Stocks: U.S. Large Caps Knocking On The Door Of A New All-Time High; Small Caps Bounce, Outperform The S&P 500 As Interest Rate Sensitive Sectors Power Gains; Developed Markets Abroad Outperform As Eurozone, Japanese Equities Rally.

Download Weekly Market Commentary | August 26 2024

What We’re Watching:

- The Conference Board’s Consumer Confidence survey for August is released Tuesday and is expected to drop slightly to 100.0 from 100.3 In July.

- July Personal Consumption Expenditure (PCE), the FOMC’s preferred measure of inflation, is released Friday. Headline PCE Deflator is expected to rise 0.2% month over month and 2.6% year over year, while core PCE Deflator is projected to rise 0.13% month over month and 2.7% year over year. Core PCE Deflator, specifically, will be closely monitored and market participants could begin to price in a greater likelihood of a 50-basis point rate cut when the FOMC meets in September should this metric come in below the consensus estimate.

- The Chicago Purchasing Managers Index (PMI) for August is released Friday and is expected to improve to 45.9 from 45.3 in July. A reading above 50 implies that economic activity is generally expanding, below 50, generally declining.

Key Observations

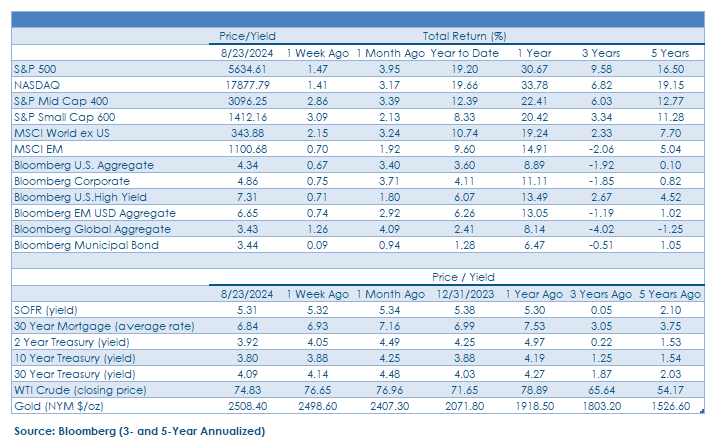

- Smaller capitalization stocks rallied into the weekend as rate cuts moved closer to reality on the heels of dovish comments made by FOMC Chair Jerome Powell on Friday. Economically sensitive cyclical sectors such as consumer discretionary, financial services, industrials, materials, and the rate-sensitive real estate sector led the charge for the S&P 500 and the S&P Small Cap 600.

- Developed market stocks abroad outperformed the S&P 500 on the week due to strength out of France, Germany, Italy, Japan, and Spain. Despite the U.S. Dollar Index (DXY) making a year-to-date low last week, emerging markets failed to capitalize as country-specific concerns tied to China and Mexico offset continued strength out of Brazil and India. Further weakness in the U.S. dollar would provide a tailwind for emerging markets, broadly speaking, by lowering commodity costs and improving the credit outlook for developing economies by reducing borrowing costs.

- Treasury yields fell modestly over the balance of the week as economic data sent mixed messages and central bankers voiced their support for the first cut to the Fed funds rate to occur in September. Non-core segments of the fixed income market, specifically high yield corporate bonds and U.S. dollar denominated emerging market debt, continued to perform well on an absolute basis last week and remain appealing for income generation and diversification purposes.

What Happened Last Week:

Stocks: U.S. Large Caps Knocking On The Door Of A New All-Time High; Small Caps Bounce, Outperform The S&P 500 As Interest Rate Sensitive Sectors Power Gains; Developed Markets Abroad Outperform As Eurozone, Japanese Equities Rally.

S&P 500 Ends The Week Less Than 1% From An All-Time High As Breadth Improves. U.S. large cap stocks gained ground again last week as there were few economic, geopolitical, or monetary policy surprises to derail the recent rally. The S&P 500 closed the week higher by 1.4% and ended less than 1% below its intra-day all-time high reached back in mid- July as a broader rally took root. A broad swath of sectors outpaced the S&P 500 index with economically sensitive pockets such as consumer discretionary, financial services, industrials, and materials all strong performers. The interest rate sensitive real estate sector rallied 3% on the week to take first place but classic defensive plays in the consumer staples and health care sectors also outperformed. While the closely watched information technology sector lagged, it still rose 1.1% on the week, and the S&P 500 energy sector was the only one to close the week lower and it did so by the narrowest of margins. While the broader market didn’t stray much from the 5,600 level over the balance of the week, broad-based sector participation was an encouraging sign and a feather in the cap of market bulls. From a factor perspective, stocks with the highest short interest, highest volatility, and highest betas outperformed after being three of the worst performing factor exposures year-to-date, a sign that risk appetite has returned, and capital is finding its way into some forgotten and relatively attractively valued areas and not just into the ‘Magnificent 7’ or semiconductor stocks, a positive character trait. The S&P 500 remains a standout globally with over 75% of index constituents trading above their 50- and 200-day moving average, an indication that the index remains on firm footing into what has been a historically weak seasonal stretch from September through mid-October.

Small Caps Rally As Less Restrictive Monetary Policy Moves Closer To Reality. After spending most of the week in the doldrums, the S&P Small Cap 600 ultimately gained 3% on the week, with the entirety of that gain coming Friday after dovish remarks out of FOMC Chair Jerome Powell that morning in Jackson Hole. Powell’s decidedly dovish comments spurred a rally in value-oriented sectors including consumer discretionary, financial services, industrials, materials, and real estate which together account for over 62% of the S&P 600 index. Most notably, two of the most interest rate sensitive areas – regional banks and real estate investment trusts (REITs) – rallied sharply as the SPDR Regional Banking ETF (KRE) rose 5.2% on Friday and on the week, and the S&P 600 Real Estate sector turned out a 2.4% return on Friday and a 3.5% weekly return.

International Developed Markets Outpace U.S. Large Caps As Japan Rebounds. Japan’s Nikkei 225 churned out a 3% gain on the week in U.S. dollar terms, narrowly besting the broader MSCI EAFE index’s 2.7% return despite strength in the Japanese yen relative to the U.S. dollar. The Japanese yen’s continued strength was partially attributable to confirmation from FOMC Chair Powell that U.S. rates are set to decline starting next month. Some market prognosticators have already sounded the all-clear on Japan as central bankers have tried to ease investor fears surrounding how high rates might need to rise to curb inflationary pressures. However, with the Bank of Japan (BoJ) releasing research last week on the potential persistence of inflationary pressures, additional policy tightening, and yen strength may be required, which could lead to additional weakness in the Nikkei 225. Policy futures in Japan maintained their prediction that the next hike is at least 12-months out, setting up for a shock if we see a hike even early next year. Uncertainty surrounding policy rates and growth cloud the outlook for Japanese stocks even after a fierce rally from the early August doldrums as the damage done is going to take time to heal as the Nikkei 225 index remains below its 50- and 100-day moving averages and only half of index constituents sit above their 200-day moving average. Conversely, signs of better economic growth alongside easier monetary policy boosted euro area indices as Eurozone Services PMI surprised to the upside with the strongest reading since April. The positive PMI data along with in-line inflation prints led indices tied to France, Germany, Italy, and Spain to rally and outperform U.S. equities last week.

U.S. Dollar Drop Unable To Drive Gains For Emerging Markets. Lackluster investor risk appetite leading up to FOMC Chair Jerome Powell’s remarks Friday and individual country issues held emerging market stocks back for most of the week, but the MSCI Emerging Markets (EM) index still eked out a 0.7% gain. Weakness out of Mexico and China partially offset tailwinds for the broader MSCI EM index from a broad strengthening of EM currencies over the past month as the U.S. Dollar Index (DXY) closed at a year to date low of $100.71 on Friday. In Mexico, equities were down 3.6% as GDP slowed to 2.1% year over while continued angst around potential political reforms weakened the peso last week. Chinese markets closed flat as tech slumped early in the week on Walmart’s plans to sell its $3.7B stake in JD.com, a move that furthered concerns that the outlook for a consumer recovery has dimmed as retail sales in China remain well off pre-pandemic levels. The country’s constrained approach to stimulus carries is to blame, holding back consumer confidence and by extension the economy’s ability re-gain its footing.

Bonds: Treasury Yields Close Out The Week Modestly Lower As Economic Data Sends Mixed Messages; Monetary Policy Pivot All But Assured In September After FOMC Chair Jerome Powell’s Remarks, But A 25-Basis Point Cut Remains Our Base Case.

Treasury Yields Across The Curve Fall As The Path Forward For Monetary Policy In The U.S. Comes Into View. Last week was a busy one on the economic data front with noise from rearview mirror payrolls data more than drowned out by more upbeat recent readings on the health of the labor market and demand for services, specifically. Last Wednesday, the Bureau of Labor Statistics (BLS) downwardly revised payrolls growth from April of 2023 through March of 2024 by 818k jobs, implying far fewer jobs had been created during that time frame than had been reported. However, a sharp downward revision was expected, and estimates called for as high as 1 million, so both the stock and bond market appeared unfazed by this stale information. On the positive side of the ledger, while initial jobless claims rose to 232k in the week ended August 17th from 228k the prior week, continuing claims for the week ended August 10th came in at 1.863 million, modestly below the 1.870 million estimate. Initial and continuing claims point toward a cooling labor market, not one rapidly decelerating. Lastly, U.S. Purchasing Mangers Index (PMI) for August was released Thursday and the Composite reading of 54.1 was just above the 54.0 estimate. Manufacturing activity remained weak during the month, evidenced by a 48.0 reading on the Manufacturing PMI, but Services PMI picked up the slack coming in at 55.2, above the 54.1 estimate. A PMI reading above 50 indicates an uptick in activity, while a reading below 50 indicates weakness. Fixed income investors appeared to key off the stronger than expected Services PMI reading and pushed Treasury yields higher on Thursday. However, yields across the Treasury curve fell Friday as expectations built that the FOMC could potentially be more aggressive in taking down the Fed funds rate on the back of FOMC Chair Jerome Powell’s decidedly dovish remarks. Powell’s comments don’t alter our view that the FOMC is likely to cut the funds rate by 25-basis points in September and is likely to follow that with a quarter-point cut in November and December. A key level to watch for the 10-year Treasury yield remains 3.80% and it’s notable that the 10-year yield failed to close out the week below that level despite Chair Powell’s dovishness.

FOMC Chair Powell Says Now Is The Time For A Policy Pivot At Jackson Hole. Both stocks and bonds appeared to bide their time in the lead-up to FOMC Chair Jerome Powell’s remarks last Friday at the Jackson Hole Economic Policy Symposium, and both asset classes ultimately rallied on comments that proved to be decidedly more dovish than virtually every Fed watcher thought they might be. Chair Powell stated that “the time and place for policy adjustment is here and that the direction of travel is clear” for rates, while also commenting that he is more confident that inflation is on a sustained path toward the FOMC’s 2% target than he was when the Committee met in July. Fed funds futures shifted very little on his remarks and were pricing in somewhere around a 40% chance of a 50-basis point rate cut in September as of last Friday, with just north of 1% of rate cuts priced in through year-end, an overly aggressive outlook for the path of rates barring a rapid and unforeseen cooling of the labor market in the coming months.

Few Surprises In The July FOMC Minutes. Minutes from the FOMC’s July meeting were released last Wednesday with few surprises from our perspective. The minutes noted that “several” members were in favor of a 25-basis point cut when the Committee met last month, which Chair Jerome Powell mentioned in his post-meeting remarks, but that the “vast majority” of Committee members viewed a September rate cut as likely more appropriate. The majority of FOMC members highlighted that risks to the employment side of the Fed’s mandate had risen while also viewing recent inflation data as providing increased confidence that inflationary pressures were moving in a sustainable manner back toward the FOMC’s 2% target. Our takeaway from the minutes was that a rate cut in July was closer to reality than Chair Powell hinted at in his post-meeting comments, but the minutes were quickly rendered moot by Powell’s dovish remarks on Friday.

IMPORTANT DISCLOSURES: THIS PUBLICATION HAS BEEN PREPARED BY THE STAFF OF HIGHLAND ASSOCIATES, INC. FOR DISTRIBUTION TO, AMONG OTHERS, HIGHLAND ASSOCIATES, INC. CLIENTS. HIGHLAND ASSOCIATES IS REGISTERED WITH THE UNITED STATES SECURITY AND EXCHANGE COMMISSION UNDER THE INVESTMENT ADVISORS ACT OF 1940. HIGHLAND ASSOCIATES IS A WHOLLY OWNED SUBSIDIARY OF REGIONS BANK, WHICH IN TURN IS A WHOLLY OWNED SUBSIDIARY OF REGIONS FINANCIAL CORPORATION. RESEARCH SERVICES ARE PROVIDED THROUGH MULTI-ASSET SOLUTIONS, A DEPARTMENT OF THE REGIONS ASSET MANAGEMENT BUSINESS GROUP WITHIN REGIONS BANK. THE INFORMATION AND MATERIAL CONTAINED HEREIN IS PROVIDED SOLELY FOR GENERAL INFORMATION PURPOSES ONLY. TO THE EXTENT THESE MATERIALS REFERENCE REGIONS BANK DATA, SUCH MATERIALS ARE NOT INTENDED TO BE REFLECTIVE OR INDICATIVE OF, AND SHOULD NOT BE RELIED UPON AS, THE RESULTS OF OPERATIONS, FINANCIAL CONDITIONS OR PERFORMANCE OF REGIONS BANK. UNLESS OTHERWISE SPECIFICALLY STATED, ANY VIEWS, OPINIONS, ANALYSES, ESTIMATES AND STRATEGIES, AS THE CASE MAY BE (“VIEWS”), EXPRESSED IN THIS CONTENT ARE THOSE OF THE RESPECTIVE AUTHORS AND SPEAKERS NAMED IN THOSE PIECES AND MAY DIFFER FROM THOSE OF REGIONS BANK AND/OR OTHER REGIONS BANK EMPLOYEES AND AFFILIATES. VIEWS AND ESTIMATES CONSTITUTE OUR JUDGMENT AS OF THE DATE OF THESE MATERIALS, ARE OFTEN BASED ON CURRENT MARKET CONDITIONS, AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. ANY EXAMPLES USED ARE GENERIC, HYPOTHETICAL AND FOR ILLUSTRATION PURPOSES ONLY. ANY PRICES/QUOTES/STATISTICS INCLUDED HAVE BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT HIGHLAND ASSOCIATES, INC. DOES NOT WARRANT THEIR COMPLETENESS OR ACCURACY. THIS INFORMATION IN NO WAY CONSTITUTES RESEARCH AND SHOULD NOT BE TREATED AS SUCH. THE VIEWS EXPRESSED HEREIN SHOULD NOT BE CONSTRUED AS INDIVIDUAL INVESTMENT ADVICE FOR ANY PARTICULAR PERSON OR ENTITY AND ARE NOT INTENDED AS RECOMMENDATIONS OF PARTICULAR SECURITIES, FINANCIAL INSTRUMENTS, STRATEGIES OR BANKING SERVICES FOR A PARTICULAR PERSON OR ENTITY. THE NAMES AND MARKS OF OTHER COMPANIES OR THEIR SERVICES OR PRODUCTS MAY BE THE TRADEMARKS OF THEIR OWNERS AND ARE USED ONLY TO IDENTIFY SUCH COMPANIES OR THEIR SERVICES OR PRODUCTS AND NOT TO INDICATE ENDORSEMENT, SPONSORSHIP, OR OWNERSHIP BY REGIONS OR HIGHLAND ASSOCIATES. EMPLOYEES OF HIGHLAND ASSOCIATES, INC., MAY HAVE POSITIONS IN SECURITIES OR THEIR DERIVATIVES THAT MAY BE MENTIONED IN THIS REPORT. ADDITIONALLY, HIGHLAND’S CLIENTS AND COMPANIES AFFILIATED WITH HIGHLAND ASSOCIATES MAY HOLD POSITIONS IN THE MENTIONED COMPANIES IN THEIR PORTFOLIOS OR STRATEGIES. THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR AN INVITATION BY OR ON BEHALF OF HIGHLAND ASSOCIATES TO ANY PERSON OR ENTITY TO BUY OR SELL ANY SECURITY OR FINANCIAL INSTRUMENT OR ENGAGE IN ANY BANKING SERVICE. NOTHING IN THESE MATERIALS CONSTITUTES INVESTMENT, LEGAL, ACCOUNTING OR TAX ADVICE. NON-DEPOSIT PRODUCTS INCLUDING INVESTMENTS, SECURITIES, MUTUAL FUNDS, INSURANCE PRODUCTS, CRYPTO ASSETS AND ANNUITIES: ARE NOT FDIC-INSURED I ARE NOT A DEPOSIT I MAY GO DOWN IN VALUE I ARE NOT BANK GUARANTEED I ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY I ARE NOT A CONDITION OF ANY BANKING ACTIVITY.

NEITHER REGIONS BANK NOR REGIONS ASSET MANAGEMENT (COLLECTIVELY, “REGIONS”) ARE REGISTERED MUNICIPAL ADVISORS NOR PROVIDE ADVICE TO MUNICIPAL ENTITIES OR OBLIGATED PERSONS WITH RESPECT TO MUNICIPAL FINANCIAL PRODUCTS OR THE ISSUANCE OF MUNICIPAL SECURITIES (INCLUDING REGARDING THE STRUCTURE, TIMING, TERMS AND SIMILAR MATTERS CONCERNING MUNICIPAL FINANCIAL PRODUCTS OR MUNICIPAL SECURITIES ISSUANCES) OR ENGAGE IN THE SOLICITATION OF MUNICIPAL ENTITIES OR OBLIGATED PERSONS FOR SUCH SERVICES. WITH RESPECT TO THIS PRESENTATION AND ANY OTHER INFORMATION, MATERIALS OR COMMUNICATIONS PROVIDED BY REGIONS, (A) REGIONS IS NOT RECOMMENDING AN ACTION TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON, (B) REGIONS IS NOT ACTING AS AN ADVISOR TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON AND DOES NOT OWE A FIDUCIARY DUTY PURSUANT TO SECTION 15B OF THE SECURITIES EXCHANGE ACT OF 1934 TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON WITH RESPECT TO SUCH PRESENTATION, INFORMATION, MATERIALS OR COMMUNICATIONS, (C) REGIONS IS ACTING FOR ITS OWN INTERESTS, AND (D) YOU SHOULD DISCUSS THIS PRESENTATION AND ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS WITH ANY AND ALL INTERNAL AND EXTERNAL ADVISORS AND EXPERTS THAT YOU DEEM APPROPRIATE BEFORE ACTING ON THIS PRESENTATION OR ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS.

SOURCE: BLOOMBERG INDEX SERVICES LIMITED. BLOOMBERG® IS A TRADEMARK AND SERVICE MARK OF BLOOMBERG FINANCE L.P. AND ITS AFFILIATES (COLLECTIVELY “BLOOMBERG”). BARCLAYS® IS A TRADEMARK AND SERVICE MARK OF BARCLAYS BANK PLC (COLLECTIVELY WITH ITS AFFILIATES, “BARCLAYS”), USED UNDER LICENSE. BLOOMBERG OR BLOOMBERG’S LICENSORS, INCLUDING BARCLAYS, OWN ALL PROPRIETARY RIGHTS IN THE BLOOMBERG BARCLAYS INDICES. NEITHER BLOOMBERG NOR BARCLAYS APPROVES OR ENDORSES THIS MATERIAL OR GUARANTEES THE ACCURACY OR COMPLETENESS OF ANY INFORMATION HEREIN, OR MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED THEREFROM AND, TO THE MAXIMUM EXTENT ALLOWED BY LAW, NEITHER SHALL HAVE ANY LIABILITY OR RESPONSIBILITY FOR INJURY OR DAMAGES ARISING IN CONNECTION THEREWITH.