broadly. While we may not know the proper term to describe the U.S. economy over the past two-plus years, we do know that “normal” is not it. There should never have been any question that as pandemic-related policy support faded, conditions would normalize and growth would revert to its long-term trend, which we do not see as having changed from where it was prior to the pandemic, i.e., right around 2.0%. That this natural slowdown is now being compounded by elevated inflation and a suddenly aggressive FOMC is what has many on edge, and we share some of those worries.

While we expect the FOMC to raise the Fed funds rate by 75 basis points at their July meeting, by 50 basis points at their September meeting, and by 25 basis points at their November meeting, beyond that it’s anyone’s guess. By then, with the funds rate above its neutral value, the FOMC may have to choose between continuing to hike in the face of slowing economic growth and slowing core inflation or pausing despite headline inflation remaining well above their 2.0% target rate. We think that choice will be less clear-cut than is implied by what remains a chorus of aggressive talk from several FOMC members.

Sources: Regions Economic Division; Bureau of Economic Analysis; Bureau of Labor Statistics; Institute for Supply Management

Investment Strategy Update

Global stocks and bonds dropped sharply in the first half of the year as investors digested slowing economic growth, rising inflation, and higher interest rates. Very few asset classes were left unscathed. 1H 2022 marked the worst start for the S&P 500 (-20%) since 1962, U.S. High Yield (-10.2%) since 1989, and U.S. 10Y Treasuries (-10.8%) since the 1970s. A traditional portfolio consisting of 60% U.S. stocks/40% U.S. bonds returned -16.1% year-to-date, the worst six-month stretch since March 2009 (-17.2%).

The Highland Diffusion Index has captured this deteriorating environment. As we’ve written about the last few months, weakness is most pronounced in the market-based indicators, especially momentum measures and credit spreads. Monetary policy indicators remain positive in our current framework, but we do expect them to weaken soon in the face of further rate hikes and the gradual reduction of the Fed’s balance sheet. Employment remains a bright spot, as hiring remains notably broad-based across private sector industry groups. The Diffusion Index continues to signal a Risk Neutral stance.

Today, the range of possible outcomes from a portfolio perspective seems quite wide. We are likely to see reduced demand and slowing growth as the Federal Reserve’s tightening campaign works its way through the economy. The equity market’s sell-off to this point reflects this new reality. A “soft landing” would mean the economy remains resilient in the face of further restrictive tightening, the job market remains strong, households continue to spend, and inflation falls close to 2% target levels. In this scenario, equities find a floor and begin to recover, and the yield curve steepens.

In a “hard landing,” inflation remains more rooted, and the Federal Reserve is forced to tighten more aggressively. The economy falls into recession, unemployment rises sharply, and business and consumer spending fall precipitously. In this scenario, equities resume their turn lower and take a broader set of risk assets down with them.

For those investors concerned about recession, bonds still offer the best alternative to the inherent riskiness of equities. Although correlations to risk assets have been higher to start the year, we would expect them to resume their role as a safe haven in a “hard landing” scenario. Moreover, with high-quality core bonds now yielding 4%–5%, the highest levels in over a decade, investors can earn a healthy return while keeping an eye toward preservation of capital. This has not been the case for a long time.

We also think it’s important for investors to focus on the long-term and not get too hung up with current market volatility. At some stage equities are going to reach their previous high and even surpass it. Let’s say it takes three years for U.S. stocks to get back to their peak of 4797 on the S&P 500 Index. In this scenario, you are looking at a 26% cumulative return or close to 8% annualized over the next three years. Improved valuations and forward return prospects at this point provide support, especially in a “soft landing” scenario.

As we wrote last month, in these periods where the range of outcomes is so wide, we believe it’s best to stay closer to neutral or strategic policy targets. With our move to neutral and prospects of a recession rising, we are taking our small-cap value overweight off and shifting back to our strategic positioning in the U.S. If the dollar continues to rise, then we could see a more pronounced global slowdown. This is not our base case, but something that bears watching.

In addition to core stocks and bonds, we continue to recommend a host of inflation-sensitive, alternative fixed income, and private investments, which have held up well in the current market downturn and continue to provide much-needed diversification and return. Moreover, we’ve identified opportunities we’d like to purchase or add to if odds of a “soft landing” increase. We will continue to monitor the investment landscape and reevaluate positioning as we get more clarity.

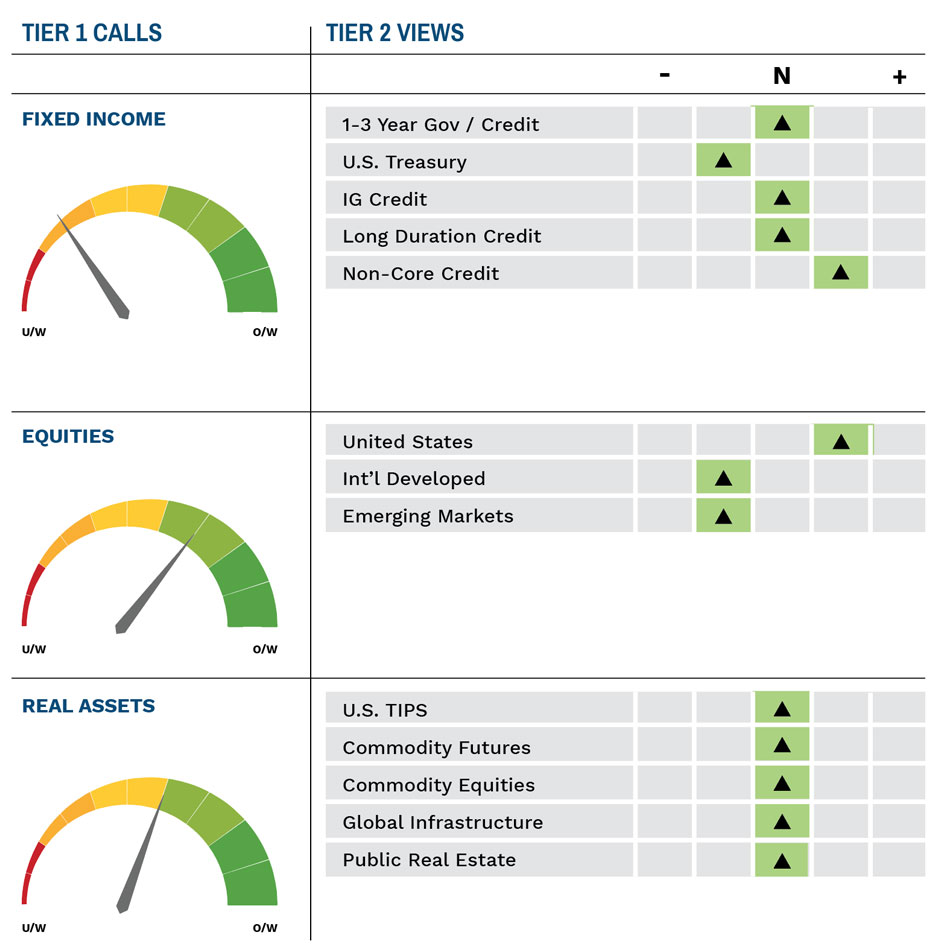

Highland Associates Cross Asset Views

As of 7/15/2022