Download Asset Allocation | April 2022

After reviewing the economic and market environment, Highland offers the following comments on the current landscape:

Economic Update

With robust and broad-based job growth, an unemployment rate of 3.6%, ongoing expansion in the factory and services sectors, and record-high household net worth, it may seem as though there is little cause for concern over the U.S. economy. Elevated inflation notwithstanding, of course. Markets, however, are all about what will happen tomorrow, not what is happening today. In that sense, there are increasing grounds for concern. Already elevated inflation is set to push even higher, and the FOMC has, somewhat belatedly, embarked on a path of Fed funds rate hikes that could prove far more aggressive than anyone would have expected two months ago. With the FOMC soon to begin the process of paring down the Fed’s balance sheet, market participants perceive an increasing risk of a policy error, i.e., the FOMC moving too far, too fast to the point that the economy tips into recession. Those concerns are reflected in the yield curve, parts of which were recently inverted, most notably the spread between yields on 2-year and 10-year U.S. Treasury notes. It is no wonder, then, that markets seem to lack direction at present.

What is shaping up to be a notably weak Q1 real GDP growth print will play right into fears over economic outlook. Most forecasts, ours included, anticipate the initial estimate from the Bureau of Economic Analysis (BEA), due on April 28, will show annualized Q1 real GDP growth of around 1.0%. That Q1 real GDP growth will look worse than it was likely won’t be of much consolation in a headline-driven world. After a significant build in nonfarm business inventories accounted for 5.3 percentage points of the 6.9% increase in real GDP in Q4 2021, inventories will act as a powerful drag on Q1 real GDP growth, perhaps deducting 3.0 percentage points from top-line growth. This is more a reflection of GDP accounting than of the underlying health of the economy. Indeed, we expect real private domestic demand, or, combined household and business spending, to grow at an annualized rate of 4.9% in Q1, up from 2.6% growth in Q4 2021, which would be more indicative of the pace of economic activity in Q1 than the headline GDP growth number will be.

The March surveys of the manufacturing sector and the broader services sector from the Institute for Supply Management (ISM) showed continued expansion and a faster pace of job growth. One noteworthy element of the manufacturing survey, however, was a sharp deceleration in the growth of new orders. While one cannot draw meaningful observations from a single data point, further weakening in orders growth in the months ahead would be a red flag not to be ignored. For now, however, lingering supply chain and shipping bottlenecks remain a source of frustration to firms while input price pressures continue to mount.

Total nonfarm employment rose by 431,000 jobs in March, with prior estimates of job growth in January and February revised up by a net 95,000 jobs for the two-month period. Hiring remained notably broad based across private sector industry groups in March, a sign of a more sustainable expansion in the broader economy. Despite a further increase in labor force participation, the unemployment rate fell to 3.6% in March. Over the past 12 months, nonfarm payrolls have increased by 6.494 million jobs, but with over 11 million open jobs across the economy, it seems clear that firms would be taking on more workers were they able to do so.

As measured by the Consumer Price Index (CPI), inflation hit 8.5% in March, with core inflation at 6.5%. Inflation is running at its fastest pace since the early 1980s and, between the economic fallout from Russia’s invasion of Ukraine and renewed stresses on global supply chains, looks set to rise higher and be more persistent than had been anticipated at the start of 2022. The FOMC has all but conceded they fell behind the curve on inflation, and the March FOMC meeting took on a surprisingly aggressive tone. The FOMC raised the Fed funds target rate by 25 basis points and the updated “dot plot” implied 25-basis point hikes at each of remaining FOMC meetings in 2022, with the funds rate ultimately pushing above the committee’s estimate of neutral. Subsequent to the March FOMC meeting, public comments by FOMC members have opened the door to a 50-basis-point funds rate hike at the May FOMC meeting. Market expectations have adapted, and 50-basis-point hikes at both the May and June FOMC meetings and 25-basis-point hikes at the four remaining 2022 meetings are now priced in.

The prospect of this more aggressive path of the funds rate helps account for growing fears of a policy mistake on the part of the FOMC, which was reflected as the 2-year U.S. Treasury note briefly rose above the 10-year yield for the first time since September 2019. While inverted yield curves have preceded past recessions, Fed Chair Jerome Powell has countered by citing three past instances – 1965, 1984, and 1994 – in which the FOMC has engineered a “soft landing,” i.e., raised the Fed funds rate without triggering a recession. It is worth noting, however, that present conditions differ significantly from conditions in these three occurrences on three grounds: 1) the labor market is much tighter now than it was in these prior episodes, meaning it is a source of more intense inflation pressures at present; 2) in these past instances, the FOMC was acting preemptively to keep inflation in check, whereas now inflation is significantly elevated and set to push even higher; and 3) in past cycles, real (or inflation-adjusted) interest rates were low but were positive, but now real interest rates are significantly negative, meaning it will take a much more substantial increase in nominal interest rates to dampen the demand side of the economy than was the case in these past cycles.

It is also worth noting that the yield curve, as measured by the spread between yields on 3-month Treasury bills and 10-year Treasury notes, which has a longer track record in foretelling recessions, remains notably wide, a stark contrast to the signal being sent by the recent inversion in the 2s10s part of the curve. This seems almost fitting in that we are in an environment of such heightened uncertainty, and clarity is hard to come by.

Sources: Regions Economic Division, Bureau of Labor Statistics; Institute for Supply Management

Investment Strategy Update

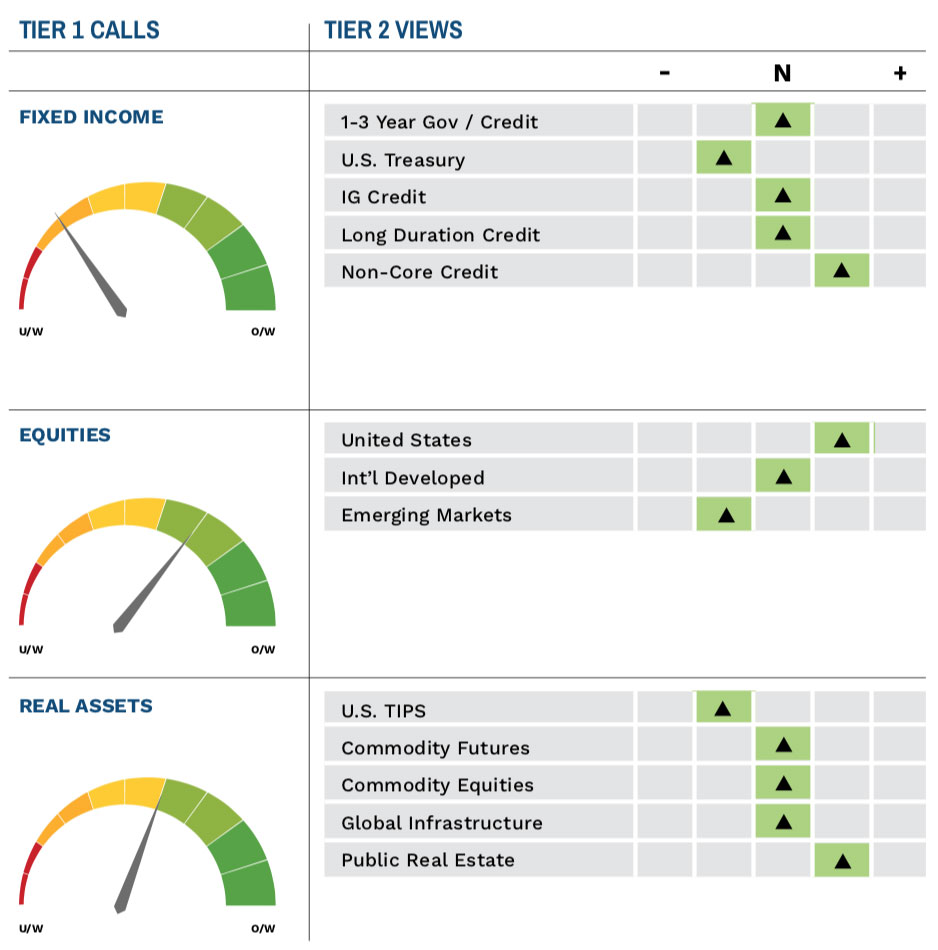

While the Highland Investment Working Group remains constructive on equity and equity-like assets, we are watching for signs that this long period of outperformance is nearing an end. The fundamental and market-based data we monitor most closely as part of our Highland Diffusion Index framework is turning mixed as the Russia-Ukraine war, China’s zero-COVID policy, and changes in Federal Reserve policy impact each in different ways. Both economic and monetary policy inputs remain positive but are being affected by stubbornly high inflation and the start of the Fed’s tightening campaign. We are watching closely how inventory buildup last year may affect new business capital goods orders, as a slowdown in orders would be another potential risk-off signal. Employment data, on the other hand, is strongly positive and supportive of growth, and household and corporate balance sheets are in very good shape. There has never been a recession without a large spike in jobless claims.

Market-based indicators have moved to a more cautious position as credit spreads continue to widen and international developed equity market momentum has slowed. Credit spreads on lower-quality bonds began to widen at the end of 2021, and the trend has spread to higher-quality bonds thus far in 2022. We are also closely monitoring market momentum, as equity momentum has weakened domestically and internationally along with stock-bond momentum. As the Fed looks to engineer a “soft-landing” in the face of rising inflation, Highland will continue to closely monitor changes to the outlook and revise portfolios accordingly.

The team recently closed the overweight to structured credit. We view structured credit (unlevered) as likely the most conservative allocation within non-core fixed income. The overweight has been accretive year-to-date and since inception. The core of our allocation to structured credit has been legacy non agency residential mortgages. The historical spread relative to agencies is now around the historical average as mortgage rates on new agency mortgages have risen in recent months. While there are still plenty of reasons to like residential mortgages yielding in the mid-single digits, the opportunity is no more compelling than other non-core sub-asset classes, such as bank loans and high yield.

As we’ve written about in recent months, Highland has long advocated clients strategically allocate to sectors like private real estate, listed real estate (REITs), natural resource equities, Treasury inflation protected securities (TIPS), and commodities. An allocation to a diversified basket of these assets was positive in the first quarter during a difficult period for traditional stocks and bonds. With inflation expected to remain elevated in 2022, we continue to believe the case for allocating to real assets is strong. Specifically, listed real estate (REIT) investors continue to benefit from healthy fundamentals, attractive inflation-hedging characteristics, upside from tight rental markets, and exposure to non-core property types like data centers, life science real estate, and single-family housing.

Within equity allocations, the team continues to favor U.S. over emerging market, and specifically U.S. small-cap value. Small-cap value has historically outperformed in periods of higher growth and higher inflation because of their overweight to cyclical sectors like banks, energy companies, and industrial manufacturers, which tend to benefit from higher interest rates and continued economic expansion. Moreover, attractive relative valuations could create a sustained runway for small-cap value stocks. Emerging markets have historically struggled during periods of Fed tightening, which could be a headwind as the FOMC continues raising interest rates and begins unwinding their balance sheet.

Highland Associates Cross Asset Views

As of 4/09/2022

IMPORTANT DISCLOSURES: This publication has been prepared by the staff of Highland Associates, Inc. for distribution to, among others, Highland Associates, Inc. clients. Highland Associates is registered with the United States Security and Exchange Commission under the Investment Advisors Act of 1940. Highland Associates is a wholly owned subsidiary of Regions Bank, which in turn is a wholly owned subsidiary of Regions Financial Corporation. Research services are provided through Multi-Asset Solutions, a department of the Regions Asset Management business group within Regions Bank. The information and material contained herein is provided solely for general information purposes only. To the extent these materials reference Regions Bank data, such materials are not intended to be reflective or indicative of, and should not be relied upon as, the results of operations, financial conditions or performance of Regions Bank. Unless otherwise specifically stated, any views, opinions, analyses, estimates and strategies, as the case may be (“views”), expressed in this content are those of the respective authors and speakers named in those pieces and may differ from those of Regions Bank and/or other Regions Bank employees and affiliates. Views and estimates constitute our judgment as of the date of these materials, are often based on current market conditions, and are subject to change without notice. Any examples used are generic, hypothetical and for illustration purposes only. Any prices/quotes/statistics included have been obtained from sources believed to be reliable, but Highland Associates, Inc. does not warrant their completeness or accuracy. This information in no way constitutes research and should not be treated as such. The views expressed herein should not be construed as individual investment advice for any particular person or entity and are not intended as recommendations of particular securities, financial instruments, strategies or banking services for a particular person or entity. The names and marks of other companies or their services or products may be the trademarks of their owners and are used only to identify such companies or their services or products and not to indicate endorsement, sponsorship, or ownership by Regions or Highland Associates. Employees of Highland Associates, Inc., may have positions in securities or their derivatives that may be mentioned in this report. Additionally, Highland’s clients and companies affiliated with Highland Associates may hold positions in the mentioned companies in their portfolios or strategies. This material does not constitute an offer or an invitation by or on behalf of Highland Associates to any person or entity to buy or sell any security or financial instrument or engage in any banking service. Nothing in these materials constitutes investment, legal, accounting or tax advice. Non-deposit products including investments, securities, mutual funds, insurance products, crypto assets and annuities: Are Not FDIC-Insured I Are Not a Deposit I May Go Down in Value I Are Not Bank Guaranteed I Are Not Insured by Any Federal Government Agency I Are Not a Condition of Any Banking Activity.

Neither Regions Bank nor Regions Asset Management (collectively, “Regions”) are registered municipal advisors nor provide advice to municipal entities or obligated persons with respect to municipal financial products or the issuance of municipal securities (including regarding the structure, timing, terms and similar matters concerning municipal financial products or municipal securities issuances) or engage in the solicitation of municipal entities or obligated persons for such services. With respect to this presentation and any other information, materials or communications provided by Regions, (a) Regions is not recommending an action to any municipal entity or obligated person, (b) Regions is not acting as an advisor to any municipal entity or obligated person and does not owe a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934 to any municipal entity or obligated person with respect to such presentation, information, materials or communications, (c) Regions is acting for its own interests, and (d) you should discuss this presentation and any such other information, materials or communications with any and all internal and external advisors and experts that you deem appropriate before acting on this presentation or any such other information, materials or communications.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.