Stocks: An “Almost Everything” Rally Ensues As The FOMC Strikes A Surprisingly Dovish Tone; Bounce In Interest Rate Sensitive Sectors May Be Overdone; Markets Abroad Rally As The U.S. Dollar Drops On More Dovish FOMC Tone.

Download Weekly Market Commentary | December 18 2023

Key Observations

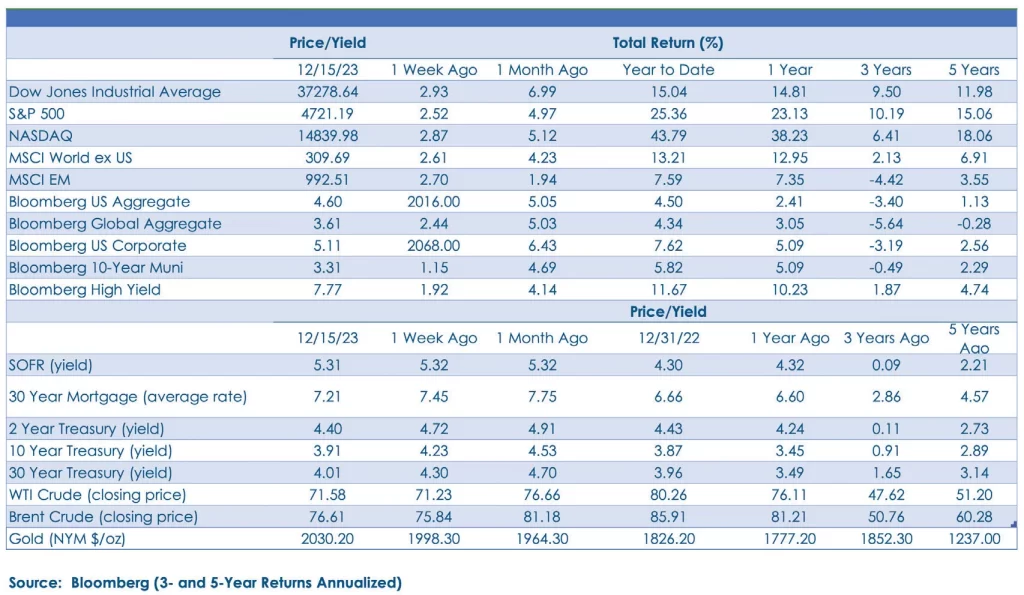

- The S&P 500 ended the week within shouting distance of its February 2021 all-time high after seven straight weeks of gains. However, after a 12%+ move in the S&P 500 just since the start of November, we do question how much higher the index can run into year-end. Market breadth has improved and could provide a springboard for stocks in 2024, but stocks, broadly speaking, appear stretched in the near-term.

- Small cap stocks outperformed again last week, but after almost a 20% gain in the past six weeks, a period of sideways price action or consolidation would likely be healthy. We see reasons to be more constructive on small caps in the coming year, but after such a sizable move in a short period of time, patience is likely warranted and should be rewarded.

- Long-term Treasuries and investment-grade corporate bonds were the biggest beneficiaries of the FOMC’s dovish pivot last week, but with the 10-year U.S. Treasury yield down 32 basis points on the week, the move lower in yields may also be overdone and the path of least resistance for yields could be higher early in the new year.

What We’re Watching:

- Eurozone Consumer Price Index (CPI) for November is released Tuesday with a 2.4% year over year reading expected, which would be in-line with the reading from the prior month. Core CPI, which excludes food and energy, is expected to rise 3.6% in November, which would also be in-line with the October reading. Notably, month over month, CPI is expected to fall 0.4%.

- The Conference Board’s Consumer Confidence survey for December is released Wednesday with a 105.6 reading expected, which would be a significant improvement from the 102.0 reading in November.

- The Conference Board’s Leading Economic Indicators (LEIs) for November are released Thursday and are expected to fall 0.45% month over month, which would be an improvement from the -0.8% reading the prior month. LEIs tend to change direction ahead of shifts in the business cycle, making this reading well worth watching as a gauge on potential upcoming economic activity.

- November Personal Consumption Expenditure (PCE), the FOMC’s preferred inflation gauge, is released Friday. PCE Deflator is expected to remain flat month over month and rise 2.8% year over year, while the core PCE Deflator, which excludes food and energy from the calculation, is expected to rise 0.2% month over month and 3.4% year over year. For comparison purposes, headline PCE Deflator rose 3.0% year over year in October, and core PCE Deflator rose 3.5%.

What Happened Last Week:

Stocks: An “Almost Everything” Rally Ensues As The FOMC Strikes A Surprisingly Dovish Tone; Bounce In Interest Rate Sensitive Sectors May Be Overdone; Markets Abroad Rally As The U.S. Dollar Drops On More Dovish FOMC Tone.

S&P 500 Ends The Week Above 4,700, Less Than 2% Away From Its January 2022 All-Time High. TThe S&P 500’s rally last week was broad-based, evidenced by the equal- weight S&P 500 outpacing the market cap-weighted S&P 500 by 1%. Consumer discretionary, energy, financial services, industrials, information technology, and materials all outperformed the broader S&P 500 on the week, while traditionally more defensive sectors such as consumer staples, health care, and utilities lagged along with the communication services sector which has been a strong performer year-to-date. Breadth has been most encouraging of late as the ‘Magnificent 7’ has shown signs of passing the leadership baton to cyclical sectors and small cap stocks, which should put the market on firmer footing as we move into 2024. However, after a 12.5% S&P 500 rally and 19.4% bounce in small cap stocks since the start of November, investors may look to take some profits into year-end which could weigh on index performance.

Small-Caps Have More Room To Run In ’24, But May Be Stretched In The Near-Term. Small-cap stocks turned out a 5.6% weekly gain, propelled higher by the FOMC’s dovish message last Wednesday. We have been taking a closer look at small caps in recent months and were growing incrementally more positive on this cohort of stocks, although we didn’t expect outperformance to materialize until 1Q or 2Q of next year. Notably, while the S&P 500 closed last week within 2% of its all-time high, small cap stocks are still 22% below their all-time high reached back in November of 2021, so investors looking for a catch-up trade as market breadth improves in the coming year may find opportunities in smaller capitalization stocks. With that said, the downward move in Treasury yields has contributed in a big way to the success of small caps, and both moves could be stretched in the near-term, with even a modest reversal higher in yields leading to profit-taking in small caps. As a result, we maintain our neutral stance on small and mid-cap (SMid) stocks into 2024 as we await a healthy shakeout to provide a better opportunity to increase exposure to the asset class.

Interest Rate Sensitive Sectors Catch A Bid On Falling Treasury Yields. Financial services and real estate, two of the more interest rate sensitive sectors in the S&P 500 and laggards in 2023, outperformed the broader index last week as the FOMC’s dovish tone provided reasons for optimism, or perhaps better said, less pessimism, surrounding the prospects for both sectors. Notably, the S&P 500 financial services sector finished the week higher by 2.7%, but the SPDR S&P Regional banking ETF (KRE) fared far better, spiking 8.3% as a more benign outlook for monetary policy spurred short covering and some long-only buyers underweight the space. While both sectors should fare better in the coming year, after such a sizable one-week gain, it’s advisable to let the dust settle and avoid chasing such a rally into year-end. and how familiar investors are with it.

U.S. Dollar Sinks On FOMC’s Dovish About-Face, Reinforcing Our View That A Weaker Dollar Will Provide A Tailwind For Foreign Markets In The New Year. The MSCI Emerging Markets (EM) index rose 2.7% last week as the U.S. dollar’s drop again boosted the prospects for developing markets abroad. Country indices tied to Mexico and South Korea were standout performers on the upside, but participation was broad-based as Brazil, China, India, and Taiwan, among others, all finished the week higher by 2% or more. The MSCI EAFE index, which tracks developed markets abroad, but excludes Canada, performed in-line with the S&P 500 on the week as Germany, Japan, the U.K., and other euro area countries experienced more muted upside. Should the U.S. dollar continue to weaken in the coming year as we expect, emerging markets abroad could be strong relative performers, but with attractive valuations and relatively high dividend yields, developed markets could fare well and shouldn’t be avoided.

Bonds: Treasury Yields Continue To Fall As The FOMC Moves Closer To The Market’s Expectations For Rate Cuts In The Coming Year; November Core Inflation Remained Sticky, Leading Us To Question The Market’s Expectation For A Rate Cut In March.

Treasury Yields Fall As The FOMC Delivers A More Dovish Message Than Expected. The Federal Open Market Committee (FOMC) concluded its two-day meeting last Wednesday, and while the Committee delivered on the market’s expectation for no change in the Fed funds rate, it surprised markets by striking a more dovish tone than was expected. Most notably, the FOMC’s Summary of Economic Projections (SEP), or dot plot, shifted lower as the median Committee member now expects three 25-basis point rate cuts in 2024 with Fed funds ending the year at 4.60%, a shift from the two quarter-point cuts expected when the last SEP was released in September. By baking another rate cut into the dot plot the FOMC moved closer to the market’s view of how aggressively the Committee would be easing monetary policy in the coming year. The FOMC’s dovish pivot forced the futures market to price-in 150-basis points, or 1.50% of cuts to the Fed funds rate for next year, up from 110-basis points last Tuesday when the FOMC kicked off its meeting The market also responded by pulling forward its expectation for when cuts would start, with Fed funds futures now placing a 70% chance on a quarter-point cut in March versus just under 40% last Tuesday, and at least one 25-basis point cut by May appears to be a slam dunk with the futures market placing a nearly 90% likelihood on at least one cut by May 1.

November Inflation Data In-Line With Expectations, But Core Inflation Is Still Sticky. Market participants were closely watching the release of November inflation data last Tuesday for signs that rate cut expectations for 2024 were either justified or were perhaps too aggressive. While year over year readings for headline and core CPI were in-line with expectations at 3.1% and 4.0%, respectively, month over month readings were a bit hotter than expected at 0.1% and 0.3%. While inflationary pressures in November proved stickier than anticipated and inflation is moving at a snail’s pace toward the FOMC’s 2% target, market participants at that time didn’t care as yields and expectations for rate cuts in the coming year remained largely unchanged on the day. However, while Fed funds futures may have shifted little on the inflation news, the market moved meaningfully on the FOMC’s surprisingly dovish message a day later. While we wouldn’t quibble with the FOMC’s next move being a rate cut, we don’t expect forthcoming inflation data to give the FOMC the required confidence to cut the Fed funds rate in March as the market expects. In our view, May will be the first ‘live’ meeting for a rate cut and we still believe two, or perhaps as many as three, 25-basis point rate cuts are more likely than the 6 currently priced into the futures market.

IMPORTANT DISCLOSURES: THIS PUBLICATION HAS BEEN PREPARED BY THE STAFF OF HIGHLAND ASSOCIATES, INC. FOR DISTRIBUTION TO, AMONG OTHERS, HIGHLAND ASSOCIATES, INC. CLIENTS. HIGHLAND ASSOCIATES IS REGISTERED WITH THE UNITED STATES SECURITY AND EXCHANGE COMMISSION UNDER THE INVESTMENT ADVISORS ACT OF 1940. HIGHLAND ASSOCIATES IS A WHOLLY OWNED SUBSIDIARY OF REGIONS BANK, WHICH IN TURN IS A WHOLLY OWNED SUBSIDIARY OF REGIONS FINANCIAL CORPORATION. RESEARCH SERVICES ARE PROVIDED THROUGH MULTI-ASSET SOLUTIONS, A DEPARTMENT OF THE REGIONS ASSET MANAGEMENT BUSINESS GROUP WITHIN REGIONS BANK. THE INFORMATION AND MATERIAL CONTAINED HEREIN IS PROVIDED SOLELY FOR GENERAL INFORMATION PURPOSES ONLY. TO THE EXTENT THESE MATERIALS REFERENCE REGIONS BANK DATA, SUCH MATERIALS ARE NOT INTENDED TO BE REFLECTIVE OR INDICATIVE OF, AND SHOULD NOT BE RELIED UPON AS, THE RESULTS OF OPERATIONS, FINANCIAL CONDITIONS OR PERFORMANCE OF REGIONS BANK. UNLESS OTHERWISE SPECIFICALLY STATED, ANY VIEWS, OPINIONS, ANALYSES, ESTIMATES AND STRATEGIES, AS THE CASE MAY BE (“VIEWS”), EXPRESSED IN THIS CONTENT ARE THOSE OF THE RESPECTIVE AUTHORS AND SPEAKERS NAMED IN THOSE PIECES AND MAY DIFFER FROM THOSE OF REGIONS BANK AND/OR OTHER REGIONS BANK EMPLOYEES AND AFFILIATES. VIEWS AND ESTIMATES CONSTITUTE OUR JUDGMENT AS OF THE DATE OF THESE MATERIALS, ARE OFTEN BASED ON CURRENT MARKET CONDITIONS, AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. ANY EXAMPLES USED ARE GENERIC, HYPOTHETICAL AND FOR ILLUSTRATION PURPOSES ONLY. ANY PRICES/QUOTES/STATISTICS INCLUDED HAVE BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT HIGHLAND ASSOCIATES, INC. DOES NOT WARRANT THEIR COMPLETENESS OR ACCURACY. THIS INFORMATION IN NO WAY CONSTITUTES RESEARCH AND SHOULD NOT BE TREATED AS SUCH. THE VIEWS EXPRESSED HEREIN SHOULD NOT BE CONSTRUED AS INDIVIDUAL INVESTMENT ADVICE FOR ANY PARTICULAR PERSON OR ENTITY AND ARE NOT INTENDED AS RECOMMENDATIONS OF PARTICULAR SECURITIES, FINANCIAL INSTRUMENTS, STRATEGIES OR BANKING SERVICES FOR A PARTICULAR PERSON OR ENTITY. THE NAMES AND MARKS OF OTHER COMPANIES OR THEIR SERVICES OR PRODUCTS MAY BE THE TRADEMARKS OF THEIR OWNERS AND ARE USED ONLY TO IDENTIFY SUCH COMPANIES OR THEIR SERVICES OR PRODUCTS AND NOT TO INDICATE ENDORSEMENT, SPONSORSHIP, OR OWNERSHIP BY REGIONS OR HIGHLAND ASSOCIATES. EMPLOYEES OF HIGHLAND ASSOCIATES, INC., MAY HAVE POSITIONS IN SECURITIES OR THEIR DERIVATIVES THAT MAY BE MENTIONED IN THIS REPORT. ADDITIONALLY, HIGHLAND’S CLIENTS AND COMPANIES AFFILIATED WITH HIGHLAND ASSOCIATES MAY HOLD POSITIONS IN THE MENTIONED COMPANIES IN THEIR PORTFOLIOS OR STRATEGIES. THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR AN INVITATION BY OR ON BEHALF OF HIGHLAND ASSOCIATES TO ANY PERSON OR ENTITY TO BUY OR SELL ANY SECURITY OR FINANCIAL INSTRUMENT OR ENGAGE IN ANY BANKING SERVICE. NOTHING IN THESE MATERIALS CONSTITUTES INVESTMENT, LEGAL, ACCOUNTING OR TAX ADVICE. NON-DEPOSIT PRODUCTS INCLUDING INVESTMENTS, SECURITIES, MUTUAL FUNDS, INSURANCE PRODUCTS, CRYPTO ASSETS AND ANNUITIES: ARE NOT FDIC-INSURED I ARE NOT A DEPOSIT I MAY GO DOWN IN VALUE I ARE NOT BANK GUARANTEED I ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY I ARE NOT A CONDITION OF ANY BANKING ACTIVITY.

NEITHER REGIONS BANK NOR REGIONS ASSET MANAGEMENT (COLLECTIVELY, “REGIONS”) ARE REGISTERED MUNICIPAL ADVISORS NOR PROVIDE ADVICE TO MUNICIPAL ENTITIES OR OBLIGATED PERSONS WITH RESPECT TO MUNICIPAL FINANCIAL PRODUCTS OR THE ISSUANCE OF MUNICIPAL SECURITIES (INCLUDING REGARDING THE STRUCTURE, TIMING, TERMS AND SIMILAR MATTERS CONCERNING MUNICIPAL FINANCIAL PRODUCTS OR MUNICIPAL SECURITIES ISSUANCES) OR ENGAGE IN THE SOLICITATION OF MUNICIPAL ENTITIES OR OBLIGATED PERSONS FOR SUCH SERVICES. WITH RESPECT TO THIS PRESENTATION AND ANY OTHER INFORMATION, MATERIALS OR COMMUNICATIONS PROVIDED BY REGIONS, (A) REGIONS IS NOT RECOMMENDING AN ACTION TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON, (B) REGIONS IS NOT ACTING AS AN ADVISOR TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON AND DOES NOT OWE A FIDUCIARY DUTY PURSUANT TO SECTION 15B OF THE SECURITIES EXCHANGE ACT OF 1934 TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON WITH RESPECT TO SUCH PRESENTATION, INFORMATION, MATERIALS OR COMMUNICATIONS, (C) REGIONS IS ACTING FOR ITS OWN INTERESTS, AND (D) YOU SHOULD DISCUSS THIS PRESENTATION AND ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS WITH ANY AND ALL INTERNAL AND EXTERNAL ADVISORS AND EXPERTS THAT YOU DEEM APPROPRIATE BEFORE ACTING ON THIS PRESENTATION OR ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS.

SOURCE: BLOOMBERG INDEX SERVICES LIMITED. BLOOMBERG® IS A TRADEMARK AND SERVICE MARK OF BLOOMBERG FINANCE L.P. AND ITS AFFILIATES (COLLECTIVELY “BLOOMBERG”). BARCLAYS® IS A TRADEMARK AND SERVICE MARK OF BARCLAYS BANK PLC (COLLECTIVELY WITH ITS AFFILIATES, “BARCLAYS”), USED UNDER LICENSE. BLOOMBERG OR BLOOMBERG’S LICENSORS, INCLUDING BARCLAYS, OWN ALL PROPRIETARY RIGHTS IN THE BLOOMBERG BARCLAYS INDICES. NEITHER BLOOMBERG NOR BARCLAYS APPROVES OR ENDORSES THIS MATERIAL OR GUARANTEES THE ACCURACY OR COMPLETENESS OF ANY INFORMATION HEREIN, OR MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED THEREFROM AND, TO THE MAXIMUM EXTENT ALLOWED BY LAW, NEITHER SHALL HAVE ANY LIABILITY OR RESPONSIBILITY FOR INJURY OR DAMAGES ARISING IN CONNECTION THEREWITH.