Download Asset Allocation | August 2022

Can’t Stop

After reviewing the economic and market environment, Highland offers the following comments on the current landscape:

Economic Update

Nowhere Near Almost Done

The (not so) great debate over whether or not the U.S. economy is in recession rages on. No matter what media platform you choose to engage, it’s hard to avoid what has seemingly turned into a nonstop shouting match. Indeed, our normally sedate knitting group nearly came to blows over this after the release of the July employment report. Though, if we’re being honest, it was probably wrong for a certain member of the “no, it isn’t” camp to throw a copy of the July employment report at a member of the “yes, it is” camp as a means of proving their point. In any event, we see that debate as being totally irrelevant and would prefer to put that tossing of the employment report incident behind us and let the data settle it. Anyone wanting to insist that the economy is in recession is free to do so, even if there is nothing in the economic data to support that contention. At the same time, however, just because the economy isn’t there yet doesn’t mean it won’t be later this year or in 2023.

Those insisting the economy is in recession base their contention on real GDP having contracted in each of the first two quarters of 2022. The initial estimate from the Bureau of Economic Analysis (BEA) shows real GDP contracted at an annual rate of 0.9% in Q2. That contraction, however, is more than fully accounted for by a smaller build in nonfarm business inventories in Q2 than was the case in Q1, which deducted two percentage points off the quarterly change in real GDP. Hardly the stuff of which recessions are made.

July job growth blew expectations out of the water, with nonfarm payrolls rising by 528,000 jobs, more than double the consensus forecast, while prior estimates of job growth in May and June were revised higher. Between these upward revisions and July’s gains, the level of nonfarm employment has finally surpassed its pre-pandemic peak. The unemployment rate fell to 3.5% in July, though this in part reflected a decline in labor force participation. The July employment report also showed a larger than expected increase in average hourly earnings, which was in line with the Q2 data on the Employment Cost Index (ECI), a measure of total labor compensation costs (wages and benefits) that many, including the FOMC, see as the most reliable gauge of trends in labor costs. The Q2 ECI data show private sector wage costs rose 5.7% year-on-year, the largest such increase in the life of the current series, while benefit costs posted their largest year-on-year increase since 2005.

As of June, the latest available data, there were 10.698 million open jobs across the U.S. economy. While this marks the third straight monthly decline, the number of job vacancies nonetheless remains over 50% higher than pre-pandemic levels. Moreover, more than two-thirds of June’s decline was accounted for by construction and retail trade, areas of the economy that have clearly slowed over the past several weeks. At the same time, the rate at which firms are hiring workers and the rate at which workers are voluntarily quitting jobs remain far above their pre-pandemic norms. All of this affirms a point we’ve been making for some time now, which is that labor supply remains no match for labor demand and, as such, there is little reason to expect meaningful easing of wage pressures until the labor market is brought into better balance.

The Institute for Supply Management’s (ISM) July surveys of the manufacturing and services sectors show continued expansion in the two broad sectors, with the services sector survey coming in much stronger than had been anticipated, including an acceleration in the growth of new orders. Two elements of the July ISM survey worth noting are signs of relief from supply chain constraints and signs that non-labor input price pressures are easing. To be sure, supply chains are far from operating freely and normally but, even so, signs of progress in that direction are most welcome. And, while input prices are still rising, they are doing so at a slower pace, which is consistent with recent declines in energy and commodity prices.

While falling retail gasoline prices will take some of the steam out of the month-to-month changes in the Consumer Price Index (CPI) and the PCE Deflator, they will bring little relief in terms of the over-the-year changes. For instance, after having risen by 1.3% in June, CPI was unchanged in July, but nonetheless left the over-the-year change at 8.5%. Moreover, the July data showed core CPI inflation accelerating from June’s pace, and we expect that acceleration to persist into the fall.

Where does this leave the FOMC in their quest to “do a job on demand” as a means of reining in inflation? If anything, the FOMC’s task now seems even more daunting than it did when the committee embarked on its course of rate hikes in March of this year. Thus far, the labor market seems not to have even noticed the FOMC’s attempts to push down labor demand as a means of alleviating wage pressures. At the same time, the inflation data have yet to bring anything close to the “clear and convincing” evidence of slowing inflation that the FOMC has stated they need to see before thinking of backing off the current course of Fed funds rate hikes.

Even before the release of the July employment report, San Francisco Fed President Mary Daly noted that the FOMC’s work was “nowhere near almost done,” and it could be that still-strong labor market data emboldens the FOMC to be more aggressive than it would’ve been otherwise. After having, somewhat curiously we might add, come to the conclusion that the FOMC had, at its July meeting, undertaken a “dovish pivot,” market participants have abandoned this interpretation, and market pricing implies a better than even chance of another 75-basis point Fed funds rate hike at the September FOMC meeting. Whether, or to what extent, the FOMC moves at a slower pace after September will depend on the incoming economic data. In short, the higher and more persistent inflation proves to be, the further the FOMC will go, and the further the FOMC goes, the greater the probability that they push the economy into recession. As such, it could be that those insisting that the U.S. economy is in recession weren’t wrong but instead were just early.

Sources: Regions Economic Division; Bureau of Economic Analysis; Bureau of Labor Statistics; Institute for Supply Management

Investment Strategy Update

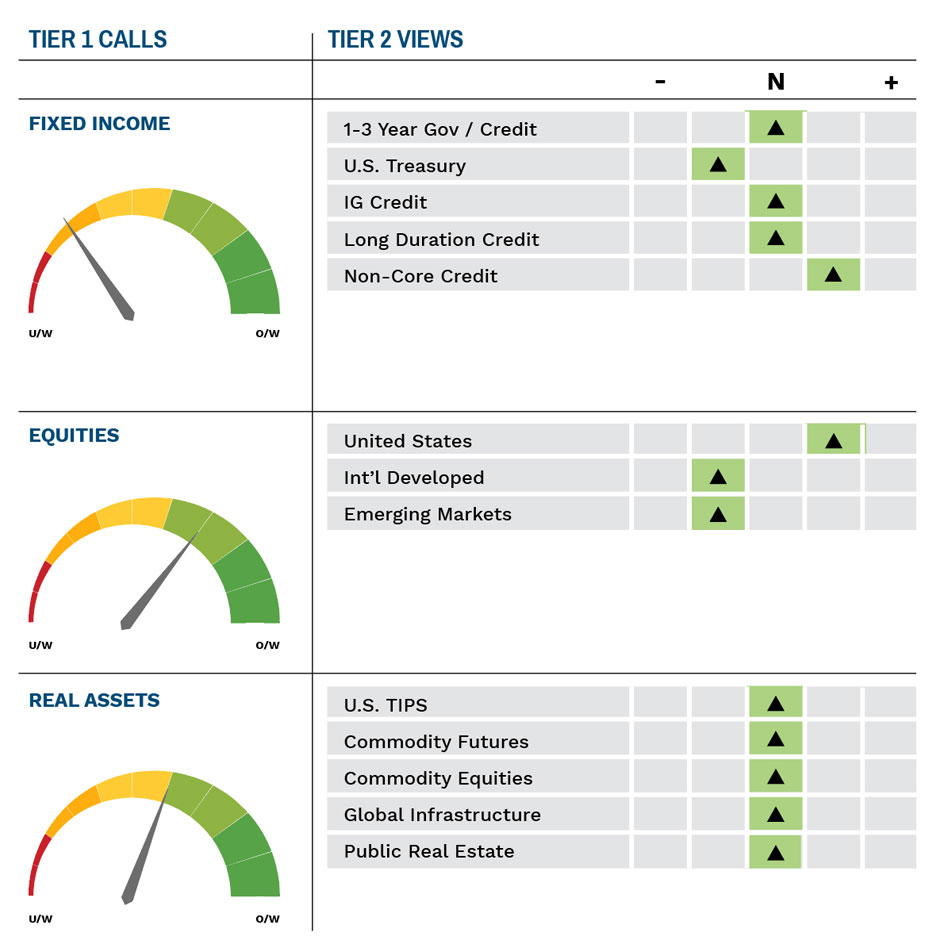

The Highland Diffusion Index continues to signal a Risk Neutral stance. Weakness is most pronounced in the market-based indicators, especially momentum measures and credit spreads. However, we are starting to see further deterioration in our economic and monetary policy indicators as average weekly hours worked dropped in June and the Federal Reserve continues to adopt a more restrictive strategy.

Employment remains a bright spot. Our forecast sees the unemployment rate rising only modestly from 3.5% at present to 3.7% in 2023. The danger is that the unemployment rate increases significantly in the coming year. This is because rising unemployment tends to feed on itself. Households react to a weaker job market by paring back spending. Businesses react by cutting investment. The U.S. has never averted a recession when the unemployment rate has risen by more than one-third of a percentage point over the preceding three months.

Private Equity Update

Private equity markets have held up well in the first half of the year despite significant declines in the public markets, but challenges remain. The average time to close for most large buyout transactions is over a year, which means most deals closing today are based on prices agreed to near peak public market prices. PitchBook, a leading private equity market database, reports venture capital valuations up across the seed/angel stage (+33%), early stage (+19%), and late stage (+10%) in the first half of the year. Buyout multiples did contract but notably less than public markets. In the U.S., the average middle market deal value reported at 11.6x, down from 12.3x a year ago. European valuations fell from a multiple of 14.1x a year ago to 11.3x in the second quarter. Growth equity often combines some late-stage venture (minority) transactions and club deal majority (buyout) transactions, but with a focus on companies with faster growth. These investments often share more similarities with buyout than venture, as they involve more established companies.

However, deal volume is slowing, and risk of recession is increasing. In the fourth quarter of 2021, just under 7,000 private investments worth over $900 billion were recorded in North America. During this past quarter, deal volumes and aggregate deal values fell (approximately 4,600 deals valued at $550 billion) to levels only slightly better than experienced during the COVID lockdowns of 2020. A similar trend has been seen in European markets, and exits have also slowed materially.

In this environment, growth is vital. Cost of financing for most large buyout transactions has risen from slightly above 6% to more than 8%. If return on assets (without assumed growth) is 5.5% to 7.7%, then an 8% cost of financing is dilutive to your ROE. From 2012 to 2021, S&P earnings grew by 8.5% per year. If current investments can achieve the same EBITDA growth over the next decade, gross returns with these entry points should be low double digits to mid-teens. We are starting to see some managers taking markdowns where growth is challenged, and we expect to see dispersion in returns for the remainder of the year.

Many investors point to the early 2000s as a comparison for today. Venture investments were challenged following that period, with median and top quartile IRRs for vintages between 2001 and 2005 of 2.4% and 5.6%, respectively. On the other hand, buyout and growth strategies for the same vintages produced median and top quartile IRRs of 13.1% and 23.1%, respectively.

Concentrating commitments in buyout and growth equity in this environment may prove beneficial as it did during the 2000s. Furthermore, with current multiple and interest rate dynamics, a focus on middle and lower middle markets as well as global or international strategies may be most fruitful. This certainly does not mean that investors should avoid venture investments. When capital becomes scarce, focusing on obtaining capacity with high-quality VCs could help investors obtain eye-popping returns when the next venture bull market returns. While the best exits in venture capital in the past two decades came in the past three years, most of these investments were made in the mid-to-late 2000s and the early part of the last decade.

Sources: BCA Research, PitchBook

Highland Associates Cross Asset Views

As of 08/15/2022