Stocks: Services PPI Gives Large Caps Pause But No News is Good News on CPI, Small Companies See Interest On Earnings; China Goes All Out By Replacing Regulator and Buying ETFs.

Download Weekly Market Commentary | February 12 2024

What We’re Watching:

- CPI data will be released on Tuesday with the headline year over year number expected to fall from 3.4% to 2.9% while Core CPI Ex Food and Energy is expected to fall from 3.9% last month to 3.7%.

- Retail sales are due out on Thursday with forecasts anticipating a fall to -0.2% from the prior reading at 0.6%, providing further detail around consumer spending habits.

- PPI Ex Food and Energy, a gauge of producer output prices, is expected on Friday with the consensus anticipating a month over month rise of 0.1% after remaining flat in the month prior.

- Michigan Consumer Sentiment data is expected on Friday with onlookers watching to see if the uptick in the consumer sentiment over the last two months persists or fades.

Key Observations

- Large Caps were off to a shaky start on elevated ISM Services PPI before regaining momentum via strength in tech and healthcare sectors, while bond proxies lagged.

- China opted to replace the country’s head securities regulator and directed the sovereign wealth fund to buy ETFs in efforts to elevate the market prior to the Lunar New Year Holiday.

- Services price inflation created concern in the bond market, prompting yields to continue their drift higher, but volatility was modest as record-setting treasury auctions were well bid.

What Happened Last Week:

Stocks: Services PPI Gives Large Caps Pause But No News is Good News on CPI, Small Companies See Interest On Earnings; China Goes All Out By Replacing Regulator and Buying ETFs.

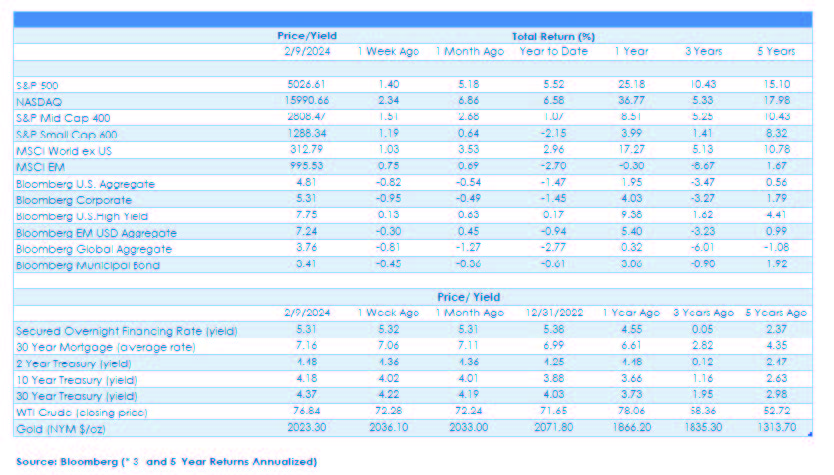

Momentum Driving Returns In Domestic Stocks After Shaky Start. The S&P 500 had a slow start to the week before printing its fifth consecutive weekly gain above 1% with the usual sectors, pushing prices higher and the index wrapping the week up 1.4%. Healthcare and tech led the pack this week with the sectors advancing 1.4% and 3.3% respectively while more rates sensitive areas including real estate and utilities predictably struggled. Friday’s CPI revisions were minimal, and markets elected to receive the modest changes as positive news that inflation wasn’t rising behind the scenes. Like the AI boom in tech, markets seem zeroed in on weight loss drugs and their increasing prevalance is leading to multiple expansion in the healthcare sector with little regard for cash flows and valuations. The comfort of buying ‘what’s been working lately’ in recent weeks has led to a run up in the momentum factor with the iShares Momentum ETF up 13.9% year-to- date, outpacing both the NASAQ 100 and Magnificent Seven over that time. Though the momentum cohort is closely aligned for now, with NVDA, Eli Lily, and Meta in the top 5 holdings. Before we hold out momentum as a silver bullet, it’s worth mentioning that momentum wandered in the desert over the last few years, as most factors do from time to time. Namely momentum struggles when there is a lack of clear trends or those trends change abruptly, as occurred in 2023 and 2021 when leadership changed between value and growth. Momentum’s rise in popularity could indicate tough sledding for sectors and styles without it.

Small Caps Snap Back After Trading Opposite of Large Caps. The S&P 600 Small Cap Index came together all at once Friday gaining 1.2% after spending most of the week underwater. This surge is refreshing for those of us watching smaller stocks get the short end of the stick so far this year, with the Index losing 2.2% relative to a 5.5% gain for the S&P 500. That lag comes as momentum trends have been working against small company stocks for now, as the sub- asset class continues to display mean reversion tendencies. That reversal behavior indicates to us that traders are just renting stocks in the space rather than owning until staying power emerges. That doesn’t sound great for small caps, but momentum can switch hands quickly especially when macro winds change direction. The earnings picture is coming through better than most thought for the subset with 68% of companies surprising to the upside or matching analysts’ estimates with nearly half the index reported thus far. It’s also worth noting we’ve seen active managers fare better than the broader index a month into 2024, as the average small-cap blend manager is outpacing the index by over 1% in January.

China Shakes Up Head Securities Regulator But CPI Stands As A Setback. Chinese equities gained 4.4% this week as Beijing seemingly reached even further this week by repalcing the head securities regulator (a familiar tactic with strong results in 2016 and 2018). Though the prior turn arounds weren’t from this low of an economic base, as China continues to struggle with deflation shown in consumer prices that came in this week a worse than feared 0.8% decline in January. In further efforts to prop up equities, the government directed purchases from the sovereign wealth fund towards broad market ETFs and increased restrictions on short selling. Volume is up substantially in the ETFs over the last month, a common indicator of capitulation that could signal a near-term bottom, but we’ve heard this story before and would be slow to warm up given the structural difficulties plaguing the country. This latest push to revive equities is likely targeted to boot sentiment as it comes just prior to the Lunar New Year holiday when Chinese equity markets will be closed for six trading sessions. Distressed debt investors with holdings in China were dealt a blow this week as Evergrande, China’s now defunct property developer, was ordered to be liquidated by a Hong Kong court and has rendered the $19B in debt effectively worthless. That outcome serves as a reminder that foreign capital is likely at the bottom of the stack in default situations and the rules in China are subject to change without notice.

Bonds: Yields Drift Higher As Services Inflation Casts Doubt On Price Declines; Equity Sensitive and Short-Term Segments Prevail

Bond Prices Lower to Start The Week as ISM Services Signal Concern. 10-Year Treasury yields rose to 4.18% over the course of the week with a majority of the move coming on Monday alongside higher jump in the ISM Services Prices Paid Index. It remains to be seen if that pickup in yields from services prices is warranted due to the noise from how ISM constructs those indices. The uptick in yields would typically spell trouble with a record-setting slate of treasury auctions planned for the week but by all accounts, the sale of $42B in 10-year notes on Wednesday was met with more than adequate demand. The 30-year bond auction of $25B on Thursday again tested investor appetite for current yields and found traction with indirect buyers. Indirect buyers, commonly foreign entities and retail took down north of 70%, the group’s highest allocation since June, with direct buyers including insurance companies, banks, and funds grabbing just 14.5%. That messaged a level of content with treasury yields that showed up in better readings on both the government liquidity index and MOVE Bond market volatility index during the week, an odd occurrence when auctions and higher rates are both present. For now, market participants seem willing to take a page from the FOMC and wait on further data to inform their outlook, buying in rate sell-offs when yields turn higher.

Short Duration Sectors Including High-Yield and Convertibles Rise. The backup in yields this week led the equity sensitive bond sectors to shine as the Bloomberg High Yield Index rose 0.13% and the Convertible Bond Index returned 1.2%. Those gains come at the expense of the broader investment grade corporates that declined 1.3% during that span, as rates and spreads move against the segment. Weekly volume in high grade corproates also exceeded the $30B dealer proejction on the week, with most of that issurance coming in 10-year or longer maturities that were in high demand. High yeild gains when rates trend higher is a great diversification story, but the rise in convertibles has a more

thematic tilt with significant sectors exposures in technology, healthcare, and consumer discretionary. Those sector allocations carried the index in the week and over the past month, all the while fallout in utilities, real estate, and communication services positions have limited the index to a flat total return so far in 2024. In high yield, spreads are grinding tighter on improving trends in credit conditions as trailing bankruptcy filings declined heavily in the last 4 weeks. The minimal change from the CPI revisions and movement in the right direction on Friday were a welcome surprise that lifted risk assets higher including below investment grade bonds. All told the biggest risk factor to the high-income sector of the bond market for now appears to be slowing growth that could case doubt on fundamentals closer to mid-year.

Emerging Market Debt Sees Strength Out Of Some Of The Riskiest Issuers. Lower rated countries benefited from an advance in risk-sentiment within developing country bonds as the Emerging Bond Index was one of the best performers, rising 0.6% last week. Argentina and Venezuela were the headline leaders, as reforms in the former are showing signs of uneven progress while J.P. Morgan disclosed a plan to reintroduce $53B in Venezuela bonds to its index suite. The decision was largely based on loosened trading restrictions that could be reactivated should unfair political practices reemerge, but the bonds’ nonperforming status likely precludes them from inclusion in actively managed portfolios until signs of life materialize. Argentina’s bonds saw price improvement as eclectic new president Milei’s government is instituting stark spending reforms that could curb the countries rampant inflation and currency devaluation. Morgan Stanley published a note citing concern from a political perspective but alluded to signs of potential austerity in keeping pacts to balance the budget and cut central bank spending entirely. Egypt and Sri Lanka experienced price improvements during the week as well, while high yield holdings in Africa declined.

IMPORTANT DISCLOSURES: THIS PUBLICATION HAS BEEN PREPARED BY THE STAFF OF HIGHLAND ASSOCIATES, INC. FOR DISTRIBUTION TO, AMONG OTHERS, HIGHLAND ASSOCIATES, INC. CLIENTS. HIGHLAND ASSOCIATES IS REGISTERED WITH THE UNITED STATES SECURITY AND EXCHANGE COMMISSION UNDER THE INVESTMENT ADVISORS ACT OF 1940. HIGHLAND ASSOCIATES IS A WHOLLY OWNED SUBSIDIARY OF REGIONS BANK, WHICH IN TURN IS A WHOLLY OWNED SUBSIDIARY OF REGIONS FINANCIAL CORPORATION. RESEARCH SERVICES ARE PROVIDED THROUGH MULTI-ASSET SOLUTIONS, A DEPARTMENT OF THE REGIONS ASSET MANAGEMENT BUSINESS GROUP WITHIN REGIONS BANK. THE INFORMATION AND MATERIAL CONTAINED HEREIN IS PROVIDED SOLELY FOR GENERAL INFORMATION PURPOSES ONLY. TO THE EXTENT THESE MATERIALS REFERENCE REGIONS BANK DATA, SUCH MATERIALS ARE NOT INTENDED TO BE REFLECTIVE OR INDICATIVE OF, AND SHOULD NOT BE RELIED UPON AS, THE RESULTS OF OPERATIONS, FINANCIAL CONDITIONS OR PERFORMANCE OF REGIONS BANK. UNLESS OTHERWISE SPECIFICALLY STATED, ANY VIEWS, OPINIONS, ANALYSES, ESTIMATES AND STRATEGIES, AS THE CASE MAY BE (“VIEWS”), EXPRESSED IN THIS CONTENT ARE THOSE OF THE RESPECTIVE AUTHORS AND SPEAKERS NAMED IN THOSE PIECES AND MAY DIFFER FROM THOSE OF REGIONS BANK AND/OR OTHER REGIONS BANK EMPLOYEES AND AFFILIATES. VIEWS AND ESTIMATES CONSTITUTE OUR JUDGMENT AS OF THE DATE OF THESE MATERIALS, ARE OFTEN BASED ON CURRENT MARKET CONDITIONS, AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. ANY EXAMPLES USED ARE GENERIC, HYPOTHETICAL AND FOR ILLUSTRATION PURPOSES ONLY. ANY PRICES/QUOTES/STATISTICS INCLUDED HAVE BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT HIGHLAND ASSOCIATES, INC. DOES NOT WARRANT THEIR COMPLETENESS OR ACCURACY. THIS INFORMATION IN NO WAY CONSTITUTES RESEARCH AND SHOULD NOT BE TREATED AS SUCH. THE VIEWS EXPRESSED HEREIN SHOULD NOT BE CONSTRUED AS INDIVIDUAL INVESTMENT ADVICE FOR ANY PARTICULAR PERSON OR ENTITY AND ARE NOT INTENDED AS RECOMMENDATIONS OF PARTICULAR SECURITIES, FINANCIAL INSTRUMENTS, STRATEGIES OR BANKING SERVICES FOR A PARTICULAR PERSON OR ENTITY. THE NAMES AND MARKS OF OTHER COMPANIES OR THEIR SERVICES OR PRODUCTS MAY BE THE TRADEMARKS OF THEIR OWNERS AND ARE USED ONLY TO IDENTIFY SUCH COMPANIES OR THEIR SERVICES OR PRODUCTS AND NOT TO INDICATE ENDORSEMENT, SPONSORSHIP, OR OWNERSHIP BY REGIONS OR HIGHLAND ASSOCIATES. EMPLOYEES OF HIGHLAND ASSOCIATES, INC., MAY HAVE POSITIONS IN SECURITIES OR THEIR DERIVATIVES THAT MAY BE MENTIONED IN THIS REPORT. ADDITIONALLY, HIGHLAND’S CLIENTS AND COMPANIES AFFILIATED WITH HIGHLAND ASSOCIATES MAY HOLD POSITIONS IN THE MENTIONED COMPANIES IN THEIR PORTFOLIOS OR STRATEGIES. THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR AN INVITATION BY OR ON BEHALF OF HIGHLAND ASSOCIATES TO ANY PERSON OR ENTITY TO BUY OR SELL ANY SECURITY OR FINANCIAL INSTRUMENT OR ENGAGE IN ANY BANKING SERVICE. NOTHING IN THESE MATERIALS CONSTITUTES INVESTMENT, LEGAL, ACCOUNTING OR TAX ADVICE. NON-DEPOSIT PRODUCTS INCLUDING INVESTMENTS, SECURITIES, MUTUAL FUNDS, INSURANCE PRODUCTS, CRYPTO ASSETS AND ANNUITIES: ARE NOT FDIC-INSURED I ARE NOT A DEPOSIT I MAY GO DOWN IN VALUE I ARE NOT BANK GUARANTEED I ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY I ARE NOT A CONDITION OF ANY BANKING ACTIVITY.

NEITHER REGIONS BANK NOR REGIONS ASSET MANAGEMENT (COLLECTIVELY, “REGIONS”) ARE REGISTERED MUNICIPAL ADVISORS NOR PROVIDE ADVICE TO MUNICIPAL ENTITIES OR OBLIGATED PERSONS WITH RESPECT TO MUNICIPAL FINANCIAL PRODUCTS OR THE ISSUANCE OF MUNICIPAL SECURITIES (INCLUDING REGARDING THE STRUCTURE, TIMING, TERMS AND SIMILAR MATTERS CONCERNING MUNICIPAL FINANCIAL PRODUCTS OR MUNICIPAL SECURITIES ISSUANCES) OR ENGAGE IN THE SOLICITATION OF MUNICIPAL ENTITIES OR OBLIGATED PERSONS FOR SUCH SERVICES. WITH RESPECT TO THIS PRESENTATION AND ANY OTHER INFORMATION, MATERIALS OR COMMUNICATIONS PROVIDED BY REGIONS, (A) REGIONS IS NOT RECOMMENDING AN ACTION TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON, (B) REGIONS IS NOT ACTING AS AN ADVISOR TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON AND DOES NOT OWE A FIDUCIARY DUTY PURSUANT TO SECTION 15B OF THE SECURITIES EXCHANGE ACT OF 1934 TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON WITH RESPECT TO SUCH PRESENTATION, INFORMATION, MATERIALS OR COMMUNICATIONS, (C) REGIONS IS ACTING FOR ITS OWN INTERESTS, AND (D) YOU SHOULD DISCUSS THIS PRESENTATION AND ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS WITH ANY AND ALL INTERNAL AND EXTERNAL ADVISORS AND EXPERTS THAT YOU DEEM APPROPRIATE BEFORE ACTING ON THIS PRESENTATION OR ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS.

SOURCE: BLOOMBERG INDEX SERVICES LIMITED. BLOOMBERG® IS A TRADEMARK AND SERVICE MARK OF BLOOMBERG FINANCE L.P. AND ITS AFFILIATES (COLLECTIVELY “BLOOMBERG”). BARCLAYS® IS A TRADEMARK AND SERVICE MARK OF BARCLAYS BANK PLC (COLLECTIVELY WITH ITS AFFILIATES, “BARCLAYS”), USED UNDER LICENSE. BLOOMBERG OR BLOOMBERG’S LICENSORS, INCLUDING BARCLAYS, OWN ALL PROPRIETARY RIGHTS IN THE BLOOMBERG BARCLAYS INDICES. NEITHER BLOOMBERG NOR BARCLAYS APPROVES OR ENDORSES THIS MATERIAL OR GUARANTEES THE ACCURACY OR COMPLETENESS OF ANY INFORMATION HEREIN, OR MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED THEREFROM AND, TO THE MAXIMUM EXTENT ALLOWED BY LAW, NEITHER SHALL HAVE ANY LIABILITY OR RESPONSIBILITY FOR INJURY OR DAMAGES ARISING IN CONNECTION THEREWITH.