Stocks: Risk Assets Rally As The FOMC Stays Out Of The Way; Japanese Equities Charge Higher As BoJ Delivers The Most Dovish Policy Pivot Possible; Improving Breadth, Strong Price Momentum Across Europe An Encouraging Development.

Download Weekly Market Commentary | March 25 2024

What We’re Watching:

- The Conference Board’s Consumer Confidence survey for March is released Tuesday and is expected to improve modestly to 107.0 after a 106.7 reading in February.

- U.S. Durable Goods Orders for February is released Tuesday and is expected to rise by 0.8% month over month after falling 6.2% month over month in January. Durable goods tend to be bigger ticket items and can be a decent gauge on the willingness and/or ability of consumers and corporations to spend on larger purchases.

- Personal Consumption Expenditure (PCE), the FOMC’s preferred inflation gauge, for February is released Friday. Headline PCE is expected to have risen 2.5% year over year, which would be 0.1% above the January reading, while core PCE, which excludes food and energy, is expected to rise 2.8% year over year, in-line with the January reading. Should headline and core PCE come in as expected, this would provide further evidence that inflation remains sticky and could take longer to bring down, potentially pushing out rate cuts into the back-half of ’24 from June.

Key Observations

- It was a strong week for stocks, broadly speaking, as the FOMC and a handful of other global central banks provided investors with the confidence and cover to take more risk in their portfolios. However, quarter-end rebalancing may loom large given the wide performance gap between stocks and bonds year-to-date, and this dynamic could limit gains over the coming weeks. The start of quarterly earnings season is the next catalyst for upside we’re waiting on.

- In its updated summary of economic projections, or dot-plot, the FOMC ratcheted expectations for inflation higher in 2024, while taking its projection for the unemployment rate lower. The FOMC’s rate outlook for the remainder of 2024 was unchanged with three 25-basis point cuts to the Fed funds rate still projected. The FOMC appears unconcerned by recent higher inflation readings and still expects to ease monetary policy in coming months into a strong U.S. economy, setting up a constructive backdrop for stocks and potentially a more challenging one for core fixed income, specifically Treasuries.

What Happened Last Week:

Stocks: Risk Assets Rally As The FOMC Stays Out Of The Way; Japanese Equities Charge Higher As BoJ Delivers The Most Dovish Policy Pivot Possible; Improving Breadth, Strong Price Momentum Across Europe An Encouraging Development.

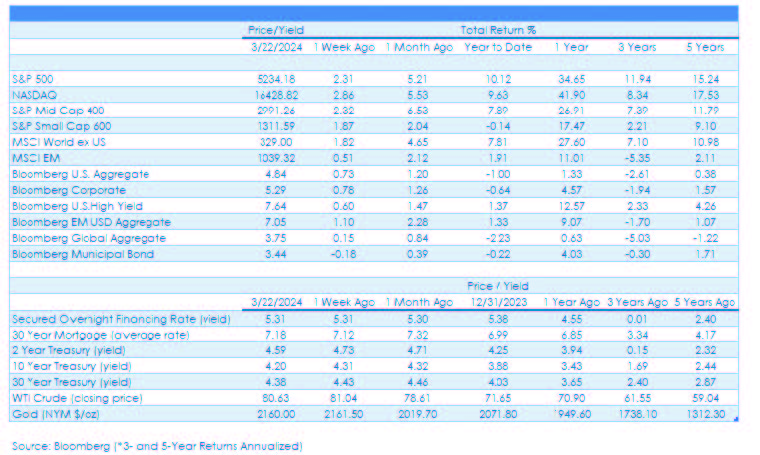

Risk-On Dominating, But Headwinds For Stocks Remain, Making Gains Harder to Come By: The S&P 500 turned out a strong 2.3% weekly return and has now gained 2.9% month-to-date, but with the closely watched March FOMC meeting now in the rearview mirror, gains may be harder to come by in the coming weeks. Notably, the blackout period for corporate buyback activity began last week and runs through late April which could serve to reduce liquidity and demand for stocks, broadly speaking. Also, with the S&P 500 higher by over 10% year-to-date while the Bloomberg Aggregate Bond index has turned out a 1% loss, some large asset allocators may elect or be required to rebalance portfolios by selling stocks and buying bonds, which could also present a near-term headwind for risk assets.

Nikkei 225 Rises Sharply On The Week As The Bank Of Japan Delivers A Dovish Policy Pivot: The The Bank of Japan (BoJ) announced changes to its long-standing negative interest rate policy (NIRP) and yield curve control (YCC) as well ending purchases of equity ETFs and real estate investment trusts (REITs) when it met last week. While the BoJ also announced it would no longer be buying ETFs tied to Japanese equities, it stated that it would continue to purchase Japanese Government Bonds (JGBs) in a similar quantity as before. The BoJ largely delivered what market participants expected, although the messaging surrounding its policy tweaks was murkier than anticipated which market participants viewed as dovish. Notably, the BoJ’s decidedly dovish messaging generated substantial weakness in the Japanese yen and a rally in Japan’s Nikkei 225 equity index, evidenced by a 3.2% weekly gain for the MSCI Japan index. The BoJ failed to convince market participants that it was interested in tightening policy meaningfully, and as a result, additional yen weaknes and strength in Japanese stocks is likely over the near-term.

Price Momentum, Breadth Much Improved Across Europe, An Encouraging Development: Quietly, many euro area country indices have been making all-time highs in recent weeks. Germany’s DAX, the CAC 40 in France, IBEX 35 in Italy, and Spain’s MIB all made new highs last week, while the FTSE 100 in the U.K. is knocking on the door of its all-time high reached back in early ’23. Notably, breadth has been impressive, with 80% of the DAX and CAC trading above their 200-day moving average, while over 70% of the IBEX and MIB can make the same claim. While the FTSE 100 is still not back to its all-time high, over 75% of the index is trading above its 10-day moving average, which implies that it’s likely only a matter of time before a new high is made. When price action and the economic outlook are at odds with one another, which is the case across Europe, it gets our attention as stock prices appear to be sniffing out a much- improved backdrop for corporate profits in the euro area over coming quarters.

Bonds: Status Quo FOMC Spurs Rally In Core Fixed Income, But Upside Could Be Limited; Emerging Market Debt Performing Well, Despite U.S. Dollar Headwind; High Yield With The Wind At Its Sails.

Treasuries Rally AS The FOMC Maintains The Status Quo, But Tough To See Rates Falling Much More From Here: Treasury bonds turned out modest gains early last week amid optimism that the FOMC would maintain its patient approach and would keep its options open for future meetings despite recent inflation data telegraphing trouble on the horizon. Those hopes proved prescient as the anticipated update to the FOMC’s summary of economic projections, or dot- plot, brought with it few changes as 9 of the 19 members continued to forecast three 25-basis point rate cuts this year, the same number as back in December. Fed funds futures shifted on the heels of Chair Jerome Powell’s post- meeting press conference and now place a 67% likelihood on a rate cut in June, up from 50% just a week before. The futures market also expects a ‘stop-and-go’ path forward, with cuts priced in for June, September, and December with skips in July and November. Coming into the meeting we were interested to see if the committee would increase the long-term neutral rate, but a measly shift from 2.50% to 2.56% rightfully failed to rattle markets. Chair Powell’s comments proved far more benign and dovish than markets had anticipated as he alluded to balance sheet run-off being tapered “fairly soon,” which was taken as another signal that recent inflation data has done little to derail the Committee’s plan to remain patient and stay the course. Taken together, the FOMC’s outlook for better economic growth, higher inflation, and a lower unemployment rate over the balance of 2024 point toward a body more likely to ere on the side of letting the economy and inflation run hot as opposed to maintaining overly restrictive policy for too long. This outlook could present a headwind for long- dated Treasury bonds as sticky inflation and above-trend (2%) economic growth over the balance of this year aren’t supportive of rates falling much from here. We continue to look for opportunities in non-core fixed income as a result.

Country-Specific Stories Boost Emerging Market Debt:

While the rally in riskier assets assets last week failed to boost emerging market stocks in a meaningful way, it proved beneficial for bonds tied to emerging markets with the Bloomberg Emerging Market Bond index advancing 0.8% and notching its strongest weekly gain of 2024. The impressive weekly advance comes despite the U.S. dollar working against developing market bonds as country specific developments buoyed bond prices. Specifically, Egypt secured a $35B investment from the neighboring UAE which sent prices of Egyptian bonds higher amid chatter that the deal increases the likelihood of a new deal being worked out between Egypt and the International Monetary Fund (IMF). Argentina was another leader as the country’s sovereign debt tacked on another 5.9% last week on its way to a 51.9% gain since the country’s reformist president took office in December. Argentina now aims to tap the IMF as well to continue its economic recovery. Investors and ratings agencies alike appear to be acknowledging the potential upside for the Argentine economy stemming from the new regime’s reforms as S&P recently upgraded the country’s government notes to CCC with a stable trend from CCC-. We continue to see promise in emerging market bonds as central banks tied to some of the largest index holdings cut rates and ease monetary policy over coming quarter, just as Mexico did last week. Mexico’s Central Bank cut rates by a quarter point to 11% as inflation in the country hovers in the mid 4% range for both headline and core measures. A strong peso has also eased the burden of repaying U.S. dollar denominated debt, improving the outlook for the country’s already investment grade credit rating.

Investors Continue To Embrace Risk Post-FOMC Meeting, A Tailwind For High Yield: With the FOMC continuing to forecase three 25-basis point cuts over the balance of this year, while also boosting its outlook for GDP growth, , it’s easy to see why fixed income investors were emboldened to reach for yield in riskier segments of the market, evidenced by the 0.6% weekly gain out of the Bloomberg U.S. Corporate High Yield index. The bulk of that gain came from higher quality tranches of the junk market as BB-rated bonds returned 1%, by far the best performing credit tier. This activity suggests traders are interested in adding high yield beta sourced from quality assets but were less prone to chasing the riskiest bonds after the recent run up in CCC’s. Month to date issuance has now exceeded $18B, taking the 2024 total to just over $73.4B, far ahead of more subdued issuance in recent years, but strong economic growth and improving fundamentals are suggestive of further gains for the asset class.

IMPORTANT DISCLOSURES: THIS PUBLICATION HAS BEEN PREPARED BY THE STAFF OF HIGHLAND ASSOCIATES, INC. FOR DISTRIBUTION TO, AMONG OTHERS, HIGHLAND ASSOCIATES, INC. CLIENTS. HIGHLAND ASSOCIATES IS REGISTERED WITH THE UNITED STATES SECURITY AND EXCHANGE COMMISSION UNDER THE INVESTMENT ADVISORS ACT OF 1940. HIGHLAND ASSOCIATES IS A WHOLLY OWNED SUBSIDIARY OF REGIONS BANK, WHICH IN TURN IS A WHOLLY OWNED SUBSIDIARY OF REGIONS FINANCIAL CORPORATION. RESEARCH SERVICES ARE PROVIDED THROUGH MULTI-ASSET SOLUTIONS, A DEPARTMENT OF THE REGIONS ASSET MANAGEMENT BUSINESS GROUP WITHIN REGIONS BANK. THE INFORMATION AND MATERIAL CONTAINED HEREIN IS PROVIDED SOLELY FOR GENERAL INFORMATION PURPOSES ONLY. TO THE EXTENT THESE MATERIALS REFERENCE REGIONS BANK DATA, SUCH MATERIALS ARE NOT INTENDED TO BE REFLECTIVE OR INDICATIVE OF, AND SHOULD NOT BE RELIED UPON AS, THE RESULTS OF OPERATIONS, FINANCIAL CONDITIONS OR PERFORMANCE OF REGIONS BANK. UNLESS OTHERWISE SPECIFICALLY STATED, ANY VIEWS, OPINIONS, ANALYSES, ESTIMATES AND STRATEGIES, AS THE CASE MAY BE (“VIEWS”), EXPRESSED IN THIS CONTENT ARE THOSE OF THE RESPECTIVE AUTHORS AND SPEAKERS NAMED IN THOSE PIECES AND MAY DIFFER FROM THOSE OF REGIONS BANK AND/OR OTHER REGIONS BANK EMPLOYEES AND AFFILIATES. VIEWS AND ESTIMATES CONSTITUTE OUR JUDGMENT AS OF THE DATE OF THESE MATERIALS, ARE OFTEN BASED ON CURRENT MARKET CONDITIONS, AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. ANY EXAMPLES USED ARE GENERIC, HYPOTHETICAL AND FOR ILLUSTRATION PURPOSES ONLY. ANY PRICES/QUOTES/STATISTICS INCLUDED HAVE BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT HIGHLAND ASSOCIATES, INC. DOES NOT WARRANT THEIR COMPLETENESS OR ACCURACY. THIS INFORMATION IN NO WAY CONSTITUTES RESEARCH AND SHOULD NOT BE TREATED AS SUCH. THE VIEWS EXPRESSED HEREIN SHOULD NOT BE CONSTRUED AS INDIVIDUAL INVESTMENT ADVICE FOR ANY PARTICULAR PERSON OR ENTITY AND ARE NOT INTENDED AS RECOMMENDATIONS OF PARTICULAR SECURITIES, FINANCIAL INSTRUMENTS, STRATEGIES OR BANKING SERVICES FOR A PARTICULAR PERSON OR ENTITY. THE NAMES AND MARKS OF OTHER COMPANIES OR THEIR SERVICES OR PRODUCTS MAY BE THE TRADEMARKS OF THEIR OWNERS AND ARE USED ONLY TO IDENTIFY SUCH COMPANIES OR THEIR SERVICES OR PRODUCTS AND NOT TO INDICATE ENDORSEMENT, SPONSORSHIP, OR OWNERSHIP BY REGIONS OR HIGHLAND ASSOCIATES. EMPLOYEES OF HIGHLAND ASSOCIATES, INC., MAY HAVE POSITIONS IN SECURITIES OR THEIR DERIVATIVES THAT MAY BE MENTIONED IN THIS REPORT. ADDITIONALLY, HIGHLAND’S CLIENTS AND COMPANIES AFFILIATED WITH HIGHLAND ASSOCIATES MAY HOLD POSITIONS IN THE MENTIONED COMPANIES IN THEIR PORTFOLIOS OR STRATEGIES. THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR AN INVITATION BY OR ON BEHALF OF HIGHLAND ASSOCIATES TO ANY PERSON OR ENTITY TO BUY OR SELL ANY SECURITY OR FINANCIAL INSTRUMENT OR ENGAGE IN ANY BANKING SERVICE. NOTHING IN THESE MATERIALS CONSTITUTES INVESTMENT, LEGAL, ACCOUNTING OR TAX ADVICE. NON-DEPOSIT PRODUCTS INCLUDING INVESTMENTS, SECURITIES, MUTUAL FUNDS, INSURANCE PRODUCTS, CRYPTO ASSETS AND ANNUITIES: ARE NOT FDIC-INSURED I ARE NOT A DEPOSIT I MAY GO DOWN IN VALUE I ARE NOT BANK GUARANTEED I ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY I ARE NOT A CONDITION OF ANY BANKING ACTIVITY.

NEITHER REGIONS BANK NOR REGIONS ASSET MANAGEMENT (COLLECTIVELY, “REGIONS”) ARE REGISTERED MUNICIPAL ADVISORS NOR PROVIDE ADVICE TO MUNICIPAL ENTITIES OR OBLIGATED PERSONS WITH RESPECT TO MUNICIPAL FINANCIAL PRODUCTS OR THE ISSUANCE OF MUNICIPAL SECURITIES (INCLUDING REGARDING THE STRUCTURE, TIMING, TERMS AND SIMILAR MATTERS CONCERNING MUNICIPAL FINANCIAL PRODUCTS OR MUNICIPAL SECURITIES ISSUANCES) OR ENGAGE IN THE SOLICITATION OF MUNICIPAL ENTITIES OR OBLIGATED PERSONS FOR SUCH SERVICES. WITH RESPECT TO THIS PRESENTATION AND ANY OTHER INFORMATION, MATERIALS OR COMMUNICATIONS PROVIDED BY REGIONS, (A) REGIONS IS NOT RECOMMENDING AN ACTION TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON, (B) REGIONS IS NOT ACTING AS AN ADVISOR TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON AND DOES NOT OWE A FIDUCIARY DUTY PURSUANT TO SECTION 15B OF THE SECURITIES EXCHANGE ACT OF 1934 TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON WITH RESPECT TO SUCH PRESENTATION, INFORMATION, MATERIALS OR COMMUNICATIONS, (C) REGIONS IS ACTING FOR ITS OWN INTERESTS, AND (D) YOU SHOULD DISCUSS THIS PRESENTATION AND ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS WITH ANY AND ALL INTERNAL AND EXTERNAL ADVISORS AND EXPERTS THAT YOU DEEM APPROPRIATE BEFORE ACTING ON THIS PRESENTATION OR ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS.

SOURCE: BLOOMBERG INDEX SERVICES LIMITED. BLOOMBERG® IS A TRADEMARK AND SERVICE MARK OF BLOOMBERG FINANCE L.P. AND ITS AFFILIATES (COLLECTIVELY “BLOOMBERG”). BARCLAYS® IS A TRADEMARK AND SERVICE MARK OF BARCLAYS BANK PLC (COLLECTIVELY WITH ITS AFFILIATES, “BARCLAYS”), USED UNDER LICENSE. BLOOMBERG OR BLOOMBERG’S LICENSORS, INCLUDING BARCLAYS, OWN ALL PROPRIETARY RIGHTS IN THE BLOOMBERG BARCLAYS INDICES. NEITHER BLOOMBERG NOR BARCLAYS APPROVES OR ENDORSES THIS MATERIAL OR GUARANTEES THE ACCURACY OR COMPLETENESS OF ANY INFORMATION HEREIN, OR MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED THEREFROM AND, TO THE MAXIMUM EXTENT ALLOWED BY LAW, NEITHER SHALL HAVE ANY LIABILITY OR RESPONSIBILITY FOR INJURY OR DAMAGES ARISING IN CONNECTION THEREWITH.