Download Asset Allocation | December 2022

Let’s Start the New Year Right

Economic Update

A Thin Line Between Growth and Contraction

By Regions Economic Division

If we had to pick one dominant theme in discussions of the U.S. economy in 2022, that theme would be recession. Contractions in real GDP in each of the first two quarters of 2022 triggered intense debate as to whether or not the U.S. economy was already in recession. That debate was sparked by those two consecutive quarterly contractions fulfilling a commonly used, particularly in the media, definition of recession but nonetheless not meeting the criteria established by the National Bureau of Economic Research (NBER), which is the definition we and most in our profession adhere to. The NBER defines recession as “a significant decline in economic activity that is spread across the economy and lasts more than a few months,” and, by that standard, it was clear, at least to us, that despite real GDP having contracted in each of the first two quarters of 2022, the economy was not in recession.

Indeed, among economists who adhere to the NBER definition, the debate hasn’t so much been along “are we or aren’t we” lines but instead along “will we or won’t we” lines, as in will the U.S. economy slip into recession and, if so, when will that happen. For many, a recession seems the inevitable end to a prolonged period of elevated inflation and interest rates being pushed significantly higher by central banks scrambling to catch up after having fallen badly behind the inflation curve. For others, supports such as strong household and business balance sheets and a resilient labor market will be enough to stave off recession. As for which side of this debate we’re on, while we’ve yet to incorporate a recession into our baseline forecast, we’ve seen it as a close call, to the point that we tell people our baseline forecast, which anticipates real GDP barely budging and the unemployment rate rising in 2023, wouldn’t look or feel much different from the brief, mild recession many are expecting.

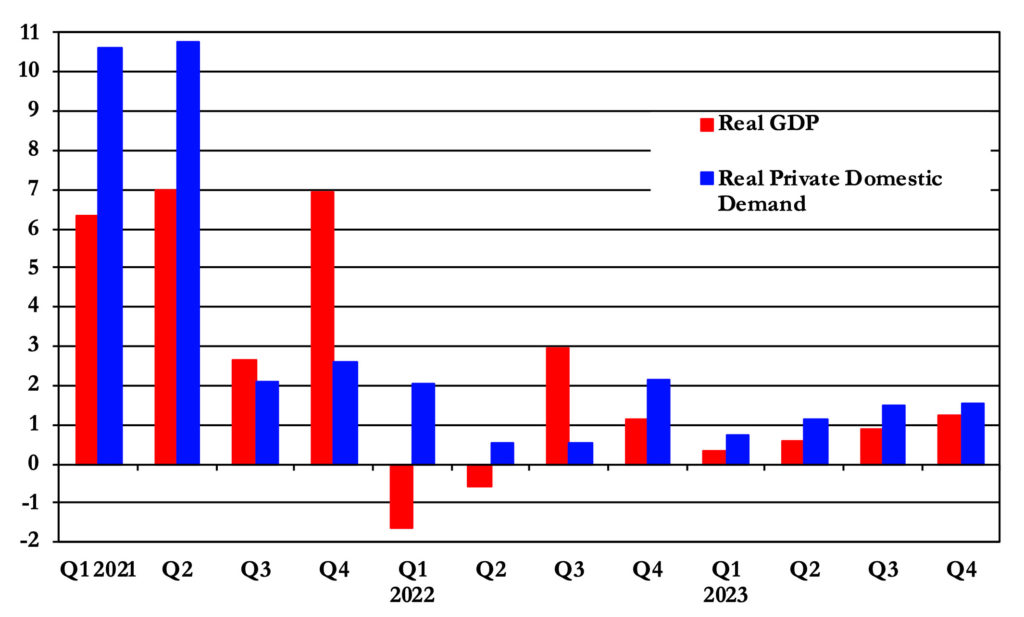

While the second estimate from the Bureau of Economic Analysis (BEA) showing annualized real GDP growth of 2.9% in Q3 may seem to settle the “are we or aren’t we” debate, it still leaves “will we or won’t we” very much up in the air, particularly when one goes through the details of the Q3 GDP data. Recall that when the BEA reported contractions in real GDP in each of the first two quarters of 2022, our view was that those contractions said more about the quirks of GDP accounting than they did about the underlying health of the U.S. economy. While inventory accumulation and net exports are small components of GDP, they also tend to be highly volatile from one quarter to the next, to the point that they can, and often do, skew top-line GDP growth. That was the case in each of the first two quarters of this year, and it was again the case in the Q3 data.

Specifically, a much narrower trade deficit added 2.93 percentage points to top-line real GDP growth, while a slower pace of inventory accumulation in the nonfarm business sector deducted 0.97 percentage points from top-line real GDP growth. Beneath these sharp swings, however, real private domestic demand, or, combined business and household spending, expanded at an annualized rate of just 0.5%. We see private domestic demand as the best gauge of the underlying health of the U.S. economy, and that real private domestic demand grew over 1H 2022 was a big reason we and many others dismissed talk of recession despite the contractions in real GDP. In Q3, however, the performance of real private domestic demand didn’t exactly inspire a ton of confidence.

Adjusted for inflation, consumer spending grew at a 1.7% rate and business fixed investment grew at a 5.1% rate in Q3, but this growth was almost entirely negated by residential fixed investment contracting at a 26.8% rate, reflecting the extent to which residential construction has been thwarted by higher mortgage interest rates. While we expect further contractions in residential fixed investment, they will not be nearly as severe as that seen in Q3, meaning residential fixed investment won’t be as big of a drag on private domestic demand going forward. At the same time, however, we expect significant decelerations in growth of consumer spending and business fixed investment, with the net result being only meager growth in real private domestic demand in 2023. Put differently, we expect there to be little buffer between the economy expanding or contracting in 2023.

norms, those balances have been shrinking and will continue to do so going forward, particularly to the extent that inflation remains elevated. If we are correct in anticipating a pronounced slowdown in the pace of job growth, that will be accompanied by a slower pace of growth in labor earnings, the largest single component of personal income. These factors will combine to weigh on discretionary consumer spending. At the same time, heightened uncertainty around the economic outlook and a less upbeat outlook for earnings growth has led many businesses to scale back capital spending plans, to the point that we now anticipate business investment being notably weak over much of 2023. That the Institute for Supply Management’s (ISM) monthly survey shows the manufacturing sector slipping into contraction in November lends downside risk to our forecast of business investment.

While this adds up to our expecting only meager growth in real private domestic demand in 2023, there are some potential bright spots. There is a growing body of evidence suggesting that we’ve turned the corner on inflation (e.g., November’s 7.1% YOY print), and it could decelerate more quickly than we anticipate in 2023. At the same time, the FOMC is winding down the magnitude of their rate hikes, and market interest rates have fallen considerably of late in anticipation of this. That said, with our baseline forecast anticipating such meager growth, there is little margin for error in a world in which plenty can still go wrong. As such, the one forecast we can have a great deal of confidence in is that the “will we or won’t we” debate will rage on through most, if not all, of 2023.

Thin Line Between Growth and Contraction in Near-Term

Sources: Bureau of Economic Analysis; Bureau of Labor Statistics; Institute for Supply Management

Investment Strategy Update

By Highland and Regions Multi-Asset Solutions

Equities performed well in November. The S&P 500 returned a respectable 5.5% for the month while the small-cap Russell 2000 returned a more modest 2.2%. Markets abroad experienced more impressive rallies of 11.8% for developed markets (MSCI ACWI ex. U.S.) and 14.9% for emerging markets (MSCI EM). Strong absolute and relative performance by international equity markets stemmed from cooler inflation data stateside during the month, allowing hopes for a dovish Fed pivot to creep back in. The thesis goes that should the FOMC pause, or potentially pivot and cut rates early next year, central bankers abroad could be afforded the opportunity to be more measured down the line in the pace of monetary policy tightening, potentially avoiding a deeper economic contraction in Europe, specifically. With the fundamental outlook for the global economy and corporate profits remaining a murky one, those hoping for a dovish central bank pivot have been disappointed based on FOMC Chair Jerome Powell’s recent comments as markets have shifted to a risk-off stance.

Hopes for the FOMC to pivot to a more accommodative policy stance have lingered even as the FOMC has messaged to markets that it has more work—i.e., tightening—to do. Equity investors have been willing to call the FOMC’s bluff and bid up prices of risk assets at various times during 2022 and were, at least briefly, rewarded for doing so in late November, as stocks rallied on comments made by Powell that proved less hawkish than feared and eased investor concerns surrounding the FOMC breaking the economy by overtightening. Higher-for-longer Fed funds and tighter-for-longer monetary policy should compress equity valuations over coming quarters, as future corporate earnings discounted at a higher interest rate have a lower present value. With the S&P 500 trading at 18.5 times estimated ’23 earnings at month-end and earnings estimates to be revised lower still in coming months, multiples likely have further to fall.

On the seasonality front, while the December through April stretch in the calendar has historically proven profitable for equity investors, there is more to monthly returns data than meets the eye. Since 1928, the S&P 500 has posted a 1.4% average return during December and has ended the month higher 69 out of 94 times, generating the best batting average of any calendar month. However, the final month of the year has historically taken its cue from the prior 11 months, and in the 15 instances since 1928 in which the S&P 500 has entered December down 10% or more year-to-date, the average S&P 500 return during the month was -1.7%. Averages are just that, and positive seasonality could win out again this month with equities building on November’s gains, but we remain of the opinion that near-term upside in stocks will be limited by lofty valuations and further tightening of monetary policies.

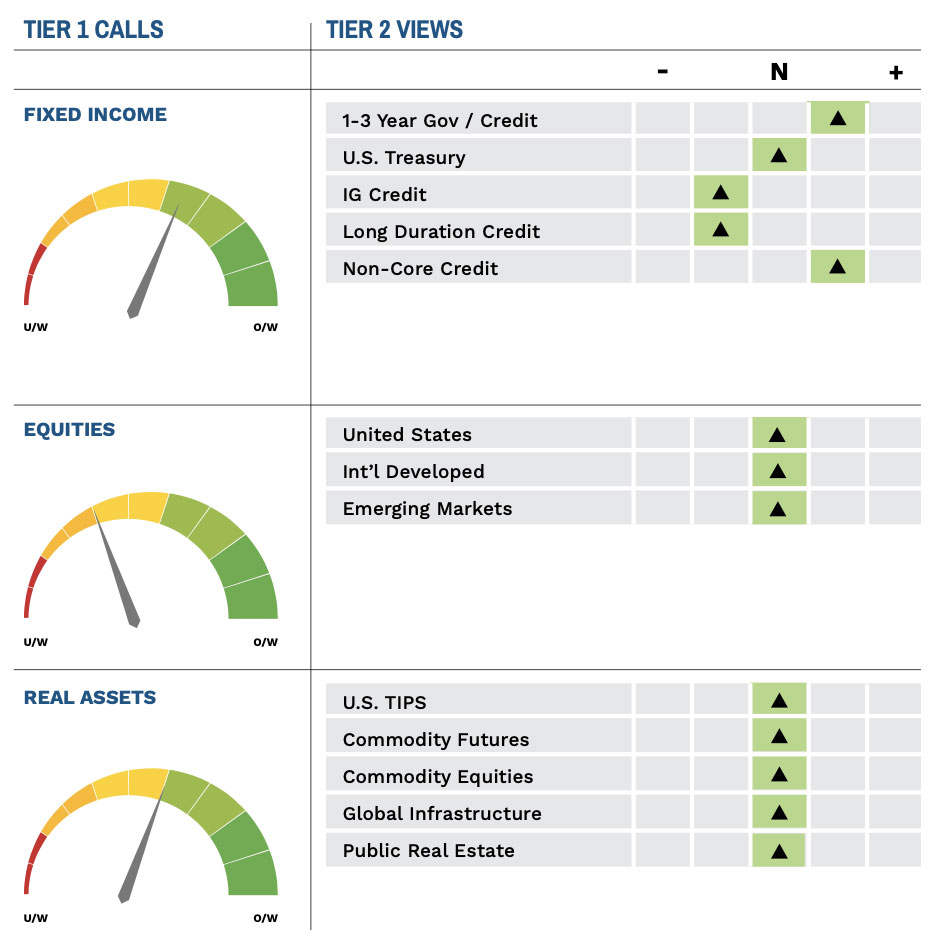

Our recommended defensive positioning remains unchanged heading into year-end. One big reason why is that the outlook for bonds has greatly improved, and they are now more appealing than they have been at almost any other time over the prior decade. We continue to prefer shorter-duration bonds for conservative, income-seeking investors, particularly given our view that inflation trending lower over the coming year(s) will improve real returns. We also continue to recommend non-directional, low-beta alternatives, which have served our clients well this year. In an investment climate likely to remain characterized by uncertainty on many fronts, we continue to believe that strategies with more flexibility across asset classes hold appeal for investors looking to limit portfolio volatility and drawdown.

As we approach the end of 2022, we would like to wish all of our clients a happy holiday season. We are honored to be your partner and look forward to a brighter 2023.

Highland Associates Cross Asset Views

As of 12/19/2022

IMPORTANT DISCLOSURES: This publication has been prepared by the staff of Highland Associates, Inc. for distribution to, among others, Highland Associates, Inc. clients. Highland Associates is registered with the United States Security and Exchange Commission under the Investment Advisors Act of 1940. Highland Associates is a wholly owned subsidiary of Regions Bank, which in turn is a wholly owned subsidiary of Regions Financial Corporation. Research services are provided through Multi-Asset Solutions, a department of the Regions Asset Management business group within Regions Bank. The information and material contained herein is provided solely for general information purposes only. To the extent these materials reference Regions Bank data, such materials are not intended to be reflective or indicative of, and should not be relied upon as, the results of operations, financial conditions or performance of Regions Bank. Unless otherwise specifically stated, any views, opinions, analyses, estimates and strategies, as the case may be (“views”), expressed in this content are those of the respective authors and speakers named in those pieces and may differ from those of Regions Bank and/or other Regions Bank employees and affiliates. Views and estimates constitute our judgment as of the date of these materials, are often based on current market conditions, and are subject to change without notice. Any examples used are generic, hypothetical and for illustration purposes only. Any prices/quotes/statistics included have been obtained from sources believed to be reliable, but Highland Associates, Inc. does not warrant their completeness or accuracy. This information in no way constitutes research and should not be treated as such. The views expressed herein should not be construed as individual investment advice for any particular person or entity and are not intended as recommendations of particular securities, financial instruments, strategies or banking services for a particular person or entity. The names and marks of other companies or their services or products may be the trademarks of their owners and are used only to identify such companies or their services or products and not to indicate endorsement, sponsorship, or ownership by Regions or Highland Associates. Employees of Highland Associates, Inc., may have positions in securities or their derivatives that may be mentioned in this report. Additionally, Highland’s clients and companies affiliated with Highland Associates may hold positions in the mentioned companies in their portfolios or strategies. This material does not constitute an offer or an invitation by or on behalf of Highland Associates to any person or entity to buy or sell any security or financial instrument or engage in any banking service. Nothing in these materials constitutes investment, legal, accounting or tax advice. Non-deposit products including investments, securities, mutual funds, insurance products, crypto assets and annuities: Are Not FDIC-Insured I Are Not a Deposit I May Go Down in Value I Are Not Bank Guaranteed I Are Not Insured by Any Federal Government Agency I Are Not a Condition of Any Banking Activity.

Neither Regions Bank nor Regions Asset Management (collectively, “Regions”) are registered municipal advisors nor provide advice to municipal entities or obligated persons with respect to municipal financial products or the issuance of municipal securities (including regarding the structure, timing, terms and similar matters concerning municipal financial products or municipal securities issuances) or engage in the solicitation of municipal entities or obligated persons for such services. With respect to this presentation and any other information, materials or communications provided by Regions, (a) Regions is not recommending an action to any municipal entity or obligated person, (b) Regions is not acting as an advisor to any municipal entity or obligated person and does not owe a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934 to any municipal entity or obligated person with respect to such presentation, information, materials or communications, (c) Regions is acting for its own interests, and (d) you should discuss this presentation and any such other information, materials or communications with any and all internal and external advisors and experts that you deem appropriate before acting on this presentation or any such other information, materials or communications.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.