Stocks: U.S. Large-Cap Stocks Close The Week Lower As Hopes For A Softer Stance On Tariffs Fade Into The Weekend; Lower Quality Leadership As The ‘Buy The Dip’ Crowd Steps Into Beaten Down Former Market Leaders; A Failed Breakout As The S&P 500 Turns Lower After Briefly Closing Above Its 200-Day Moving Average; International Developed Stocks End 9-Week Stretch Of Outperformance As Automobile Tariffs Spur Selling.

Download Weekly Market Commentary | March 31 2025

What We’re Watching:

- The Institute for Supply Management (ISM) Manufacturing Index for March is released Tuesday with the reading expected to fall to 49.8 from 50.3 the prior month. The Prices Paid component of the index will be closely watched after rising sharply in February as manufacturers pulled forward demand in anticipation of tariffs being levied in the months ahead. A reading above 50 indicates expansion or growth, while a reading below 50 is indicative of contraction.

- The ISM Services Index for March is released Wednesday and is expected to remain in expansion territory at 53.1, albeit down slightly from the 53.5 reading in February.

- The March Nonfarm Payrolls report is released Friday and 135k jobs are expected to have been created during the month, down from 151k the prior month. The unemployment rate is expected to remain static month over month at 4.1% in March, while average hourly earnings are expected to rise 0.3% month over month, in-line with the February reading.

Key Observations

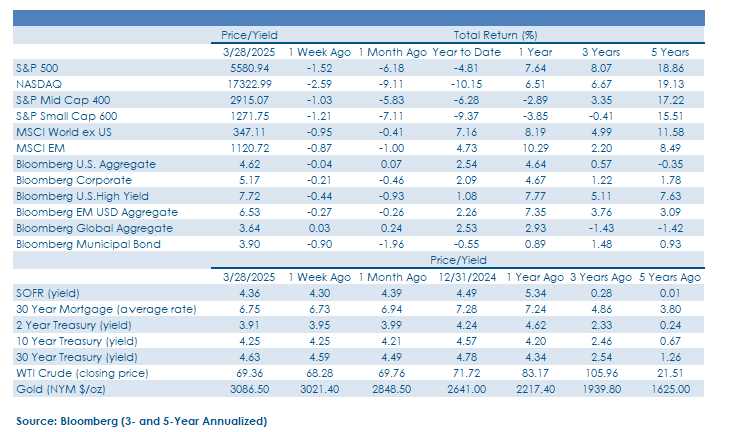

- U.S. stock indices gave back early-week gains to close the week in negative territory as automobile tariffs and elevated February inflation readings weighed on sentiment. Lackluster consumer spending data from February stoked fears of an economic slowdown into the weekend and led to a flight to quality out of stocks and into Treasuries and other safe-haven assets such as gold.

- U.S. stocks associated with the artificial intelligence (AI) theme and the buildout of infrastructure tied to a broader adoption of this technology were noticeably weak as the information technology sector was the biggest laggard on the week, pulled lower by a sharp drop in semiconductor stocks, specifically.

- Treasury yields little changed on the week as selling early in the week pushed yields higher to the top-end of recent trading ranges, a move that brought buyers looking to lock-in higher yields back into the market. ‘Non-core’ fixed income segments such as U.S. corporate high yield, along with developed bonds abroad, provided valuable diversification benefits last week and should continue to do so amid a backdrop of heightened economic and policy uncertainty.

What Happened Last Week:

Stocks: U.S. Large-Cap Stocks Close The Week Lower As Hopes For A Softer Stance On Tariffs Fade Into The Weekend; Lower Quality Leadership As The ‘Buy The Dip’ Crowd Steps Into Beaten Down Former Market Leaders; A Failed Breakout As The S&P 500 Turns Lower After Briefly Closing Above Its 200-Day Moving Average; International Developed Stocks End 9-Week Stretch Of Outperformance As Automobile Tariffs Spur Selling.

U.S. Stocks Give Back Gains Even As The Trump Administration Expresses A Willingness To Be “More Lenient Than Reciprocal” With Tariffs. U.S. stocks rallied to start the week but closed in negative territory as automobile tariffs, ‘hotter’ February inflation readings, and muted consumer spending data weighed on sentiment and risk appetite. The Trump administration announced its intention early last week to move forward with reciprocal tariffs, but delayed the announcement of sectoral tariffs beyond April 2, a move market participants took to positively as this appeared to be a softer approach than had been feared given the ramp-up in trade-related rhetoric in the past month. Going the reciprocal route could bring our trading partners to the negotiating table, while levying sweeping, across the board sectoral tariffs is a more combative approach that could potentially prove more damaging for the U.S. economy in the near-term. However, an April 2nd announcement on the scope and scale of tariffs still looms and market participants have more questions than answers regarding which countries will be subject to reciprocal tariffs and those that might get a reprieve as negotiations evolve. It’s encouraging that both U.S. large caps as well as SMid were able to gain ground early in the week despite trade uncertainty, but the selloff that materialized later in the week still points toward investors being skittish and unwilling to do much more than rent exposure to U.S. stocks at present.

Factor Leadership Favors Quality, Defensive Areas. The S&P 500 churned out a 1.5% loss on the week, and the type of stocks that were rising early on in the week left something to be desired as stocks with the highest short interest, highest betas, and momentum names led the charge, a sign that old habits die hard and that investors were eager to buy the dip in some of last year’s highflyers that have lagged year-to-date. However, the factor leadership profile of the S&P 500 shifted in a big way mid-week and more defensive traits ruled the day as indices tied to stocks with lowest volatility profile, as well as those with dividend growth and the highest dividend yield outperformed. This pivot toward quality and defensive characteristics favored the consumer staples, health care, and utilities sectors, each of which outperformed the S&P 500 to varying degrees. It’s worth noting that some of the biggest S&P 500 names such as Meta Platforms and Nvidia, along with semiconductor stocks tied to the buildout of artificial intelligence (AI) infrastructure, were some of the poorest performers, a sign that investors may not be done reducing exposure to last year’s winners just yet. How the S&P 500 responds this week after the President’s tariff announcement on Wednesday will be telling.

Beware, A Failed Breakout! The S&P 500 rally early last week as ‘Mag 7’ members staged a comeback allowed the index to close above its 200-day moving average on Tuesday, an encouraging development from a technical perspective. However, price action over the balance of the week was less constructive as investors looked to sell into strength with some of the Mag 7, semiconductor stocks, and other artificial intelligence (AI)-related plays finding themselves at the epicenter of the selling. Famed investor Paul Tudor Jones famously quipped that “nothing good happens below the 200-day moving average” and this quote seems well worth remembering given the precarious technical position the S&P 500 finds itself in at present and until further notice, 5,758 or thereabouts will likely provide staunch resistance on the upside for the index. In the interest of having a fair and balanced view, a weekly close above that level could bring the 50-day moving average at 5,900 into play. But with a likely lackluster earnings season set to start in mid-April, the most likely near-term path for stocks is likely to be lower with a potential retest of the mid-March low around 5,500 within reach after the S&P 500 closed last week at 5,580.

U.S. Dollar Bounce, Automobile Tariffs Spur Modest Profit Taking In International Developed Stocks. The U.S. Dollar Index (DXY) held onto recent gains last week and finished marginally higher at $104.05 as fast-approaching tariffs were rumored to be more lenient than feared which would be less of a headwind for U.S. economic growth. These hopes initially led to renewed interest in domestic equities and tariffs aimed at car manufacturers outside the U.S. mid-week led to a continuation of the pullback overseas and brought the MSCI EAFE index lower by 1.0% extending its now 10-week stretch of outperformance over the S&P 500 by just over 50 basis points. The MSCI Europe index dropped 1.2% on the week while the MSCI Japan index fell 1.3% automobile tariffs weighed on the share prices of BMW, Mercedes, and Toyota, among other manufacturers based in the Eurozone and Japan. Industrial stocks were also a weak spot for Japan’s market as the country’s export-heavy business mix could increasingly be under fire from impending U.S. tariffs in the coming weeks. Even amid a murky backdrop on the trade front, international stocks have provided stability to geographically diversified portfolios of late, and while some give back is possible after a nice rally, valuations and relatively attractive dividend yields should continue to buoy this cohort of stocks.

Bonds: Treasury Yields Fall After Approaching The Top-End Of Recent Trading Range; Foreign Bonds Continue To Provide Diversification Benefits; Weak Consumer Spending Offsets Hotter Inflation Readings, Forces Treasury Yields Lower Into The Weekend.

Treasury Yields End Little Changed As Growth Fears And Inflation Concerns Offset One Another. Treasury yields remain a battleground of sorts for investors as persistent growth fears and inflation concerns have led to sizable intra-week moves but little resolution in either direction yet. The 10-year Treasury yield moved higher for much of last week, reaching 4.36% on Thursday, its highest level in a month, before closing unchanged on the week at 4.25%. The Bloomberg Aggregate Bond index fell flat on the week while the more interest rate sensitive Bloomberg Corporate index declined by 0.2%. The March preliminary reading on the S&P U.S. Services Purchasing Manager Index (PMI) easily topped the consensus estimate and called into question the narrative that the U.S. economy was grinding to a halt, which along with 2-year inflation breakeven rates making a 12-month high last week, kept upward pressure on yields throughout the balance of the week. Notably, the backup in rates reversed course as the 10-year yield approached its 50- and 100-day moving averages, areas that could pose near-term resistance on the upside for yields. That view in mind, we prefer interest rate risk with a quality bias in what appears to be a fragile growth environment where valuations still leave plenty of room for downside in credit.

Diversification In Favor As Dollar Reversal, Higher Rates Abroad Boost Foreign Bonds. The dollar’s reversal higher in recent weeks, and the coinciding upward movement in U.S. Treasury yields, have propelled ‘non-core’ segments of the fixed income landscape to outperform. The Bloomberg U.S. Dollar Hedged Global Aggregate Bond index closed the week unchanged, modestly outpacing the Bloomberg U.S. Agg. The relative outperformance out of hedged international bonds was welcome considering most fixed income segments, including high yield, saw prices decline last week. Some of the success for developed market sovereigns abroad has been a moderation in German yields as a spike early in the month on stepped up fiscal support brought buyers in since and the yield on 10-year German bunds fell by 4-basis points last week. Yields on Japanese Government Bonds (JGBs), on the other hand, were flat to modestly higher as Tokyo CPI ex-fresh food and energy was released Thursday and showed a 2.2% year over year rise, above the consensus estimate of 1.9%, but growth concerns stemming from automobile tariffs kept yields anchored. Diversification should continue to be a valuable defense against economic and policy uncertainty in the quarters to come considering inflation fears and growth concerns are likely to persist.

Fed’s Preferred Inflation Gauge Comes In ‘Hotter’ Than Expected, But Treasury Yields Fall As Consumers Tighten Their Purse Strings. The February Personal Consumption Expenditure (PCE), which is viewed as the FOMC’s preferred measure of inflation, was released Friday with the headline reading rising 0.3% month over month and 2.5% year over year, in-line with the consensus estimates, but core PCE came in hotter than expected at 0.4% month over month and 2.8% year over year, with both readings 0.1% above the consensus. The initial response out of market participants to February PCE was to sell bonds, but yields across the curve made an abrupt about-face and moved sharply lower into the weekend as personal spending data in the PCE release pointed toward a more cautious U.S. consumer less willing to spend/consume. Fixed income investors took the paltry 0.1% month over month rise in real personal spending as a sign that economic growth was indeed set to slow alongside consumption. Neither the February PCE nor personal spending data altered the narrative that stagflation is becoming a more likely path forward for the U.S. economy in the coming quarters, but investors, last Friday anyway, appeared more focused on the ‘stag’ and less on the ‘flation’ as they bought Treasuries of all tenors with both hands into the weekend.

IMPORTANT DISCLOSURES: THIS PUBLICATION HAS BEEN PREPARED BY THE STAFF OF HIGHLAND ASSOCIATES, INC. FOR DISTRIBUTION TO, AMONG OTHERS, HIGHLAND ASSOCIATES, INC. CLIENTS. HIGHLAND ASSOCIATES IS REGISTERED WITH THE UNITED STATES SECURITY AND EXCHANGE COMMISSION UNDER THE INVESTMENT ADVISORS ACT OF 1940. HIGHLAND ASSOCIATES IS A WHOLLY OWNED SUBSIDIARY OF REGIONS BANK, WHICH IN TURN IS A WHOLLY OWNED SUBSIDIARY OF REGIONS FINANCIAL CORPORATION. RESEARCH SERVICES ARE PROVIDED THROUGH MULTI-ASSET SOLUTIONS, A DEPARTMENT OF THE REGIONS ASSET MANAGEMENT BUSINESS GROUP WITHIN REGIONS BANK. THE INFORMATION AND MATERIAL CONTAINED HEREIN IS PROVIDED SOLELY FOR GENERAL INFORMATION PURPOSES ONLY. TO THE EXTENT THESE MATERIALS REFERENCE REGIONS BANK DATA, SUCH MATERIALS ARE NOT INTENDED TO BE REFLECTIVE OR INDICATIVE OF, AND SHOULD NOT BE RELIED UPON AS, THE RESULTS OF OPERATIONS, FINANCIAL CONDITIONS OR PERFORMANCE OF REGIONS BANK. UNLESS OTHERWISE SPECIFICALLY STATED, ANY VIEWS, OPINIONS, ANALYSES, ESTIMATES AND STRATEGIES, AS THE CASE MAY BE (“VIEWS”), EXPRESSED IN THIS CONTENT ARE THOSE OF THE RESPECTIVE AUTHORS AND SPEAKERS NAMED IN THOSE PIECES AND MAY DIFFER FROM THOSE OF REGIONS BANK AND/OR OTHER REGIONS BANK EMPLOYEES AND AFFILIATES. VIEWS AND ESTIMATES CONSTITUTE OUR JUDGMENT AS OF THE DATE OF THESE MATERIALS, ARE OFTEN BASED ON CURRENT MARKET CONDITIONS, AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. ANY EXAMPLES USED ARE GENERIC, HYPOTHETICAL AND FOR ILLUSTRATION PURPOSES ONLY. ANY PRICES/QUOTES/STATISTICS INCLUDED HAVE BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT HIGHLAND ASSOCIATES, INC. DOES NOT WARRANT THEIR COMPLETENESS OR ACCURACY. THIS INFORMATION IN NO WAY CONSTITUTES RESEARCH AND SHOULD NOT BE TREATED AS SUCH. THE VIEWS EXPRESSED HEREIN SHOULD NOT BE CONSTRUED AS INDIVIDUAL INVESTMENT ADVICE FOR ANY PARTICULAR PERSON OR ENTITY AND ARE NOT INTENDED AS RECOMMENDATIONS OF PARTICULAR SECURITIES, FINANCIAL INSTRUMENTS, STRATEGIES OR BANKING SERVICES FOR A PARTICULAR PERSON OR ENTITY. THE NAMES AND MARKS OF OTHER COMPANIES OR THEIR SERVICES OR PRODUCTS MAY BE THE TRADEMARKS OF THEIR OWNERS AND ARE USED ONLY TO IDENTIFY SUCH COMPANIES OR THEIR SERVICES OR PRODUCTS AND NOT TO INDICATE ENDORSEMENT, SPONSORSHIP, OR OWNERSHIP BY REGIONS OR HIGHLAND ASSOCIATES. EMPLOYEES OF HIGHLAND ASSOCIATES, INC., MAY HAVE POSITIONS IN SECURITIES OR THEIR DERIVATIVES THAT MAY BE MENTIONED IN THIS REPORT. ADDITIONALLY, HIGHLAND’S CLIENTS AND COMPANIES AFFILIATED WITH HIGHLAND ASSOCIATES MAY HOLD POSITIONS IN THE MENTIONED COMPANIES IN THEIR PORTFOLIOS OR STRATEGIES. THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR AN INVITATION BY OR ON BEHALF OF HIGHLAND ASSOCIATES TO ANY PERSON OR ENTITY TO BUY OR SELL ANY SECURITY OR FINANCIAL INSTRUMENT OR ENGAGE IN ANY BANKING SERVICE. NOTHING IN THESE MATERIALS CONSTITUTES INVESTMENT, LEGAL, ACCOUNTING OR TAX ADVICE. NON-DEPOSIT PRODUCTS INCLUDING INVESTMENTS, SECURITIES, MUTUAL FUNDS, INSURANCE PRODUCTS, CRYPTO ASSETS AND ANNUITIES: ARE NOT FDIC-INSURED I ARE NOT A DEPOSIT I MAY GO DOWN IN VALUE I ARE NOT BANK GUARANTEED I ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY I ARE NOT A CONDITION OF ANY BANKING ACTIVITY.

NEITHER REGIONS BANK NOR REGIONS ASSET MANAGEMENT (COLLECTIVELY, “REGIONS”) ARE REGISTERED MUNICIPAL ADVISORS NOR PROVIDE ADVICE TO MUNICIPAL ENTITIES OR OBLIGATED PERSONS WITH RESPECT TO MUNICIPAL FINANCIAL PRODUCTS OR THE ISSUANCE OF MUNICIPAL SECURITIES (INCLUDING REGARDING THE STRUCTURE, TIMING, TERMS AND SIMILAR MATTERS CONCERNING MUNICIPAL FINANCIAL PRODUCTS OR MUNICIPAL SECURITIES ISSUANCES) OR ENGAGE IN THE SOLICITATION OF MUNICIPAL ENTITIES OR OBLIGATED PERSONS FOR SUCH SERVICES. WITH RESPECT TO THIS PRESENTATION AND ANY OTHER INFORMATION, MATERIALS OR COMMUNICATIONS PROVIDED BY REGIONS, (A) REGIONS IS NOT RECOMMENDING AN ACTION TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON, (B) REGIONS IS NOT ACTING AS AN ADVISOR TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON AND DOES NOT OWE A FIDUCIARY DUTY PURSUANT TO SECTION 15B OF THE SECURITIES EXCHANGE ACT OF 1934 TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON WITH RESPECT TO SUCH PRESENTATION, INFORMATION, MATERIALS OR COMMUNICATIONS, (C) REGIONS IS ACTING FOR ITS OWN INTERESTS, AND (D) YOU SHOULD DISCUSS THIS PRESENTATION AND ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS WITH ANY AND ALL INTERNAL AND EXTERNAL ADVISORS AND EXPERTS THAT YOU DEEM APPROPRIATE BEFORE ACTING ON THIS PRESENTATION OR ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS.

SOURCE: BLOOMBERG INDEX SERVICES LIMITED. BLOOMBERG® IS A TRADEMARK AND SERVICE MARK OF BLOOMBERG FINANCE L.P. AND ITS AFFILIATES (COLLECTIVELY “BLOOMBERG”). BARCLAYS® IS A TRADEMARK AND SERVICE MARK OF BARCLAYS BANK PLC (COLLECTIVELY WITH ITS AFFILIATES, “BARCLAYS”), USED UNDER LICENSE. BLOOMBERG OR BLOOMBERG’S LICENSORS, INCLUDING BARCLAYS, OWN ALL PROPRIETARY RIGHTS IN THE BLOOMBERG BARCLAYS INDICES. NEITHER BLOOMBERG NOR BARCLAYS APPROVES OR ENDORSES THIS MATERIAL OR GUARANTEES THE ACCURACY OR COMPLETENESS OF ANY INFORMATION HEREIN, OR MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED THEREFROM AND, TO THE MAXIMUM EXTENT ALLOWED BY LAW, NEITHER SHALL HAVE ANY LIABILITY OR RESPONSIBILITY FOR INJURY OR DAMAGES ARISING IN CONNECTION THEREWITH.