Stocks: Interest Rates, U.S. Dollar End

The Week Sharply Lower, Leading To Broad-Based Gains With Foreign Markets Outperforming.

Download Weekly Market Commentary | July 17 2023

What We’re Watching:

- U.S. retail sales for June are released Tuesday and are expected to have risen 0.6% month over month after a 0.3% month over month rise in May.

- Initial jobless claims for the week ending July 15 are released Thursday, as are continuing jobless claims for the week ending July 8. Given the focus on labor market strength, these data points will likely continue to garner investor interest over coming weeks/months.

- The Conference Board publishes its index of leading economic indicators for June on Thursday. Leading indicators are expected to fall 0.6% month over month, a modest improvement from down 0.7% in May.

- Japan’s Consumer Price Index (CPI) for June is released Thursday and a 3.3% month over month rise is expected after a 3.2% reading in May. With inflation readings elevated and with the yield on 10-year Japanese Government Bonds again knocking on the door of the 0.50% ceiling targeted by the Bank of Japan, a shift toward less accommodative monetary policy in Japan in the back-half of 2023 remains likely, likely leading to higher bond yields, a stronger yen, and potentially weaker equity prices.

What Happened Last Week:

Equity

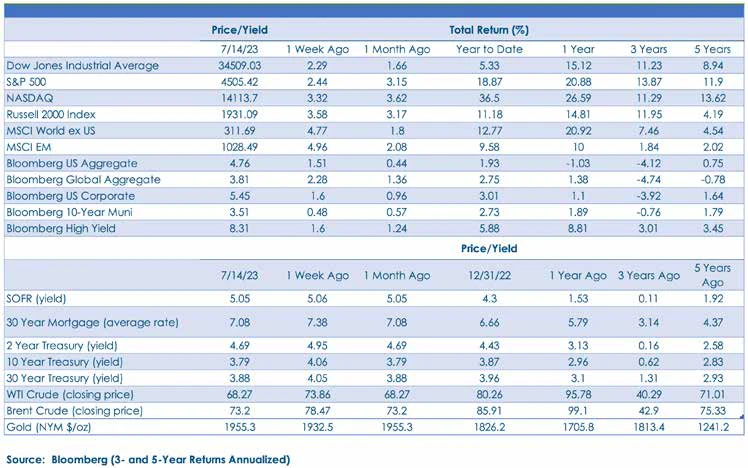

- Falling Treasury yields and a drop in the U.S. dollar led to broad-based gains for stocks, with small-cap stocks outperforming large-caps and foreign outperforming the U.S. on the week.

- Interest rates fell sharply on cooler than expected inflation data, generating a selloff in the dollar and a rebound out of developed and developing markets abroad. The dollar’s drop may be stretched in the near-term, and a reversal could lead to some profit- taking in stocks.

Stocks: Interest Rates, U.S. Dollar End

The Week Sharply Lower, Leading To Broad-Based Gains With Foreign Markets Outperforming.

Upward Bias To Equities In The U.S. With Small Cap Stocks Leading.

There was an upward lift to equity prices in the U.S. last week as inflation data cooled more than expected in June, leading market participants to conclude with greater conviction that the Federal Open Market Committee (FOMC) would be finished raising the Fed funds rate for good after another 25-basis points hike later this month. The U.S. economic soft-landing narrative gaining traction led small-cap stocks to outperform large-caps stateside, with the Russell 2000 gaining 3.5% versus the S&P 500’s still respectable 2.4% weekly return. From a sector perspective, communication services was the big winner on the week, rising 3.5% as the two largest sector constituents, Meta Platforms (Facebook) and Alphabet (Google), rallied 6.3% and 4.6%, respectively, and the 3rd largest position, Activision, surged 9.2% as a U.S. district judge signed off on Microsoft’s proposed acquisition of the company. Not to be overlooked, the consumer discretionary sector also gained 3.2% on the week, propelled by strength out of Amazon and Tesla, which together make up over 43% of the sector. Notable lagging sectors on the week included energy and consumer staples which eked out modest gains of 0.8% and 1.1%, respectively.

Dollar Drop A Tailwind For Foreign Markets.

The weaker U.S. dollar contributed in a big way to the lift in equity prices abroad as the U.S. Dollar Index, or DXY, made a 15-month low in the middle of last week, which generated a strong bid for international developed and emerging market equities. The MSCI EAFE developed markets index gained 4.1% on the week while the MSCI Emerging Markets (EM) index rallied 4.9%. The EAFE’s gains were generated by broad-based strength out of the euro area and U.K., with country indices tied to France, Germany, Italy, Spain, and the U.K. each ending the week higher by 4% or more. The MSCI Japan index rose 1.2% on the week and was a drag on the EAFE after propping the index up in recent months. The U.S. dollar’s decline and a constructive meeting between Treasury Secretary Janet Yellen and her counterparts in China boosted sentiment surrounding China, South Korea, and Taiwan, among others, lifting the broader MSCI EM index. Secretary Yellen’s visit generated optimism surrounding improved relations between China and the U.S. while continued weak economic data out of China is expected by to be met by more aggressive stimulus measures to spur spending and consumption, but to what end remains to be seen. The weaker U.S. dollar and sharp drop in Treasury yields buoyed equities last week, but the 2.2% weekly drop in the DXY appears stretched in the near-term, and with the 10-year Treasury yield ending last week at 3.83%, toward the lower end of its recent trading range, a reversal in the dollar and/or yields could be in the cards, potentially leading to some profit taking in developed and emerging market stocks over coming weeks.

Earnings Season Is Upon Us Once Again.

Quarterly reporting season kicked off in earnest last Friday with three of the ‘Big 4’ banks, J.P. Morgan, Citigroup, and Wells Fargo posting quarterly results and kicking things off as they do each quarter. The consensus estimate currently forecasts that S&P 500 earnings will decline 7.5% in the second quarter of 2023 relative to the second quarter of 2022, thus providing the broader index with a relatively low bar to chin from an expectations perspective. 2Q earnings are likely to exceed a lowered bar, but we are more concerned that estimates for the back-half of ’23 as well as for 2024 remain too high, thus, we will be closely watching for signs of improved sentiment and forward guidance out of corporations this earnings season as a sign that perhaps at least full-year ’23 numbers are likely attainable.

Fixed Income

- Hopes for an economic soft-landing may have been boosted by cooler June inflation data, but our outlook and expectations for the U.S. economy and path forward for monetary policy stateside is unchanged on the heels of the release.

- Credit performed well on the week, with both investment-grade and high yield corporate bonds rallying alongside stocks, corroborating the move in equities and indicating improved investor risk appetite.

Bonds: Treasury Yields Fall As Inflation Data Cools More Than Expected, Leading To Gains For Holders Of Long-Term Treasuries And Corporate Bonds Of All Types.

Treasury Yields Fall As Inflation Cools More Than Expected In June. U.S. Consumer Price Index (CPI) for June was released Wednesday. Headline CPI rose 3.0% year over year, below the 3.1% consensus estimate and well shy of the 4.0% year over year reading in May. Perhaps most notably for central bankers, core CPI, which excludes volatile food and energy prices, rose 4.8% year over year, below the 5.0% estimate and the 5.3% reading from May. CPI was widely expected to cool year over year, due in large part to inflation rising sharply and peaking in June of 2022, allowing for favorable year over year comparisons, but June CPI was even better than expected. The downshift in year over year CPI is encouraging, but we focus more on month over month readings, and on that measure both headline and core CPI rose just 0.2% month over month, below the 0.3% estimate for both. Treasury yields fell sharply on the release as cooler inflation readings were viewed as allowing the Federal Open Market Committee (FOMC) to take a more measured approach over coming months and perhaps only hike the Fed funds rate by another 25- or 50-basis points between now and year-end. While June CPI is a feather in the cap for the Fed, the trend in core CPI, specifically, over coming months will be well worth watching to see if it moves lower, stabilizes, or reaccelerates, potentially forcing the FOMC to tighten monetary policy further.

Investment-Grade, High Yield Corporates Beneficiaries Of Falling Treasury Yields, Improved Soft-Landing Odds.

The prospect of a less aggressive FOMC lent credibility to the economic soft-landing narrative making the rounds and boosted prices and demand for investment- grade and high yield corporate bonds. The Bloomberg Corporate index primarily made up of investment-grade corporate bonds, as well as the Bloomberg U.S. High Yield index each rallied 1.6% on the week, buoyed by falling Treasury yields and improved investor sentiment and risk appetite. The downward bias to Treasury yields may be a bit overdone in the near-term, but over the balance of 2023 we do expect a downtrend to reassert itself, which should benefit investment-grade corporates relative to high yield. With that said, over the next couple of quarters, we expect corporate bonds, broadly speaking, to perform well.

Emerging Market Debt Remains Attractive

Emerging market (EM) debt has performed well year-to-date, the J.P. Morgan Emerging Market Bond Index (EMBI) rallying 4.8% and recouping some of 2022’s loss. Broadly speaking, emerging market central banks were quick to raise rates as inflation expectations began to rise in the back-half of 2021, in stark contrast to developed market central bankers that viewed inflationary pressures as transitory or fleeting. Now, with inflationary pressures subsiding, many EM central banks are contemplating cutting rates to stimulate economic growth, moves that could be supportive of strength in some EM currencies and allow for a less costly payback of U.S. dollar denominated debt as local currencies strengthen. It’s notable that the EMBI has averaged a double-digit return over the last 20-years following years in which a double-digit decline materialized such as last year. Risk management dictates a small exposure to EM debt, and we prefer U.S. dollar denominated bonds to reduce volatility, but if sized appropriately, exposure continues to hold appeal. An improved outlook for emerging market economies could be a back-half of ’23 story should inflationary pressures subside further, and the U.S. dollar continues to weaken, but with a 7.6% yield-to-worst on the J.P. Morgan Emerging Market Bond Index (EMBI), we believe investors are being compensated handsomely to hold on and wait for a meaningful improvement in fundamentals.

IMPORTANT DISCLOSURES: THIS PUBLICATION HAS BEEN PREPARED BY THE STAFF OF HIGHLAND ASSOCIATES, INC. FOR DISTRIBUTION TO, AMONG OTHERS, HIGHLAND ASSOCIATES, INC. CLIENTS. HIGHLAND ASSOCIATES IS REGISTERED WITH THE UNITED STATES SECURITY AND EXCHANGE COMMISSION UNDER THE INVESTMENT ADVISORS ACT OF 1940. HIGHLAND ASSOCIATES IS A WHOLLY OWNED SUBSIDIARY OF REGIONS BANK, WHICH IN TURN IS A WHOLLY OWNED SUBSIDIARY OF REGIONS FINANCIAL CORPORATION. RESEARCH SERVICES ARE PROVIDED THROUGH MULTI-ASSET SOLUTIONS, A DEPARTMENT OF THE REGIONS ASSET MANAGEMENT BUSINESS GROUP WITHIN REGIONS BANK. THE INFORMATION AND MATERIAL CONTAINED HEREIN IS PROVIDED SOLELY FOR GENERAL INFORMATION PURPOSES ONLY. TO THE EXTENT THESE MATERIALS REFERENCE REGIONS BANK DATA, SUCH MATERIALS ARE NOT INTENDED TO BE REFLECTIVE OR INDICATIVE OF, AND SHOULD NOT BE RELIED UPON AS, THE RESULTS OF OPERATIONS, FINANCIAL CONDITIONS OR PERFORMANCE OF REGIONS BANK. UNLESS OTHERWISE SPECIFICALLY STATED, ANY VIEWS, OPINIONS, ANALYSES, ESTIMATES AND STRATEGIES, AS THE CASE MAY BE (“VIEWS”), EXPRESSED IN THIS CONTENT ARE THOSE OF THE RESPECTIVE AUTHORS AND SPEAKERS NAMED IN THOSE PIECES AND MAY DIFFER FROM THOSE OF REGIONS BANK AND/OR OTHER REGIONS BANK EMPLOYEES AND AFFILIATES. VIEWS AND ESTIMATES CONSTITUTE OUR JUDGMENT AS OF THE DATE OF THESE MATERIALS, ARE OFTEN BASED ON CURRENT MARKET CONDITIONS, AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. ANY EXAMPLES USED ARE GENERIC, HYPOTHETICAL AND FOR ILLUSTRATION PURPOSES ONLY. ANY PRICES/QUOTES/STATISTICS INCLUDED HAVE BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT HIGHLAND ASSOCIATES, INC. DOES NOT WARRANT THEIR COMPLETENESS OR ACCURACY. THIS INFORMATION IN NO WAY CONSTITUTES RESEARCH AND SHOULD NOT BE TREATED AS SUCH. THE VIEWS EXPRESSED HEREIN SHOULD NOT BE CONSTRUED AS INDIVIDUAL INVESTMENT ADVICE FOR ANY PARTICULAR PERSON OR ENTITY AND ARE NOT INTENDED AS RECOMMENDATIONS OF PARTICULAR SECURITIES, FINANCIAL INSTRUMENTS, STRATEGIES OR BANKING SERVICES FOR A PARTICULAR PERSON OR ENTITY. THE NAMES AND MARKS OF OTHER COMPANIES OR THEIR SERVICES OR PRODUCTS MAY BE THE TRADEMARKS OF THEIR OWNERS AND ARE USED ONLY TO IDENTIFY SUCH COMPANIES OR THEIR SERVICES OR PRODUCTS AND NOT TO INDICATE ENDORSEMENT, SPONSORSHIP, OR OWNERSHIP BY REGIONS OR HIGHLAND ASSOCIATES. EMPLOYEES OF HIGHLAND ASSOCIATES, INC., MAY HAVE POSITIONS IN SECURITIES OR THEIR DERIVATIVES THAT MAY BE MENTIONED IN THIS REPORT. ADDITIONALLY, HIGHLAND’S CLIENTS AND COMPANIES AFFILIATED WITH HIGHLAND ASSOCIATES MAY HOLD POSITIONS IN THE MENTIONED COMPANIES IN THEIR PORTFOLIOS OR STRATEGIES. THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR AN INVITATION BY OR ON BEHALF OF HIGHLAND ASSOCIATES TO ANY PERSON OR ENTITY TO BUY OR SELL ANY SECURITY OR FINANCIAL INSTRUMENT OR ENGAGE IN ANY BANKING SERVICE. NOTHING IN THESE MATERIALS CONSTITUTES INVESTMENT, LEGAL, ACCOUNTING OR TAX ADVICE. NON-DEPOSIT PRODUCTS INCLUDING INVESTMENTS, SECURITIES, MUTUAL FUNDS, INSURANCE PRODUCTS, CRYPTO ASSETS AND ANNUITIES: ARE NOT FDIC-INSURED I ARE NOT A DEPOSIT I MAY GO DOWN IN VALUE I ARE NOT BANK GUARANTEED I ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY I ARE NOT A CONDITION OF ANY BANKING ACTIVITY.

NEITHER REGIONS BANK NOR REGIONS ASSET MANAGEMENT (COLLECTIVELY, “REGIONS”) ARE REGISTERED MUNICIPAL ADVISORS NOR PROVIDE ADVICE TO MUNICIPAL ENTITIES OR OBLIGATED PERSONS WITH RESPECT TO MUNICIPAL FINANCIAL PRODUCTS OR THE ISSUANCE OF MUNICIPAL SECURITIES (INCLUDING REGARDING THE STRUCTURE, TIMING, TERMS AND SIMILAR MATTERS CONCERNING MUNICIPAL FINANCIAL PRODUCTS OR MUNICIPAL SECURITIES ISSUANCES) OR ENGAGE IN THE SOLICITATION OF MUNICIPAL ENTITIES OR OBLIGATED PERSONS FOR SUCH SERVICES. WITH RESPECT TO THIS PRESENTATION AND ANY OTHER INFORMATION, MATERIALS OR COMMUNICATIONS PROVIDED BY REGIONS, (A) REGIONS IS NOT RECOMMENDING AN ACTION TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON, (B) REGIONS IS NOT ACTING AS AN ADVISOR TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON AND DOES NOT OWE A FIDUCIARY DUTY PURSUANT TO SECTION 15B OF THE SECURITIES EXCHANGE ACT OF 1934 TO ANY MUNICIPAL ENTITY OR OBLIGATED PERSON WITH RESPECT TO SUCH PRESENTATION, INFORMATION, MATERIALS OR COMMUNICATIONS, (C) REGIONS IS ACTING FOR ITS OWN INTERESTS, AND (D) YOU SHOULD DISCUSS THIS PRESENTATION AND ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS WITH ANY AND ALL INTERNAL AND EXTERNAL ADVISORS AND EXPERTS THAT YOU DEEM APPROPRIATE BEFORE ACTING ON THIS PRESENTATION OR ANY SUCH OTHER INFORMATION, MATERIALS OR COMMUNICATIONS.

SOURCE: BLOOMBERG INDEX SERVICES LIMITED. BLOOMBERG® IS A TRADEMARK AND SERVICE MARK OF BLOOMBERG FINANCE L.P. AND ITS AFFILIATES (COLLECTIVELY “BLOOMBERG”). BARCLAYS® IS A TRADEMARK AND SERVICE MARK OF BARCLAYS BANK PLC (COLLECTIVELY WITH ITS AFFILIATES, “BARCLAYS”), USED UNDER LICENSE. BLOOMBERG OR BLOOMBERG’S LICENSORS, INCLUDING BARCLAYS, OWN ALL PROPRIETARY RIGHTS IN THE BLOOMBERG BARCLAYS INDICES. NEITHER BLOOMBERG NOR BARCLAYS APPROVES OR ENDORSES THIS MATERIAL OR GUARANTEES THE ACCURACY OR COMPLETENESS OF ANY INFORMATION HEREIN, OR MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED THEREFROM AND, TO THE MAXIMUM EXTENT ALLOWED BY LAW, NEITHER SHALL HAVE ANY LIABILITY OR RESPONSIBILITY FOR INJURY OR DAMAGES ARISING IN CONNECTION THEREWITH.