Stocks: Arm IPO Boosts Investor Sentiment, Buoys Domestic Equity Indices; It Was Another Good Week For Crude Oil Despite Dollar Strength, But Energy Stocks Don’t Participate In The Rally.

Download Weekly Market Commentary | September 18 2023

Key Observations

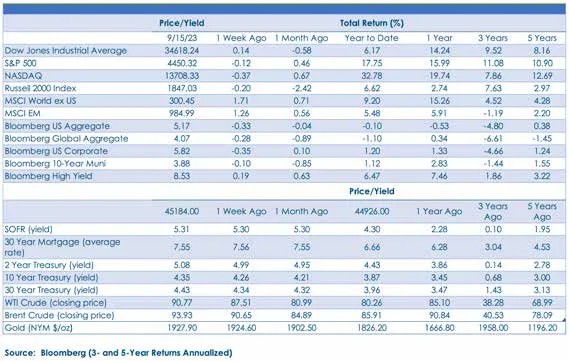

- The S&P 500 closed lower by 0.1% while the small-cap Russell 2000 declined 0.2% amid a choppy, range-bound week of trading. The consumer discretionary sector led, followed by communication services, while the information technology sector was the worst performing sector and pulled down the performance of the broader indices.

- International equities outperformed on the week, with the MSCI ACWI ex U.S. index gaining 1.7%, pulled higher by strength out of Japan and the U.K., among others. The MSCI Emerging Markets (EM) index returned 1.2% as Brazil, South Korea, and Taiwan were noticeably strong.

- On balance, August inflation data met the market’s expectations last week and gives the FOMC the cover to ‘skip’ a rate hike at this week’s meeting. However, with rising energy prices serving to increase inflation expectations, the Committee will want to keep its options open.

- The European Central Bank (ECB) hiked policy rates by another 25-basis points last week, but backed itself into a corner by strongly hinting that this hike would be its last. The ECB’s pronouncement initially pulled euro area sovereign bond yields lower but yields in the U.S. and abroad rose into the weekend as investors began to fear that central banks would balk at further policy tightening, despite signs that inflation could reaccelerate into year-end.

What We’re Watching:

- The Federal Open Market Committee (FOMC) holds its regularly scheduled two-day meeting on Tuesday and Wednesday. The Committee will release an updated Summary of Economic Projections, otherwise known as the dot plot after this meeting. Market participants will be on the lookout for any material changes to the Committee’s expectations surrounding inflation and the potential terminal Fed funds rate. We don’t expect the FOMC to hike the Fed funds rate at this meeting, but it will likely talk tough on inflation and keep its options open for November.

- Japan’s Consumer Price Index (CPI) for August is released Thursday with a year over year reading of 3.0% expected, below the 3.3% reading in July, while core CPI of 3.2% year over year is expected, just above the 3.1% reading from the prior month. Inflationary pressures remaining elevated in Japan may force the BoJ’s hand to alter policy prior to year-end, which could strengthen the Japanese yen and possibly put upward pressure on global sovereign bond yields.

- The Conference Board’s index of leading economic indicators (LEIs) for August is released Thursday with a -0.40% reading expected, which would be in-line with the July data.

- U.S. PMI (Purchasing Managers Index) for September is released Friday. PMI Composite is expected to fall to 50.0 from 50.2 in August. Services PMI is expected to fall to 50.1 from 50.5 the prior month, while Manufacturing PMI is expected to remain static month over month at 47.9. A reading above 50 indicates expansion or growth, below 50 slowing or contraction.

What Happened Last Week:

Stocks: Arm IPO Boosts Investor Sentiment, Buoys Domestic Equity Indices; It Was Another Good Week For Crude Oil Despite Dollar Strength, But Energy Stocks Don’t Participate In The Rally.

Crude Oil Has Another Good Week, But Energy Stocks Take A Breather. West Texas Intermediate (WTI) crude oil ended the week higher by 4.5% per barrel and closed above $90 for the first time since November of 2022. While the S&P 500 energy sector had the wind at its sails from rising energy prices, it failed to capitalize and ended the week flat after profit-taking Friday. Notably, WTI is now higher by 28% since the end of June, and the S&P 500 energy sector has returned 13.3% quarter-to-date, far outpacing the S&P 500 which is flat. What has been most noteworthy about the rally in crude oil this quarter is that it has occurred during a period of U.S. dollar strength as the U.S. dollar index, or DXY, has rallied 2.4% over that time frame. Typically, crude oil and the dollar move in opposite directions as dollar strength makes crude oil more expensive for foreign buyers, particularly emerging markets, thus reducing demand expectations. WTI rallying alongside the dollar is a sign that upside has been driven more by fears of a supply shortfall and inventory draws rather than by an expected uptick in demand, a dynamic likely to remain in place through year-end. However, WTI has come very far very fast, and with WTI above $90 per barrel at the end of last week, round numbers such as this are logical places for investors to think about taking profits and for a pause in the rally to take place.

Consumer Discretionary Leads Despite The Continued Lift In Energy Prices. The S&P 500 consumer discretionary sector was the best performing sector last week as it returned 1.8% vs. the S&P 500’s 0.5% loss. However, after taking a deeper dive into the drivers of the sector’s performance, it quickly becomes apparent that just two stocks – Amazon and Tesla – were responsible for the strong relative performance. Backing up this conclusion is the fact that the equally weighted consumer discretionary sector lost 0.6% on the week. All things considered, the S&P 500 consumer discretionary sector has weathered the storm of higher energy prices as well as could be expected given the sector is higher by 1.3% quarter-to-date, but looking at the equally-weighted version of the sector which is down 4.2% since the end of June, signs of stress and weakness are evident, highlighting the importance of security selection moving forward as we see headwinds for the consumer ahead. While we have our concerns surrounding the U.S. consumer entering the 4th quarter, so long as the consumer discretionary continues to outperform consumer staples as it did last week, we hesitate to get too bearish on the outlook for the U.S. economy or equities into year-end.

The IPO Market Opens Up, Providing A Boost To Investor Sentiment In A Rudderless Week. The initial public offering (IPO) market ramped up last week with U.K. semiconductor manufacturer Arm Holdings (ARM) going public. Companies coming to market via IPO seek to price stock at a level that both rewards existing shareholders and allows for additional upside post-offering to draw new investors in. By that standard, Arm delivered as it priced at $51 per share, opened at $56, and closed above $63 on its first day of trading for just shy of a 25% one-day gain for those that got in on the IPO before trading began. Given how well the Arm IPO performed in its first two days of trading, some unprofitable companies debating going public could be emboldened to do so to take advantage of a more hospitable environment for new issues, which is often a sign that enthusiasm and greed have taken over, an unsustainable and worrisome sign for the broader market. The Arm IPO performing well on its first day of trading appeared to buoy the broader S&P 500, which turned out a 0.8% gain on the day, its best daily return September to-date, and the IPO market ‘thawing’ could provide a tailwind for investor sentiment into October, assuming issues perform well and that there isn’t a flood of new supply. The IPO market is a double-edged sword: IPOs need to do well to boost investor sentiment and enthusiasm for new issues and encourage more companies to go public, but not too well to invite all comers to do so, increasing competition for a limited pool of investor capital. A thin line to toe to be sure.

Bonds: A September FOMC Pause Or ‘Skip’ Still Our Base Case; European Central Bank (ECB) Hikes, Hints At Pausing But Receives Immediate Pushback From Member States Concerned About Inflation.

August Inflation Data Mostly In-Line With Expectations, Unlikely To Alter The FOMC’s Decision This Week. The August Consumer Price Index (CPI) was released last Wednesday. Headline CPI rose 0.6% month over month, in-line with the consensus estimate, but above the 0.2% reading from July. Core CPI, which excludes food and energy prices, rose 0.3% month over month, just above the 0.2% consensus estimate and the 0.2% reading from July. Headline inflation was expected to rise sharply month over month, driven primarily by higher energy/gasoline prices, and while core CPI came in a tick hotter than expected, on balance, August inflation data met the bond market’s expectations. After the CPI release, Fed funds futures took down expectations for rate cuts in 2024, so market participants are begrudgingly buying into the ‘higher for longer’ interest rate narrative the Fed has been pushing. Nothing in the CPI release alters our expectation that the Federal Open Market Committee (FOMC) will ‘skip’ a rate hike when it meets this week, but in contrast to the ECB, the Committee will want to keep its options open for November should inflationary pressures build over coming months.

The ECB Hikes, But By Strongly Hinting It Is Done Makes Stagflation The Most Likely Outcome. The European Central Bank (ECB) raised its key deposit rate by 25-basis points last week to a record 4%. Leading up to the meeting, the decision had been viewed as a coin-flip due to the ECB’s newly adopted data-driven approach. With more signs the Eurozone economy was slowing in recent months, many believed the ‘doves’ would defeat the ‘hawks’ and the Committee would stand pat on rates. However, the ‘hawks’ won out after convincing their counterparts that wage growth in the Eurozone remains far too high for comfort and by agreeing that they wouldn’t push for rate hikes after this one. Bond investors initially forced yields on euro area sovereign bonds sharply lower on the heels of the ECB’s decision, but yields rose on Friday as finance ministers from Italy, Portugal, and Spain voiced concerns and pushed back on the ECB pronouncement that it was likely done hiking rates. The ECB is in a tough spot as inflation remains too high, but by tightening monetary policy further risks sending the Eurozone into a deeper and prolonged economic downturn, which is also not palatable. We see stagflation as the most likely outcome as economic growth estimates continue to decline, and the sharp drop in the euro relative to the U.S. dollar echoes that sentiment as it now trades at the lowest level in the past 6-months.

Bank Of Japan Hints At Altering Yield Curve Control Again, Ending Long-Standing Zero Interest Rate Policy (ZIRP). The Bank of Japan (BoJ) has seen the yield on 10-year Japanese Government Bonds creep higher to 0.70% in recent weeks, and the Japanese yen continues to trade shy of 150¥ to $1, a level that could force the BoJ to step in and buy bonds to support the currency. The BOJ is in the early innings of taking a stair-step approach toward implementing a looser yield curve control framework that gives it some flexibility and would allow rates to drift higher at measured intervals, and without an explicit target. This would allow the BOJ to incrementally alleviate some of the upward pressure on Japanese Government Bond yields while also weaning market participants off the fully transparent approach to monetary policy that has been in place for decades. The BoJ pivoting away from providing explicit guidance on rates to the market could give investors some angst and could force yields in Japan sharply higher, likely putting additional upward pressure on U.S. Treasury yields in the process.

IMPORTANT DISCLOSURES: THIS PUBLICATION HAS BEEN PREPARED BY THE STAFF OF HIGHLAND ASSOCIATES, INC. FOR DISTRIBUTION TO, AMONG OTHERS, HIGHLAND ASSOCIATES, INC. CLIENTS. HIGHLAND ASSOCIATES IS REGISTERED WITH THE UNITED STATES SECURITY AND EXCHANGE COMMISSION UNDER THE INVESTMENT ADVISORS ACT OF 1940. HIGHLAND ASSOCIATES IS A WHOLLY OWNED SUBSIDIARY OF REGIONS BANK, WHICH IN TURN IS A WHOLLY OWNED SUBSIDIARY OF REGIONS FINANCIAL CORPORATION. RESEARCH SERVICES ARE PROVIDED THROUGH MULTI-ASSET SOLUTIONS, A DEPARTMENT OF THE REGIONS ASSET MANAGEMENT BUSINESS GROUP WITHIN REGIONS BANK. THE INFORMATION AND MATERIAL CONTAINED HEREIN IS PROVIDED SOLELY FOR GENERAL INFORMATION PURPOSES ONLY. TO THE EXTENT THESE MATERIALS REFERENCE REGIONS BANK DATA, SUCH MATERIALS ARE NOT INTENDED TO BE REFLECTIVE OR INDICATIVE OF, AND SHOULD NOT BE RELIED UPON AS, THE RESULTS OF OPERATIONS, FINANCIAL CONDITIONS OR PERFORMANCE OF REGIONS BANK. UNLESS OTHERWISE SPECIFICALLY STATED, ANY VIEWS, OPINIONS, ANALYSES, ESTIMATES AND STRATEGIES, AS THE CASE MAY BE (“VIEWS”), EXPRESSED IN THIS CONTENT ARE THOSE OF THE RESPECTIVE AUTHORS AND SPEAKERS NAMED IN THOSE PIECES AND MAY DIFFER FROM THOSE OF REGIONS BANK AND/OR OTHER REGIONS BANK EMPLOYEES AND AFFILIATES. VIEWS AND ESTIMATES CONSTITUTE OUR JUDGMENT AS OF THE DATE OF THESE MATERIALS, ARE OFTEN BASED ON CURRENT MARKET CONDITIONS, AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. ANY EXAMPLES USED ARE GENERIC, HYPOTHETICAL AND FOR ILLUSTRATION PURPOSES ONLY. ANY PRICES/QUOTES/STATISTICS INCLUDED HAVE BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT HIGHLAND ASSOCIATES, INC. DOES NOT WARRANT THEIR COMPLETENESS OR ACCURACY. THIS INFORMATION IN NO WAY CONSTITUTES RESEARCH AND SHOULD NOT BE TREATED AS SUCH. THE VIEWS EXPRESSED HEREIN SHOULD NOT BE CONSTRUED AS INDIVIDUAL INVESTMENT ADVICE FOR ANY PARTICULAR PERSON OR ENTITY AND ARE NOT INTENDED AS RECOMMENDATIONS OF PARTICULAR SECURITIES, FINANCIAL INSTRUMENTS, STRATEGIES OR BANKING SERVICES FOR A PARTICULAR PERSON OR ENTITY. THE NAMES AND MARKS OF OTHER COMPANIES OR THEIR SERVICES OR PRODUCTS MAY BE THE TRADEMARKS OF THEIR OWNERS AND ARE USED ONLY TO IDENTIFY SUCH COMPANIES OR THEIR SERVICES OR PRODUCTS AND NOT TO INDICATE ENDORSEMENT, SPONSORSHIP, OR OWNERSHIP BY REGIONS OR HIGHLAND ASSOCIATES. EMPLOYEES OF HIGHLAND ASSOCIATES, INC., MAY HAVE POSITIONS IN SECURITIES OR THEIR DERIVATIVES THAT MAY BE MENTIONED IN THIS REPORT. ADDITIONALLY, HIGHLAND’S CLIENTS AND COMPANIES AFFILIATED WITH HIGHLAND ASSOCIATES MAY HOLD POSITIONS IN THE MENTIONED COMPANIES IN THEIR PORTFOLIOS OR STRATEGIES. THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR AN INVITATION BY OR ON BEHALF OF HIGHLAND ASSOCIATES TO ANY PERSON OR ENTITY TO BUY OR SELL ANY SECURITY OR FINANCIAL INSTRUMENT OR ENGAGE IN ANY BANKING SERVICE. NOTHING IN THESE MATERIALS CONSTITUTES INVESTMENT, LEGAL, ACCOUNTING OR TAX ADVICE. NON-DEPOSIT PRODUCTS INCLUDING INVESTMENTS, SECURITIES, MUTUAL FUNDS, INSURANCE PRODUCTS, CRYPTO ASSETS AND ANNUITIES: ARE NOT FDIC-INSURED I ARE NOT A DEPOSIT I MAY GO DOWN IN VALUE I ARE NOT BANK GUARANTEED I ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY I ARE NOT A CONDITION OF ANY BANKING ACTIVITY.

NEITHER REGIONS BANK NOR REGIONS ASSET MANAGEMENT (COLLECTIVELY, “REGIONS”) ARE REGISTERED MUNICIPAL ADVISORS NOR PROVIDE ADVICE TO MUNICIPAL ENTITIES OR OBLIGATED PERSONS WITH RESPECT TO MUNICIPAL FINANCIAL PRODUCTS OR THE ISSUANCE OF MUNICIPAL SECURITIES (INCLUDING REGARDING THE STRUCTURE, TIMING, TERMS AND SIMILAR MATTERS CONCERNING MUNICIPAL FINANCIAL PRODUCTS OR MUNICIPAL SECURITIES ISSUANCES) OR ENGAGE IN THE SOLICITATION OF MUNICIPAL ENTITIES OR OBLIGATED PERSONS FOR SUCH SERVICES. WITH RESPECT TO THIS PRESENTATION AND ANY OTHER INFORMATION, MATERIALS OR COMMUNICATIONS PROVIDED BY REGIONS, (A) REGIONS IS NOT RECOMMENDING AN ACTION TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON, (B) REGIONS IS NOT ACTING AS AN ADVISOR TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON AND DOES NOT OWE A FIDUCIARY DUTY PURSUANT TO SECTION 15B OF THE SECURITIES EXCHANGE ACT OF 1934 TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON WITH RESPECT TO SUCH PRESENTATION, INFORMATION, MATERIALS OR COMMUNICATIONS, (C) REGIONS IS ACTING FOR ITS OWN INTERESTS, AND (D) YOU SHOULD DISCUSS THIS PRESENTATION AND ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS WITH ANY AND ALL INTERNAL AND EXTERNAL ADVISORS AND EXPERTS THAT YOU DEEM APPROPRIATE BEFORE ACTING ON THIS PRESENTATION OR ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS.

SOURCE: BLOOMBERG INDEX SERVICES LIMITED. BLOOMBERG® IS A TRADEMARK AND SERVICE MARK OF BLOOMBERG FINANCE L.P. AND ITS AFFILIATES (COLLECTIVELY “BLOOMBERG”). BARCLAYS® IS A TRADEMARK AND SERVICE MARK OF BARCLAYS BANK PLC (COLLECTIVELY WITH ITS AFFILIATES, “BARCLAYS”), USED UNDER LICENSE. BLOOMBERG OR BLOOMBERG’S LICENSORS, INCLUDING BARCLAYS, OWN ALL PROPRIETARY RIGHTS IN THE BLOOMBERG BARCLAYS INDICES. NEITHER BLOOMBERG NOR BARCLAYS APPROVES OR ENDORSES THIS MATERIAL OR GUARANTEES THE ACCURACY OR COMPLETENESS OF ANY INFORMATION HEREIN, OR MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED THEREFROM AND, TO THE MAXIMUM EXTENT ALLOWED BY LAW, NEITHER SHALL HAVE ANY LIABILITY OR RESPONSIBILITY FOR INJURY OR DAMAGES ARISING IN CONNECTION THEREWITH.